In the growth and development of Bitcoin towards a mainstream financial asset, the desire to have a Bitcoin ETF has been high on the wish list. Many companies have put forward proposals only for the SEC to strike them down over fears of market manipulation and other issues with the burgeoning space.

However, it appears that the SEC has finally given in to the desires of the majority with a rumored ETF on its way. This is hugely bullish news for the cryptocurrency space, and Bitcoin in particular, and the rumors have sent the market price skyrocketing.

Bitcoin has crossed over the $60,000 mark and neared $63,000 off of this news, which is just short of its all-time high of $64,800. The cryptocurrency has been on a relatively strong rise in the last three months, having doubled in value since the end of July. Many now feel that the ETF news could be the catalyst for a new all-time high, which was last seen in mid-April this year.

The ETF news is also positive as this tool would be great for institutional interest in Bitcoin. Institutions still look to be playing a major part in the markets currently and are in a period of accumulation. The approval of an ETF would empower institutions further to make a bigger impact in the market leading to higher prices, potentially.

Elsewhere in the traditional markets, better-than-expected earnings from companies that reported last week kept stocks higher in a week that saw mixed economic numbers. While inflation was higher than expected, so were retail sales, which surprisingly rose 0.7% against a consensus expectation of only 0.2%. This unexpected beat has managed to keep sentiments positive.

US inflation numbers released mid-week showed that inflation is still raging. The US inflation rate rose to a 13-year high in September as rising costs for food and shelter pushed the rate up to 5.4% when economists were expecting the number to come in at around 5.3%. For the month, the CPI rose 0.4%, when consensus was for a 0.3% increase.

Amid the mixed numbers, better than expected earnings reports from financial heavyweights like JPMorgan, Bank of America, Morgan Stanley, Citigroup, and Goldman Sachs spurred the markets on, helping the major indices end the week on a positive note. The Dow saw a weekly gain of 1.6%, while the S&P 500 advanced 1.8% and the Nasdaq rose 2.2%.

Gold and Silver trading remained lackluster, while the DXY consolidated at around the 94 levels. The highlight remains on the energy market, with Oil surging above $82 to close the week.

The WTI Crude Oil was up 3.5% in an eighth consecutive weekly rise, while Brent Crude broke the $85 level, up 3% for the week. A supply deficit coupled with increasing demand due to COVID reopening could send prices even higher as we head into the winter season. Unless the OPEC+ decides to suddenly increase supply, which will be highly unlikely, a supply gap of around 700,000 bpd is expected through the end of this year which could send prices soaring.

In spite of the bullish outlook for Oil, it pales in comparison with the cryptocurrency market, which is even more bullish. A rumor of the first BTC ETF being approved by the US SEC initially sent front-runners buying up BTC in anticipation mid-week, while the eventual approval announced late Friday afternoon saw the next wave of buyers send the price of BTC firmly above $60,000 for the first time since April.

