It was not a good week for crypto fans as a massive drop off saw Bitcoin lose 20 percent of its value rapidly. The coin, which was well set in the $50,000 to $60,000 range plunged as low as $40,000 in an hour.

As was to be expected in such a huge drop for Bitcoin, altcoins were also impacted, and some feeling more than double the damage as some shed 40 percent of their worth over the same period.

Much of the drop in price was worsened by more than $2.4 billion worth of positions getting liquidated in that 1 hour alone, with $600 million involved in BTC futures.

It has not been a good week for many markets with stocks falling in a see-saw fashion last week, dragged lower by three major developments spread over the course of the week. Every time the markets tried to rebound, a fresh new piece of news would drag the markets back lower.

First, FED Chair Powell’s testimony before the US Senate on Tuesday kicked started the decline when he mentioned that it was time to remove the word “transitory” from their inflation expectation and that they could be ending their asset purchases earlier than previously telegraphed.

Things were made worse on Wednesday after the USA discovered its first Omicron case, and then the nail in the coffin came on Friday after the payrolls report missed.

Nonfarm payrolls increased by only 210,000 in November, following a gain of 546,000 the previous month. The number released was well below Wall Street expectations of 573,000, which caused anxiety amongst many traders. With a weakening labour market, a new COVID variant and a tightening FED, the situation was one of nightmarish proportions.

With the economy showing signs of slowing down and a new COVID variant making its round around the world, Oil continued down its slippery slope, falling another 5.7% to settle at $66 before opening the new week rebounding more than 2% to $67.50.

Gold was unchanged while Silver was playing out its industrial metal role, falling 3% to $22.50. The CBOE Volatility Index (VIX), continued to rise on the back of rising fears, ending the week at 30.67. At the height of the COVID fear when the markets sold off drastically last March, the VIX was at 66.

The Dow fell 0.9% for the week despite a 600-point gain on Thursday, the S&P 500 fell 1.2%, and the Nasdaq lost 2.6%.

Crypto Had A Bloody Saturday

As mentioned, the situation was markedly worse in the cryptocurrency asset class, with BTC losing bids towards the end of the week, breaking the $50,000 mark and plunging over 20% to a low of $40,500 early Saturday. The bloodbath on altcoins was a tad worse, with the worst of the declines reaching almost 40% over a 24-hour period.

On an hourly basis, the plunge looked worse, as BTC lost $10,000 within 1 hour early Saturday to see the low hit $40,500 on some exchanges, while ETH sank to $3,100 at the lowest. The amount of liquidation during the bloodletting hour was massive by today’s standard. More than $2.4 billion worth of positions had been liquidated in just 1 hour alone, with $600 million involved in BTC futures. Total amount of long liquidations added up to more than $1.3 billion.

Around 4,000 BTC were rumoured to be sold during that 1-hour period, which pushed the market abruptly down, with 1,500 BTC alone sold in less than a minute at the time of the worst drop.

