The week started with US Treasury Secretary Janet Yellen stating in a prepared Senate testimony that she thinks the US economy faces unacceptable levels of inflation and headwinds from supply chain disruptions. Well, this fact is not unknown in the market and stock traders were simply just glad that she finally admitted it.

Target’s profit warning did not do much to cause stock prices to fall early week, however, as Friday drew near, concerns over the CPI numbers led stocks to start retreating from Thursday.

The 10-year Treasury yield started rising again on Thursday, as traders began to price in higher rates. The traders were right as Friday’s release of the CPI showed that inflation surged higher than expectations, up 8.6% against consensus estimate of 8.3%. More importantly, the figure the FED is sensitive to, the Core CPI, was also 0.1% higher than estimates, coming in at 6%.

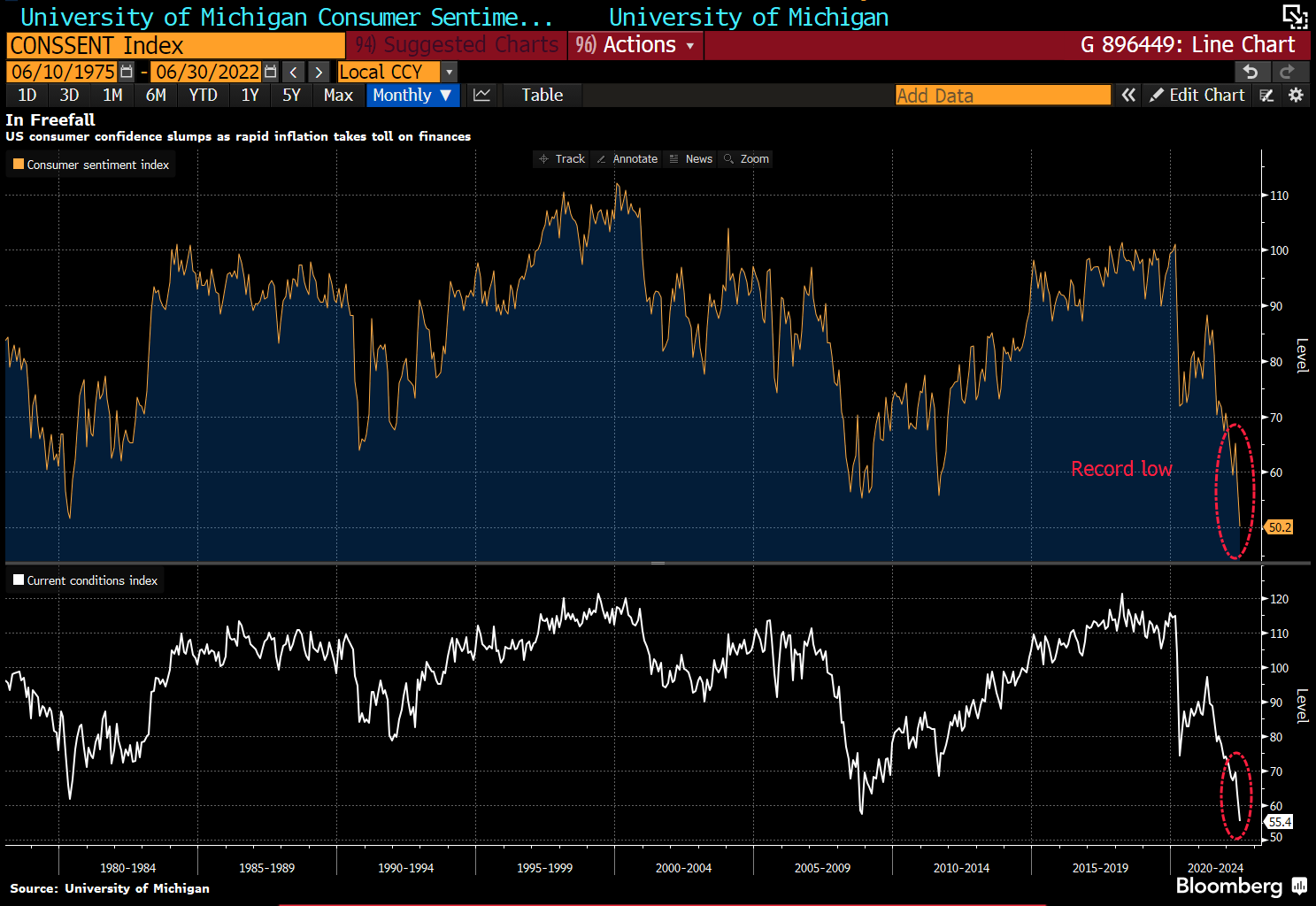

The hot inflation readings have flamed concerns about a potential recession for the US economy, with the preliminary June reading for the University of Michigan consumer sentiment index coming in well below expectations – hitting its lowest point in history.

