Global markets had a roller-coaster week characterised by central bank actions again. This time, it was the BoE that intervened in the financial markets to stop bloodletting in its bond markets as yields spiked to dangerous levels that would cause systematic damage to its financial market landscape.

UK Policy Makers Throw in the Kitchen Sink

The UK intervened in the markets last week by temporarily buying long-dated bonds and suspending the planned start of the UK government bond selling next week after the pound continued to crash as investors question the UK government’s ability to fund its latest reform package that will see massive tax cuts for the wealthy.

The temporary stop-gap QE came as bond yields in the UK surged at their fastest pace in history, threatening the solvency of many pension funds which would have trouble paying interests on debt instruments. While controversial, the move managed to calm the UK bond markets and halted the free fall of the pound, even though market participants think this is just a technical rebound and the BoE will need to hike rates by another 200-400 bps to contain the flight from the pound.

The events last week have prompted many experts to diss at the UK government’s policies even as they ponder over the laughability of QE and QT being done at the same time.

Britons Rush to BTC For Safety as the Pound Gets Pounded

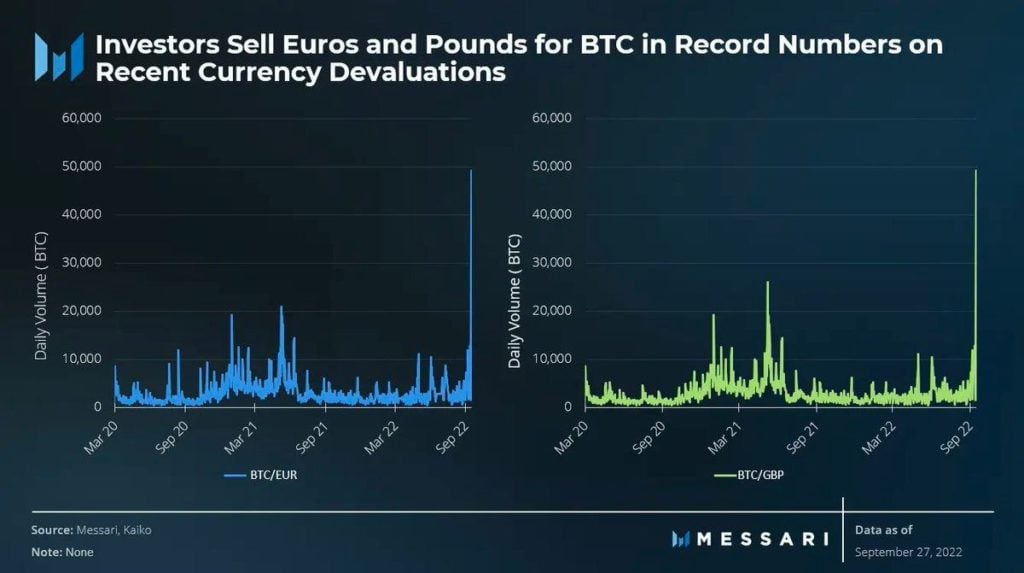

As investors packed their bags and left the British investment scene, BTC trading volumes in the pound sterling jumped more than 10-fold as the pound fell after investors dismissed the new economic reform package. The September average trading volume was $881 million vs $70 million for the same month.

It was the same situation in Europe, as Europeans too followed in the footsteps of the Britons by buying BTC as the euro fell even as inflation continued to climb in the EU, with the latest CPI figure out of Europe on Friday showing a historical high reading of 10%, up from August’s 9.1%. A falling euro in spite of record inflation may have prompted investors to park funds in an alternative asset as confidence in the Euro-zone continues to fall.

Holders of the British pound and euro are rushing to buy BTC en masse as a safe haven to prevent their wealth from being depleted. The last time this happened was when the Russian ruble fell against the US dollar.

These incidents clearly show that BTC is seen as a good quality protective asset in the minds of wealthy investors – a sign that BTC is gaining foothold as the most viable alternative to the increasingly vulnerable fiat currencies.