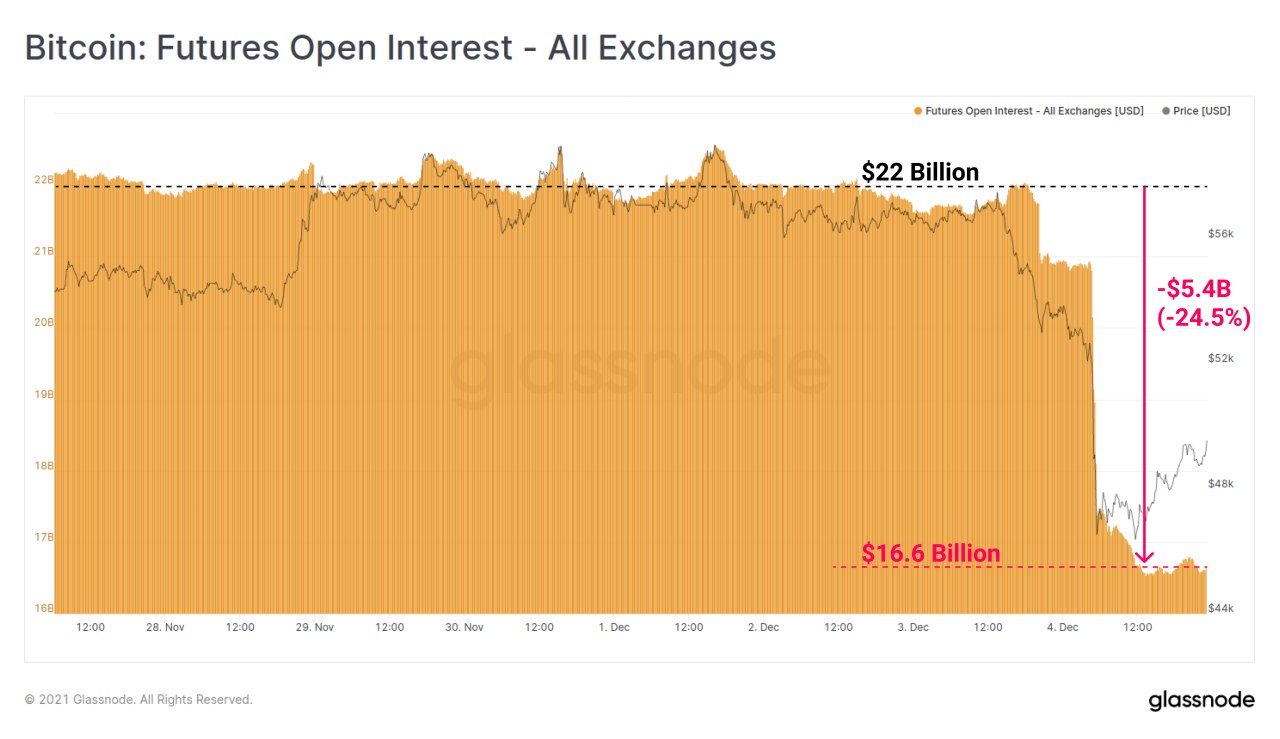

On a 24-hour basis, the numbers aren’t any better. Over $5.4 billion had been lost in the BTC futures market, or around 25% of Open Interest (OI). The OI for BTC Futures fell from $22 billion to $16.6 billion in just one day.

Positive News Did Nothing As BTC Supplies Were Sold

The crypto space did see some positive developments over the week; however, they did nothing to prevent prices from cratering on Friday and early Saturday.

MicroStrategy announced that it had purchased an additional 7,002 BTC for $414.4 million, at an average price of approximately $59,187. As of November 29, 2021, MicroStrategy has acquired approximately 121,044 BTC for approximately $3.57 billion, with an average price of approximately $29,534 per BTC.

Fidelity has also announced that it launched a spot BTC ETF in Canada.

Facebook announced on Wednesday that it would reverse its ban on cryptocurrency advertisements on its platform, which could help in bringing crypto awareness to the non-crypto population.

El Salvador stated that it bought 150 bitcoins at an average price of $48,670 during the dip, and likewise Tron Founder Justin Sun, said he bought 100 BTC during the dip.

