Bitcoin continues to make great leaps forward, breaking new all-time highs through a couple of weeks, but the coin has retreated after its latest surge. The major cryptocurrency managed to push to $69,000 last week on its way to what would be a powerful milestone in the $70,000 mark, however, it has begun this week a couple $1,000 down from there.

The market cap of all cryptocurrencies crossed $3 trillion for the first time, and news around is still incredibly positive. Exchange withdrawals of Bitcoin have continued to increase, a sign that spot accumulation is getting stronger even with the price of the coin topped near its all-time high.

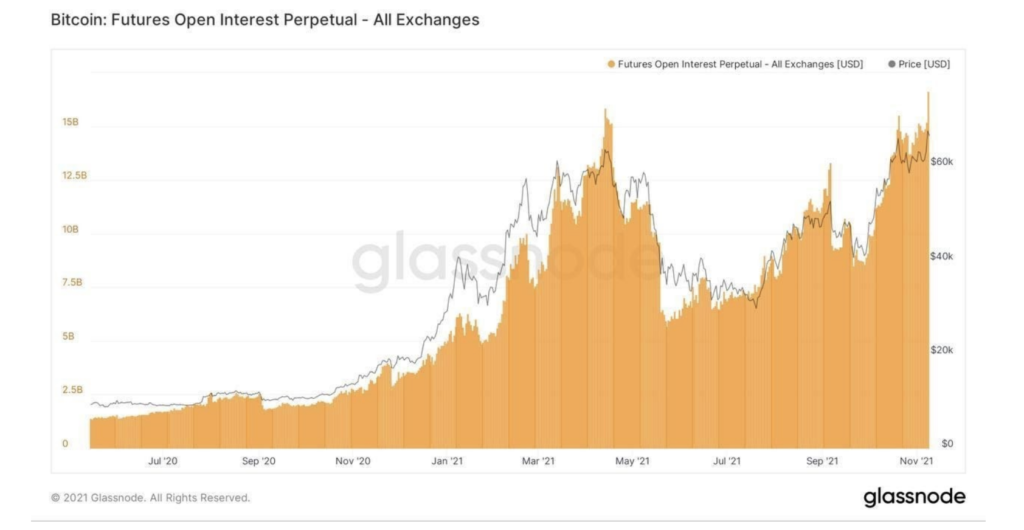

It is worth noting that even though most traders are bullish with Bitcoin testing new all-time high levels, the Bitcoin Futures Open Interest exceeded levels last seen in April. Historically, this level of open interest has led to a dip in price.

Meanwhile, stock indices came off their own all-time highs as worries over the latest inflation report caused some traders to take money off the table early last week. As expected, the CPI released on Wednesday showed that consumer prices jumped 6.2% in October, the biggest inflation surge in more than 30 years, prompting the markets to sell off further on fears of a more aggressive monetary tightening by the FED to keep inflation in check.

The Dow fell 0.6%, the S&P inched 0.3% lower and the Nasdaq dipped about 0.7% on the week. Tech stocks were further dragged lower by Elon Musk, who sold around $5.7 billion, or slightly over a 3% stake, in Tesla. Musk is expected to sell around 10% of Tesla to pay taxes, which could continue to put a damper on Tesla and tech stocks.

The hot inflation number managed to prop up the price of precious metals, however, sending Silver up 5.4%, and Gold by 2.4% higher. Both metals are opening the new week slightly weaker, down by around 0.2% each.

Surprisingly, the higher than expected inflation number didn’t do much for the price of Oil as the “black gold” fell below $80, closing the week down 2% on the same fear as stocks – worries about monetary tightening reducing the demand for Oil. Beginning the new week, OIl is still slightly weaker, down by around 0.3%.

The 10-year Treasury yield remained calm, closing the week relatively unchanged at 1.57%.

Cryptocurrencies gave an even bigger surprise to market participants as the price of BTC didn’t manage to climb higher despite the red-hot inflation numbers. It did, however, manage to break into a new ATH of $69,000 before giving up around 10% of gains thereafter.

