News that the US judge ruled the public sale of XRP to retail investors was not a security offering erupted through the crypto market on Thursday, propelling the price of XRP up 100% to almost hit the $1 mark, with the excitement from the win permeating the entire cryptoverse, sending other altcoins up by between 5% to 40%. The win for Ripple is important for the crypto industry after months and months of attack from the US SEC – it shows that the US regulators are not necessarily in agreement with the ultra-tough stance that the SEC has been adopting. Ripple’s win especially gives coins that have been recently singled out by the SEC as securities, namely, SOL, MATIC and ADA, a new lease of life as they exploded with more than 30% gains overnight.

DeFi tokens which have also suffered heavily after the SEC tried to clamp down on staking services also bounced, with LDO jumping 30% after the price of ETH finally crossed $2,000.

The huge jump in crypto prices after the unanticipated announcement of the court ruling liquidated around $200 million worth of short positions in the market within 12-hours, one of the highest amounts of short liquidation in recent days.

BTC fails to break resistance despite Ripple’s win

King of crypto BTC needless to say, also bounced on the news, however, its failure to cross the $31,500 resistance led to a price decline on Friday, which took the price of BTC back to $30,000.

The inability of BTC to break resistance dragged down the crypto market, causing altcoin prices to retreat by an average 10% by the end of Friday, liquidating another $160 million worth of long positions in another 12-hour span.

Overall, the two-way action between Thursday and Friday liquidated around $400 million in positions, one of its highest two-way liquidations in recent history.

The crypto market’s volatile three days started after news that the US Department of Justice (DOJ) began to sell their seized BTC on Wednesday.

Traders started to open short positions after the DOJ was reported to have sent a total of 9,825 BTC out from their wallet to Coinbase for sale.

In March 2023, the US government announced its intention to sell off the 51,351 BTC that it seized from online marketplace Silk Road. After having sold almost 20,000 BTC since, the DOJ has another 30,000 BTC that it plans to dispose of in another three rounds of selling within a year of March 2023. Although the pattern of sale cannot be ascertained, from the dates of the past two sales, it seems that the DOJ would sell around 10,000 BTC every three to four months.

When traders saw that the price of BTC corrected lower even after a lower-than-expected US CPI reading on Wednesday, which sent the dollar on a tailspin, the shorts began to pile up.

However, after news broke about Ripple’s initial win in the lawsuit, the market completely erased any losses in prices incurred the day before, sending prices of altcoins rocking higher.

However, as traders started getting all too euphoric, prices soon came back to earth as soon as the price of BTC failed to cross the $31,500 barrier, resulting in late longs getting liquidated.

The actual cause of the market pullback was not known, but after overnight gains of more than 30% in many altcoins, a 10% correction was not surprising, while BTC’s pullback could simply be a result of the DOJ’s dumping.

Market sentiment could also have been soured by world biggest exchange Binance’s laying off of 1,000 staff as well as the deteriorating situation surrounding Multi Chain, a popular cross chain bridge that had its founders arrested by the Chinese government. As a result of the arrest, users with assets locked on the Multi Chain bridge could not be accessed.

