The Japan stock market features the Nikkei 225 as its primary index. This index tracks the performance of the 225 largest corporations in Japan, representing diverse industries. Therefore, it is an excellent financial instrument for investors who seek diversification. Nikkei 225 trading provides a gateway to gain exposure to the Tokyo Stock Exchange.

What is the Nikkei 225?

The Nikkei 225 is a stock index used to track the performance of the 225 largest companies in Japan listed on the Tokyo Stock Exchange. The index has broad coverage, making it a key indicator of the strength of the Japanese market.

The Nikkei 225 index was launched in 1950, and its value was set at 250. It is a price-weighted index, differentiating it from most stock indices in the Asian financial sector calculated based on market capitalization.

As a price-weighted index, the Nikkei 225 is similar to other popular stock indices such as the Dow Jones, where the value of the index is calculated using the per-share price of the companies constituted in the index. However, it is different from popular indexes such as the FTSE 100 and the German Dax calculated by market cap.

The Nikkei 225 companies

The Nikkei 225 index is spread across different sectors of the Japanese market. The largest companies by weighting in this index are Fast Retailing, the holding company of the Uniqlo fashion brand, SoftBank Group and Tokyo Electron, a leading electronics brand in Japan.

The Nikkei 225 index also received a new addition in October 2020; the NGK Spark Plug Co. The other well-known companies in Japan that feature on the index include Sony Corp, Canon Inc, Panasonic Corp, Mazda Motor Corp, Toyota Motor Corp, and more.

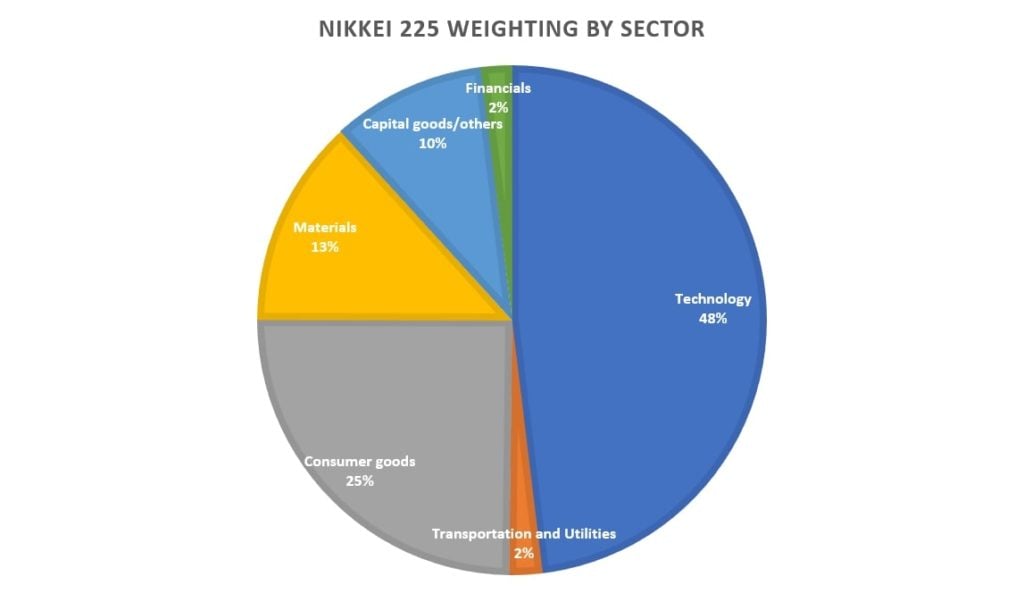

The index is inclusive of different sectors of the Japanese financial markets. The companies listed on this index operate in technology, consumer goods, finance, materials, capital goods, utilities and transportation.

Given the broad coverage of this index, it stands as a better alternative for an investor looking for greater exposure to the Japanese stock market and the broader Asian market compared to investing in individual stocks. The index’s price is determined by the share price of the constituents.

Nikkei 225 trading hours

The companies on the Nikkei 225 index are listed on the Tokyo Stock Exchange (TSE). TSE is the largest stock exchange in Japan, and just like other global exchanges, trading hours are from Monday to Friday.

The Nikkei 225 trading hours are from 9:00 to 11:30 and 12:30 to 15:00 (GMT +09:00). These trading hours are for five trading days each week.

