US stocks closed positive for the week, with huge gains made mid-week able to erase losses incurred early week and on Friday. Positive earnings by firms that reported in the week gave investors the confidence to return to the market, buoying up tech shares after the US Senate pushed forward a $50 billion bill to bolster chip manufacturing in the US. Better than expected earnings from Netflix on Wednesday also gave the markets a lift as some traders began to bet that the bottom was in.

However, risky assets gave back some gains after a string of data released between Wednesday and Friday were worse-than-expected. On Thursday, US initial jobless claims surprisingly rose higher than expected. New claims of unemployment rose by 251,000 against a consensus estimate of 240,000 to its highest level since November 2021, while the Philadelphia Manufacturing Index came in at -12.9 vs expectation of +0.9. The Flash Manufacturing PMI released on Friday was also weaker than anticipated, coming in at 47 against estimates of 52.6. All these weaker data point to an economy slowing down quickly.

Led by these weaker data, the USD fell sharply, with the DXY continuing to roll down a cliff from the high of 109 hit the week before to end the week at 106.50 as traders reposition themselves ahead of the big risk event coming this week – the FED meeting on Wednesday.

The US 10-year Treasury yield dipped sharply from above 3% before the jobless claims data to close at around 2.754% on Friday.

Even though stocks were broadly weaker on Friday after existing home sales slowed more than expected, US indices still managed to end the week higher, with the Dow closing out the week nearly 2% higher. The S&P rose about 2.6% and the Nasdaq gained 3.3% as the leading sector once again.

Over in Europe, inflation in the UK rose again, with the UK CPI for June rising 9.3% annually, in line with a consensus forecast and up slightly from 9.1% in May. Despite having had five consecutive 25-bps interest rate hikes, the Bank of England Governor Andrew Bailey still suggested on Tuesday that policymakers could consider a 50-bps hike at its August policy meeting to reel in inflation.

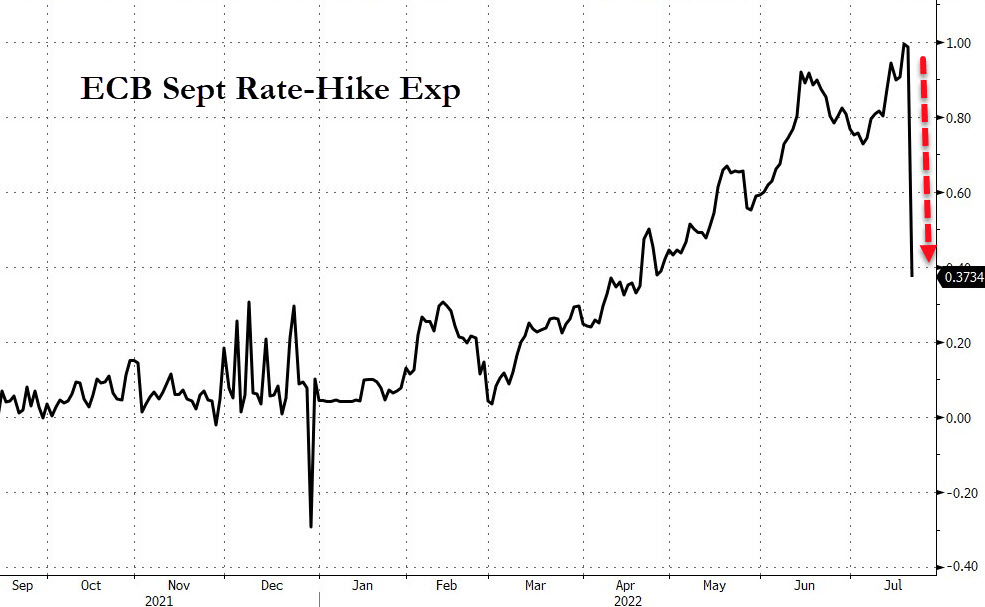

As for the rest of the bloc, the ECB raised rates for the first time in 11 years, surprising market watchers with a 50-bps hike instead of the anticipated 25-bps hike. In the same meeting, the central bank also revealed details of its anti-fragmentation tool, named the Transmission Protection Instrument (TPI), to purchase assets of nations with lofty debt piles and high borrowing costs to prevent unwarranted and disorderly market dynamics from them spilling over to other nations within the EU. As soon as the TPI was revealed, traders sensed the easing vibe and immediately dismissed the 50-bps as mere front-loading.

