Stock and crypto prices tanked after Fed Chairman Powell made his stand about interest rates very clearly at the Jackson Hole Symposium on Friday. Recent weak data out of the USA and the easing inflation rate had given some traders hope that the Fed would ease on their monetary tightening, which would be a boon for the prices of risk assets. However, Powell was even more hawkish than what hawks expected, noting that rates are not expected to come off anytime soon, and that the Fed would continue to raise rates until inflation reverts to their target 2%.

With inflation currently at 8%, a 2% target is very far away, and this caused a broad selloff in both stocks and crypto. Things were made worse as Powell warned of some pain ahead in the economy as the Fed would do whatever it takes to fight inflation.

Stock prices tanked the moment Powell started his very short but concise speech, sending major US indices to their worst rout in 3 months. All three US stock indices lost more than 3% on Friday, closing the second consecutive losing week at their lowest levels.

For the week, the Dow lost 4.2%, the S&P dropped 4% while the Nasdaq was lower by around 4.4%.

The USD was clearly the big winner, as would yields, as the US 2-year Treasury and the March 2023 Fed Funds Futures shot up by roughly 0.5% after Powell’s comments. The benchmark 10-year Treasury yield went back above 3% to close at 3.043%.

Gold and Silver were similarly hammered after Powell’s comments, as both precious metals gave up early week gains and closed the week flat but are opening the new week down 1%.

Oil is the only unscathed asset, still managing to eke out solid gains despite the stronger USD. Brent rose by 4% to move above $100 again, while the WTI gained more than 3% to trade near $94 in early Asian trading today. Oil prices started rising last Monday after Saudi Arabia flagged the possibility of production cuts to offset the return of Iranian barrels to oil markets should Tehran clinch a nuclear deal with the West. Even after the Fed warned of economic slowdown on Friday, the fear of supply disruption kept the price of oil moving higher.

Cryptocurrencies were negatively impacted by Powell’s speech as cryptos are known to have an inverse correlation with the USD. BTC fell more than 6% in the immediate aftermath of Powell’s speech, while ETH sank more than 10%. After weeks of small gains, crypto prices finally gathered the down draft for a fall that had been subtly pre-warned here in our previous reports.

From Friday to the early hours on Saturday, long liquidations were notable, with around $300 million worth of longs liquidated and not many shorts being liquidated. While this was the highest amount of liquidation for the past 10 days, it is much lesser than the amounts seen in June and mid-August as most traders are already prepared for the bear market.

Stablecoin Supply Forewarned Lack of Crypto Demand

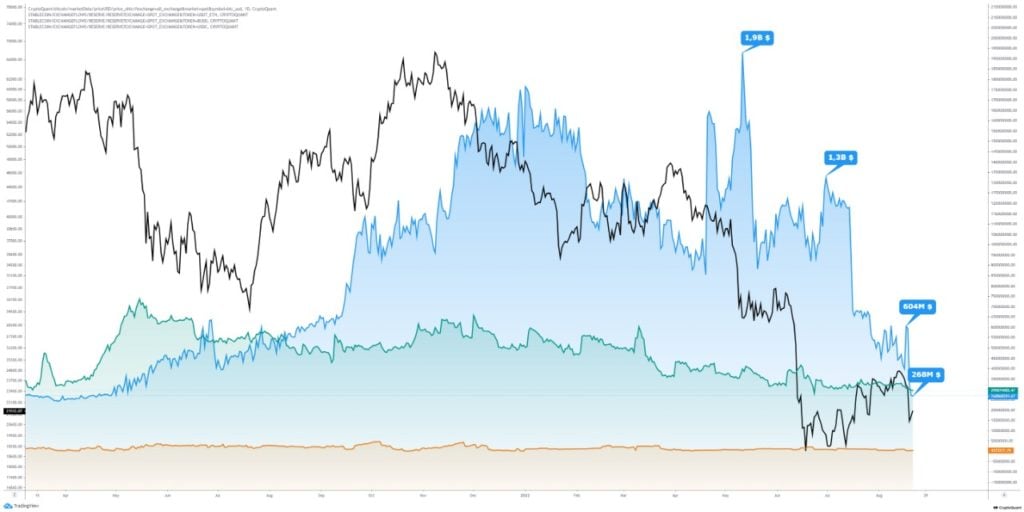

The warning signs were all over the place as exchange deposits and stablecoin supply already gave hints of a possible dip forthcoming.

The supply of stablecoins on spot crypto exchanges has not shown any big movement, a sign that investors are neither buying or selling crypto tokens since stablecoin reserves appear generally flat. This happens when there is a lack of interest in trading, which is typical of a prolonged bear market, which could imply that the market is still not out of the woods.