Besides trading the index in the spot market, a trader can also choose to trade in contracts for difference and futures. This can allow them to access Nikkei 225 trading when the TSE is closed.

How is the Nikkei 225 Calculated?

The Japan 225 is a price-weighted index like the Dow Jones Industrial Average. As a price-weighted index, the stocks with higher prices have a greater weight in the index. Such stocks usually have a notable influence on the index’s overall performance.

The Nikkei 225 index is calculated in real-time after every five seconds. Its calculation only happens when the Tokyo Stock Exchange is open, as this is when the price tends to move.

To calculate the weighted price average of the Nikkei 225, the sum of the constituent stock prices is adjusted by the presumed par value and then divided by a divisor. The divisor is known as the “Dow adjustment”, and it is used to maintain the continuity of the index by locking out external factors that do not affect the market performance.

The Nikkei 225 index is reviewed on an annual basis. The review happens at the beginning of October, and during this time, various criteria are considered before retaining or removing a company from the index. The criteria include the market liquidity and the sector balance.

Nikkei 225 historical information

| Date | Milestone |

| 7th September, 1950 | Nikkei first issued at 176.21 points |

| July 1950 | Nikkei 225 dropped to all-time low of 85.25 |

| December 1989 | Nikkei 225 reached an all time high of 38957.44 |

| 2008 Financial crisis | Nikkei sets longest losing streak in half a century thanks to high oil prices and the global economy |

| March 2020 | The Nikkei 225 moves higher as the pandemic spreads, although underperforms global benchmarks |

| 15th Feb 2021 | The Nikkei 225 passed 30,000 on Monday, the first time in over three decades |

The Nikkei 225 index is maintained and regulated by Nikkei Inc. The index was created on September 7 1950, and it is still in the form in which it was first published. The index’s record low of $85.25 happened in 1950.

The Nikkei 225 index recorded an all-time high of $38,915.87 in December 1989. On March 10 2009, this index closed at $7054.98, 81.9% below the all-time high created two decades prior. In May 2013, the index exhibited strong performance and reached an annual peak of $15,942.

By 2015, the Nikkei 225 Index had reached the 20,000 record mark. In 2018, the index recorded moderate growth, and its price started to fluctuate at the 22,000 level. The Nikkei 225 index is also known as Nikkei or the Nikkei Index, and it is the oldest index in the Asian stock market.

What drives the Nikkei 225’s price?

Nikkei 225 is one of the popular indexes in Asia. However, as seen from its historical price movement, the index occasionally fluctuates. There is a wide range of factors that move the price of this index. Monitoring these factors can ensure an investor is equipped with the information needed to make the right trading decisions.

Strength of the Yen

The first major factor that drives the index’s price is the strength of the Japanese Yen. Japan is one of the world’s largest exporters, and most of the goods and services from the country are purchased using foreign currency.

When the value of the Japanese yen is weak, exports from Japan tend to become more competitive. This creates demand from the international market, which can raise the revenues of Japanese companies and result in a better performance of the Japanese Yen.

However, the Japanese yen is one of the strongest currencies globally. Therefore, there is usually an influx of money into the currency, making it stronger than most trading pairs. This results in the exports being less competitive, pushing the stocks lower and consecutively resulting in a negative performance of the Japanese Yen.

Acts of God and market slowdowns

Last but not least, socio-political events can also affect the performance of the Nikkei 225. Socio-political events have an impact on the entire global market. Some of these factors include a global recession or the coronavirus pandemic.

Negative occurrences in the external environment can lower the market demand. Japan is one of the world’s largest manufacturers. In March 2020, when the pandemic was at its peak, there was a sharp decline in Japan’s manufacturing activities and market demand.

Because of this, the value of the Nikkei 225 dropped by over 38% between February and March of that year. However, as manufacturing activities steadied in the following years, the Nikkei 225 index also witnessed substantial growth.

Political events also affect the value of the Nikkei 225. It is important to keep abreast with the political environment in Japan to help you make early trading decisions.

BOJ’S impact on Nikkei 225

The monetary policy adopted by the Bank of Japan can weaken or strengthen the yen, which affects the exporting conditions. However, the Bank of Japan has been questioned over the measures taken to aid the country’s economic growth.