Odds that the ECB would hike rate in September dipped sharply from 100% to 37% as traders bet that the 50-bps hike in July would render the ECB unable to hike again in September.

The EUR/USD however, did manage to recover some loss ground to close a tad higher at $1.0215 due to the USD selloff towards the end of the week, but is opening the new week appearing to give up the gains as the pair flirts with $1.02 in early Asia trading.

Speaking of Asia, the only major central bank that is on a different course than the rest of the world continues to re-iterate its easy monetary stance. In its regular policy meeting last Thursday, the Bank of Japan not only maintains its ultra-loose monetary policy and yield curve control, but even went further to say that it will not hesitate to take additional easing measures, if necessary.

Gold managed to climb 1.2% for the week after a brief dip below $1,700 mid-week while Silver lost around 2% due to worries of economic slowdown. Both metals are around 0.2% weaker in the new week as the USD is slightly stronger.

Oil started last week with a bang after Biden’s fruitless Saudi Arabia trip, breaking through the $100 barrier but did not manage to stay above it as the week progressed. A higher-than-expected US gasoline stockpile released on Wednesday, coupled with news that oil from Libya was returning sent the price of oil reeling. A resumption of Russia’s gas flows to Europe eased gas supply concerns, while worries of economies slowing down dampened traders’ appetite to add longs. Brent Crude eventually ended the week up about $0.60 at $99.70 while WTI Crude closed the week unchanged at $94.83. Both distillates open the new trading week down about 1% each.

Crypto had a positive week due to quick gains made early on Monday and Tuesday but spent the rest of the week consolidating as it tried to make up its mind where to go after most tokens hit short-term resistance. There was some selling pressure mid-week, but the selling was well-absorbed by buyers who came in to prop prices up every time bears tried to push prices lower.

The surge in prices early week did not seem sustainable at first as a consistently high funding rate coupled with a large increase in Open Interest signalled that that leveraged bets were increasing. Indeed, BTC did retreat 5% on Wednesday after Tesla revealed that it has sold the bulk of their BTC holdings. However, dip buyers managed to stem BTC from deeper losses as the leading crypto remains well-supported near the $22,000 level even into the weekend.

3rd Largest Whale Did Not Sell BTC, But Tesla Did

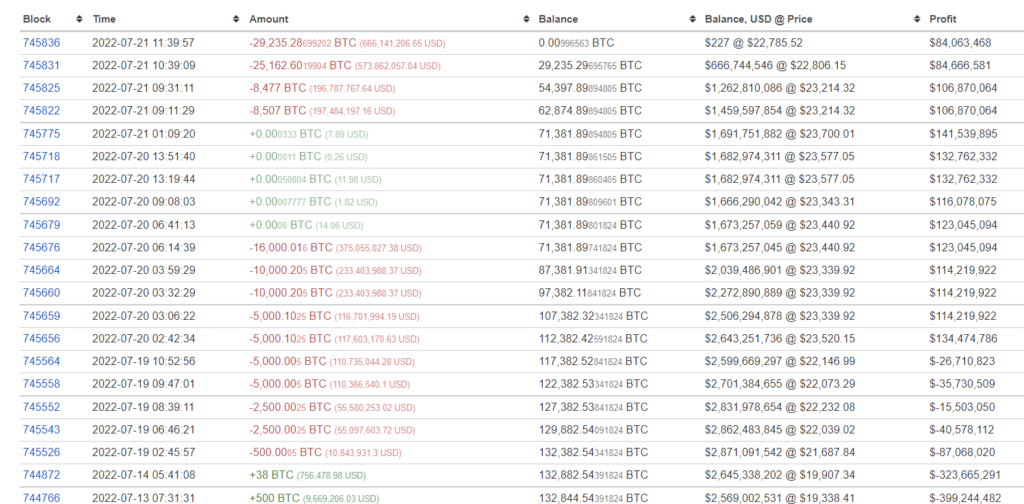

Mid last week, there was a lot of chatter about the 3rd largest BTC whale selling his BTC as his BTC stash was reportedly being removed from his wallet. The whale account had more than 132,800 BTC but that amount was reduced to zero by last Thursday, which caused the price of BTC to dip slightly as worried traders sold into the rumour.

