After suffering a rather large collapse last week, the Bitcoin market is struggling to bounce back in characteristic fashion. The major cryptocurrency is seemingly range bound and is failing to push much above the $40,000 mark.

Meanwhile, all thoughts of an altcoin season during the Bitcoin fall have really evaporated for now as many of the more popular coins for investing in the last few months have struggled to maintain value.

However, looking into it a bit more, there is some positivity that is flowing around the crypto space in general which many expect to have a positive impact soon enough. Long term American Bitcoin Whales have been seen buying up Bitcoin at these discount prices.

Even Elon Musk, who seemingly turned on Bitcoin, has had a positive spin on things stating that they are looking to make Bitcoin mining greener — a key concern of his.

Meanwhile, stocks recorded gains in a muted week that saw its fifth-lowest turnover since the pandemic began, with light trading volumes recorded in most asset classes ahead of Memorial Day holiday on Monday.

President Biden’s unveiling of his $6 trillion 2022 budget boosted confidence in the economy after a slightly higher-than-expected rise in CPI failed to incite fears amongst traders, with the yield on the benchmark 10-year U.S.

Treasury note decreasing over the week. This sent the US major indices higher, with the Dow rising 0.9%, the S&P rising 1.1%, bringing the large-cap S&P 500 to within 0.5% of the ATH it established on May 7. Nasdaq was the top-performer with a 2.2% rise with a rebound in tech stocks. Expectations are for the stock market to continue on its upward trajectory after recent corrections on the back of increased government spending and a calmer bond market.

The USD didn’t move much for the week, with the DXY pinned at the 90 level. Gold and Silver however, saw increased inflows, with Gold managing to close above $1,900 the first time since January 2021. Price action for Gold and Silver is looking good, with a high possibility of them retesting their recent highs.

Some institutions like JP Morgan are advising their clients to buy Gold instead of BTC as an inflation hedge because of BTC’s volatility, which will greatly benefit Gold and Silver in the short-term. Gold has opened the week above $1,900 while Silver is above $28, both rising about half a percent in the first trading day of the week.

Oil price rose 5% last week, with Crude price closing in on a $68 resistance. Goldman Sachs issued a Crude Oil report with a target price of $80 per barrel by the end of this year on the back of an increase in travel demand made possible by mass vaccinations. Crude Oil currently trades around $66.50 to start the week.

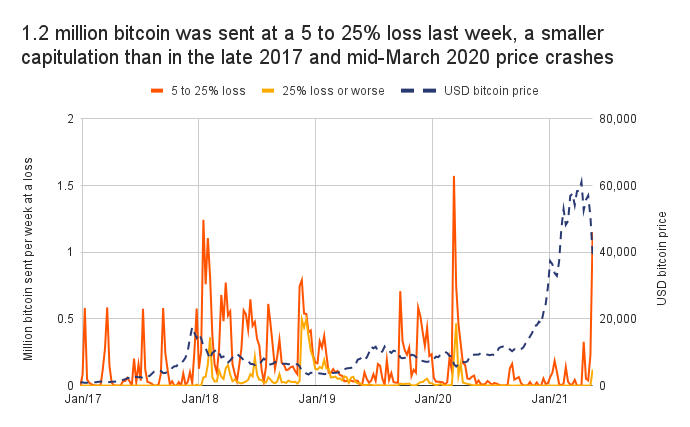

Short-Term Investors Sold More Than 1.2 million BTC At A Loss

After its heavy plunge the week before, last week saw BTC consolidating towards $35,000 after it failed to break above $42,000. For the total of 2 weeks, a considerable amount of BTC was being moved on-chain at a loss, meaning these BTC positions were either force-sold or panic sold by traders who bought after January since the price of BTC was lower before.

According to data, 1.2 million BTC were sold at between 5-25% losses, and around 120,000 BTC were sold at a 25% loss or more. Despite the large USD value however, the number of BTC sold was still smaller than that witnessed in the Jan 2018 and March 2020 price crashes, indicating that last week was not the worst capitulation of holders in BTC’s history.