Stocks were crushed, with broad-based selling seen in all sectors as the week drew to a close. The Dow fell 4.58% for its 10th down week in the past 11. The S&P lost 5.05% and the Nasdaq bled 5.60%, for their ninth losing week in 10 and the worst week since January.

Yields spiked as expectations of a more aggressive FED sent the USD higher. The 2-year Treasury yield, which is seen as one of the most sensitive to FED rate hikes, jumped above 3% on Friday to hit its highest level since 2008, while the 10-year surged to 3.18% before closing the week at 3.165%. Traders are now pricing in a 50% chance that the FED would hike 75-bps in July. Some banks are even predicting that the FED could up 75-bps in this Wednesday’s FED meeting. Hence, this FED meeting, and its post-meeting press conference is going to be keenly watched by many.

It was a similar situation at other countries, with a series of rate hikes by several other central banks last week. To name a couple, the Reserve Bank of Australia raised its benchmark interest rate by 50-bps to 0.85% on Tuesday, shocking market participants. Only 3 out of 29 economists polled had predicted the outcome, with most expecting only a 25-basis point hike.

The Reserve Bank of India also raised its benchmark interest rate by 50-bps to 4.9% on Wednesday.

The ECB similarly showed its hawkishness during the ECB policy rate meeting on Thursday, where the central bank confirmed that its net asset purchases under its asset purchase programme (APP) will end on 1 July 2022. It has also revealed that it will raise its key interest rate by 25-bps in July, while hinting at another hike at the September meeting.

Further to that, the ECB also raised inflation expectation to 6.8% from 4.5%, while at the same time, cutting its 2022 growth forecast to 2.8% from 3.7% and 2023 to 2.1% from 2.8%. Traders have now moved the ECB rate-hike expectations up to around 150-bps by December 2022.

Gold appears to be benefitting from the higher inflation however, gaining 1.3%, while Silver was unchanged last week. Both precious metals are weaker by about 1% in the new week as the USD continues to gain strength in Asia trading today.

Oil continued to surge higher after Goldman Sachs raised their price target for oil this year to $140 from $125 previously, citing the need for oil price to average around $135 per barrel for the next one year for the current supply crunch to be normalised. However, the black gold retreated towards the end of the week as the high possibility of global slowdown could reduce the demand for oil. Nevertheless, oil was still higher by around 2%, with Brent closing at $121.90 after hitting an intra-week high of $124, while Crude ended the week at $118. Oil is starting the new week almost 2% weaker though, as China has resumed its lockdown after opening up its economy for barely a week. Brent is now flirting with $120 after hitting a high of $124 last week.

Cryptocurrencies were crushed, with late-week action over the weekend posing the biggest damage. ETH was the biggest large cap casualty, losing a whopping 23% and dragging other altcoins with it. BTC was not spared either, although its role as a crypto safe haven prevented it from losing more for the time being, dropping only 14% in sharp contrast to how it started the week.

The week for crypto started with a bang as prices rose around 10% overall on the back of rumours of whale buying. That hope soon turned the other way around as new sell walls were reportedly observed on Binance. Crypto gains soon evaporated on Monday evening as a sudden dump brought prices back down again as over $200 million of longs, who were conned into chasing the rise on Monday, were liquidated.

Crypto prices started showing signs of weakness from Tuesday when a new bearish report issued by Morgan Stanley likens the current weakness in crypto market, the failure of a dollar stablecoin and a reduction in leverage in DeFi, the crypto equivalent of quantitative tightening. However, the big crash came after the CPI number release on Friday, where the dump worsened over the weekend. The higher-than-expected CPI number could merely have been an excuse to dump, as fundamentals within the crypto sector has already been under pressure from regulators.

Hedge downside risk with leverageUS Regulators Put Up Crypto Bill

As regulators start looking into the crypto market, news of more probes has been making the rounds in the market. While EU regulators have yet to disclose anything, US regulators are hot on their heels and beginning to zoom in on the sector after repeated appeals from US Treasury Secretary, Janet Yellen.

The latest involves a top ten coin, BNB. The US SEC is reportedly investigating whether Binance’s BNB token was a security at the time of its sale in 2017.