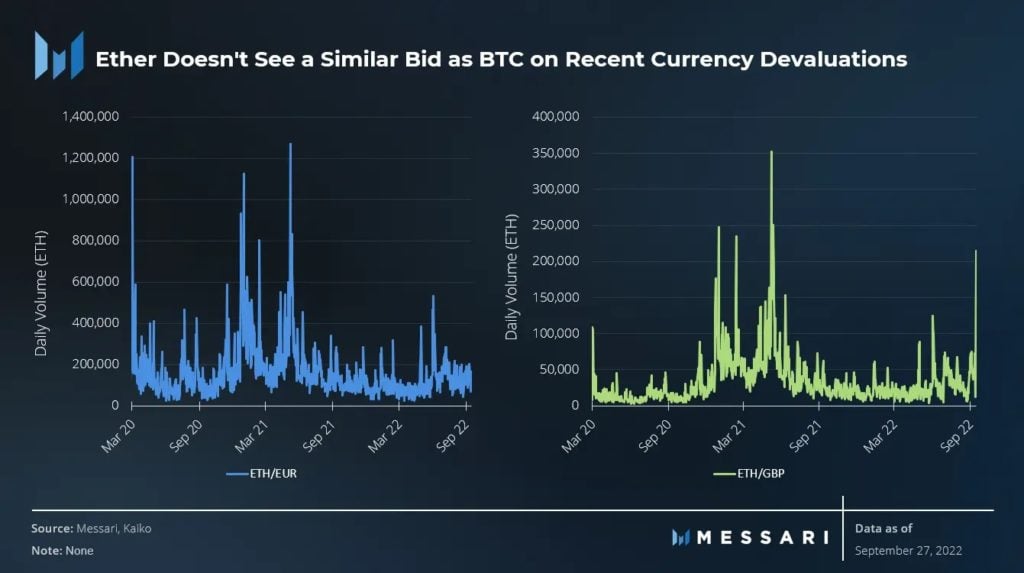

However, ETH is not seeing the same surge in trading volume, which may imply that investors only see BTC as the de facto safe haven asset and not other cryptocurrencies as yet.

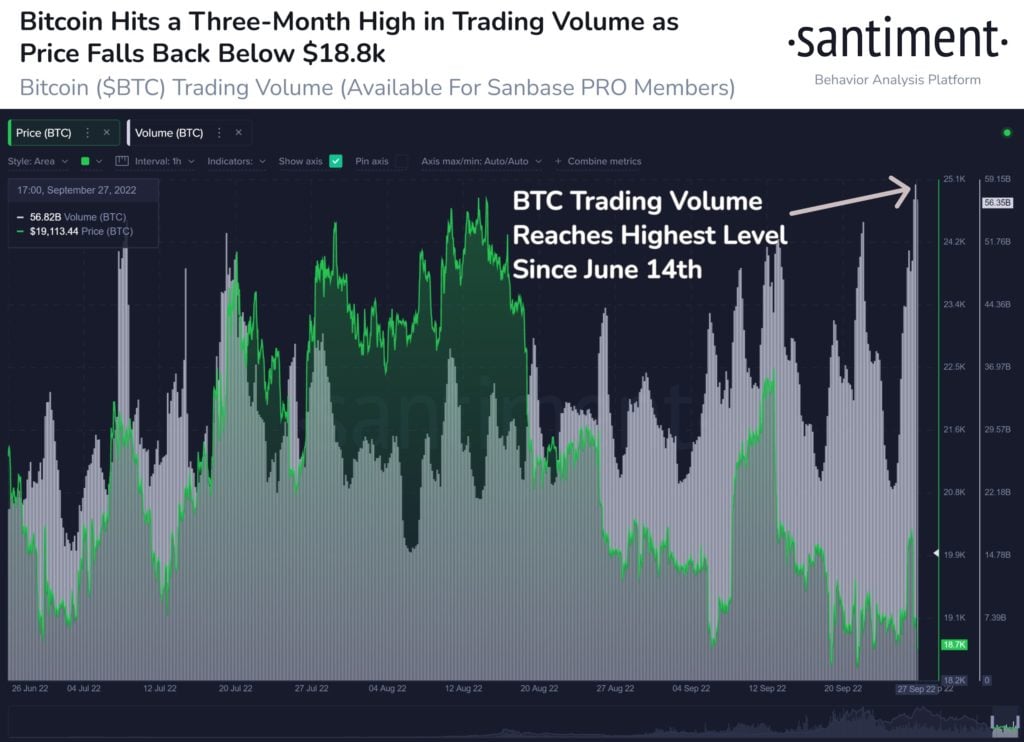

BTC trading volumes in stablecoin denomination also surged to a three-month high as the price of BTC simply bounced around the $19,000 level despite volatility in the stock markets surging to one of its highest levels in recent times. This could be partly attributed to European funds flowing into BTC, preventing it from breaking the $17,500 support.

