Following news that another Singapore-based crypto lending platform, Hodlnaut, has stopped withdrawals due to liquidity problems, the crypto market came off early week, but managed to recoup all their losses and made new recent highs after the US CPI data released on Wednesday showed that inflationary pressures were easing in the USA, which led traders to think that a Fed pivot could be coming soon.

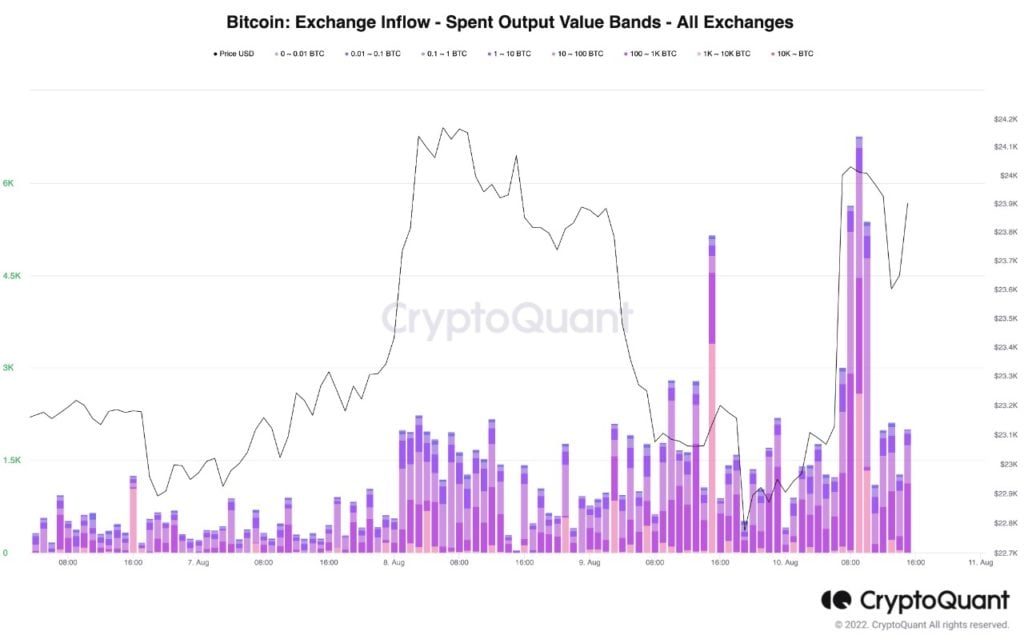

However, strangely enough, while some short liquidation sent crypto prices higher, there was a significant amount of BTC deposits to exchanges shortly after. Whale wallets holding between 1,000 to 10,000 BTC moved their coins to exchanges more than usual on Wednesday. Could this whale action stop the BTC assault on $25,000 again?

ETH led the market higher after a successful final testnet implementation of PoS on Thursday, which means the next step will be the mainnet Merge, which has been brought forward by a few days and is expected to happen between September 15-16. Market participants are excited, with many investors rushing to buy ETH in the hope of getting new forked PoW versions of ETH after some miners are going ahead with their plan to fork into new ETH that would continue to use PoW.