Bloomberg reported on Monday that the SEC has launched a probe into the BNB token. The US securities regulator is said to be looking at the early days of the exchange, examining whether the sale of its BNB token during a 2017 initial coin offering amounted to an unregistered sale of securities.

Another even more impactful regulation involves DeFi. In the latest draft bill to be voted on, there are various proposals to regulate crypto assets. The paper appears to focus on stabelcoin and crypto exchanges. In it, all exchanges and stablecoin providers that accepts USA clients are to be registered entities in the USA.

While depository institutions have been given the right to issue stablecoins which is good clarity for centralised stablecoins, it opens up big uncertainties for algorithmic stablecoins, and poses an even bigger question mark for DeFi and decentralised exchanges, as the new disclosure requirements would make anonymous-run projects almost impossible to comply under the law as it determines that anything platform that trades 1 digital asset meets the burden of being a digital asset exchange.

It is not all bad however, as the key positive to take away from this bill is that it considers most cryptocurrencies as commodities and will be under the purview of the CFTC instead of the SEC, much to the relief of crypto investors.

There was another piece of good news last week which came from PayPal.

After rolling out the ability to buy and sell crypto on its platform in October 2020, PayPal is finally allowing users the ability to natively transfer, send and receive digital assets between PayPal and other wallets and exchanges. In addition, customers who transfer their crypto onto PayPal can spend it via Checkout at millions of merchant terminals. The company has been granted a full Bitlicense by the New York Department of Financial Services for the conduct. However, as expected, one piece of good news against a backdrop of concerning news in a bear market is not going to do anything for prices. The crypto market is trading under a cloud of regulation uncertainty even as the macro picture is deteriorating.