Crypto Market Dips After New High Achieved

The market cap of all cryptocurrencies crossed $3 trillion for the first time on Monday after BTC sped past its previous ATH of $66,900, and as ETH also climbed higher, looking more probable to be challenging $5,000.

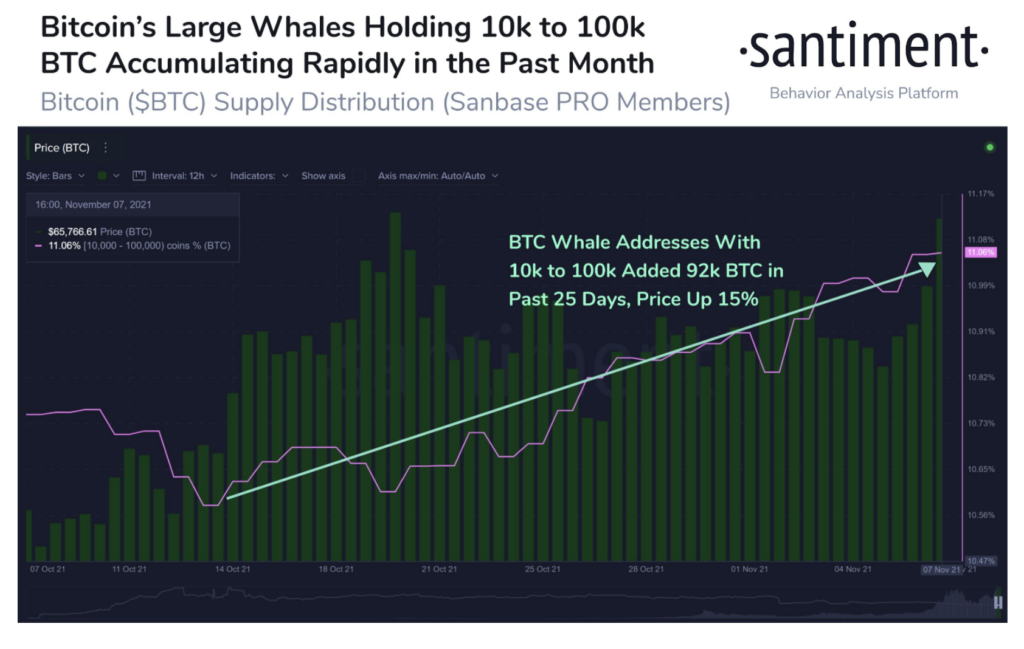

BTC made a major leap in the early Monday hours and crept up above $66,000. Large whale addresses holding 10k to 100k BTC have accumulated 43,000 more BTC and increased their holdings by +2.1% in just the 5 days prior.

