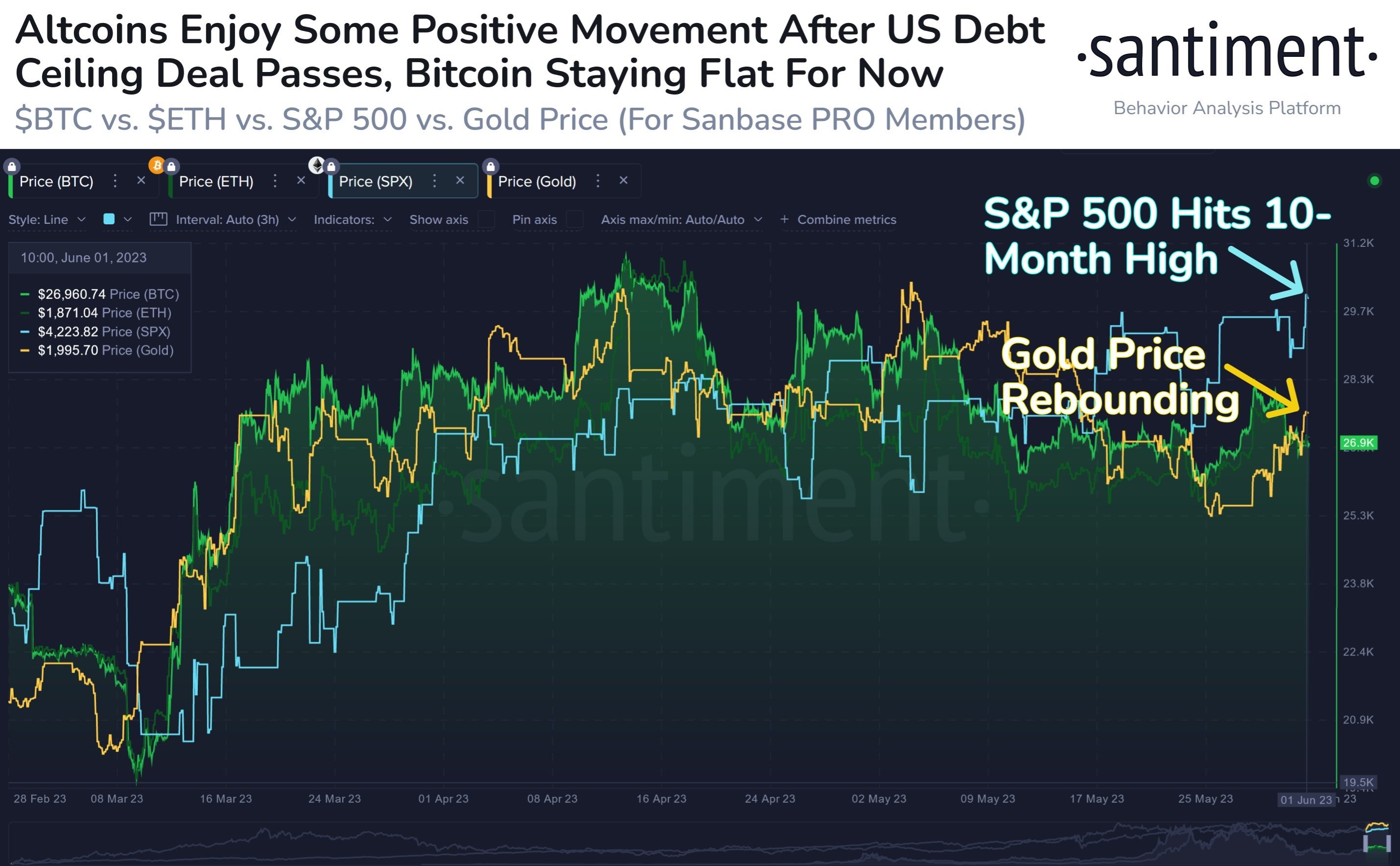

Crypto prices have been locked in the same range again as early week losses due to the initial impasse in the US debt ceiling gave way to a recovery after US lawmakers voted to pass the bill late on Thursday. Eventually, most crypto prices ended the week near levels where they started, with leading crypto BTC ending the week again around the $27,000 level. Altcoin leader ETH however, had a more bullish week in comparison, closing the week around $1,900.