For instance, the interest rates in Japan have been historically low, making the Bank of Japan less active in changing the monetary policy compared to countries such as the US. In the US, the Federal Reserve can raise or lower the interest rates depending on the levels of inflation.

Investors in US stock indices use measures such as the CPI, which is associated with inflation, to make trading decisions. However, things are quite different in Japan, and the Nikkei 225 index investors use the Tankan survey. The latter is an economic report provided by the BOJ of companies in Japan, and it is believed to be a useful tool to assess business sentiment.

A proactive investor can also use quarterly research to gain insight into the commercial trends and conditions in the industry. At the peak of the Covid-19 pandemic in 2020, the Tankan survey showed that business sentiment was at the lowest in over a decade. The release of this report caused Nikkei to dip by 0.75%.

Large weighted companies impact on performance

The other factor that influences the value of the Nikkei Index is the performance of the companies listed within the index. The Nikkei 225 is a price-weighted index. The companies with a large weighted share price tend to have a notable impact on the index’s price movement compared to smaller companies.

The company commanding the largest weighted share price on the index is Fast Retailing. The performance of this company has the potential to drive the price of the Nikkei 225. However, companies with a lower weighted share price have minimal effect on the index’s value.

What are the benefits of Nikkei 225 trading?

There are many benefits realized from trading the Nikkei 225 index. These benefits include but are not limited to the following:

- It is Asia’s oldest index – One of the top benefits of investing in the Nikkei 225 is that it is one of the oldest indexes in Asia. The index has lengthy historical data that can be used by a trader to predict future performance.

- Good for diversification – Nikkei 225 trading is also a good investment when a trader is looking for diversification. The index’s constituents are companies operating in different sectors, which allows an investor to gain broader exposure from a single index.

- Attractive for day traders – Nikkei 225 is also good for day traders because it has a significant level of volatility. The price movements of this index tend to change rapidly during the day, allowing a trader to bet on short-term price movements.

- Good average returns – The Nikkei 225 index has an average annual return of 12%. The index has grown substantially over the years, and traders with long positions are assured of notable growth in their investment.

- Liquidity – There is ample liquidity in trading Nikkei 225, making it easy for traders to enter and exit trading positions.

What are the drawbacks of Nikkei 225 trading?

While there are ample benefits to trading Nikkei 225, drawbacks are also associated with the index. These drawbacks include the following:

- Companies with larger weighted share prices affect index price – One of the major drawbacks of investing in Nikkei 225 is that companies with a larger weighted share price will move the index. If such companies perform poorly for a long time, it could have a long-term effect on the index’s price.

- Reliance on exchange rates – Most of the companies on the index trade in the global financial market and rely on exchange rates. Therefore, the yen’s strength is a major factor influencing company returns.

- Volatility – While volatility could be good for traders, it is not ideal for a trader looking for a stock that does not have significant short-term price movements.

How to trade Nikkei 225

There are various ways that one can trade Nikkei 225. The trading instruments can be selected depending on a trader’s needs and preferences. The different ways that one can trade the Nikkei 225 index include the following:

Nikkei 225 CFDs

One of the top ways to trade Nikkei 225 is through contracts for difference. CFDs are derivatives that derive value from an underlying asset. When you trade CFDs, in this case, the underlying asset will be the Nikkei 225 index.

When one is trading CFDs, they are not taking ownership of any asset. A trader simply speculates if the index’s price will gain or dip, and if the prediction is correct, the trader makes profits.

Nikkei 225 futures

You can also trade Nikkei 225 using futures. Futures contracts happen when there is an agreement to trade an asset at a predetermined price and date.

One can trade Nikkei 225 futures through a brokerage platform. When trading futures for this index, no underlying asset will be exchanged. The index is just a figure representing the group of stocks constituting the index.

Nikkei 225 options

Trading Nikkei 225 options will give you the right, but not the obligation, to trade the index at a predetermined time and date in the future. Nikkei 225 options are also available on brokerage platforms. One can trade Nikkei 225 options using CFDs.

Nikkei 225 stocks and ETFs

You can trade Nikkei 225 using exchange-traded funds (ETFs). ETFs are investment instruments that include a group of shares that make up this index. On the other hand, it is also possible to trade the individual shares in this index. This allows a trader to focus on a single industry.