Institutions Piling in On BTC Ahead of Rumoured ETF Approval

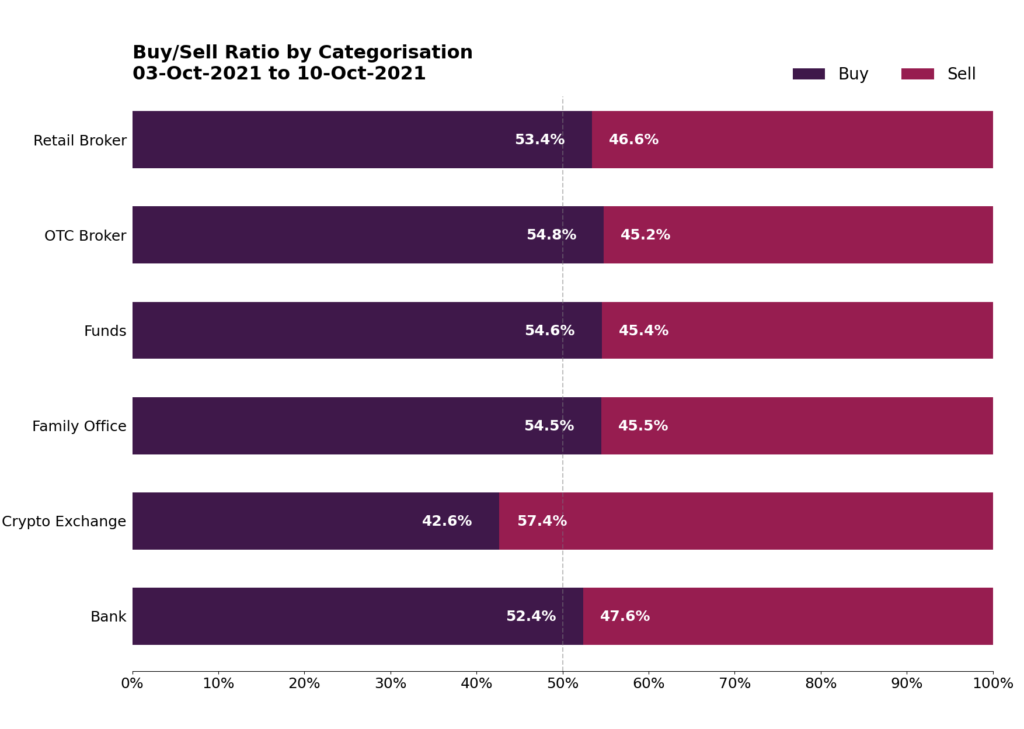

According to data, the recent surge in the price of BTC appears to be led by institutional investors, with OTC brokers, funds and family offices taking the lead in the buying category, while crypto exchanges which typically service retail investors are skewed on the selling side.

Crypto exchanges, which have millions of retail clients, were skewed 57.4% to the sell-side from October 3 to October 10, while OTC desks were buyers of crypto, skewed 54.8%.

This could show that the current run-up in BTC price is caused by institutional buyers, which may have a longer-term view than the average retail investor.

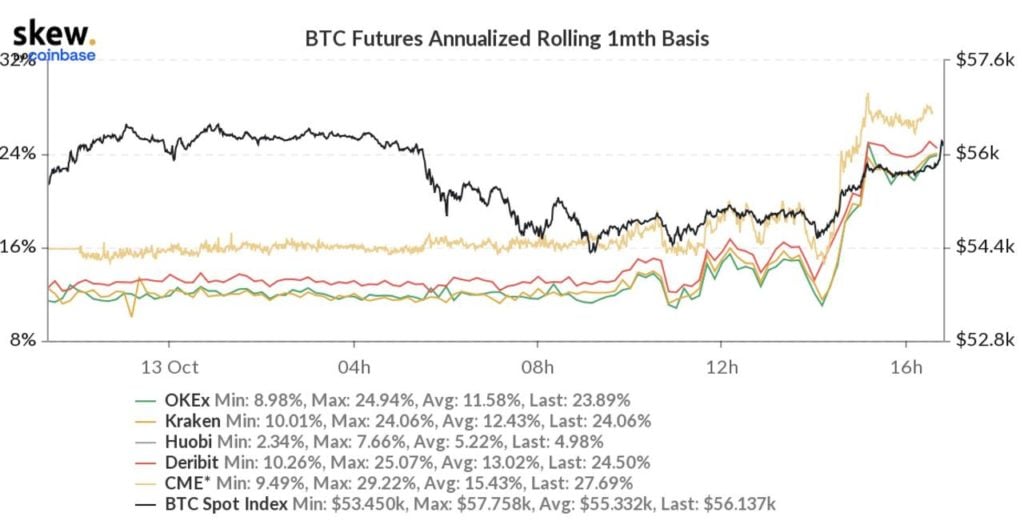

In another sign that shows the recent bullish move in BTC is driven by institutions, last week saw a spike up in the Futures Market price of BTC on the CME Exchange. Since the middle of last week, as the price of BTC increased, the basis of BTC had started to increase sharply, meaning the BTC futures on the CME started to trade at a larger premium to that offered by other crypto exchanges. This could mean that US institutional traders using the CME are the ones bidding up the price of BTC recently. Optimism surrounding the SEC’s approval of a futures-led BTC ETF could be a key reason for the aggression by institutions.