Altcoins also showed a marked improvement in price action last week, with some popular names demonstrating strength in the midst of an uncertain crypto market. Coins like FIL, LDO, TRX and XRP put in some commendable gains, with XRP even gaining 15% after we highlighted it last week.

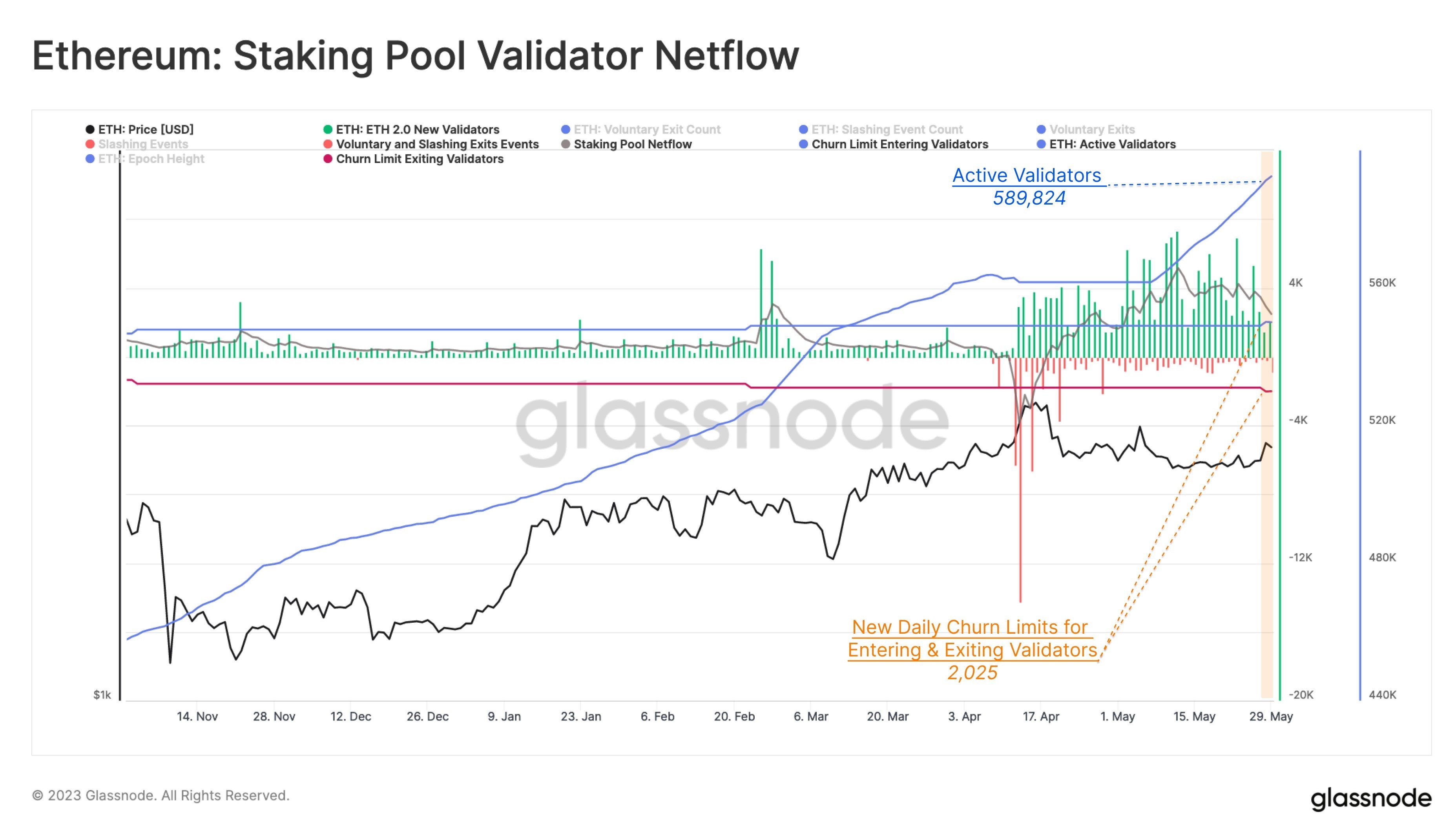

ETH Validator Count Shows Steady Growth

One possible reason for the current outperformance in the price of ETH against BTC could be improving ETH staking fundamentals as the number of ETH stakers (ie validators) has shown a steep but steady climb in the month of May after the initial pent-up initial withdrawals have been completed towards the end of April.