This data could also imply that long-term holders had not been selling their BTC since these investors would still be selling at a profit, not at a loss.

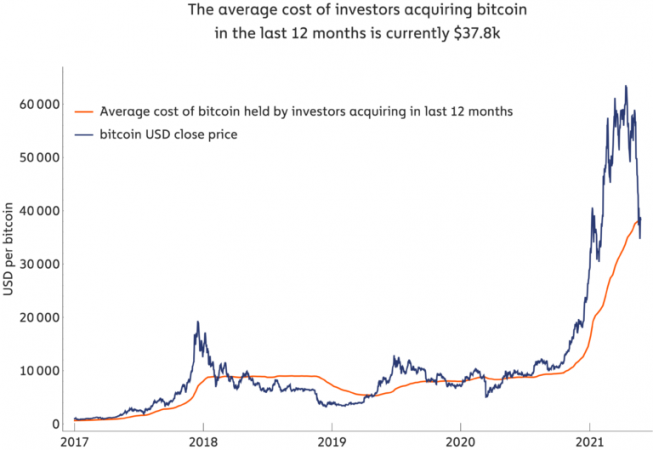

As price cooled off, a reversion to mean seems to be on-going, with BTC price now much closer to its average purchase price over the last year of $37,800. The area just below this level may provide some form of interim support since long-term buyers would not be tempted to sell at this price, while short-term speculators may see no need to sell to cut loss nor need to sell in order to meet margin calls. New investors will also be happy to buy at a slightly better-than-average price.

American BTC Whales Continue To Buy The Dip

Long-term BTC hodlers with between 10,000 to 100,000 BTC were observed to be buyers in the dip, mopping up around 122,588 BTC. These buyers seem to be coming from the USA, as evidenced by a $3,000 BTC price premium on one of the largest US crypto exchanges. Exchanges in S Korea also saw an 11% Kimchi Premium over other non-Korean crypto exchanges, suggesting that the dip is being actively bought by investors in these 2 countries.

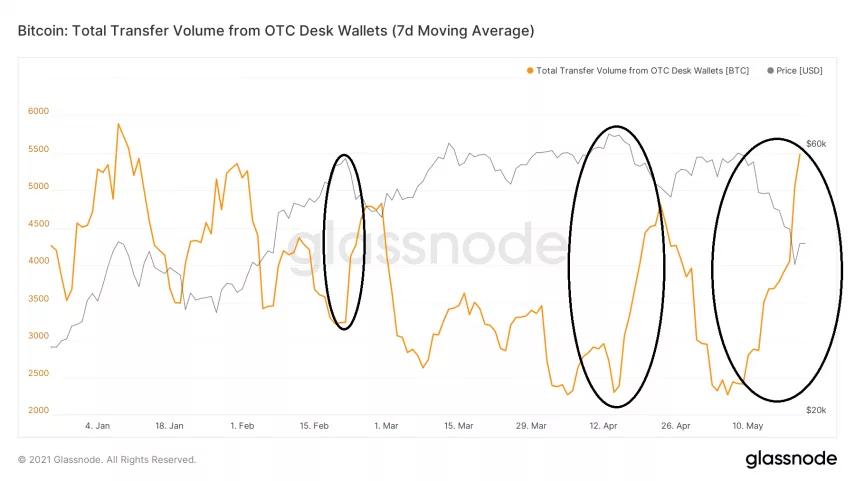

Institutional investors were the most likely buyers, as daily OTC transfers rose to a record high of 245 on Thursday, a 10-fold increase compared with a week ago. Institutional investors typically buy from OTC desks to avoid influencing spot prices. The average number of BTC outflows from OTC desks doubled to more than 5,000 units per day from 2,500 before the crash.

BTC News Flow Turning Positive Again

Other than flows, the narrative for BTC also seems to be getting more positive, especially out of the USA, with early week tweets from Elon Musk lending support to the price of BTC. Elon Musk said in a tweet that he and Michael Saylor had met up with North American miners to set up a commitment towards sustainable BTC mining. This development was followed by new endorsements from various high-profile celebrities in the investment circle.