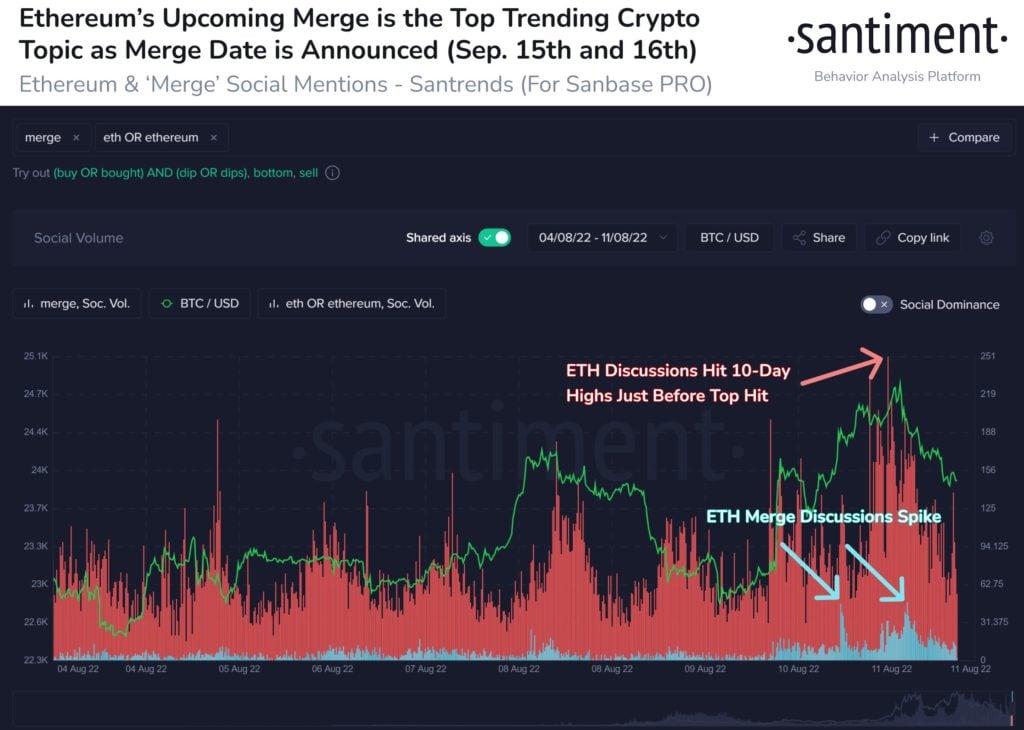

This excitement can be clearly seen in the social media mentions of ETH and the Merge, which have spiked on Thursday to a 10-day high.

The rush to buy ETH to get the forked tokens have led to the steepest backwardation in ETH’s price since the March 2020 crash, with its spot price trading at a premium to its futures price as traders buy in the spot market to get the forked tokens, but at the same time, are hedging against a price fall by shorting ETH in the futures market, causing a strange occurrence where the future price of ETH is lower than its spot price.

However, bearing in mind that the Merge is not going to happen in another month, investors need not FOMO now but have one more month to wait for a better price to buy ETH.

It wasn’t only ETH with singing and dancing; revelation out of Blackrock, who manages $10 trillion, also gave BTC investors something to cheer about as the largest VC firm in the world revealed that it has seen substantial interests in BTC from institutional clients despite the steep downturn in the market. This news may have supported the price of BTC, with the leading crypto attempting to challenge $25,000 over the weekend as more investors are coming back in to buy BTC.

Crypto starting to heat upBTC Bottomed but Bull Run Not Near Yet

While BTC’s price has been bullish of late, metrics however, still do not suggest a sustainable rise in price.

The BTC Investor Tool, which shows the BTC realized price against various long-term Moving Averages (DMA), is one example. According to this tool, a new bull trend starts when the realized price (yellow line) trends above the 730-day MA (green line) while a bottom is said to be in place when market price moves above the yellow line.

Currently, the market price of BTC has traded above the yellow line, which could imply that the bottom is in. However, since the yellow line has not moved above the green line, a new bull market is still not imminent, which could mean BTC’s price could remain rangebound for some months more.

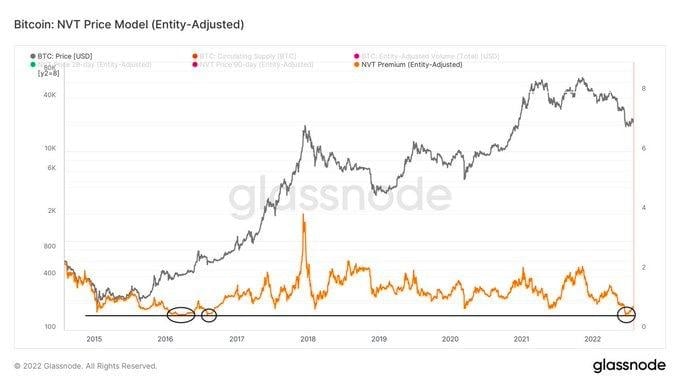

According to the NVT, BTC could also have put in a bottom already. However, this metric has had two variations in the past, where one bounces off sharply and the other would create a double bottom as seen in the 2 circled portions between 2016 and 2017. Hence, for this current cycle, it may be too soon to assume that the metric would continue moving up sharply. It may be more prudent for investors to not be too tempted to chase rallies but to wait for good entry levels to come to them.

Could BTC Still Put in a New Low?

According to Whalemap, the realized BTC purchase price of wallets holding 10-100 BTC have acted 3 times as key support during previous bear markets and thus, should do the same in this cycle. At the moment, this realized price is $12,780, which could mean that there is still the possibility that BTC may have one more dump should the macro-economic situation take a turn for the worse. However, in other years like 2014 and 2020, BTC’s price did not hit the realized price but instead bounced ahead of touching it. As such, investors could treat this metric as a bear case scenario instead of a default scenario to prevent missing out on buying opportunities in case the final dump does not materialise.

Goerli Merge Success Sent ETH Soaring

Late Wednesday night, the final ETH testnet goerli activated PoS successfully, sending the price of ETH soaring by over 10% overnight as investors cheered the dawn of a new era for ETH. As more clarity is received from large stakeholders like issuers of stablecoins Circle and Tether, who have come out in favour of supporting only the PoS version of ETH instead of whatever new forked versions that would run on PoW, the price of ETH had already been climbing since the start of the week, and the goerli network’s successful merge puts the icing on the cake for ETH holders, who have seen their ETH rise more than 15% to touch $2,000, helped further along by the lower than expected CPI number out of the USA.