As it was proven on Friday, the price of cryptos tanked after comments made by Powell dashed hopes of a pivot in monetary policy anytime soon.

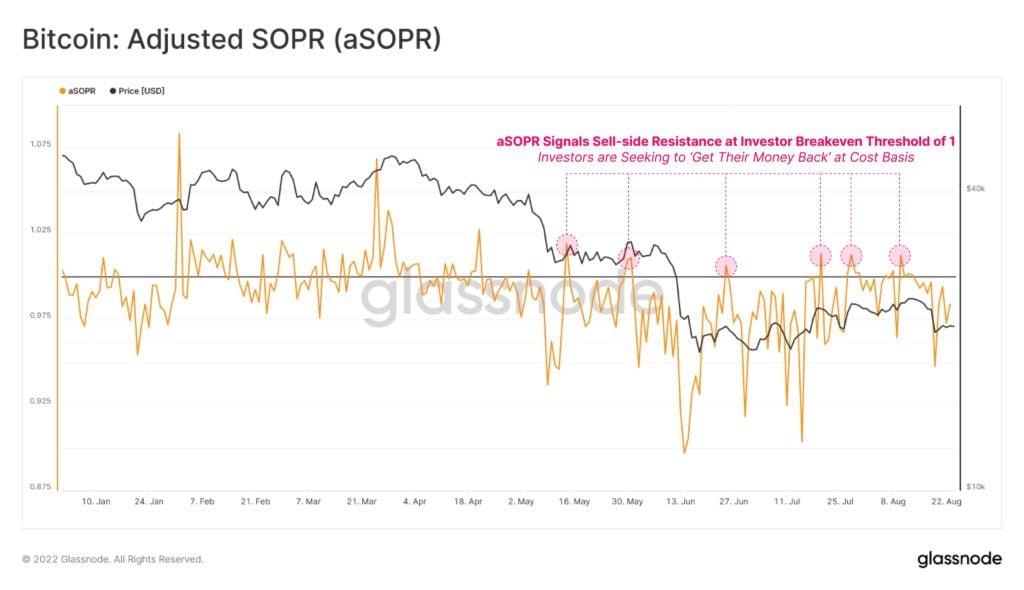

To make things worse, according to BTC’s adjusted SOPR, since May, investors were taking any bounce in price to sell, with data showing that most investors were only trying to recover their capital.

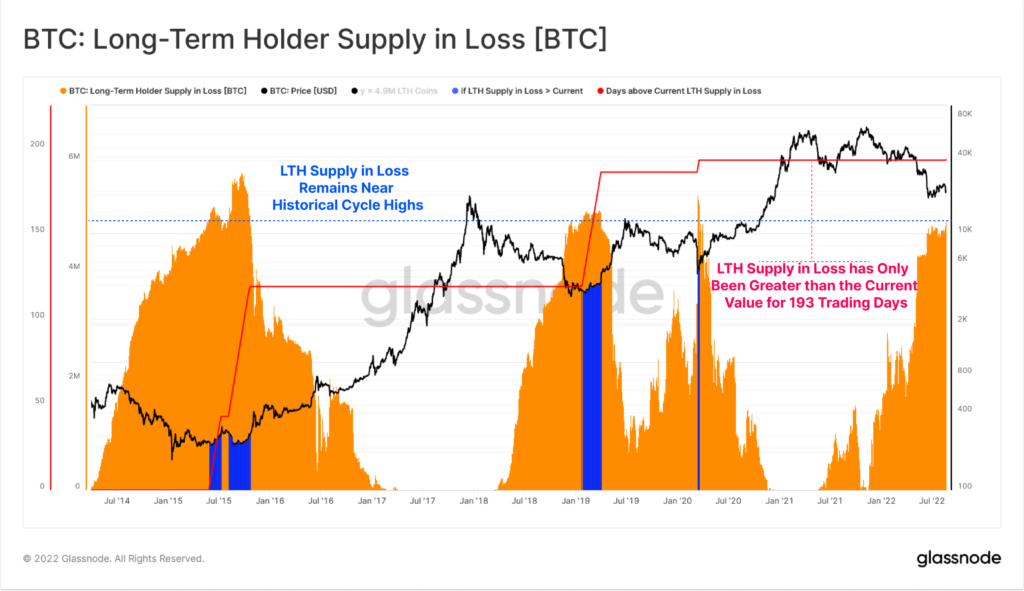

History Hints of Another 6 Months of Bear Market

The above reaction is understandable as the amount of BTC held at a loss amongst long-term holders is increasing sharply again, only inches away from the 2015 ATH. For the record, this metric has been at around this level for another 193 days in previous cycles, which could imply that the bear market may have another 6 months to go before a more sustained period of price increase would materialise.