First off, billionaire investor Ray Dalio said he believes BTC is a superior instrument for saving compared with government or corporate bonds, and admitted to holding BTC despite the risk of regulatory intervention.

After Ray Dalio, another widely followed activist investor Carl Icahn also says he is exploring going into crypto in a big way, potentially investing up to $1.5 billion into the sector. While he did not specify how he would invest the money, observers seem to think that Carl could invest in ETH as he spoke positively about ETH in an interview.

Meanwhile, Nobel Prize-Winning Economist Robert Shiller also hinted that he may get involved with buying BTC, while another Nobel laureate Paul Krugman said that he has given up predicting the imminent demise of BTC, now calling it a cult that can survive indefinitely.

Even though the series of positive narrative briefly took prices up to $40,000, profit taking ensued as the long weekend in USA loomed, with traders taking small profits before the month-end expiry of both the BTC options and futures, sending BTC price back down below $35,000.

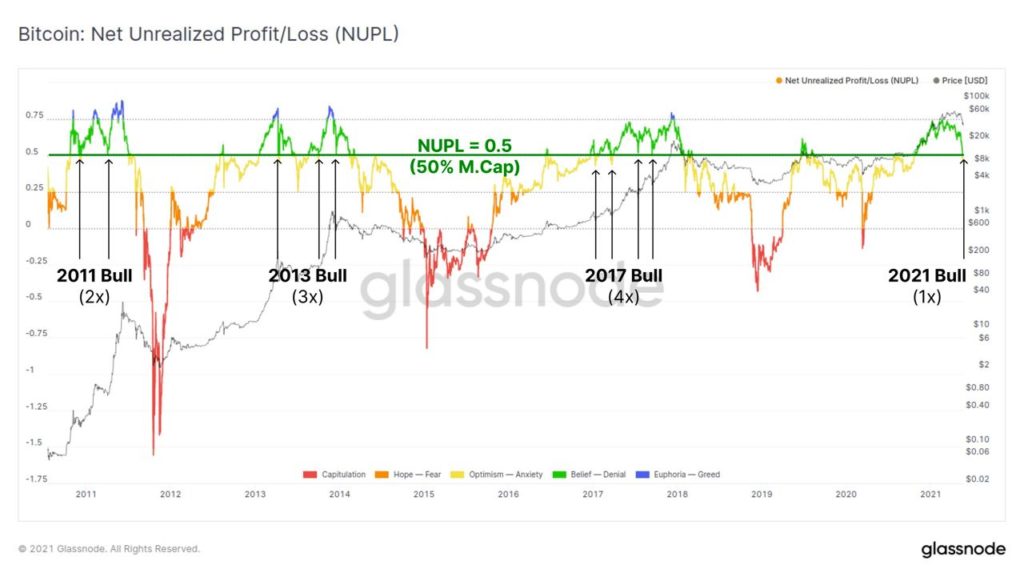

Notwithstanding the tug-of-war between buyers and sellers, the Net Unrealised Profit and Loss (NUPL) metric has pulled back to 0.5, which means that currently 50% of the market is in profitable positions. This level has historically acted as a support in all 3 of the previous bull markets and this is the first time the level has dipped to this level in our current 2021 bull market. Can this metric work for the fourth time to signal a support around this area?