US Investors Exiting Crypto

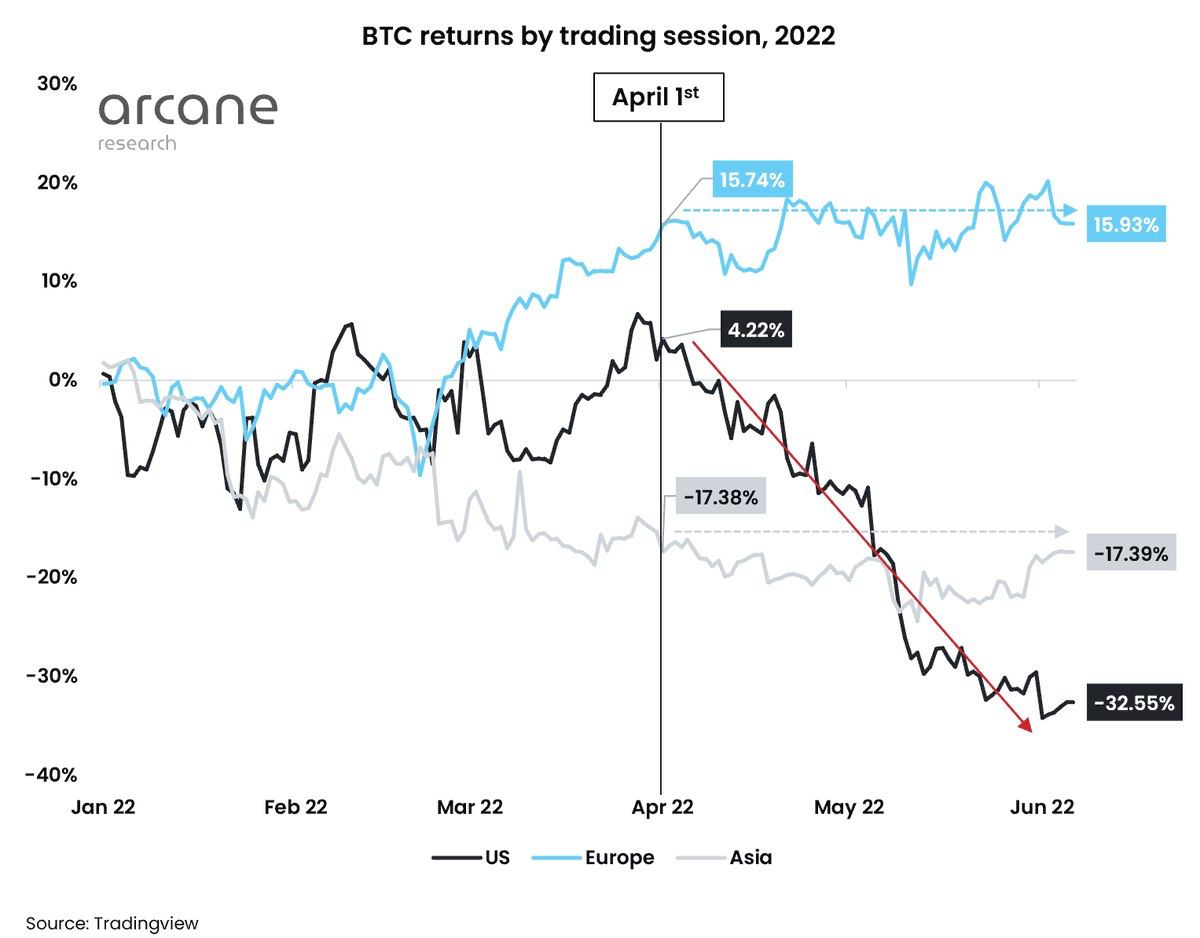

With US regulators not withholding on their rule setting, not surprisingly, there has been more selling pressure coming from the US trading session as investors there exit the market in anticipation of more stringent rules to come.

This phenomenon started in April, where the entire crypto sell-off occurred during US trading hours. The cumulative YTD return of BTC during US trading hours has plunged from 4.22% on 1 April to -32.55% today.

While some market watchers attribute this exodus from crypto the result of a hawkish FED, there did not seem to be as large an exit from the US stock market to justify this hypothesis.

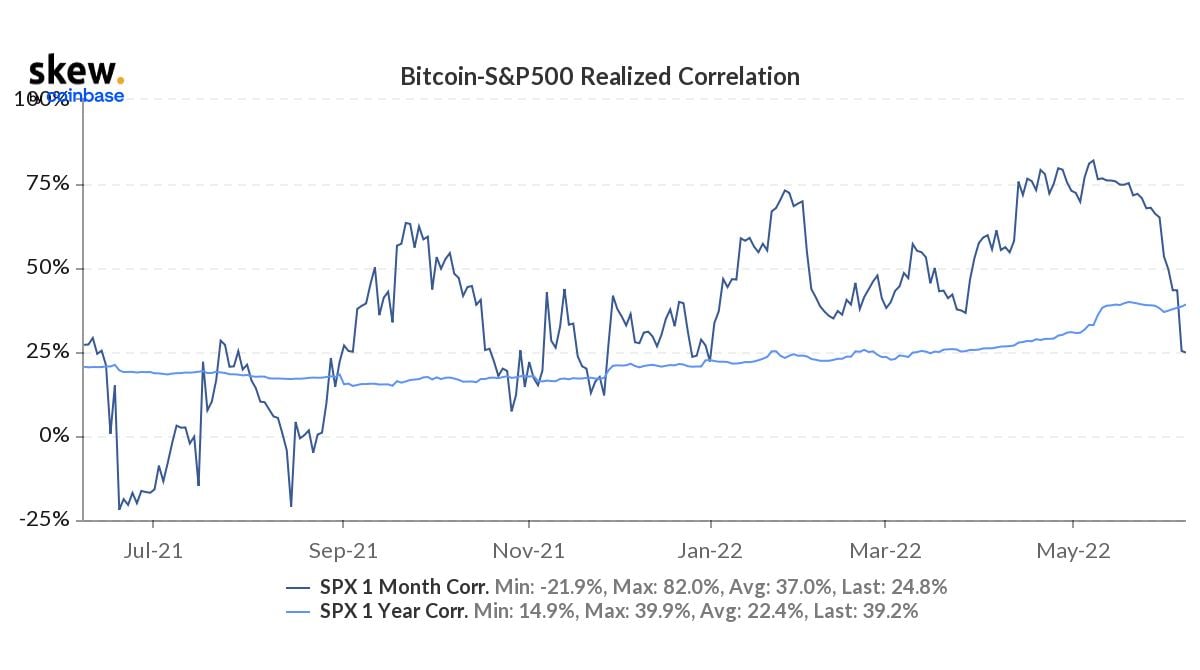

BTC’s correlation with US stocks has been falling. The 1-month average correlation between BTC and the S&P has dipped to just 25% in June compared with 75% early May. This explains why BTC has not managed to rebound even when US equities have been rebounding off their lows early June. This is not the kind of decoupling that most crypto traders were hoping for and could spell further weakness for crypto prices ahead. The more likely reason for funds leaving crypto could be due to fundamental reasons unique to the crypto asset class. One reason would be regulations, as we have seen above.