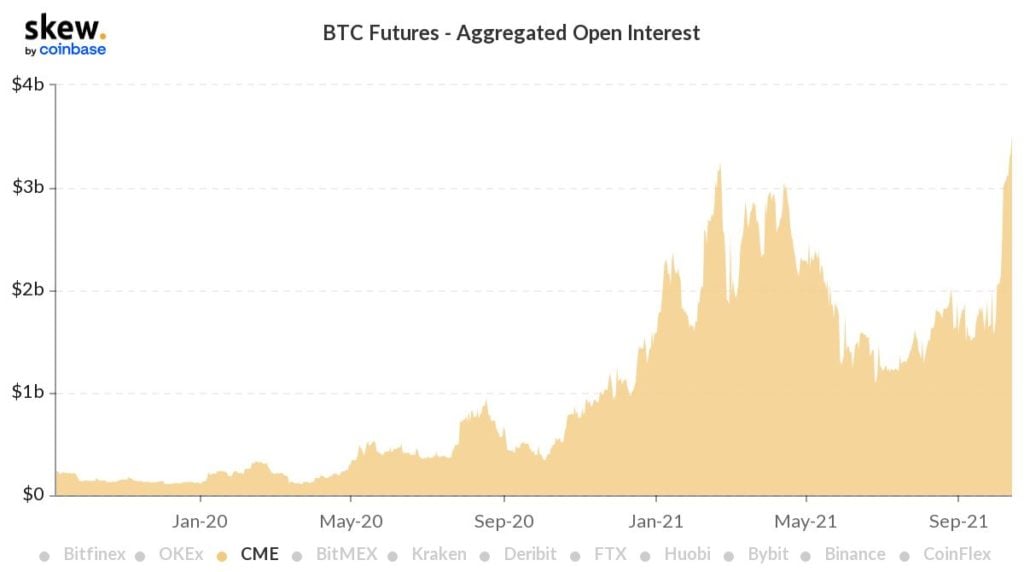

Similarly showing increased institutional interest, the CME Open Interest also surged to an ATH.

This information shows that just before news broke that the first Futures-based BTC ETF could be approved for trading in the US, there has been a surge in institutional investors taking positions on the CME in anticipation.

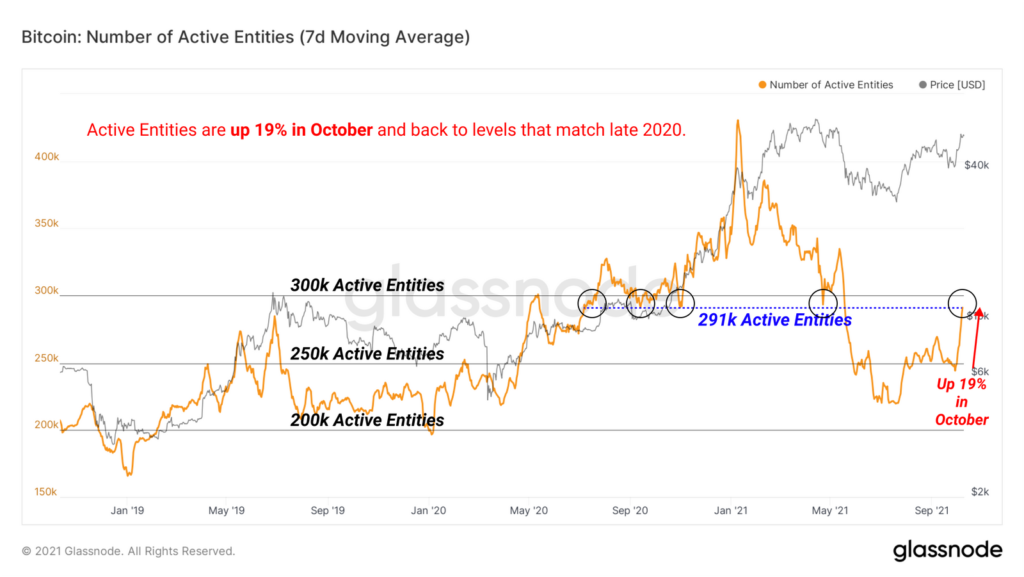

BTC Active Entities Increasing

BTC in the spot market has also witnessed an increase in unique users. The BTC Active Entities Count has been increasing. Ever since falling from the beginning of this year, the number of active entities using the BTC blockchain has started on an uptrend in July, with a surge in entities since October. The last time the number of active entities saw such a turnaround was from May to July of last year, which preceded the beginning of the bull run. Between the months of October to January, last year saw a big spike in the number of active entities, which coincided with a large surge in the price of BTC. Could it be the same this time around?