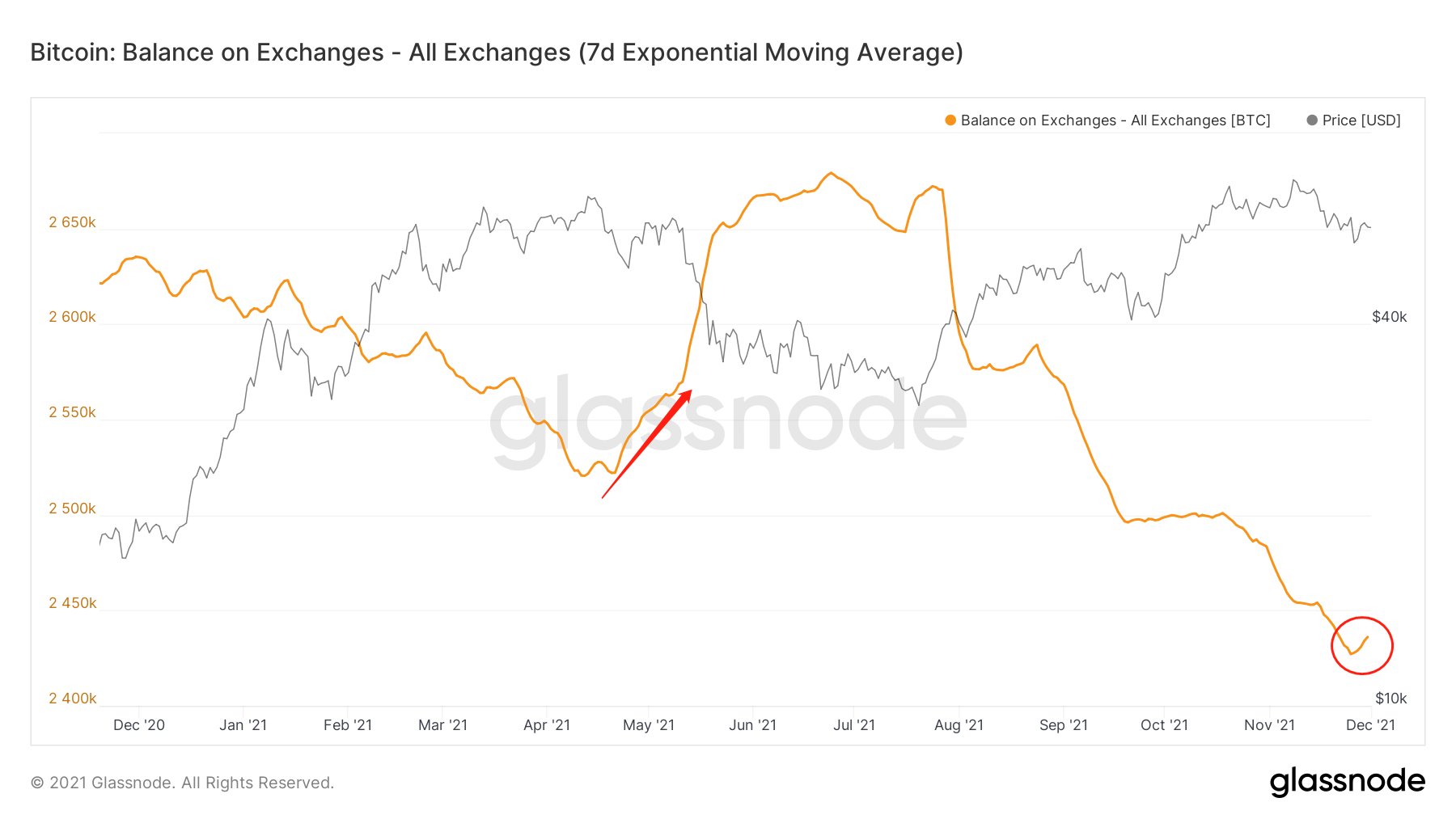

BTC Balance on Exchanges Already Gave a Grave Warning

BTC data already started showing signs of an impending drop as the BTC all exchange reserve witnessed a sudden uptick mid last week after the metric had been falling since August. Exchanges saw an inflow of more than 15,000 BTC in the days prior to the crash.

A close-up version of the exchange inflow with the subsequent almost vertical drop in the price of BTC is shown below.