More BTC Metrics Signalling Pain Ahead

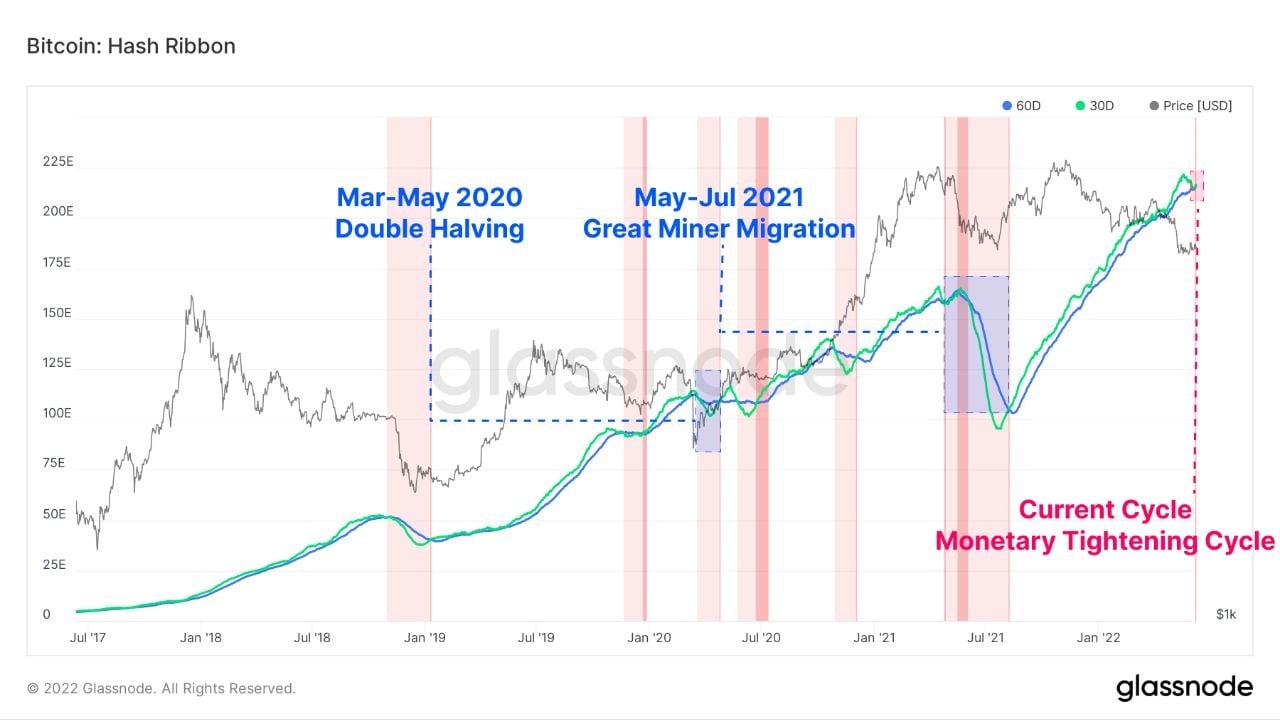

The BTC hash ribbons have just entered the weakness zone, where hash rate is starting to go offline, just as what our last week’s report had anticipated – that the weak BTC price relative to cost of mining would cause miners to pause mining BTC until its price recovers.

The consolation here is that historically, this has happened during the second half of a bear market which means to say that we only have halfway more of the bear market to go.

The BTC MVRV ratio, which is calculated by dividing the BTC market cap over the realized cap, is also showing more price weakness could be ahead. This metric has been historically accurate to determine bull market tops and the bear market bottoms. While bottoms typically occurred at MVRV value of less than 1, MVRV values of more than 3 would determine that price was overheated.

The MVRV ratio currently sits around 1.3, which means that BTC’s price could still experience more decline before a cyclical bottom forms. Even if we were to follow the higher low as seen in the chart below, BTC may need to fall to a MVRV value of around 0.9 before a cyclical bottom can be confidently called.

