It has been a week of comebacks on the trading front as the stock market rebounded thanks to stabilizing yields while Bitcoin also gained after being down for some time. It was a large Option expiry that caused the price of Bitcoin to rise back up after hovering around $50,000 for an extended period.

Bitcoin might be back up, but there is still pressure being seen on the coin from a few fronts. The regulatory uncertainty around cryptocurrencies keeps raising its head despite major normalization — such as Tesla accepting Bitcoin as a payment method for their cars.

Stock Climb Back Up

Stocks fell early last week, with even a positive Q4 GDP revision and a surprise drop in weekly jobless claims data having little impact. Worries about US-China tension intensified, as US companies rank among the top in a growing list of companies facing a possible boycott in China due to recent human rights-based materials sourcing decisions. This time, the selloff was led by Dow stocks, with consumer stocks like Nike being hit.

However, stocks managed to brush off the fears into the second half of the week to stage dramatic rises on Thursday and Friday.

The Dow and S&P are back to ATHs, while Nasdaq ended the week slightly lower after rebounding on the last 2 trading days of the week. Risk assets started to recover after bond yields stabilized, as the 10-year benchmark Treasury yield retreated to around 1.67% without spiking further.

Even though bond yields eased off, the USD traded slightly higher. The USD gained against all other currencies, with the DXY nearing the 93.0 level, before pairing gains late week to close at 92.7. Gold and Silver saw some selling early week but rebounded together with the stock market, strangely behaving like a risk-asset. Oil has gone above $60 once again after rebounding from early week selling. But news of the Suez Canal stuck ship being finally refloated sent Oil prices lower by around 2% back below $60 as we start the new week. Geopolitical tensions in the form of North Korea firing missiles and US-China tension, however, may put a bid under the price of oil.

BTC Price Under Pressure From Various Fronts

News of Tesla beginning to accept Bitcoin as payment for Tesla cars sent the price of BTC going up, albeit only for a few hours as stock market woes dragged down the price of BTC early week. While the Tesla announcement is not new, the key takeaway is that Tesla does not plan to convert the BTC received as payment into fiat but will retain them as BTC.

This, however, did nothing for the price of BTC as the flagship cryptocurrency fell 4 days in a row, from around $60,000 to $50,000. Regulatory uncertainty is another reason why cryptocurrencies have been weak lately, this time with a Korean exchange announcing that it will shut its doors due to its inability to conform to Korean regulations.

Adding to the negativity is Ray Dalio, billionaire investor and founder of the world’s largest hedge fund, Bridgewater Associates, suggesting that BTC is likely to be outlawed by governments in the future.

On the technical front, some traders are also fearful of a potential double top forming in the chart of BTC. However, as we are midway from the top and the neckline, it is still too early to assume that the neckline will be broken, especially when the uptrend is still very much intact.

The huge amount of $8b worth of BTC futures and options contracts expiring on Friday also added to traders’ caution, as most traders would wait until after the expiration date to open new positions, for fear of large price swings in the hours leading up to expiry. Indeed, immediately after the contracts expired, BTC price bounced higher, recovering from $51,000 to $55,500 to post its only gain of the week on Friday. Over the weekend, BTC price continued to inch up.