However, it was later revealed that the whale merely moved all his BTC to another wallet. As can be seen below, all his 132,800 BTC are intact after the move. While we cannot ascertain that the resultant owner of the 132,800 BTC is the same whale, this at least shows that the move did not cause a BTC dump in the market as the price of BTC remained stable throughout the entire time.

While this whale did not appear to have sold his BTC, another whale did, albeit in June.

In its 2Q2022 financial report released on Wednesday, Tesla revealed that it has sold 75% of its BTC holdings in June, taking back $936 million of cash to its balance sheet. This amount would roughly translate into 33,000 BTC assuming the sale caused the large fall in BTC’s price in early June where it fell from $28,000 to a low of $17,600.

The firm nonetheless said that it is open to acquiring more BTC in future and that the sale should not be taken as a negative reference to the company’s view of BTC but was merely an attempt to improve the cash flow of the company to better equip the company as it navigates the tough environment in China because of unanticipated COVID lockdowns.

The company specifically said that it has not sold any of its DOGE. However, the credibility of Tesla and Elon Musk has been badly affected by the sale since Tesla’s CEO Elon Musk, has promised last year that the company will never sell its BTC, but has reneged on its word after a year.

As news of Tesla’s sale broke, the price of BTC fell more than 5% from a high of $24,200 back below $23,000 within 24-hours but managed to bounce back slightly after the weaker-than- expected US initial jobless claims data released on Thursday caused the USD to dip.

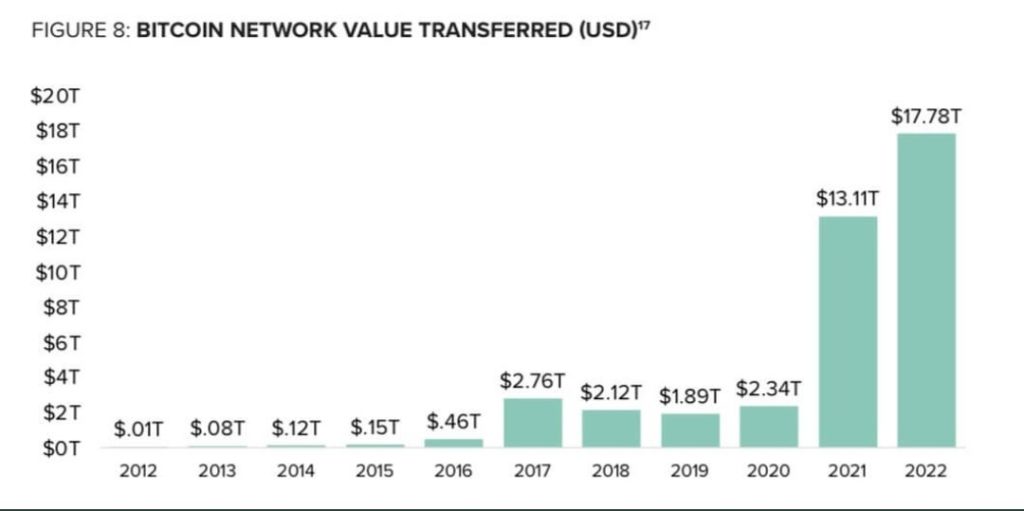

BTC Not Just a Store of Value

Even though 2022 has been a bearish year for the price of BTC, the Bitcoin network has transferred $17.78 trillion in 2022 with another 5 months to go before the year ends. The amount is 2x that transferred in 2021 during the bull market. This shows that the usage of BTC as a trusted value transfer is increasing at a quick pace even as price is dipping, and smashes previous notions about BTC being just a store of value rather than as a medium of transfer, which is very good news for the adoption of BTC for the long-term.

Dip in BTC Volume Hints of Diminishing Whale Purchase

Pea-sized BTC holders continue to grow at an increasing pace as the price of BTC becomes more affordable. The number of small holders with 0.1 to 1 BTC has continued to rise at an increasing speed as price recovered.