Positives aside, there is also a small amount of contention amongst market watchers who fear that moving to PoS could make ETH meet the definition of a security under the Howey Test. However, for the moment, investors do not seem bothered by that possibility yet.

ETH Throughput to Surpass Visa Post Merge

Vitalik Buterin has claimed that when ETH 2.0 is complete, ETH will be able to process 100.000 transactions per second (TPS).

Someone has put together a nice infographic to illustrate the TPS of each service provider, including VISA. As can be seen, the post Merge ETH could process 4x as many transactions per second as compared with VISA.

However, this end result could still take several years to achieve and may not happen for ETH immediately post merge, as opposed to what some influencers are shilling.

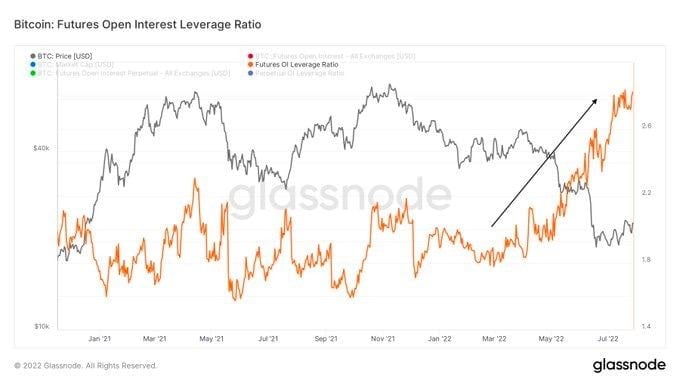

After the late week market rally, the leverage ratio vs Open Interest on BTC futures has spiked higher again, almost about to hit a new ATH. An increase in this ratio typically indicates that leveraged open trades are large relative to BTC’s market size, thus raising the risk of a squeeze, depending on whether the trades are mostly long or short. Hence, traders need to exercise more caution and not use excessive leverage as volatility could spike either way in the coming days.

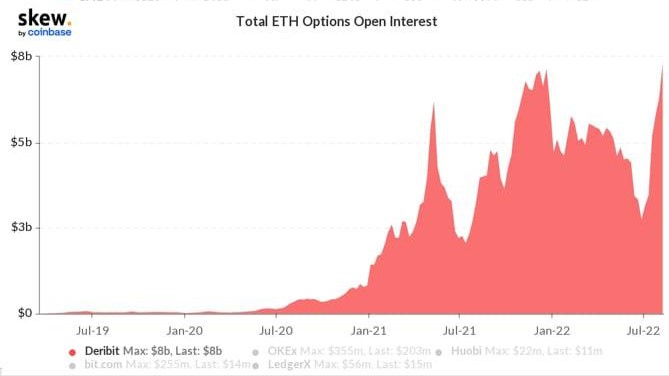

The surge in OI is especially significant for ETH, where the OI has even exceeded the ATH seen in January 2022. Hence ETH traders may need to exercise extra caution in the days ahead as the Merge draws near.

Traditional Markets

Over at the traditional markets, US stocks rose after the key CPI reading for July showed a better-than-expected slowdown in rising prices. The headline CPI for July rose 8.5% year over year and was flat compared with June. Economists were expecting an increase of 8.7%. The producer price index released on Thursday also showed a surprise decline, which sent cheers across risky assets like stocks, which rallied strongly to close yet another positive week.

The Dow thus netted a weekly gain of 2.92%, the S&P surged 3.26% and the Nasdaq rose 3.08% for the week as some investors were starting to call this a new bull market instead of a bear market rally.

The USD fell initially but recovered some lost ground towards the week’s close to 105.40, while the 10-year US Treasury yield remained flat on the week at 2.84%. This seems to show that the market is not expecting the USD to fall significantly lower in spite of the cooler inflation numbers.

Silver surged 4.4% while Gold was 1.6% higher, in line with the USD’s decline.

By the same account, oil prices were slightly higher for the week, with Brent gaining 3.4% to settle at $98.15 and WTI Crude rose 3.5% to close the week at $92.09. European sanctions on Russian oil are due to tighten later this year while the six-month coordinated energy release by the USA and other developed countries is due to end in 3-months, prompting oil traders to start loading long positions ahead of the winter season as experts expect the supply drought up ahead could continue to support prices even if economies plunge into a recession.

This week is relatively quiet on the economic calendar, with key event risks being the US retail sales and Fed meeting minutes that will both be released on Wednesday. On the currency front, the RBNZ will be having its policy meeting on Wednesday morning Asia time. Expectations are for a 50-bps hike.