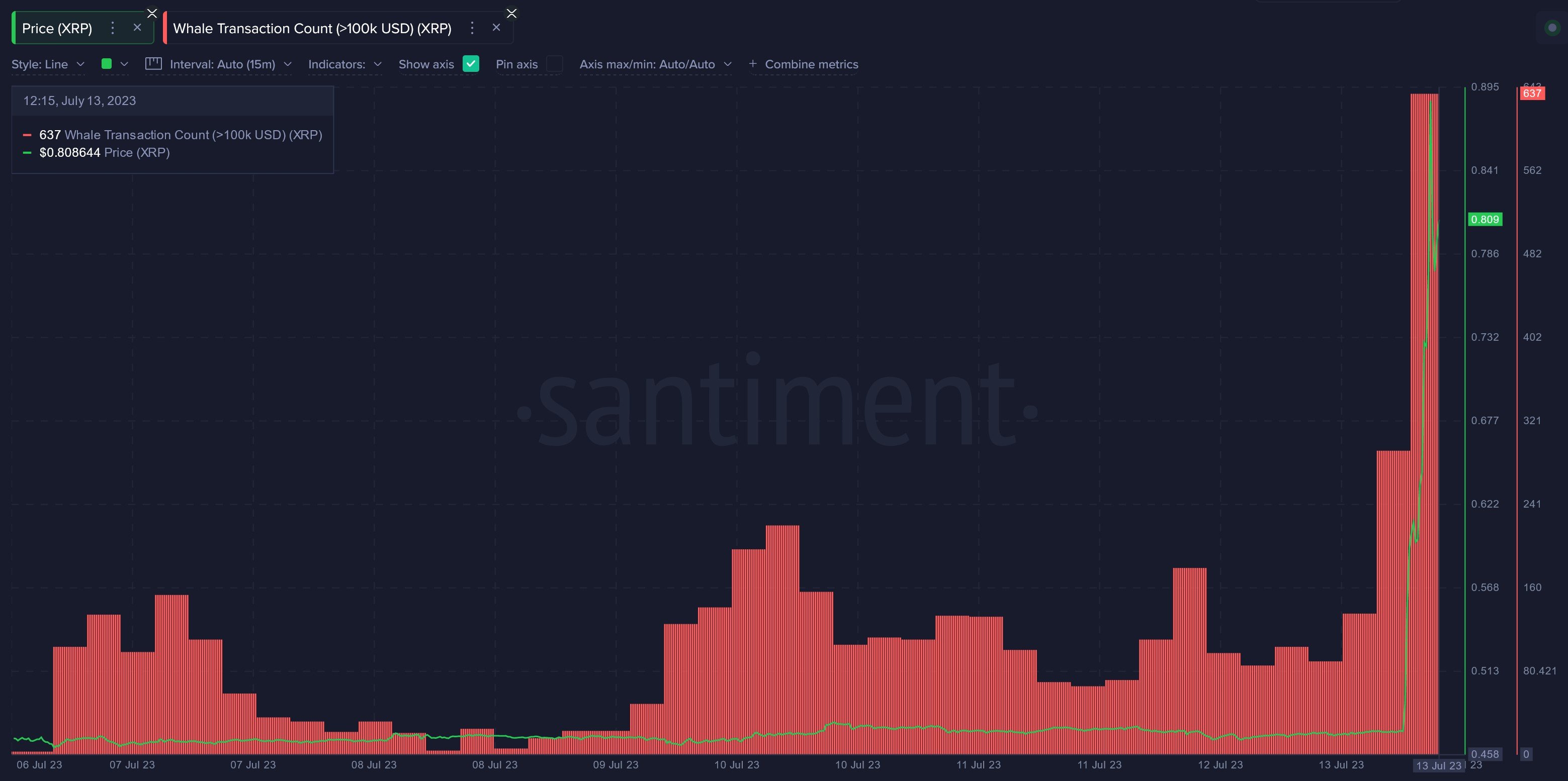

XRP whale address jump after positive ruling

As is to be expected after Ripple’s win, the number of whale transactions on XRP surged as investors started to buy XRP again. Exchanges that plan to relist XRP would also need to buy the token to prepare for its relisting. For instance, the largest exchange in the USA, Coinbase, immediately announced that it would relist the XRP token, and many other exchanges are expected to follow suit. This development is positive for the price of XRP after the token has lagged behind the rest of the market and has not had the chance to increase in value even after the Ripple team managed to achieve many positive milestones for the token over the past three years.

However, as the euphoria on XRP is high, which can be seen by the huge spike in XRP’s social volume, it may be more prudent to accumulate the token after a larger pullback when its social volume recedes.

While the judge ruled that the XRP token by itself is not a security, she did agree with the SEC that certain parts of the institutional offer of XRP in the past could be securities offerings. Furthermore, the SEC reserves the right to appeal the court’s decision and a trial would still be needed to finally settle the case since the judge did not issue a summary judgement. Thus, while the initial assessment is a win for Ripple, the case itself is not entirely over and further developments could still cause the price of XRP to fluctuate.

Gemini’s lawsuit on DCG could impact prices

A piece of news that has largely gone unnoticed by retail investors is the lawsuit filed by Gemini to Digital Currency Group (DCG) on 7 July after DCG failed to honour its repayments to Gemini. Should DCG be forced to sell its assets to repay Gemini or worse, file for bankruptcy, there could be an adverse effect on the crypto market as DCG would be forced to sell its assets, which comprises investments in a lot of crypto firms as well as tokens. One of DCG’s largest investments is the Grayscale Bitcoin Trust (GBTC), followed by its stake in the world’s largest BTC mining firm, Foundry Digital. Should DCG need to dispose of its prized assets, there could be a material impact on the price of BTC. Hence, the development of the lawsuit and more importantly, the fate of DCG and how it raises funds to repay debts owed and the way it disposes of its assets ought to be something that crypto investors and traders need to keep in view of.

However, other than this possible hiccup, the crypto market on the whole is on a better footing as regulations start to gain clarity and the more established fund names start to get involved by their filing of spot BTC ETFs.