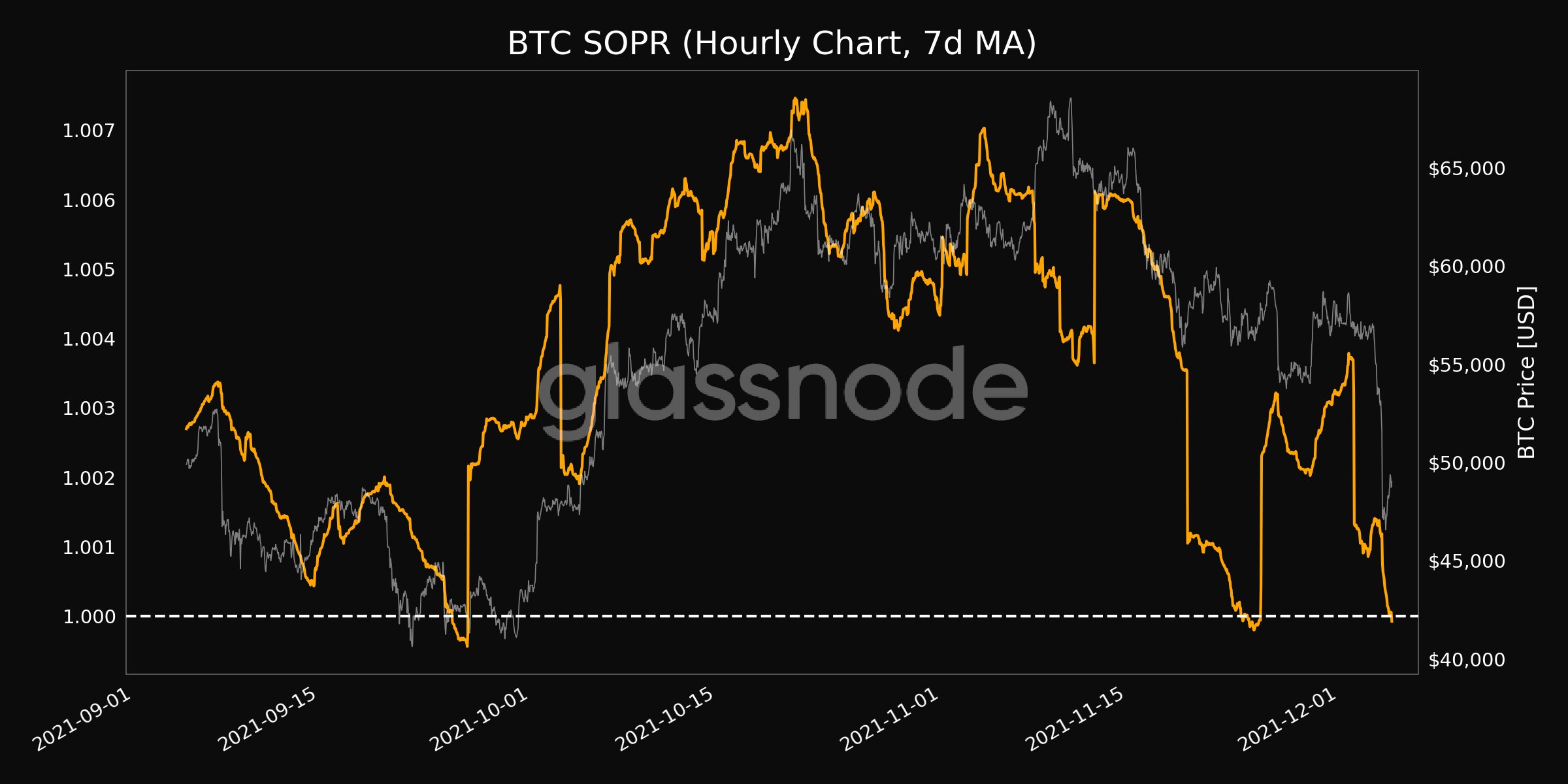

While preliminary data shows that not all 15,000 BTC had been sold yet, post sell-off, the Spent Output Ratio (SOPR) for short-term BTC holders has fallen to 0.99. A SOPR of 0.8 is typically seen as a fantastic buying opportunity.

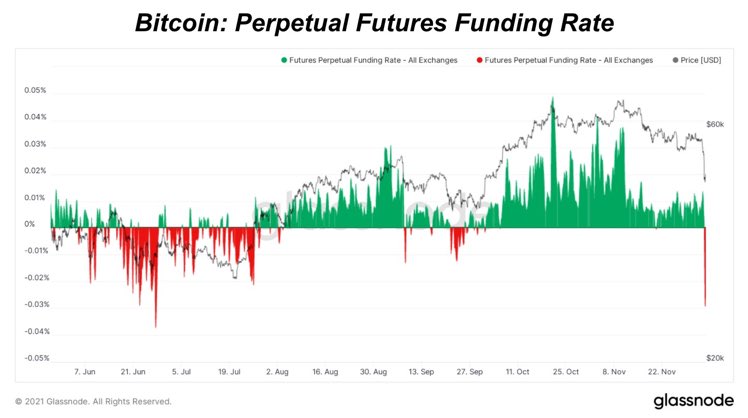

However, no one knows for sure if the ratio will indeed fall to 0.8 this time, or if we have seen the local low, as BTC funding rates have fallen significantly in the aftermath of the sell-off, implying that traders are extremely bearish; usually a counter-indicator.