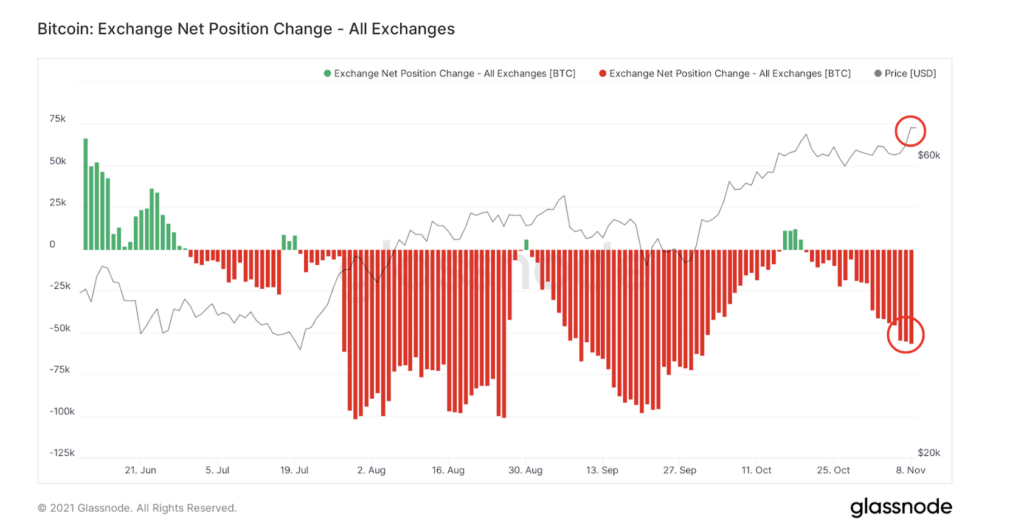

Despite BTC hovering just below its recent ATH early week, exchange withdrawals of BTC continued to increase, a sign that spot accumulation was getting stronger even with the price of BTC very near ATH. Eventually, this gave BTC the break that traders were hoping for, with BTC breaking ATH to race to a high of $69,000 on Tuesday.

However, as most traders have turned bullish upon BTC’s break of ATH, the BTC Futures Open Interest exceeded levels last seen in April. Historically, this level of open interest has led to a dip in price.

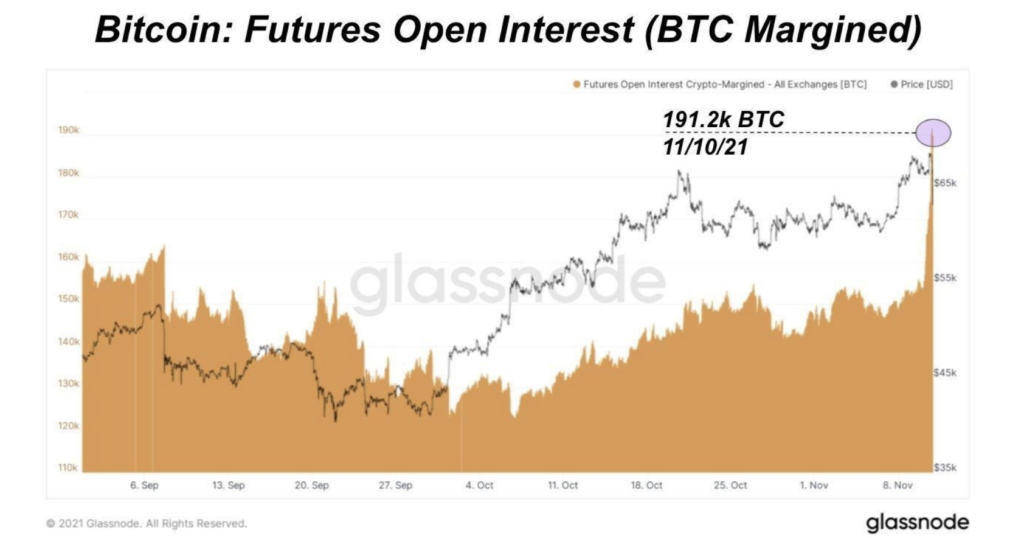

A close-up version of the same chart above shows more clearly the extent of the rise in BTC Open Interest in the Futures market as BTC price broke ATH, which cannot possibly be sustainable.

As “long BTC” became a crowded trade after it carved out a new ATH, BTC started selling off after news that a dormant address containing 2,207 BTC (worth around 150,512,129 USD) has just been activated after 8.1 years. This created some fear that old dormant BTC wallets could be taking the opportunity to sell. This particular wallet, however, was later revealed to have sold its BTC in the OTC market which does not affect market price.