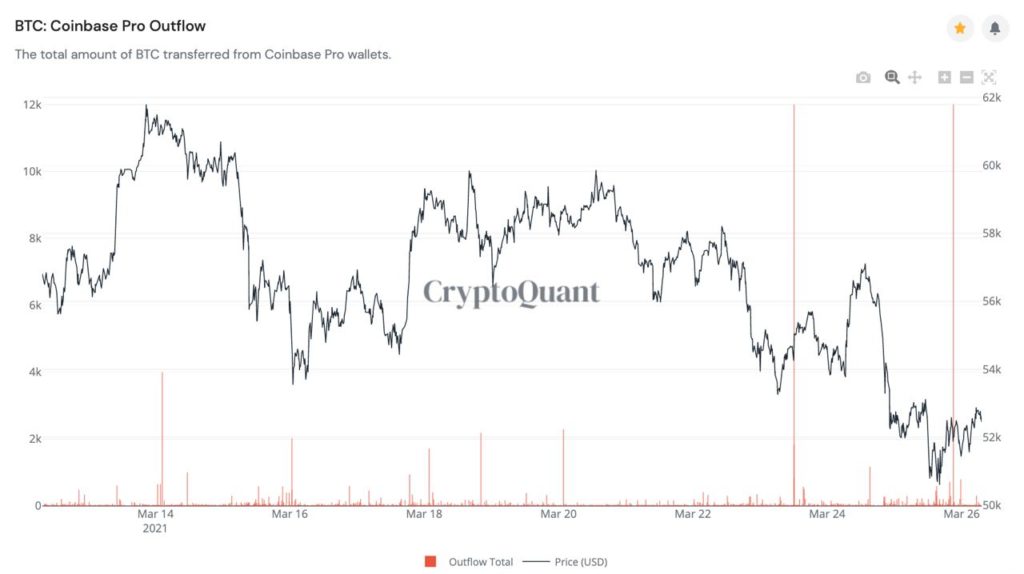

Some institutional investors likely bought the dip last week, as two large withdrawals of around 14,000 BTC each happened on Wednesday and Friday at Coinbase Pro.

Positive adoption news from government funds were also announced last week. First, in a sign that governments could be starting to accumulate BTC, New Zealand pension fund KiwiSaver announced that it had invested 5% of its $350 million fund in BTC. Singapore sovereign wealth fund Temasek Holdings was also revealed to have been investing in BTC.

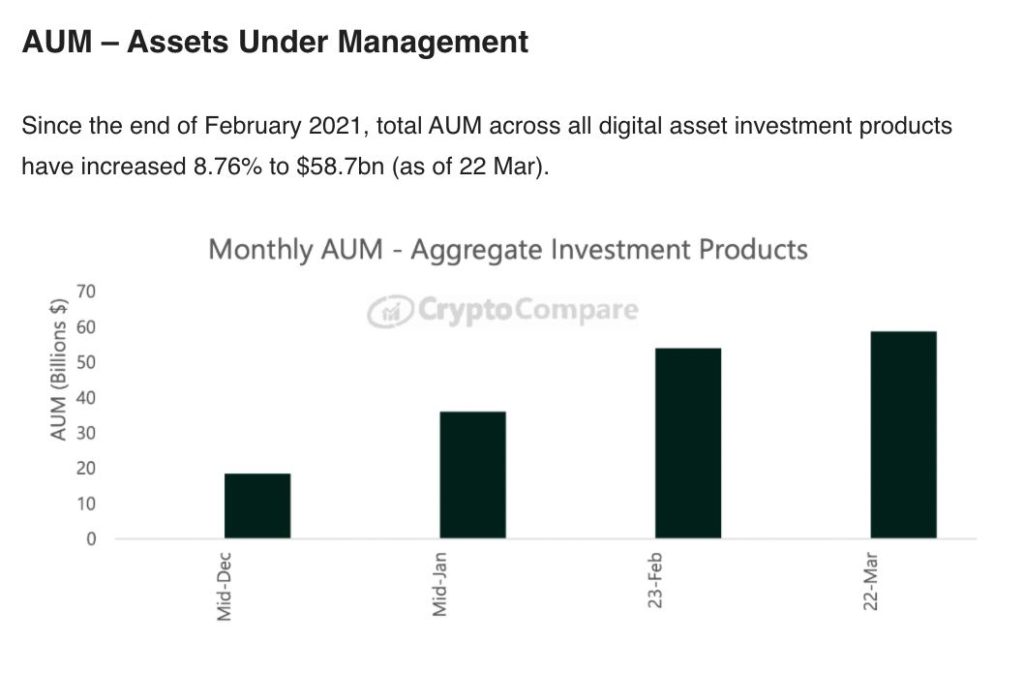

Institutional Inflows Slowed in March

Even though Institutional demand continues to grow, its pace has slowed down in March.