As naysayer’s warning of a big price dump did not materialize, confidence in ETH appears to be restoring as more stakers are participating in ETH staking, as can be seen in the high number of new validators entering each day as shown in the diagram below.

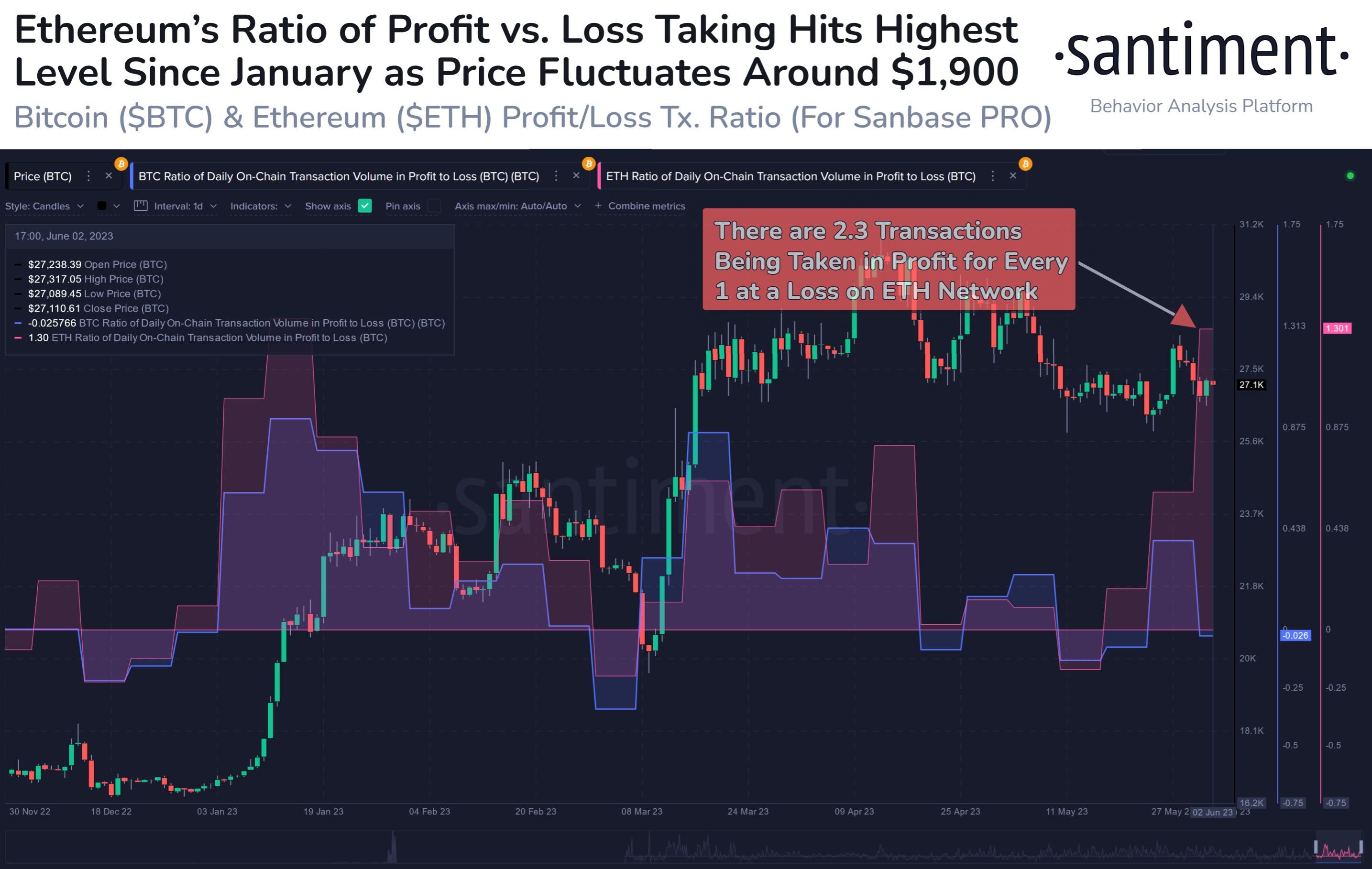

However, in the short-term, there has been an increase in the number of profit-taking transactions on ETH, especially over the weekend after the price of ETH crossed $1,900. As can be seen in the diagram below, the amount of profit-taking on ETH has grown to twice that of BTC, which may imply that ETH is facing more short-term profit-taking than BTC. This could affect the short-term price performance of ETH when compared with BTC.