The pink line, which shows the 90-day change, has spiked up vertically, which reveals that much of these purchases were made within the last 3 months and more so, after the price of BTC plunged to between $17,600 and $20,000. Following previous years’ example, should this 90-day change begin to reverse, some downward pressure on BTC’s price could start to unravel.

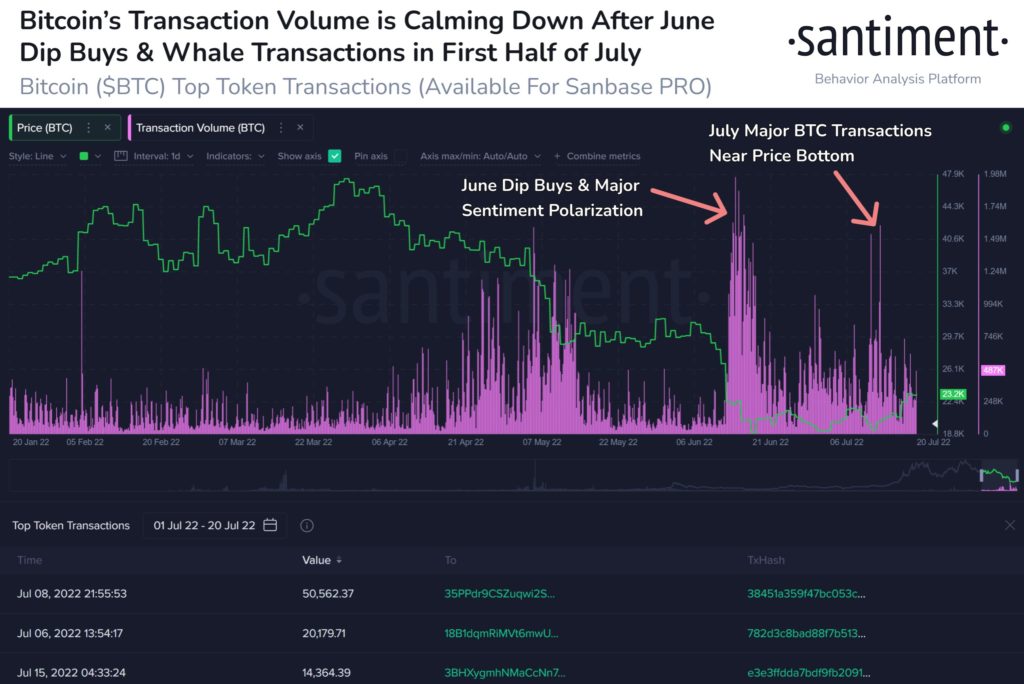

One interesting metric that could send an early signal of a rally that could be losing steam is the transaction volume. Notice that in June when BTC’s price was trading near the bottom of the year, transaction volumes saw a huge spike, a sign that whales were swooping in to buy the dip when most retail traders were bearish. That activity volume has since dipped back closer to the norm, which could mean that the whales have stopped buying, at least for the time being.

Experts Think ETH Could Fall to $675; Metrics Suggest Otherwise

A panel of industry experts has predicted that ETH will bottom out at $675 before the end of this year. They have considerably lowered their ETH predictions since the start of 2022 but are still expecting the price of the cryptocurrency to end the year 2022 at $1,711 before rising to $5,739 by 2025, and $14,412 by 2030.

The findings are a result of a survey on a panel of 54 industry experts including university directors, crypto exchange executives, crypto research analysts, and executives of various firms with crypto-related products.

However, their predictions have had limited consistency as they previously predicted in January that ETH would be worth $26,338 by 2030. In April, they lowered their prediction to $23,372, and now, they have lowered their estimates again to $14,412 by 2030.