As BTC appears to be facing some headwinds ahead, the situation for ETH appears to be worse as it gets hit with a double dose of issues. Other than the macro-economic environment not favourable for crypto, ETH investors have another reason to be fearful of a possible large price dip – the Merge.

ETH Community Tense Ahead of The Merge

As the date of The Merge draws near, experts in the ETH community are having cold feet, as some developers have said that they found several bugs.

Investors also seem to be a lot less enthusiastic and teeming on the cautious side, selling their ETH stake to wait for the dust to settle. One such investor is Valkyrie Investments that manages $1 billion in crypto AUM.

Valkyrie CIO Steve McClurg said during an interview last week that as ETH prepares to transition to a proof-of-stake consensus mechanism in September, his fund is exiting all its positions in ETH to wait in the safety of BTC until the final PoS product proves to be as secure as its current version.

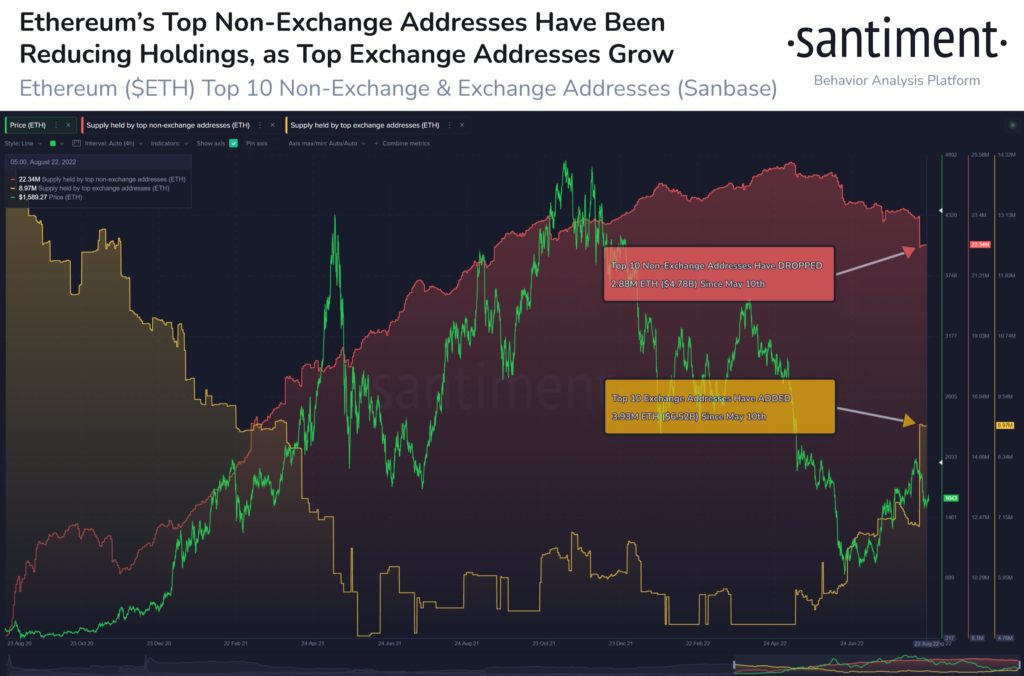

Indeed, Valkyrie is not the only whale exiting from ETH. Taking a look into ETH top wallets balance vs ETH exchange balance shows that whales are depositing ETH into crypto exchanges, possibly in preparation for sale. There was an in-tandem fall in the whale wallet balance that corresponds to exchange deposits last week. In fact, the amount of ETH deposited to exchanges is even larger than what ETH whales have sent out – a sign that many other smaller investors are sending their ETH to exchanges for sale. This can be easily deduced by looking at whale address balance, which have only declined by around 11%, against exchange deposits, which have surged by 78%, under the same scale.

This shows investors’ fear about the outcome of the Merge that is scheduled to occur on/around 15 September, which is not a good sign for the price of ETH in the near-term, at least until after the Merge is complete and the PoS blockchain is stable.

BTC and ETH Break Support as Dump Intensifies

Even though the traditional markets were closed for the weekend, the crypto market continued to trade, sending the prices of BTC and ETH lower. BTC has broken below $20,000, while ETH is now convincingly below $1,500.

Altcoins are also faring badly although most of the carnage appears to be centred on ETH. There are bursts of positive altcoin action however, as some investors may have taken the dip to accumulate the more popular altcoins like MATIC, which has bounced by about 6% over the weekend but has given up almost all the gains as Monday beckoned.

With funding rates negative at the weekend, crypto prices stabilised on Saturday, only to dump when the Asian stock markets opened much lower on Monday. Should the US stock market also slide when it returns, crypto is expected to follow suit. With its June low of $17,500 only 10% away, many eyes will be on BTC this week to see if that level will hold.