BTC Could Come Back Even Stronger

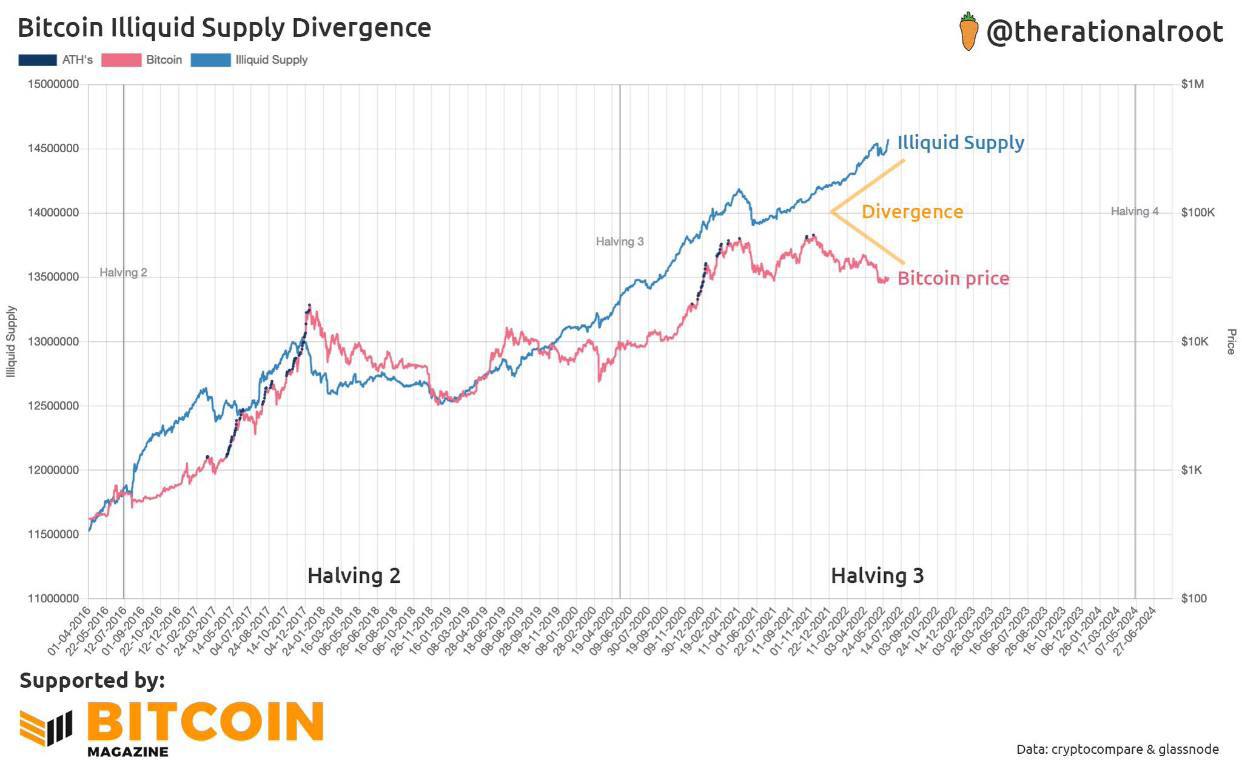

Once this bear market is over, there is a high chance BTC could rally even more strongly as its illiquid supply is rising at one of its fastest paces when price is dipping.

This bear cycle is markedly different from previous cycles in that in previous cycles, a price dip coincided with a fall in BTC’s illiquid supply – a sign that long-term holders were selling. However, in this downturn, the illiquid BTC supply is rising constantly – a sign that long-term holders have been buying the dip.

Perhaps this may even mean that this downturn could have a shorter duration as previous downturns. It will be an even better sign to see this illiquid supply continue to rise even as the price of BTC drops.

As more long-term holders sit on their BTC and refuse to sell, by the time the next bull market comes, demand could outstrip supply so much that the price of BTC could skyrocket very quickly within a very short period of time.

ETH Crashes After Hitting New Milestone, Network Activity Falls

The testnet of ETH’s Merge—the blockchain’s much-anticipated transition from its current proof-of-work (PoW) mechanism to a proof-of-stake (PoS) consensus algorithm, has finally gone live last Wednesday. This means ETH transiting to PoS would be on track to be achieved this year. However, ETH did not budge on the news, as traders are still unsure about what this change could mean for ETH’s price, as the first staking rewards would be paid out to stakers once mainnet goes live, hence, there is some concern that stakers could dump their rewards recover some capital since the market is weak.

