One of the major reasons as to why Bitcoin is heralded as an impeccable example of a digital currency system has to do with its supply regulation and its inflationary mechanics. The way in which Bitcoin is created as a financial system sees it have a set and mathematically unalterable supply of 21 million coins.

However, having a predetermined supply is one thing — and one reason why it is superior to gold with its unknown supply — but the other important factor that impacts its scarcity and inflation links to what is known as the halving. This hard-coded event has great implications on Bitcoins supply and creation, and is happening for a third time this month.

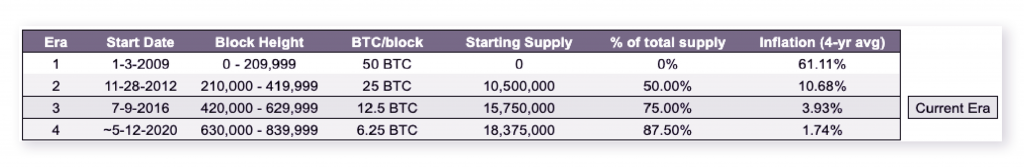

The halving, which sees the reward for unlocking a new Bitcoin block cut by 50 percent, happens every 210,000 blocks, or roughly every four years. The next Bitcoin halving will occur at block 630,000, which is expected to take place on May 12, 2020.

This halving will reduce the block reward, which is the amount of Bitcoin that is paid for figuring out the algorithm for a new block from 12.5 Bitcoins per block to 6.25 Bitcoins per block. This will also take the supply inflation from 3.72 percent to 1.79 percent.

This will take Bitcoin’s inflation rate under 2 percent for the first time ever, and this is an important margin as the 2 percent inflation target used by most central banks for their fiat currencies.

As of January 31, 2020, 18.19 million coins have been mined, which is approximately 87 percent of the total supply.

How Bitcoin Halving Affects Its Market Price

While this is a rather technical occurrence and primarily influences the mining and network health of the coin, it usually has greater implications for the market and the price of the coin as it is generally seen as a bullish move for the coin.

Bitcoin Block Halving Schedule

As mentioned, Bitcoin will be seeing its third halving in history. The first halving took place on November 28, 2012, and the second on July 8, 2016. As these events continue to happen, so the inflation level will keep shrinking until the final block is mined before the 33rd halving on block 6,929,999 and here the mining reward will drop to 0, with a technical supply cap of 20,999,999.9769 Bitcoins. The last coin is expected to be mined in March 2140.

The first halving in 2012 took the reward from 50 coins down to 25 coins. With an assumption that 144 blocks are mined per day, this event caused daily supply adding to the circulating supply to decline from 7,200 to 3,600 coins.

The second halving took that 25 coins and cut it by 50 percent to leave it at 12.5 coins and is what we currently see being rewarded. This meant that new coins fell from 3,600 to the current rate of 1,800 per day added to the supply.