Leverage Reset Could Stabilize Market

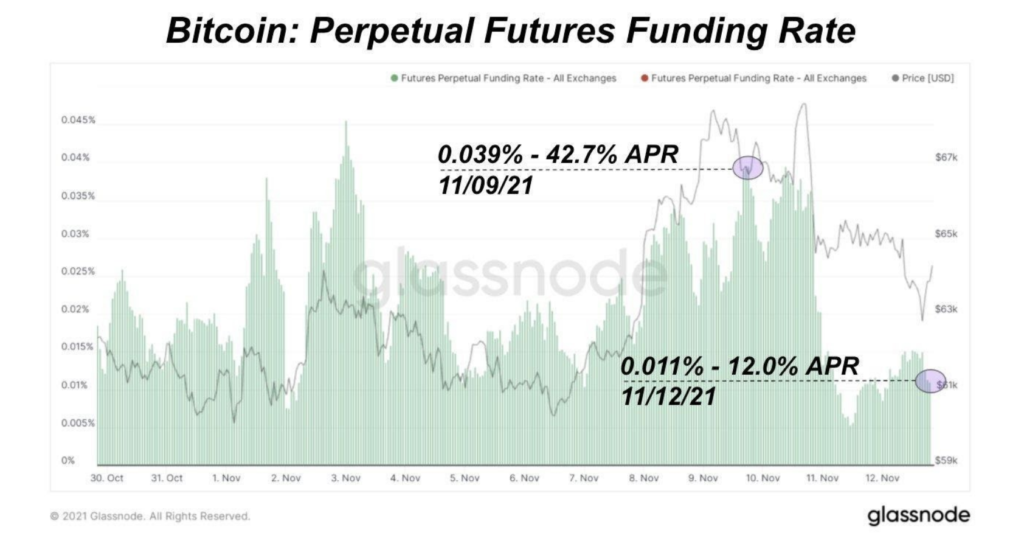

Another event that could be raising caution amongst traders was the BTC Taproot Upgrade, which has been successfully deployed over the weekend. The removal of this execution risk could be positive for price this week as the funding rate on BTC Futures has fallen significantly after the selloff, suggesting that leverage in the market has fallen back to a healthy level.

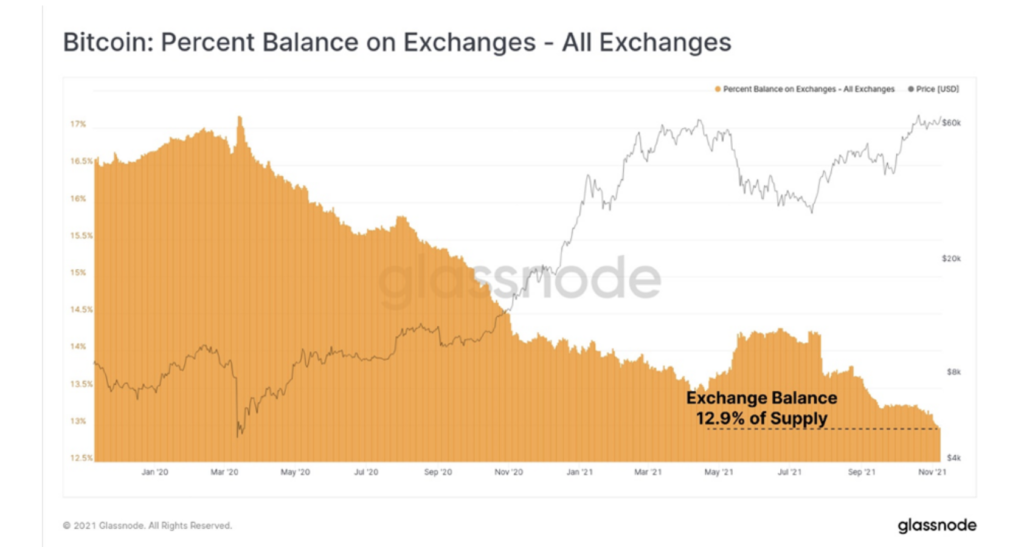

Another factor supporting an increase in BTC price is that the accumulation of BTC has continued to be aggressive even during the midweek dip, which has led to another low in BTC reserves at exchanges.

The exchange balance of BTC has fallen to a new low of just 12.9% of the total circulating supply. Should the pace of withdrawals continue, the BTC supply shock could be very intensive in the coming weeks and months.

Altseason Rotation Continues But BTC Still The Keeper

The rotational play on altcoins moved to the original 2017 old favorites like BCH, XRP, and LTC last week.