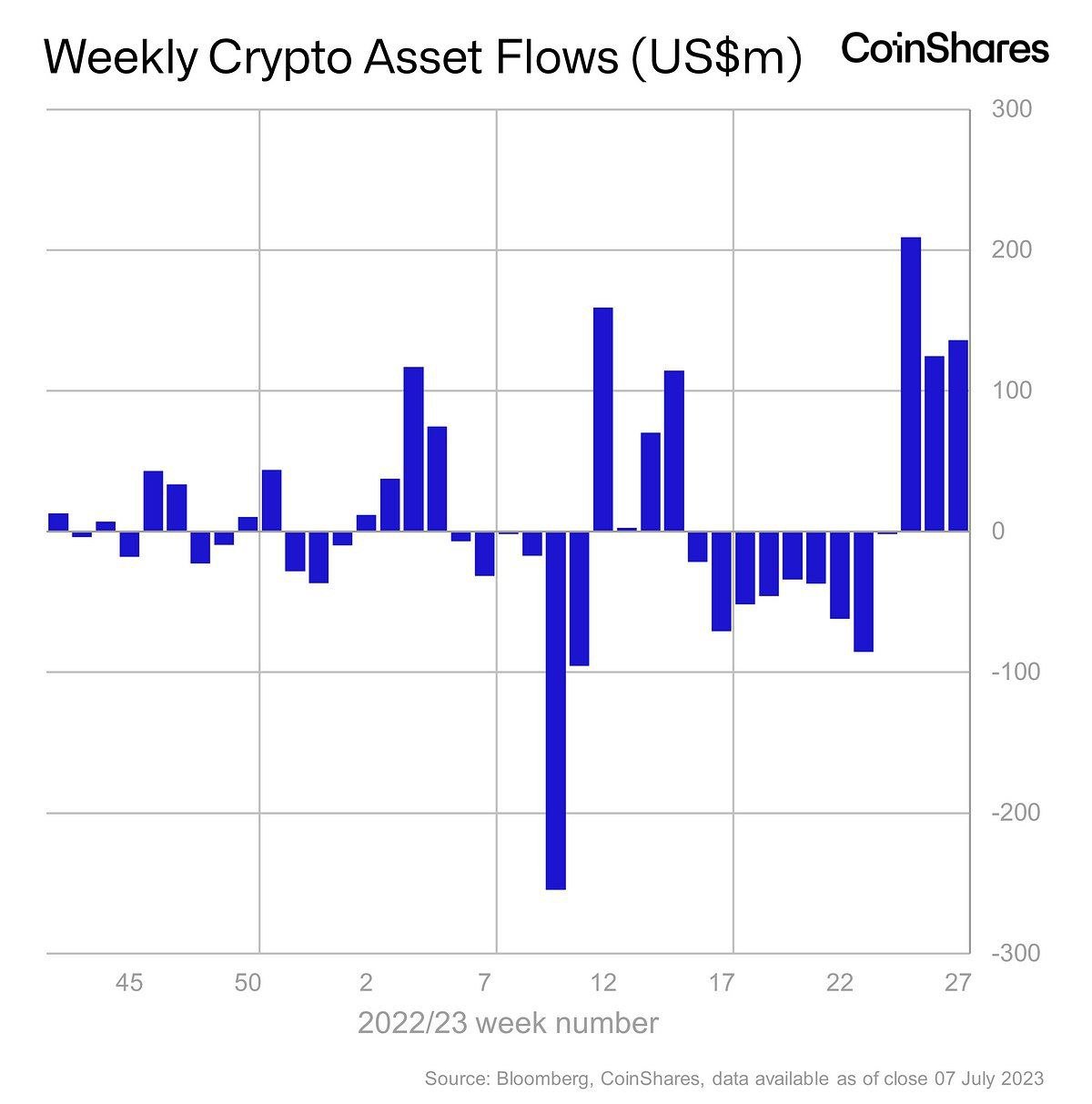

Fund flow to BTC and crypto improving

Confidence in the asset class has returned as digital asset investment products once again saw $136 million of inflows the week before, bringing the last 3 consecutive weeks’ inflows to $470 million, fully correcting the prior 9 weeks of outflows.