ETH Traps Option Traders With False Bull

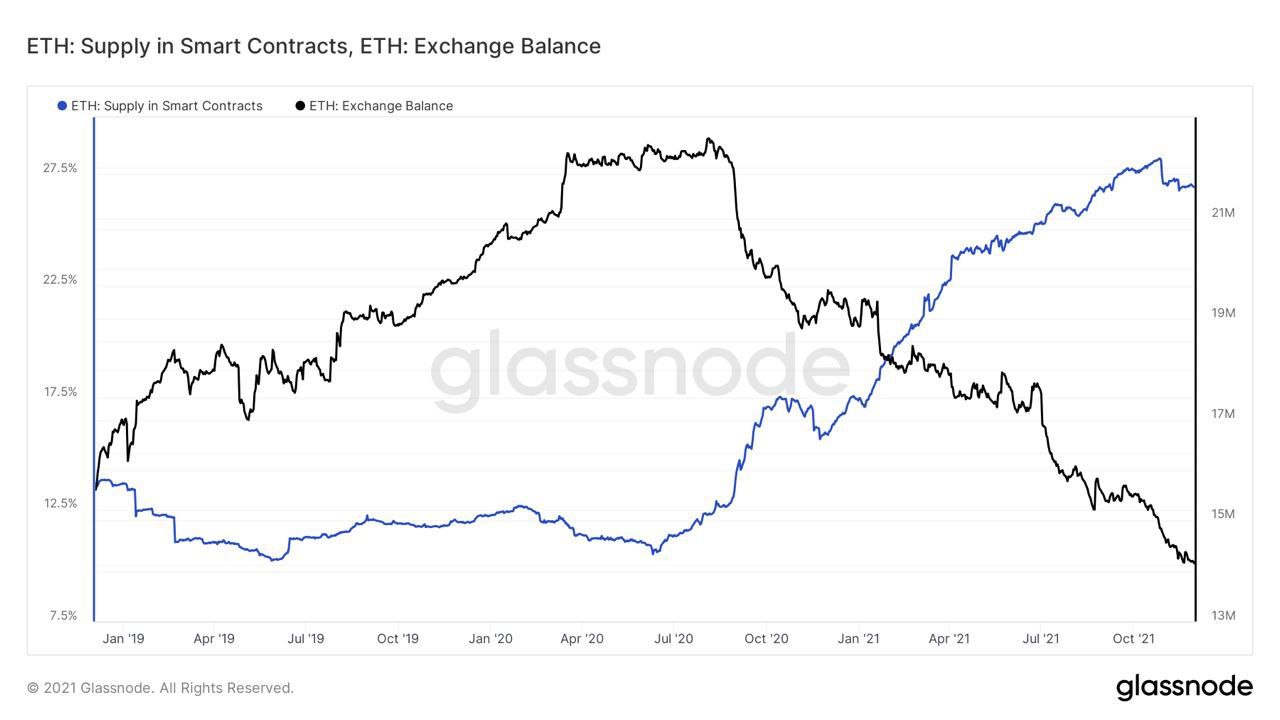

ETH reserve on exchanges has continued to drop into Dec, while the amount of ETH locked in smart contracts continues to flatten after peaking in Oct. These 2 metrics are painting a mixed picture with regards to investor appetite on ETH. While investors are buying and removing ETH from exchanges, they are not necessarily putting them to use in applications, meaning these could simply be investors that are buying ETH for price appreciation instead of using it on DeFi, which could imply these to be short-term buyers.

On the back of growing TVL on Layer-2s built on ETH, hot money could have bought ETH as traders bet that L2 scaling solutions could solve the high gas-fee problem that ETH has. The drawing near to the date of the Merge where ETH becomes fully PoS has also boosted sentiment, sending the price of ETH upwards near $4,800 early week.