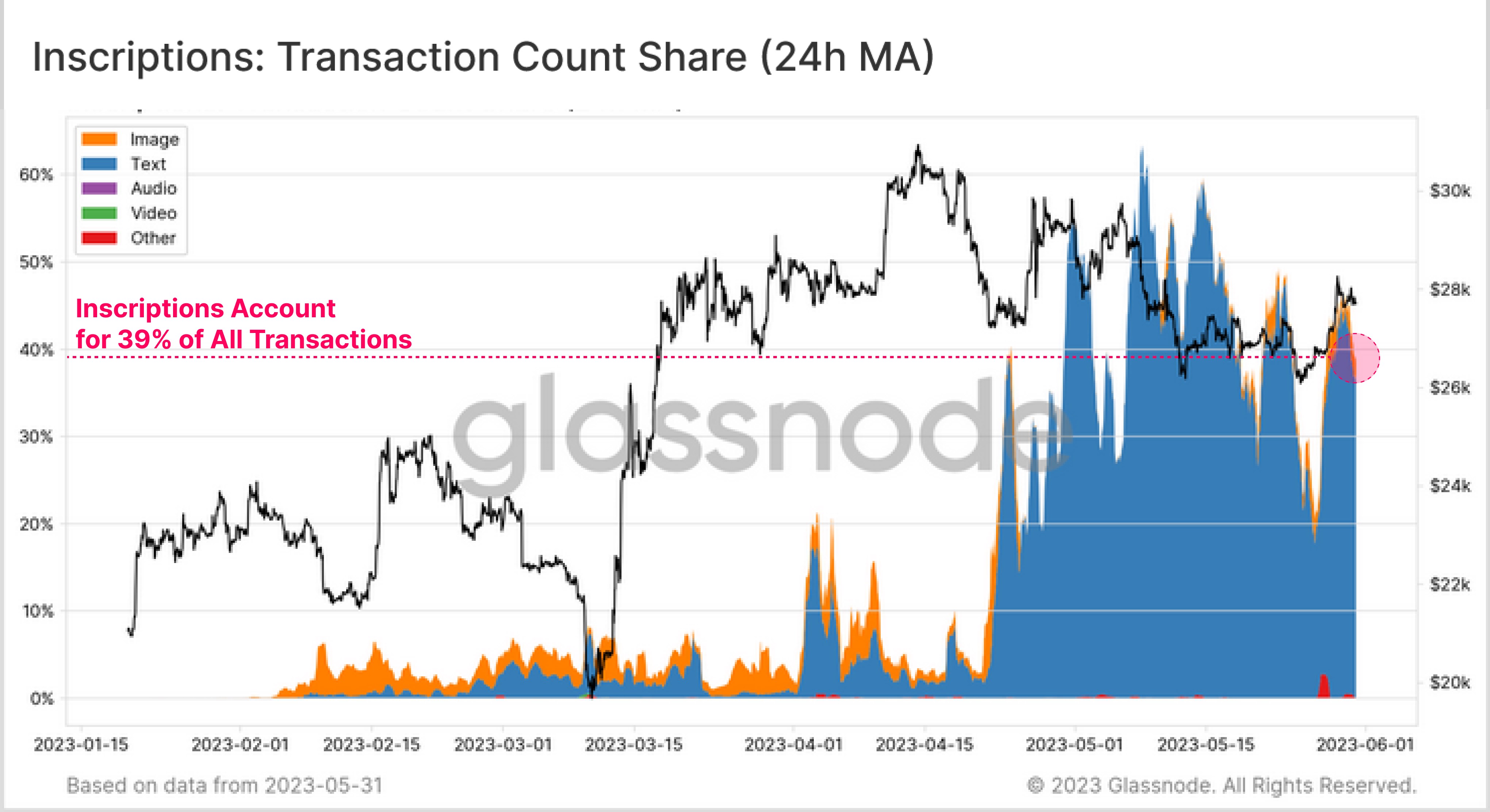

Popularity of Ordinals a Boon for BTC Miners

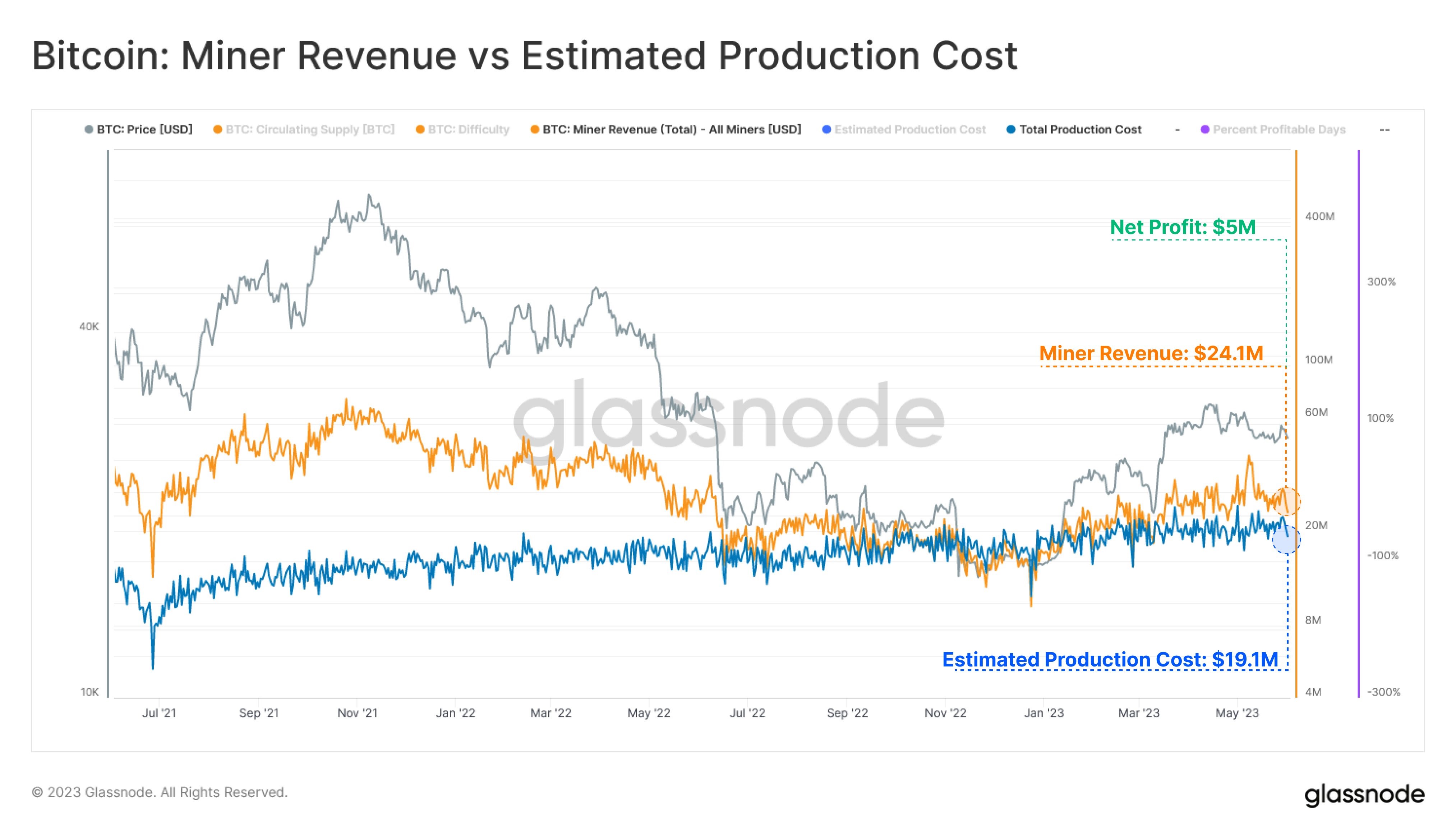

BTC, on the other hand, is showing some underlying strength, as the number of Ordinal transactions has managed to remain at elevated levels. We had mentioned before in our previous reports that the ability to maintain the high level of transaction was an important factor in determining the longevity of the Ordinals trend, which has been helping to improve BTC miner’s profitability as the extra transaction fees generated would go to miners as rewards.

To give an illustration, listed BTC miner Marathon Digital said the company mined a record 1,245 BTC in May, an increase of 77% from the previous month and a 366% increase from a year ago, due to the emergence of Ordinals which significantly increased transaction fees. The company opted to sell a minimal number of only 554 BTC in May to pay costs as it remains hopeful that better times are ahead. Thus it can be seen that the emergence of Ordinals can help miners’ profitability and this in turn reduces selling pressure on BTC. On the demand side, the sustenance of Ordinals also creates a consistent demand for BTC, which will benefit its price.

Overall, BTC miners, with the help of Ordinals, are out of the survival crisis they experienced late last year, and have turned profitable since March. Their profitability has also seen a jump in May, which in turn greatly reduces their need to sell more BTC.