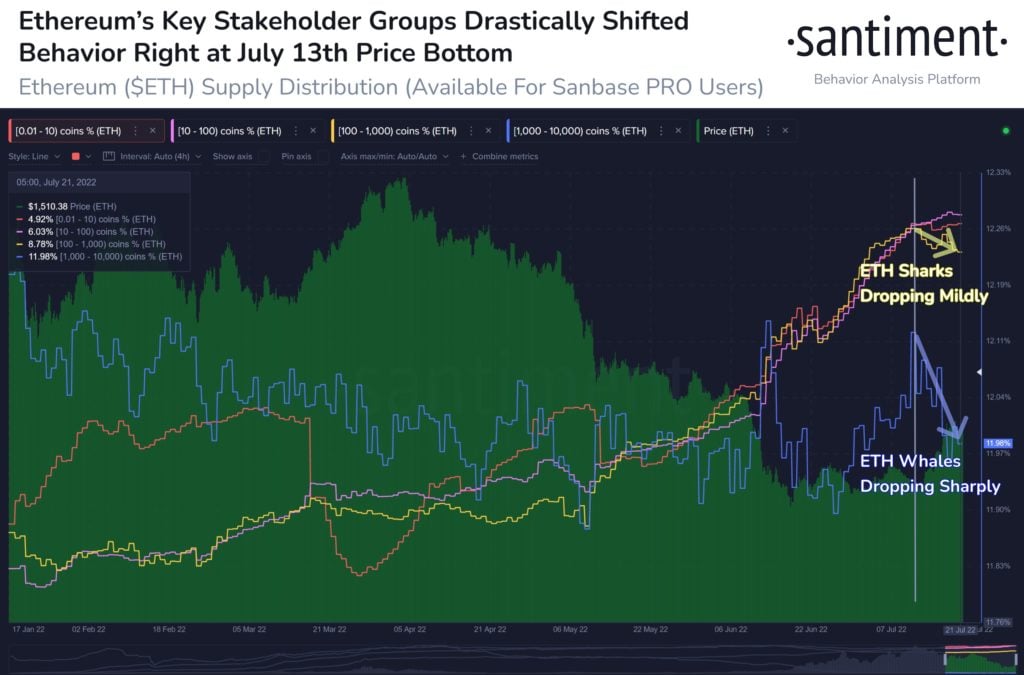

It appears that the experts were not the only ones with a view that the price of ETH could dip lower. Even ETH whales have been making use of last week’s price rebound to sell into the rally.

The whale group that holds between 1,000 to 10,000 ETH have seen the largest reduction in holdings, selling about 0.2% of ETH’s total supply, while those with 100 to 1,000 have reduced their holdings by a lesser amount. Smaller holders are the ones still holding, not having taken the latest bounce to sell at all.

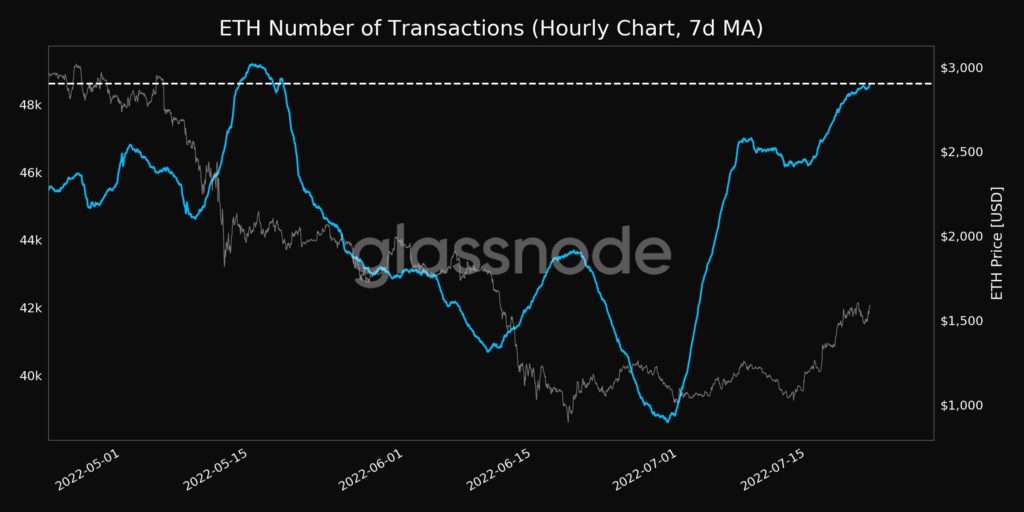

Could the latest sale by whales cause the price of ETH to pull back? While price could retrace in the near-term, longer-term metrics seems to suggest that downside could be limited, as the number of transactions on ETH has recovered sharply since early July, a sign that activities on the blockchain is very vibrant again. A rising transaction count usually underscores a sustainable price recovery. However, this metric needs to be closely monitored as it can fluctuate wildly from time to time. Looking at the rising transaction number together with the fall in large whale holdings would suggest that some ETH has moved hands from the largest whales to smaller whales, which means ETH is being distributed to a larger number of holders, which is a good development as it means the holdings of ETH is becoming more decentralized.