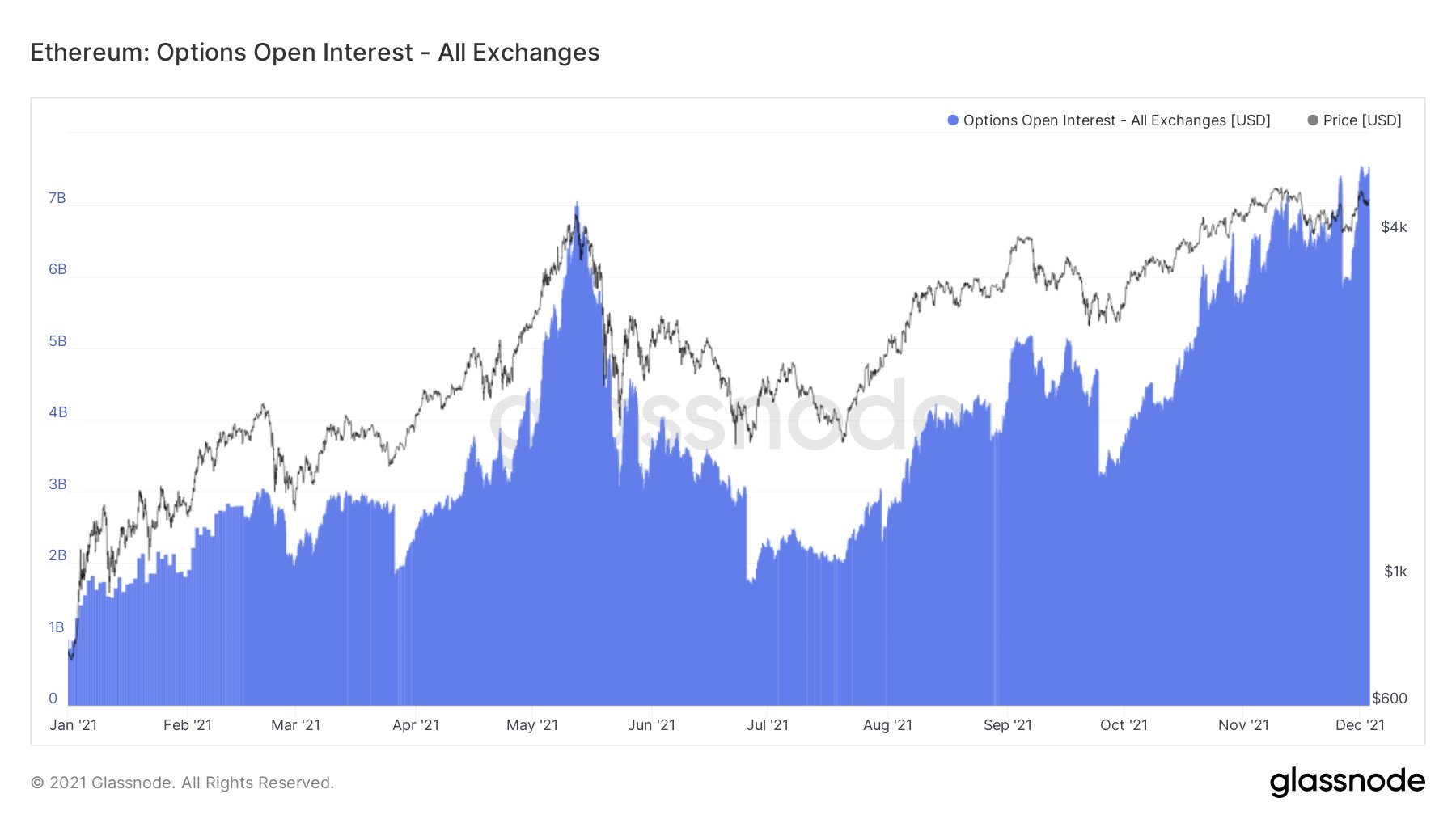

With the sharp rise in price, Open Interest on ETH Options spiked up, making a new ATH. The largest option delivery date this month is December 31. A total of 689,653 options will be due for delivery, with 469,486 calls and 220,167 puts.

The number of call options with an exercise price of $5000 is the largest.

Usually, such sudden over-enthusiasm does not end well. Indeed, the price of ETH crashed together with BTC over the weekend, falling phenomenally to a low of $3,100. Should the price of ETH not hit $5,000 by the end of this month, those options would expire worthless and their buyers would lose all their money. However, it is still too early to declare these options worthless as there are still 4 more weeks till the end of December. Afterall, ETH has rebounded very strongly from the sell-off low of $3,100 back above $4,000.