Coinbase NFT Project Helps ETH Breakout

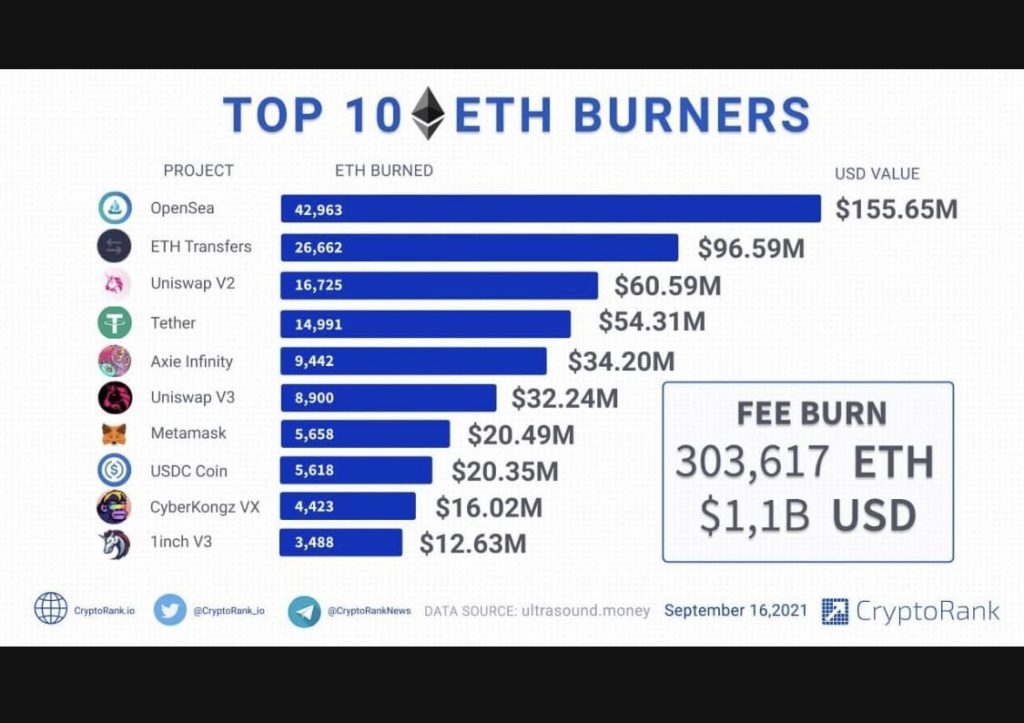

Coinbase’s introduction of an NFT marketplace sent positive vibes across smart contract blockchains and in particular to ETH as NFTs have been the highest ETH gas guzzlers on the ETH blockchain, as can be seen in Opensea’s lead over even popular DeFi projects like Uniswap. With the NFT Marketplace to be launched on ETH, bullish sentiment took the price of ETH breaking out from consolidation, soaring above $3,600 convincingly. The more gas is being paid as a fee, the more ETH will be burned, reducing the circulating supply of ETH. Thus, an introduction of an NFT marketplace by the largest US crypto exchange could drive a big increase in usage, further reducing the supply of ETH as more ETH will be burned.

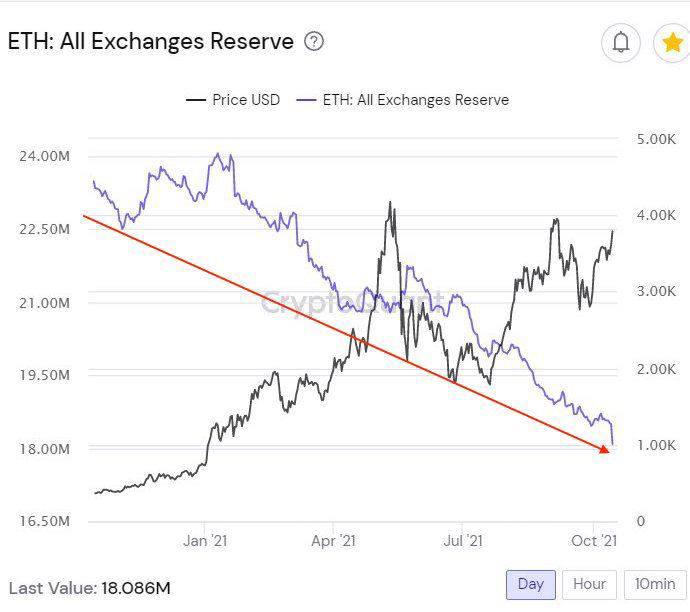

Coincidentally, after the NFT news from Coinbase that brought about positivity to ETH’s price, 400,000 units of ETH were withdrawn from Coinbase. This could mean that a whale from the USA had bought and removed around $1.5 billion worth of ETH from Coinbase. As the sum is a rather big amount, could this whale move be another large corporation that is adding ETH to its balance sheet?

Following the large withdrawal from Coinbase, the exchange reserves of ETH have dropped to a new all-time low of only 18 million units. This could intensify the ETH supply crunch as we head towards the implementation of ETH 2.0.

Besides the ETF approval, other notable bullish news for crypto includes Russia, which is said to be open to accepting cryptocurrencies as a legitimate form of payment. However, Russian President Putin acknowledges that it is still too early to consider using cryptocurrencies in the trading of energy resources.

With the newly approved ProShares BTC ETF to start trading today, eyes will be on how this will impact BTC price and as such, market direction this week could hinge on the performance of the ETF. If the response is positive and the price of BTC bids higher, then we could be expecting BTC to hit ATH very soon.

About Kim Chua, Top Coin Miners Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.