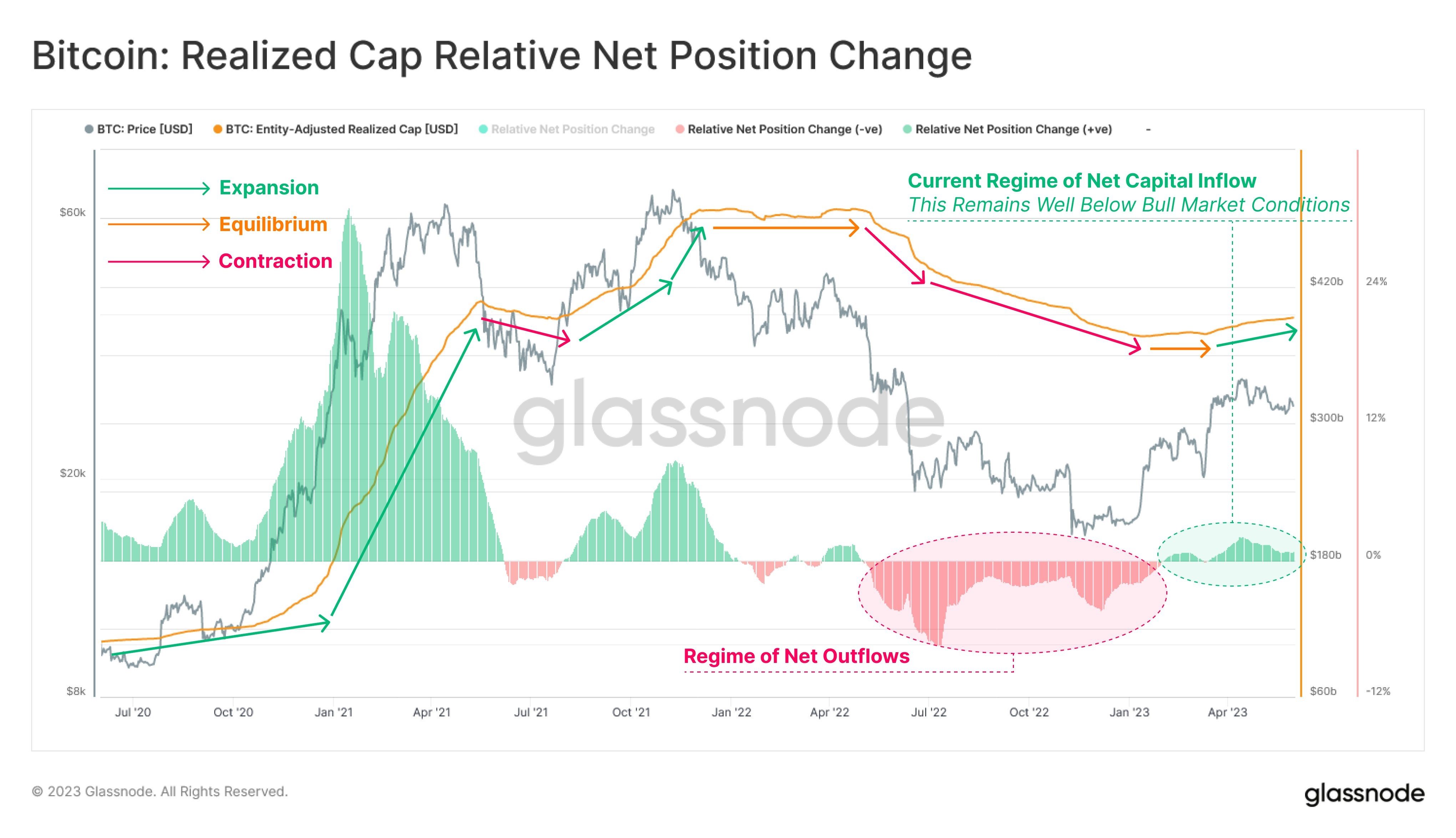

BTC Realized Cap Shows We Are in Pre-Bull

Following a period of significant capital outflow, the BTC Realized Cap has stabilized, and is beginning to record a net capital inflow once more. This change from negative to a small positive has been historically reminiscent of the beginning stages of a new bull market. However, it could still be many months more before the actual bull market takes off, as can be seen in the 2020 cycle.

Stocks Surge On Debt Deal and Balanced Labor Data

US stock markets popped higher after US legislators finally voted to pass an extension of the debt ceiling late last Thursday, while employment data released over the week too gave investors reasons to cheer as data released showed that the US labor market was in good shape. First, the ADP figure released on Thursday showed that private payrolls grew more than economists expected for the month of May, while the number of jobless claims filed last week was smaller than economists forecasted. Next, Friday’s release of the non-farm payrolls for May increased by 339,000, beating the 190,000 estimate by a huge margin.

The positive news led major stock indices to a strong rally, as the Dow put in its best day since January on Friday, gaining more than 700-points. Tech stocks, which have been the strongest sector quarter-to-date, led the Nasdaq to its six consecutive winning week, posting a similar percentage gain with the Dow, with both indices putting in a rise of 2% for the week. The S&P was not very far behind, as the broader based index made a weekly gain of 1.8%.