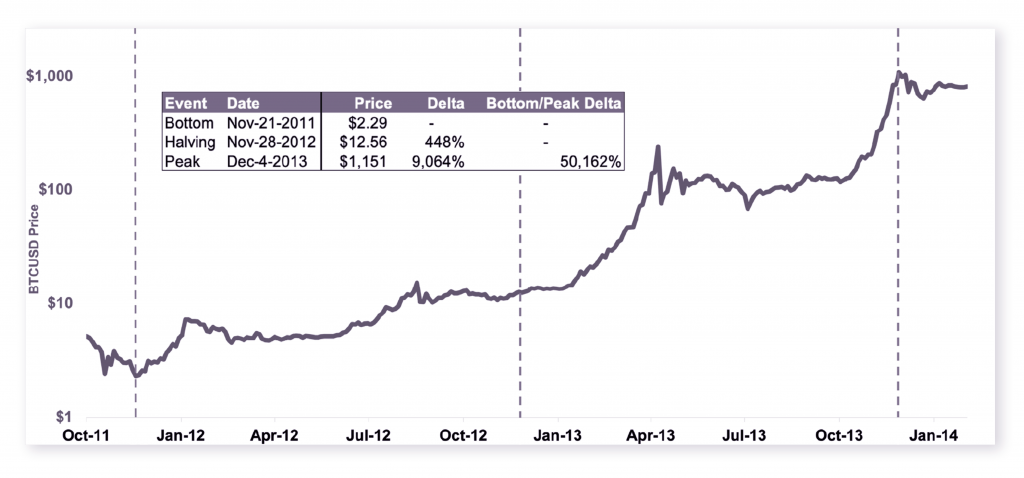

BTC/USD Price Nov. 2011 – Dec. 2013

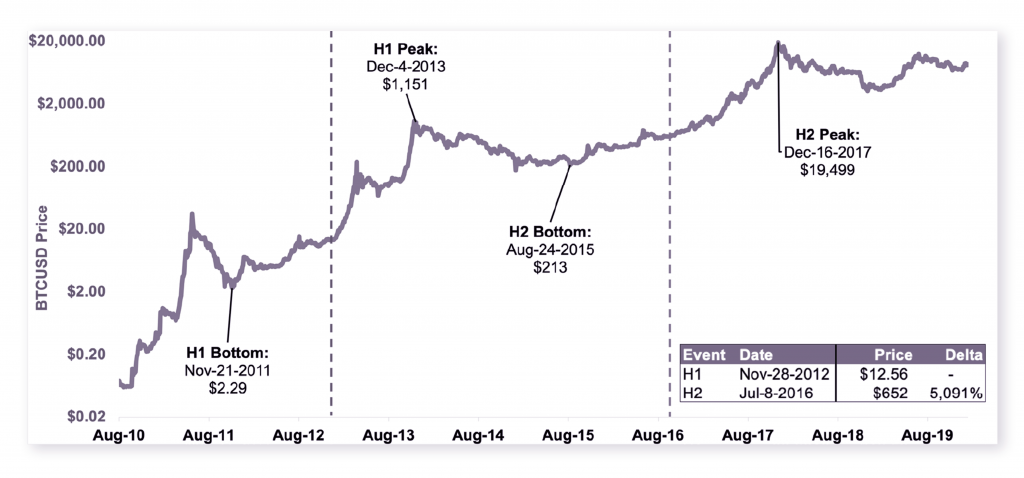

In both halvings previously, there were bull runs prior to the event. But, unlike the first halving, where the upward trend began one year before the halving to the event, Bitcoin experienced a second bull run, but it was nine months prior.

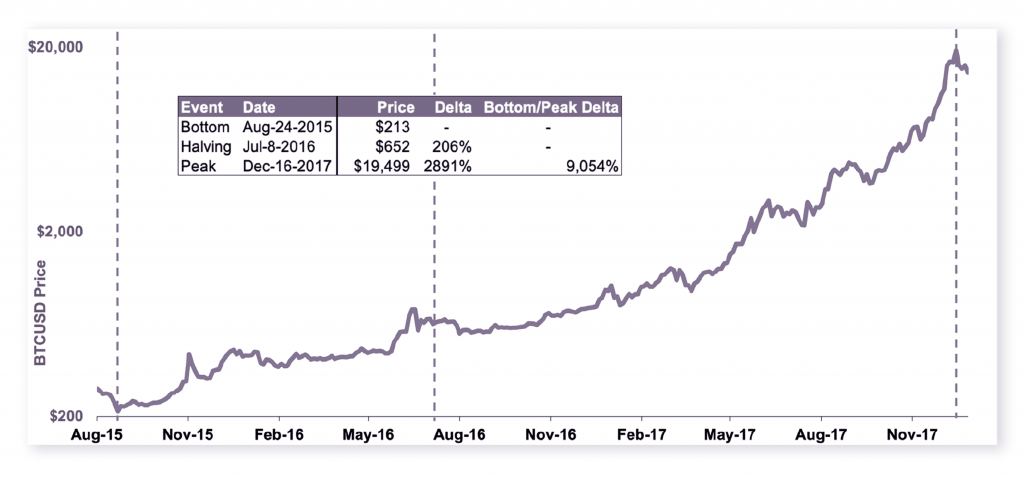

Bitcoin’s peak to its all time high of $20,000 saw a +9,054% appreciation in price between the relative price bottom of $213 on September 21st, 2015 and the relative price peak on December 16th 2017, 18 months after the second halving. This is similar to what happened in the first instance first halving and, this bull run also saw a fall of -80%, bottoming out in December 2018.