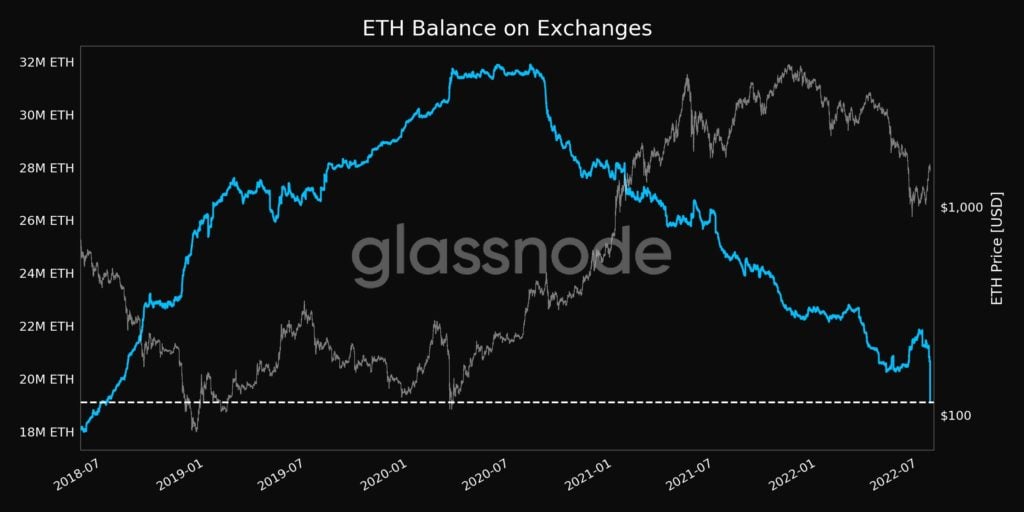

To back up the positivity is that ETH exchange reserves have fallen significantly even as price has surged over the past week, suggesting that buyers are purchasing and moving ETH out of exchanges at top speed. The speed of the withdrawals last week was the highest in history.

ZK Announcement Sends MATIC Soaring, XRP Transactions Surged Again

Polygon announced that it is the first L2 that has deployed a zkEVM, a major upgrade that most other blockchains said need another few years to be developed. The zkEVM is said to be the first ETH-compatible scaling solution that uses the cryptographic method called zero-knowledge proofs, which will enable the ETH Layer-2 to process up to 2,000 transactions per second, while simultaneously reducing transactions costs on ETH by 90%.

The price of its native token MATIC, thus saw a massive surge of 63% over the week, rising from around $0.70 to almost hit $1. However, as with all “buy the rumour sell the news”, the price of MATIC eventually saw a bit of profit-taking, retreating slightly to $0.87 to close the week. With such a large upgrade and a series of positives news as we had covered before in previous weeks though, the price of MATIC is expected to stay well-bid and the bottom could already be in for this token.

Interestingly, sounding almost like a reconstitution for ETH as various other layer-2s have also announced upgraded ETH scaling solutions last week, Vitalik Buterin said during the Ethereum Community Conference (EthCC) in Paris on Thursday that the final version of ETH 2.0 would be able to handle 100,000 transactions per second, an increase of 5000x from its current 20 transactions per second. This improvement, however, would take several years to achieve after the Merge, which will only be the first step in a 4-stage upgrade that ETH will undergo after it transitions to PoS later this year. This effectively means that scaling solutions like MATIC would at the very least, have another few more fantastic years before the efficiency of “ETH 2.0 final product” renders them redundant.

Further on XRP, last week saw yet another large surge in transaction volume, this time, with dormant coins held for more than one year changing hands. This, in addition to the recent spikes in transaction volume, could mean that new buyers are coming in to scoop up chunks of XRP. Could these new buyers be anticipating some good news to be announced by Ripple?

As the market prepares for the FED meeting on Wednesday, profit-taking could happen as traders take some money off the table until more clarity is seen regarding the Fed’s monetary policy, which will have a big impact on both the traditional and crypto markets.