Nikkei 225 Trading Strategies

There are different strategies that a trader can use to trade the Nikkei 225. The trading strategies can be chosen depending on the risk appetite and the willingness of a trader to make active trades. Nikkei 225 trading strategies include:

Nikkei 225 Swing trading

Swing trading is the ideal trading strategy for a trader that does not have the time to keep monitoring the charts and making trades regularly. With swing trading, the trader will only analyze the charts for a few minutes every week, making it suitable for people with full-time jobs.

Swing trading involves focusing on the daily charts to enter or exit a position. Through this strategy, traders leave their position open for a long time. The position will be subjected to gains or losses depending on current events. Swing trading is more of a long-term trading strategy.

Nikkei 225 scalping strategy

If you have time on your hands to make active traders during the day, the scalping trading strategy could be suitable for you. Scalping involves trading the Nikkei during the day and taking advantage of slight price movements.

In scalping, trades are made in 15 minutes to one-hour intervals. This trading strategy takes into account the daily economic climate. When scalping, there is no need to heavily invest in fundamental analysis. Positions are closed very quickly, and profits or losses are realized after a short while.

Tips for Nikkei 225 trading

Nikkei 225 trading can give an investor exposure to notable profits, given that it covers the largest and top-performing companies listed on the Tokyo stock exchange. The tips for trading Nikkei 225 include the following:

- Use fundamental analysis – The first tip when trading the Nikkei 225 is to use fundamental analysis. Fundamental analysis helps you detect price patterns and trading signals that enable you to make an informed trading decision.

- Use the right trading strategy – There are two main trading strategies for Nikkei 225. These strategies include scalping and swing trading. Choosing a trading strategy depends on the time one has in their hands and their trading objectives.

- Analyze charts – The other top when trading the Nikkei is analyzing the price charts for this index. Charts depict the price movement of an index, and they can help a trader understand the market sentiment.

- Manage risks – It is also important to adopt risk management strategies to ensure you do not incur heavy losses from your position. Managing risks is a principle that applies across all forms of investment.

- Understand what drives prices – It is also important to understand the factors that move the price of the Nikkei to determine the appropriate time to make a trading decision.

Why trade Nikkei 225 with Top Coin Miners?

Top Coin Miners is an award-winning platform that facilitates trades across different asset classes. Top Coin Miners is a platform supporting features for both new and expert traders. Below are the top reasons why you should trade Nikkei 225 with Top Coin Miners:

- User-friendly features – Top Coin Miners is a user-friendly platform. It comes with friendly trading fees and a user-friendly interface that makes it easy for traders to navigate the platform as they enter and exit positions.

- Easy to get started – The registration process at Top Coin Miners is easy and fast. Moreover, the minimum deposit fees needed to enter a trade is low. This makes it easy for a new trader to trade Nikkei 225 on the platform.

- Focus on safety – Top Coin Miners complies with all regulations, ensuring that the data security of customers is a priority. User funds on the platform are also secured, and withdrawals can be made at any time.

- Access to charts – At Top Coin Miners, a trader can easily conduct price analysis because the platform gives them access to price charts and tools, paving the way for informed decision-making.

- All-round trading – Top Coin Miners provides all-around trading. It enables a trader to access stock indices, commodities, forex and cryptocurrencies.

What time does the Nikkei 225 index open and close?

The Nikkei 225 index is open from Monday to Friday. During these five days, the market is open between 09:00 – 11:30 and 12:30 – 15:00 (GMT+09:00).

Is Nikkei 225 volatile?

The Nikkei 225 is ranked as the most volatile stock index in the developed markets. For instance, in 2013, the index started the year at around 10,600. By May, it had peaked at over $15,000 but later dropped by around 10%.

How is Nikkei weighted?

Nikkei is a price-weighted average of the top 225 Japanese companies listed on the Tokyo Stock Exchange. The index is calculated by dividing the sum of the adjusted prices by a divisor. The divisor maintains the continuity of the index.

What is the difference between Topix and Nikkei?

The Nikkei Index ranks stocks based on price, and it is constituted by the top 225 companies listed on the Tokyo Stock Exchange. On the other hand, Topix ranks stocks based on the free-float adjusted market cap.

What are the major indices related to the Nikkei 225 index?

The major index related to the Nikkei is Dow Jones. Just like Nikkei, Dow Jones is a price-weighted index.