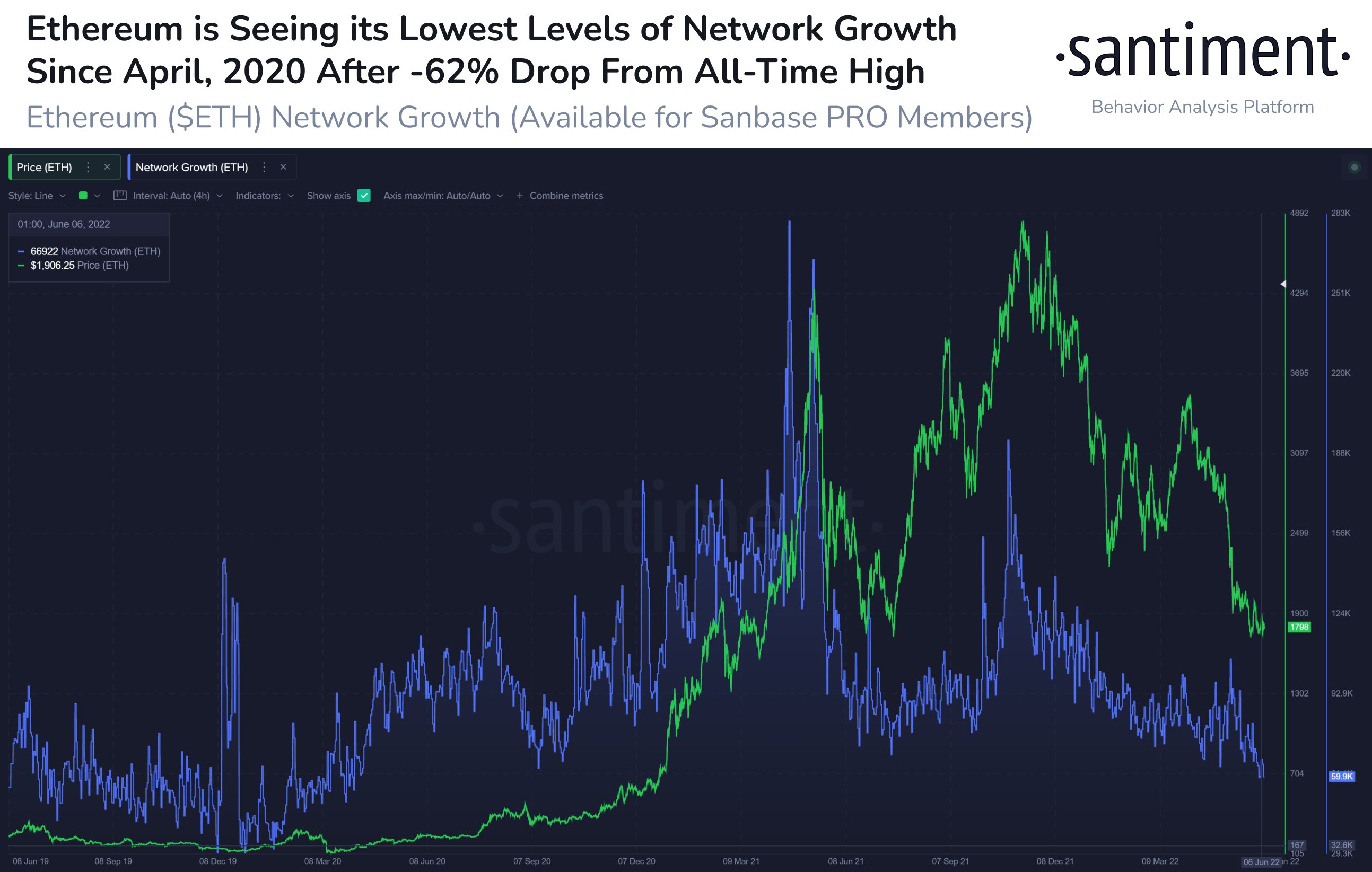

With more competitor chains and higher regulatory risk to DeFi, ETH network growth has fallen to its lowest in over 2 years, which is not a good sign for adoption. With less adoption, price could get affected as demand slows.

Already, the price action of ETH is beginning to price in these negative implications as ETH broke lower again last week, losing more than 20%. As the near-term support of $1,700 has been breached, ETH could be entering precarious moments in the days ahead.