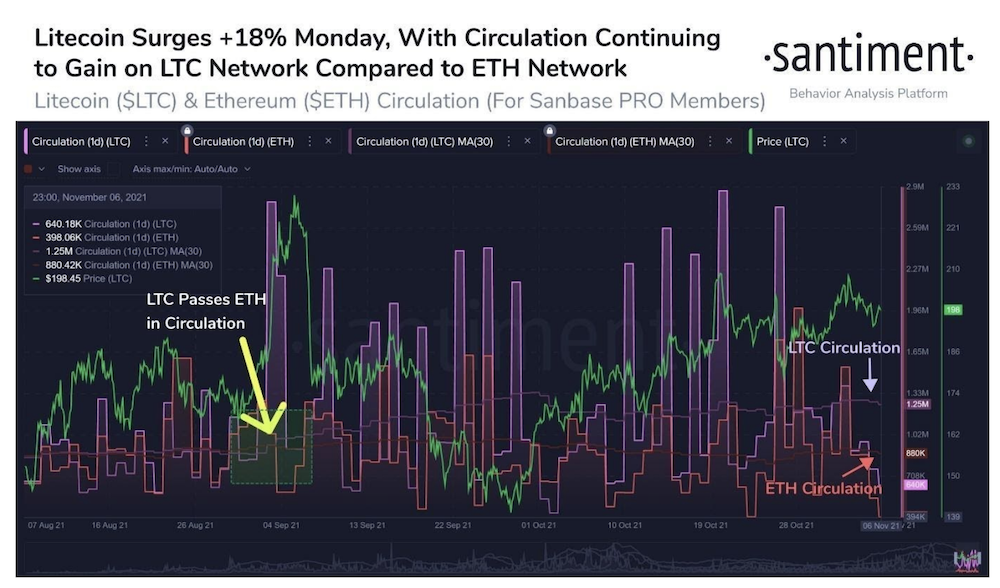

Old favorite LTC, which has been almost forgotten by many traders, burst to life, gaining about 50% to a high of $300 after the amount of LTC transactions was shown to have started increasing. LTC’s number of tokens circulating, now 1.25 million tokens per day, is surpassing that of ETH by an increasing margin. Traders could be buying LTC to send around because of LTC’s relatively lower gas fees as compared with ETH. ETH, with its high fees, is now transferred less frequently and is seen more as a token to stake and farm by investors.

Market participants were very interested in chasing trends last week, as tokens that have clocked triple-digit gains over a few days continued to be chased by traders looking for a quick profit. Tokens like KDA, LRC, IOTX, and K3PR saw more massive price increases over the week led by a new wave of speculative frenzy after the metaverse play fizzled out. However, even the new favorites ran out of favor very soon as most tokens that have seen sharp rises have started to retreat at the end of the week. This rotation into different altcoins is expected to continue over the course of this bull run and a new theme is expected to play this week.