Other than ETH, some other altcoins like LUNA also showed amazing resilience. One such coin is LUNA, which had rebounded to make a new ATH of $78.20 after it bounced dramatically from the sell-off low of $30. TVL on the Terra Blockchain where LUNA is the native token has risen about 43% in the past week to a fresh ATH, surpassing that of AVAX and SOL to rank third behind BSC.

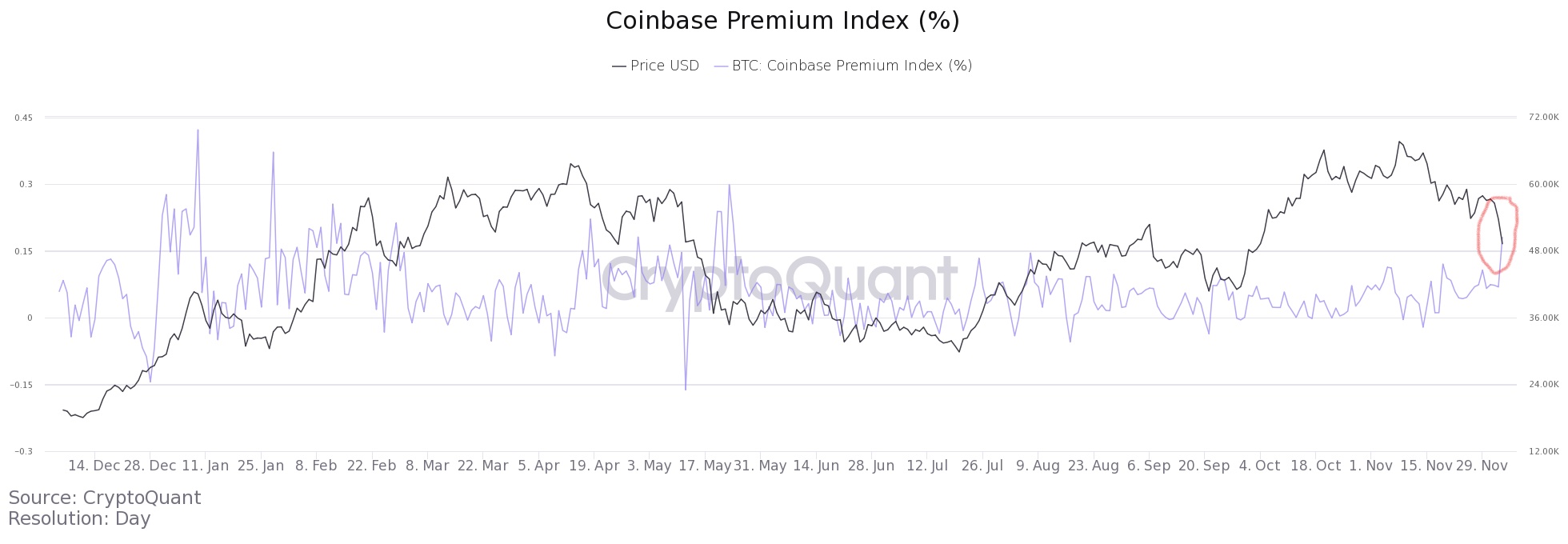

USA and Korea Traders Go On A Shopping Spree

USA and Korean buyers seem to be the main contributors to the market bounce, as the price premiums on Coinbase and Korean exchanges are rapidly increasing from the rest of the other exchanges. With the Greed and Fear Index having fallen to the extreme fear category of 18, this indeed could be a great buying opportunity. Leverage washouts like this are not uncommon during a crypto bull market and oftentimes experienced traders use the opportunity to load up on their longs.

The bull market of 2017 saw six large drawdowns of more than 30% before rallying to six respective new ATHs later. Hence, while this weekend’s bloodbath may seem drastic to some traders, it is nothing new to the crypto market.

While crypto had managed to conjure up some rebound over the weekend when the traditional markets were closed, the real test of their resiliency will come when the stock market opens. With the Asian stock market opening lower, altcoins have already started pulling back quite significantly. The fate of crypto this week could depend on how the US stock market reacts.