US Stocks Lower in Volatile Trading as Playbook Turns to Europe

Volatility in the stock and bond markets continued last week, with swings of more than 500 points on the Dow being recorded almost daily as market participants try to make sense of what is happening in the UK.

The key US indices eventually ended the week at their lowest points again, while statistics for the month are not any better – the Dow tumbled 8.8%, the S&P 500 fell 9.3%, and the Nasdaq lost 10.5% in September. For the week, the Dow and S&P were lower by 2.9% while the Nasdaq fell 2.7%. On a quarterly basis, the Dow lost 6.7%, the S&P lost 5.3% and the Nasdaq dipped 4.1%.

Market experts predict the volatility in the stock and bond markets to continue as we move into the earnings season, albeit with a downside bias to prices, as US inflation does not appear to be abating.

Economic figures released on Friday showed that supplier-side inflation rose 4.9% from a year ago in August and +0.6% on a month-on-month basis, around 0.1% higher than expectations, while consumer spending and personal income remain robust. As these numbers will likely make the Fed continue its aggressive tightening stance for a while longer, the USD moved higher again on Friday after a mid-week pullback after the numbers were released.

The USD initially declined mid-week after the UK started temporary QE to stem a systematic failure of its bond markets, leading market participants to expect the Fed to have to do something similar down the line. However, US data released on Friday squashed that hope.

Nonetheless, the mid-week USD pullback was a saving grace for precious metals, which have been languishing under the weight of the USD. Gold managed to end the week a tad higher to close at $1,660 while Silver rose about 2.7% to settle at $19. Both metals are opening the fresh new week flat.

Oil had a relatively uneventful week as traders await the OPEC+ meeting scheduled on October 5. Both Brent and WTI saw a weekly gain of around 2% as the market expects OPEC+ to announce an output cut in the meeting. Indeed, prices are starting the new week up almost 3% in early Asian trading after an OPEC+ official revealed on Sunday that the cartel will consider an oil output cut of more than a million barrels per day at its Wednesday meeting. And as NATO is expected to dish out fresh new sanctions on Russia after it annexed four former Ukrainian states on Friday, traders expect oil prices to climb again as we head into the winter season.

Crypto Sees Mixed Week as BTC Holds Firm

Cryptocurrencies have been mixed, with only BTC managing to witness a more sizable capital inflow compared with all other altcoins. The month of September has seen BTC dominance gain back to above 41% after hitting a low of 38.8.

This may possibly show that BTC has lived through the worst period of purging when the aftereffects of several crypto firm failures hit the leading crypto. While being a good sign, this may not necessarily mean that the price of BTC would not decline but is merely signalling that its price performance could likely outperform altcoins in the near-term.