BTC/USD Price Sept. 2015 – Dec. 2017

The similarity of price movements between the two events allow for conclusions to be drawn for the upcoming event which could follow a similar pattern. Both halvings before indicate a two year upward move in Bitcoin’s price by the halvings which then follows a 12-18 month, a fall of upwards of 80 percent.

The peak in the first halving came in December 2013 where it topped $1,150 — this was about 1 year after the halving. Then, two years later Bitcoin’s price had fallen over 80 percent to $212 in August of 2015. But then, the second halving’s bull-market cycle began

The bull run for this second halving ended nearly two and a half years later in December 2017 as price reached its all-time high. Then, in the same way, the price fell over 80 percent to around $3,000, but a year after that and Bitcoin’s price is up again and over $9,000.

BTC/USD Price Jan. 2009 – Jan. 2020

Why It Matters

Bitcoin, as a financial system and monetary asset, is quite unique in that it follows a deflationary curve which is relatively set and unerring. As mentioned, the latest fall in its inflation takes it under two percent, and thus it is under what most central banks consider to be a fine inflation level. This deflationary curve also helps define the asset as it follows something like gold, which is of course a well known store of value.

Fiat currencies are well known to be inflationary assets, and thus help define a store of value against a monetary asset, but it also means the true value of the likes of fiat currencies also lessens over time.

If you look at how fiat currencies have fared as inflationary assets, it is concerning just how much value major currencies have lost — especially when it comes to comparison with stores of value such as gold and silver.

For example, the British pound is 317 years old but it has lost more than 99.5 percent of its value since it came into existence. Another instance shows how since the U.S. officially ended its tie to the gold standard in 1973, the value of gold has gone up by +1,760% while the dollar has inflated by 472.53% at the same time — this means $1 in 1973 had the same purchasing power as $5.73 does today.

Different Measures

Because Bitcoin is more closely aligned to gold — often referred to as digital gold — as compared to fiat currencies with their high inflation curves, it is worth looking at different measurements for gold when trying to ascertain what Bitcoin will do. What also helps is looking at the scarcity of Bitcoin which is far more miserable than with gold given that Bitcoin is set at 21 million coins.

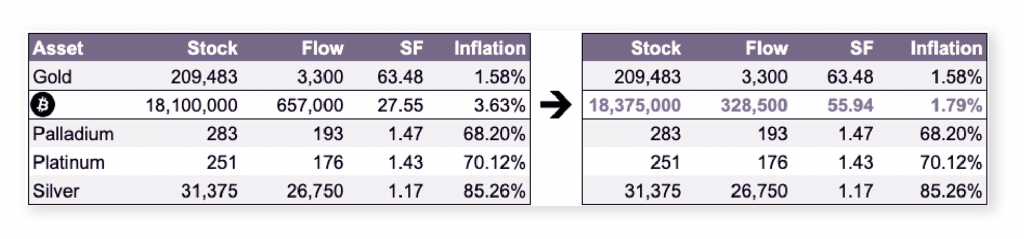

Part of the reason gold’s value holds well over time due to its scarcity, which is measured by the stock-to-flow (SF) ratio. The SF ratio quantifies the scarcity of an asset, measured by dividing an asset’s total circulating supply (stock) by the amount produced annually (flow).

The SF measure recognizes that economic utility of a consumable good is realized when the good is used, but the utility of investment assets with high SF ratios lie in their storage and eventual resale. For reference, an asset with a SF ratio of 50 will take 50 years of the current production rate to double current stock levels.

SF of metal commodities vs. BTC

It shows that assets with a higher SF will give off lower annual inflation rates and it is seen that gold exhibits the highest SF of metal commodities. But, Bitcoin’s SF is expected to take the lead when the fourth halving takes place in May 2024.

What is interesting to note is that the SF ratio may be unpredictable for commodities, like gold, if major deposits are suddenly found, or even if technology advances see cheaper mining or extraction. This is where Bitcoin benefits from mathematical certainty of a known supply and its movement into circulation based on current network parameters.