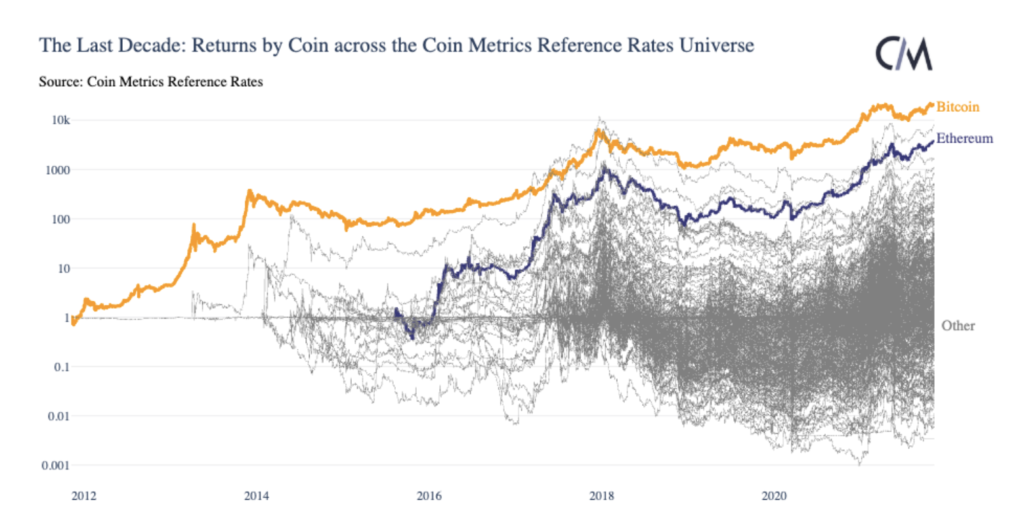

Despite the short-term large price increases by altcoins, data from Coin Metrics show that while some smaller-cap assets will undoubtedly outperform BTC during the bull run, many will likely not stand the test of time. Historically, most tokens have fallen off over the long run compared to BTC and even to ETH.

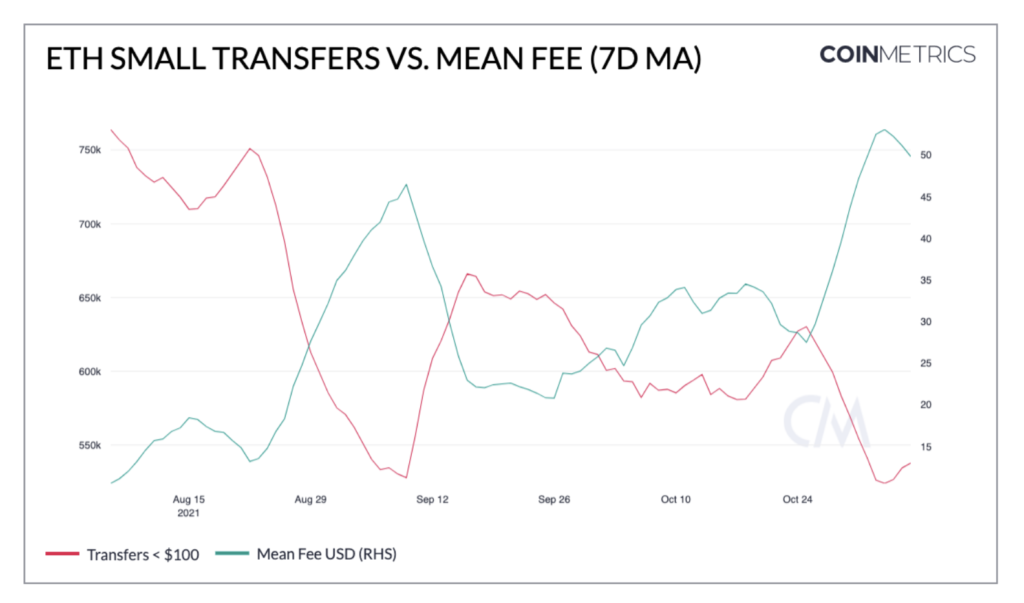

Speaking of ETH though, with its price at a higher level, gas fees are back rising significantly since the end of October as network activity picks up. Daily active addresses have averaged over 650,000, back at the August level of this year.

The high fees are starting to price out certain economic activities such as small transfers. And as we have seen above, this has led to an increase in the number of LTC transfers.

The price of ETH also took a hit after it was revealed that the ETH Foundation had sold 20,000 ETH on Thursday.

However, 20,000 ETH is not a huge number since around 12,000 ETH is being burned daily currently. The impact of 20,000 ETH sold can be easily offset by 2 days of burn and hence, the impact of the Foundation sale is on a psychological level instead of having a real price impact. The supply of ETH being removed from exchanges is still seeing a downtrend, meaning investors are still not sending their ETH to exchanges for sale, but are still buying and moving them into cold storage, or for use in DeFi farming. The amount of ETH reserves in exchanges has fallen to around 15.7% of circulation, trailing slightly behind BTC’s 12.9%.

Tim Cook Likes Crypto But Apple Does Not

Tim Cook, Apple’s CEO, revealed that he personally owns cryptocurrency and has been interested in it for a while. He however dismissed the possibility that Apple would be adding cryptocurrency to its balance sheet, nor that Apple would be accepting cryptocurrency as payment, to the disappointment of many crypto investors.

About Kim Chua, Top Coin Miners Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.