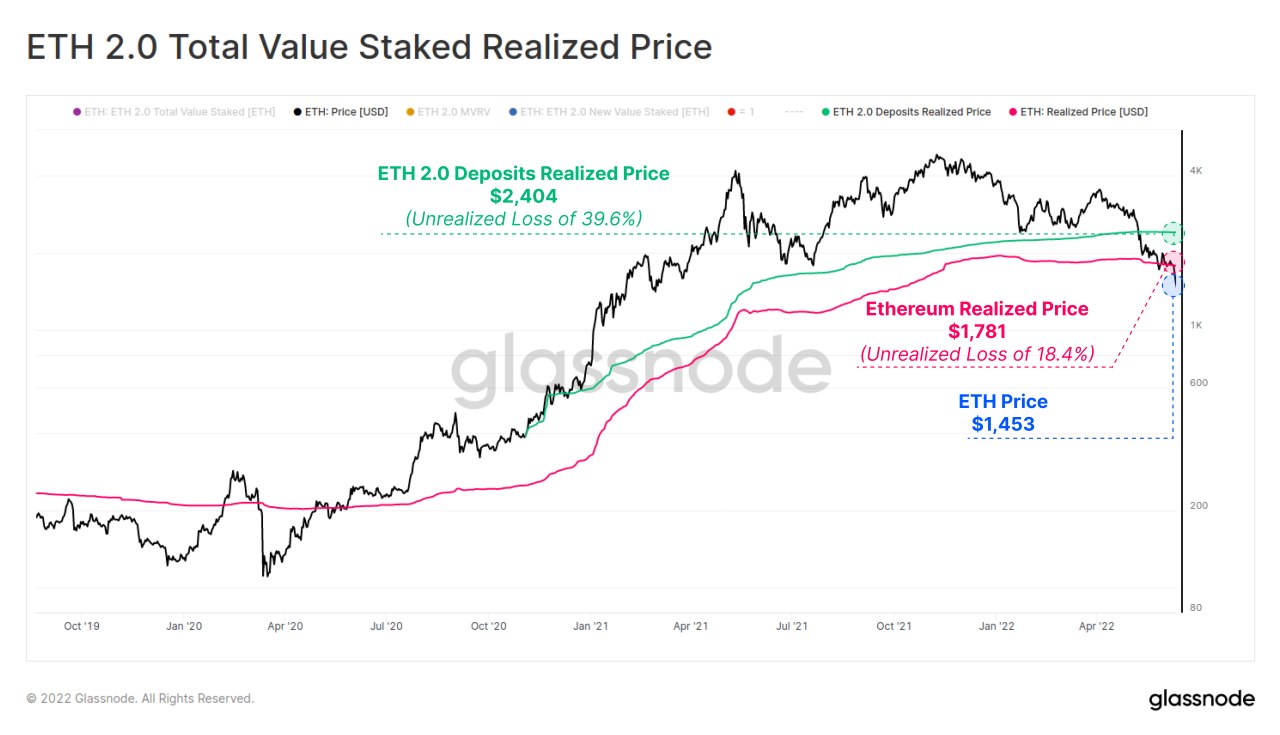

The “depegging” (as it has been widely referred to on social media) of a ETH staking product called stETH at a DeFi platform, while not affecting the price of ETH directly, may have caused some traders who were not aware of the differences to dump ETH as the nightmare of the UST depegging is still fresh on the minds of many traders. The word “depeg” has become a very scary word in the crypto space and it would not be surprising that traders are adopting a “sell first, ask later” mentality. Furthermore, buying this stETH would enable the holder to redeem for ETH once ETH 2.0 goes live. Hence, some traders may also sell ETH to buy stETH, which would worsen the already bad situation in ETH further. While this arbitrage may make sense on paper, it is of no use should ETH continue to dip further. As it is, the realised loss for staked ETH has already increased to 39% after the weekend’s dump.

The “depegging” of the stETH product has been largely caused by a single large CeFi wallet that holds more than 450,000 units of this staked ETH product that is forced to sell its holdings to raise capital to fulfil customer redemptions. This once-popular wallet is facing a massive surge in withdrawals as it is rumoured to be in a bad situation from the contagion effect of the UST-LUNA fallout. While ETH has fundamentally nothing to do with it, bad publicity at a time like this could continue to cast a dark cloud on the price of ETH in the near-term.

The unravelling of ETH’s price may be a warning sign for altcoins as ETH has since its inception, always been the bell weather leading indicator for altcoins. Many altcoins have already broken lower over the weekend when in previous weeks, weekends were always a time for small rebounds. The weekend dump may be a sign that retail traders are panicking, which could imply that we are entering the capitulation stage of the bear market.

As the new week begins, US stock futures are negative while Asian stock indices are down by over 2%. Crypto market continues to get hammered with ETH falling below $1,400 and BTC attempting to break $25,000 after a very brief short squeeze on Sunday. Traders may need to be prepared for extra volatility as the FED meeting on Wednesday draws near, which in itself, makes for good trading opportunities as long as risk and position management is being taken care of.