How Miners Will Be Impacted

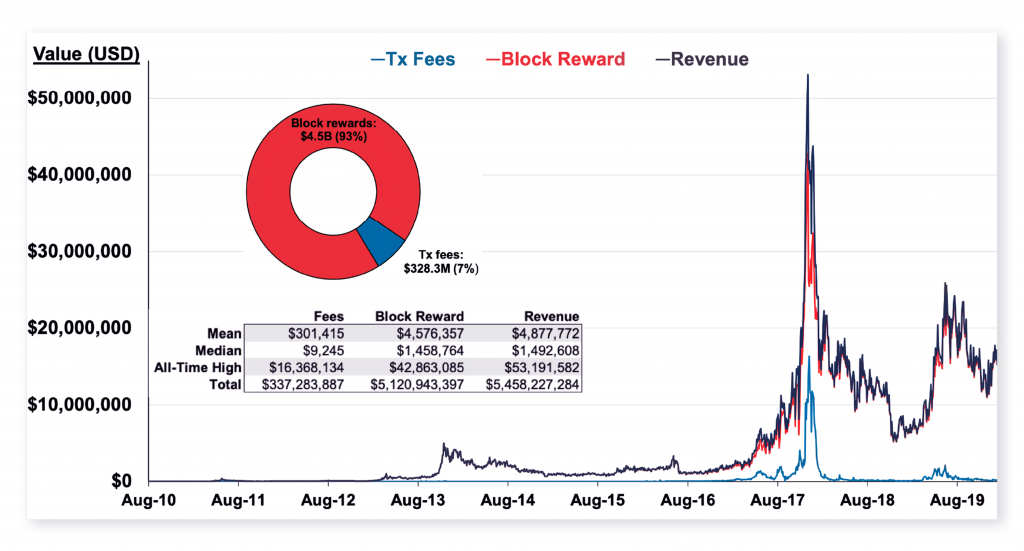

There is a lot of focus on how the halving will impact the market, but overall, this event is a huge factor for the miners and the mining ecosystem as their profitability is instantly cut by 50 percent. This may seem like a huge blow for miners who rely on fine margins, but it is more complex than that.

By the regular change to Bitcoin’s mining difficulty, how challenging the protocol is for solving the calculations required to produce valid blocks adjusts programmatically every two weeks ,so there will be an expected change in difficulty after the halving to make it more inclusive.

This is how the miners will feel the impact:

• Miners will experience an estimated 45% – 50% decrease in nominal Bitcoin rewards.

• Mining profitability will come under pressure, but it also depends on Bitcoin price performance going into the halving. Operating costs, including electricity, will remain largely fixed.

• If the price is around $9,300, gross annual mining revenue will drop from $6.1 billion per year to $3.1B billion

• There is expected to be a miner capitulation if they choose to exit the market and this could lead to a fall in hash rate as well as security. But, that fall in security is not expected to be great enough for any major concern.

Transaction fees are also part of the mining consideration as higher fees incentivize miners to process a transaction. Therefore, transaction fees will be more closely correlated with an increase in demand rather than the halving itself. It is not expected that transaction fees will increase in direct response to the halving, but they have on average been increasing over time.

But, as it stands, Bitcoin does not have the transaction volumes or fees to compensate for the halving in rewards. So there will be a big reduction in miner revenue. Total miner revenue will be reduced by an estimated $58,125 and if this was to be compensated by transaction fees, the fees would need to rise almost 20 times.

Conclusion

The halving is predicted to be a bullish event for Bitcoin as the above all explains, but it also helps point in what direction and designation Bitcoin is currently in. It is deflationary and more like gold than fiat, and thus Bitcoin, designed to be digital cash, has leaned towards being a store of value.

This means the halving will have a big role to play in its future success of such an asset. We have seen, as Bitcoin started becoming a better store of value, the two previous halvings have pushed its price up in familiar and constant patterns.

Moreover, the fall of the inflation to below two percent suddenly makes Bitcoin a better asset than a top fiat currency as the central banks look to maintain at best two percent. But Bitcoin also benefits from being with a constant supply and that also could see it overtake gold sooner, rather than later.

This ties back to the stock to flow model where Bitcoin, in comparison with other metals, is right up there and predicted to even overtake gold with its set supply following its fourth halving in another couple of years.

So, while Bitcoin may be struggling to compete with mass-adopted payment systems due to price volatility, scaling limitations, and a complex user experience. It is heading more and more towards being a store of value, thanks to the halving.

All reference material and data provided by Kraken Intelligence, Blockchain.com, Mining.com, Statistia.com, Gold.org, SilverInstitute.org.