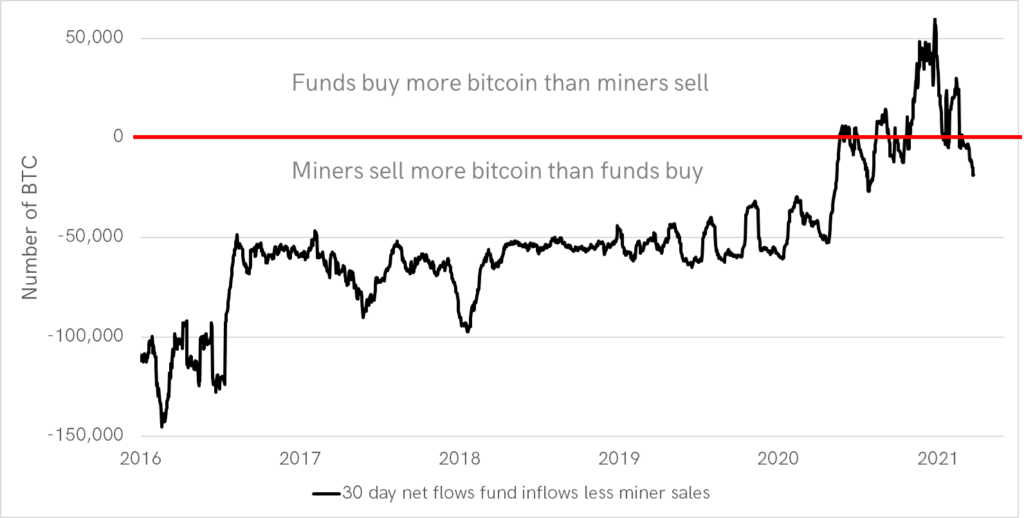

Compared with the magnitude of miners selling, net institutional demand has fallen sharply since Feb, implying that miners have been selling more BTC than the institutional demand for it, which explains the recent price weakness. We will need either more institutional demand or for miners to stop selling, for the price of BTC to continue moving up.

Source: Bloomberg; ByteTree Asset Management

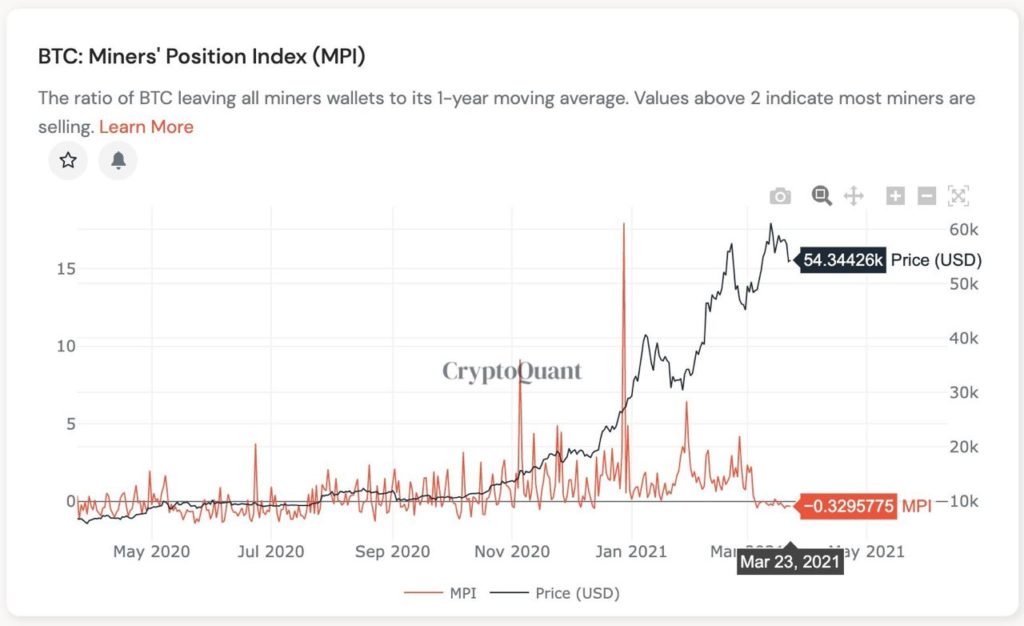

The good is, miners’ selling has indeed started to slow down last week. The MPI has dropped to negative since 23 March, suggesting that miners are no longer selling BTC. Should this trend continue, the price of BTC may start to recover.