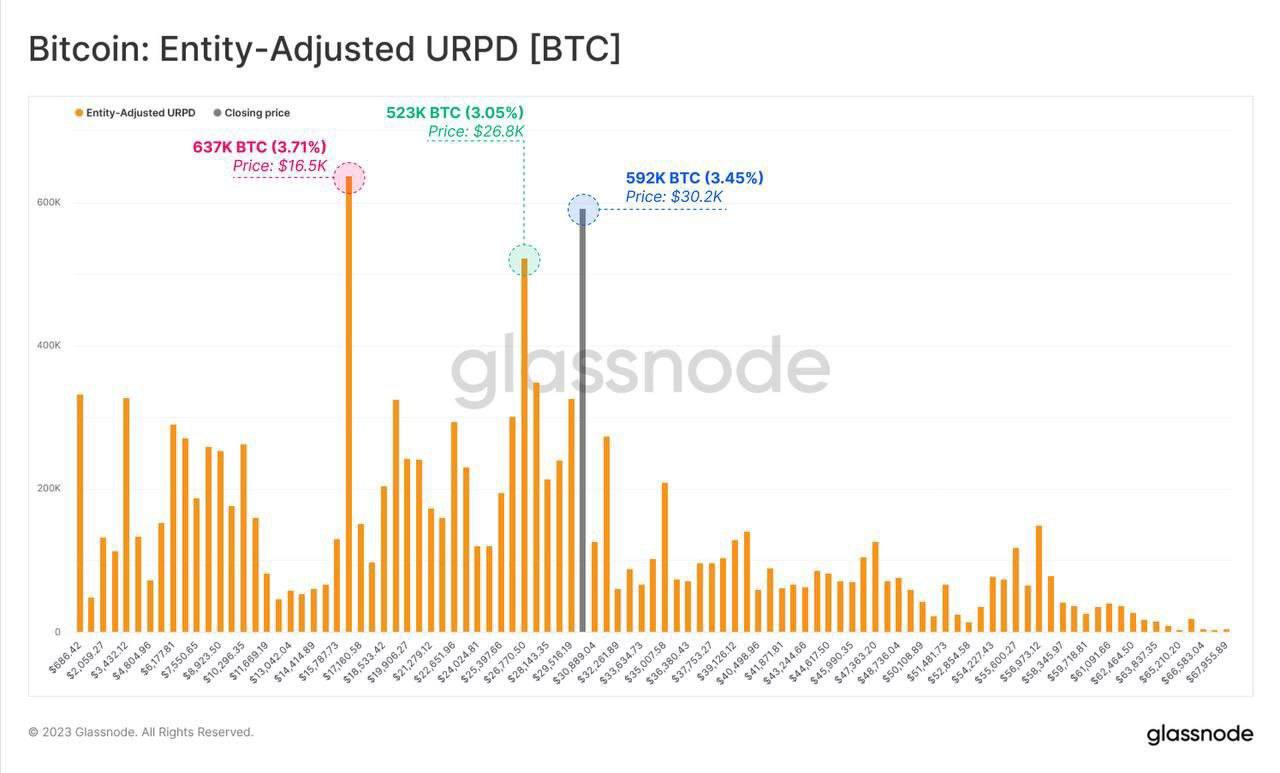

Furthermore, according to market data, there is a large amount of spot accumulation of BTC around the price of $30,200, which is the second highest amount next to the $16,500 level. This could mean the area around $30,000 level should be a good support. However, should this level break, the next cluster of support is not too far away either, at around $26,800.

Dollar sinks after inflation eases in USA

The release of lower-than-expected CPI numbers on Wednesday gave the already weakening US dollar another punch in the face last week, sinking it by 3%. More significantly, the DXY broke below the psychologically important 100 level which had held it up since early 2022, ending the week at 99.95.

The break of this key support could mean troubling times ahead for the dollar, which in turn could be a boon to other assets including commodities and crypto. As a result, Gold rose by 1.6% and Silver gained a whopping 8%, ending the week near $25 and is merely 20% away from its two-year high of $30.

The weaker dollar further caused oil prices to climb for the second week after OPEC+ cartel’s new supply cut, pushing the WTI higher by 2.3%, while Brent Crude rose by 1.85%, a lesser margin.

Needless to say, the more benign CPI numbers was a positive catalyst for equities, sending the Dow surging 2.3% for the week, notching its best performance since March. The S&P 500 added 2.4%, while the Nasdaq gained 3.3%. The positive showing from stocks also stemmed from better-than-expected Q2 earnings numbers from major banks like JP Morgan and Wells Fargo.

This week sees the retail sales number out of the USA on Tuesday – a better than expected retail sales number would convince investors that the US economy is still on a strong footing despite the past interest rate increases and could propel the stock market higher. Thursday sees the release of unemployment claims which could provide a further glimpse into the health of the US labour market in the final week leading to the FED meeting on 25-26 July.