While the strong employment numbers may worry some investors that more rate hikes could be on the way, the declining average hourly wage and higher-than-expected unemployment rate of 3.7% versus 3.5% could prevent the FED from getting too aggressive.

Furthermore, the lower-than-expected PCE inflation index released the week before showed that inflation is easing, which has prompted some investors to expect the FED will pause in June and do a last hike at their 26 July meeting. Previously, market expectation was for a 25-bps hike in both the June and July meetings.

This reduced hawkishness has caused the US dollar to lose some ground late week as the DXY declined 0.22%, giving some room for commodity prices to bounce. Gold gained 0.22% and Silver rose 1.5%. However, oil prices still languished for the week, with the WTI and Brent losing 1.8% and 1.6% respectively even after a rally on Friday as traders reduced exposure ahead of the OPEC+ meeting on 04 June.

But the opening of the new week has seen oil prices pop by some 2.5% in early Asian trading on Monday as Saudi Arabia announced during the OPEC+ meeting that it would cut production by one million barrels per day – something that traders were not expecting.

On the macro data front, this week is relatively quieter, with only the Services PMI on Monday and Unemployment Claims on Thursday being key releases out of the USA. However, the central banks of Australia and Canada are scheduled to have their regular monetary policy meetings on Tuesday and Thursday respectively.