With the BTC price decline, stablecoins stored on exchanges have seen an increase, perhaps due to holders selling crypto into fiat, while reserves of BTC at exchanges have continued to decline, suggesting that long term buyers are still accumulating BTC and removing them from exchanges, a positive sign for price for the mid to long term.

Should fundamental factors make a more positive shift, eg the stock market recovers, or the Fed says something more dovish, the price of BTC and the broad crypto market could bounce back quite fast and strongly since there are ample stablecoins on standby to make purchases.

The size of the stablecoin market has continued growing, with them contributing around $40b to the crypto market cap now.

Even though BTC price has been weak lately, most experts agree that the current bull market is not yet over, as most data still points to BTC not having reached its cycle peak yet. One such ratio is the Reserve Risk, which is a measure of the conviction of long-term holders. The current risk/reward ratio of 0.008 to invest and hold is still attractive compared to previous cycle tops when the reading was 0.02.

The quest for a US BTC ETF gets heated up in the meantime, with both Goldman Sachs and Fidelity filing to the SEC for a BTC ETF. A BTC ETF now seems more like a “when” than an “if”, with 7 contenders in the race now.

With the BTC dump, altcoins had an even lousier week, with many coins losing more than 10%. The broad altcoin market has underperformed BTC since the end of Feb, although rotational plays kept activities alive.

However, last week didn’t see altcoin action that could be sustained, with most coins not being able to hold on to their gains. Interesting, THETA managed to edge into the crypto top 10 after almost doubling, but has since retreated.

It however still remains at number 9 as all other coins have fallen as well. Although the broad market was weaker, some coins with Coinbase listing news saw large increases in price. ANKR and STORJ each saw 100% rallies shortly after Coinbase announced plans to list them. FIL also saw a 100% increase in price after a collaboration with LINK was announced. With the rebound in BTC after the large options expire, most alts are also recovering into the weekend.