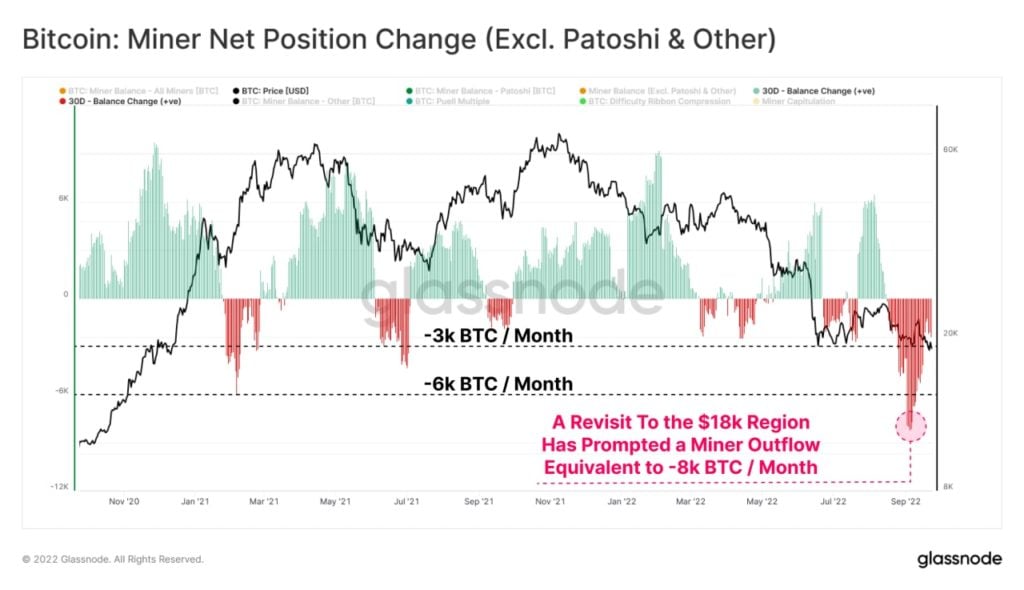

That said, BTC has not been without sellers, as miners have been seen disposing of their stash last week.

BTC Miners Selling but LTHs Remain Steadfast

Miners have turned sellers again as the price of BTC showed a lack of direction. BTC miner NPI shows that miners have sold another 8,000 BTC last week.

However, despite some selling pressure seen last week, BTC held by long-term holders remains untouched.

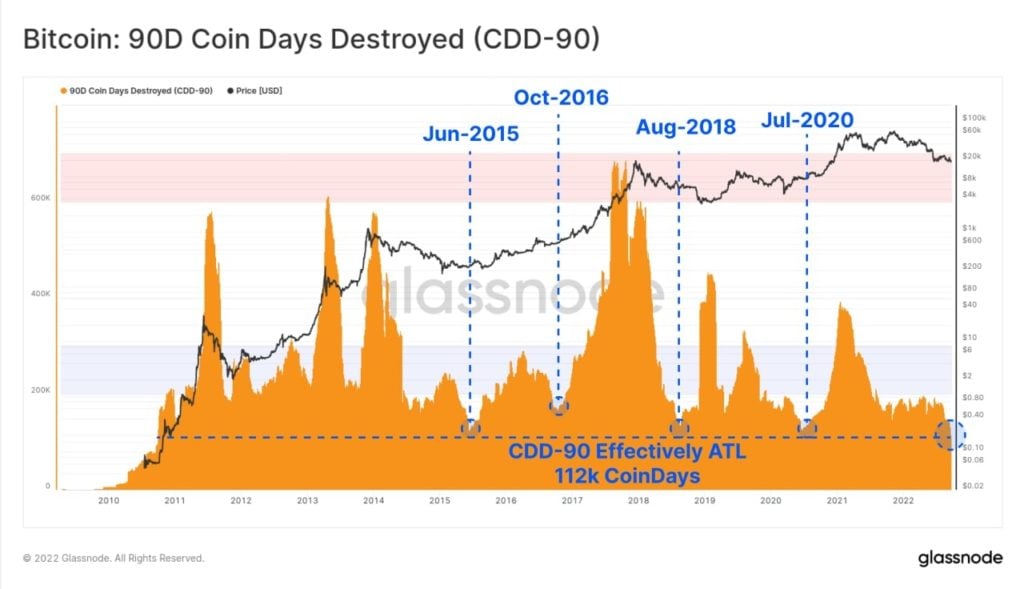

The BTC 90-day average days-destroyed has reached an all-time-low, even below the levels seen in previous bear markets. This shows that long-term holders in the current bear market have more conviction and are not selling, since the coins days-destroyed metric tracks how much coins have been sold. The low value indicates that long-term holders have not been actively selling since May.

With not much fundamental story inherent to crypto markets this week, movement in the crypto markets should continue to be influenced by the traditional markets, especially the US stock market and USD.

Unless something out of norm happens in Europe again, attention in the traditional markets this week should likely move back to the US as important economic numbers for September get released. Monday and Wednesday will see the manufacturing and services PMI data released – readings that are in-line with expectations could see the USD bounce higher, while the much-followed non-farm payrolls will be released on Friday.

There are also central bank meetings in Australia on Tuesday and New Zealand on Wednesday. Expectations are for a 50-bps rate hike each.

However, it is worth mentioning that over the weekend, rumours about Credit Suisse bank having a “Lehman” type credit problem have started making its rounds. While such a situation normally takes a while to implode, it may be prudent for traders to keep this issue at the back of their minds in case the situation starts blowing up, which would be catastrophic for the already dire situation in Europe.