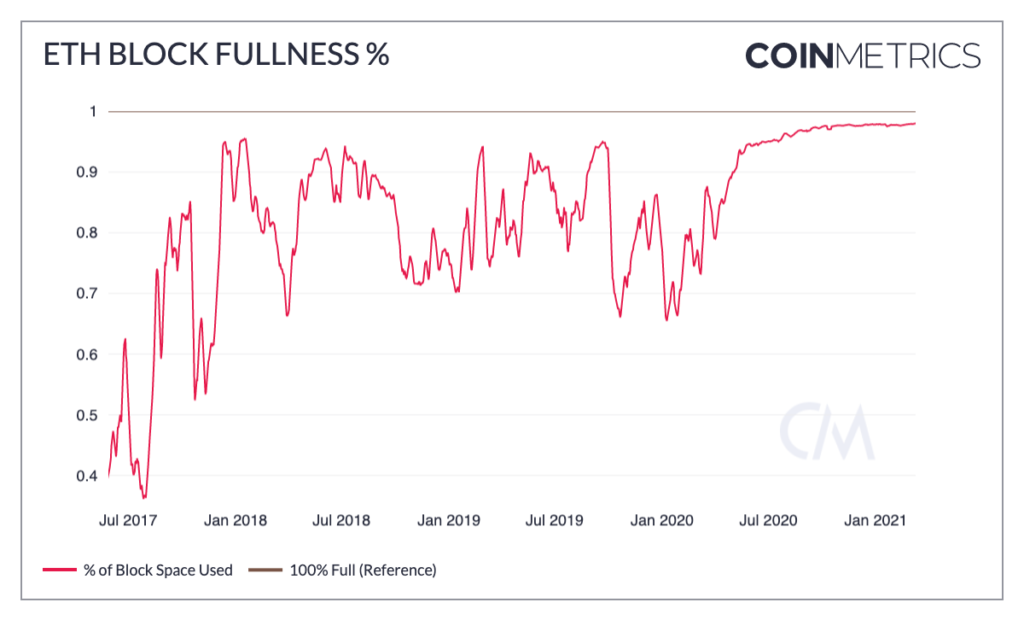

As for the 2nd largest crypto ETH, while its price has retreated together with the rest of the market, demand remains high as other than for DeFi usage, the NFT craze has increased usage of ETH so much so that ETH blocks have been at least 95% full this year. Ever since DeFi gained popularity in July last year, ETH blocks have consistently been around 93% full. According to data, for the month of March, ETH blocks have been 97%-98% full.

The amount of ETH on centralized exchanges has reached the lowest level of 12.9% of supply in the last 19 months, while ETH balance held in smart contracts have reached over one-fifth of ETH supply at 21.11%. This effectively removes around 34% of the supply of ETH in the market. When the token-burn upgrade launches in July, much more supply of ETH is expected to be removed from circulation, which many experts think will eventually raise the price of ETH.

Other noteworthy news last week includes a fresh twist to the SEC’s fight against Ripple Labs. A US judge ordered both parties from the Lawsuit to hold a Discovery Conference on April 6, as Ripple lawyers have alleged that the SEC has failed to provide a single document concerning BTC and ETH which they had requested – two virtual currencies that are closely analogous to XRP.

Furthermore, in their motion, the lawyers also allege that the SEC is failing to produce internal documentation that relates to XRP’s legal status. The lawyers are also seeking “any documents from ten of the nineteen custodians the defendants proposed.”

Also, according to attorney Jeremy Hogan, the SEC, in one of its defenses, unintentionally implied that exchanges that relist and allow trading of XRP would not violate any guidelines. Under Section 4 of the Securities Act, only Ripple and its affiliates could be accused of illegal sales.

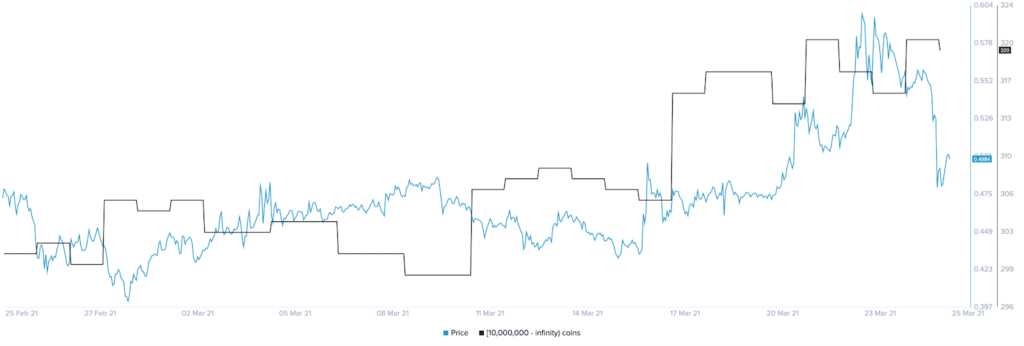

These developments sent optimism surging, with some in the XRP community even demanding exchanges relist the token. “RelistXRP” was trending on Twitter in the USA early last week. The number of XRP-related posts on different social media networks subsequently skyrocketed, with over 80% of all the social interactions bullish about XRP. Positive social engagement has led many large investors to add more XRP to their portfolios.

According to on-chain data, large whales with more than 10 million XRP tokens have started increasing by around 5%, and roughly 15 new whales have joined the network within the last week.

XRP Holders Distribution by Santiment

This resulted in the price of XRP rallying 20% from $0.46 to $0.55 as traders piled back into the token, and the optimism-led buying is expected to continue to put a bid under the price of XRP with every new positive development until the lawsuit comes to a conclusion.

About Kim Chua, Top Coin Miners Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Top Coin Miners. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Top Coin Miners recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.