BTC Exchange Outflow Picks Up Pace

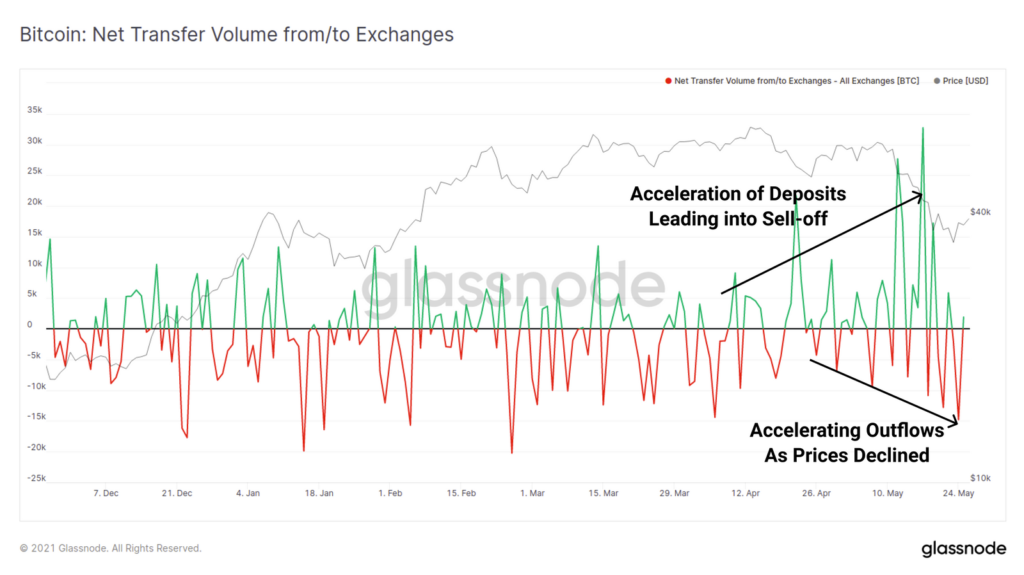

The net transfer volume for BTC to/from exchanges shows that BTC outflow from exchanges is accelerating as price falls, implying that the rate of purchase is also increasing with the drop in price. Hence, this data set also seems to suggest that despite the weak price action, the increase in buying flow could lend some support to prices.

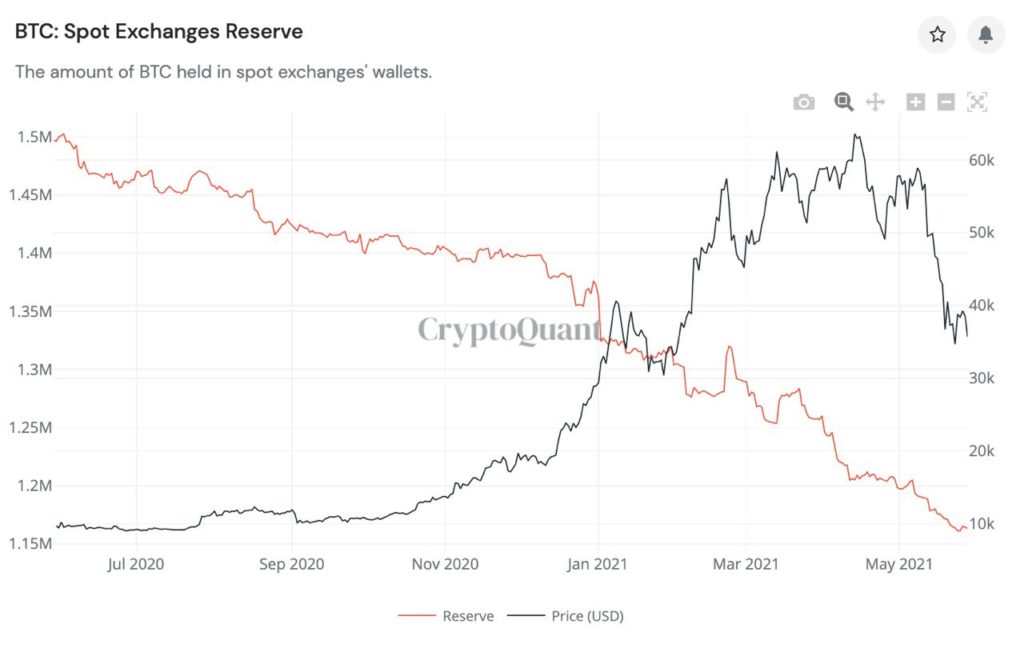

BTC Exchange Reserve Sees Continuous Dip As Price Falls

BTC reserve at exchanges is also experiencing a consistent drop despite the weak looking price action, suggesting that long-term holders are quietly accumulating on the dip and removing BTC from circulation.

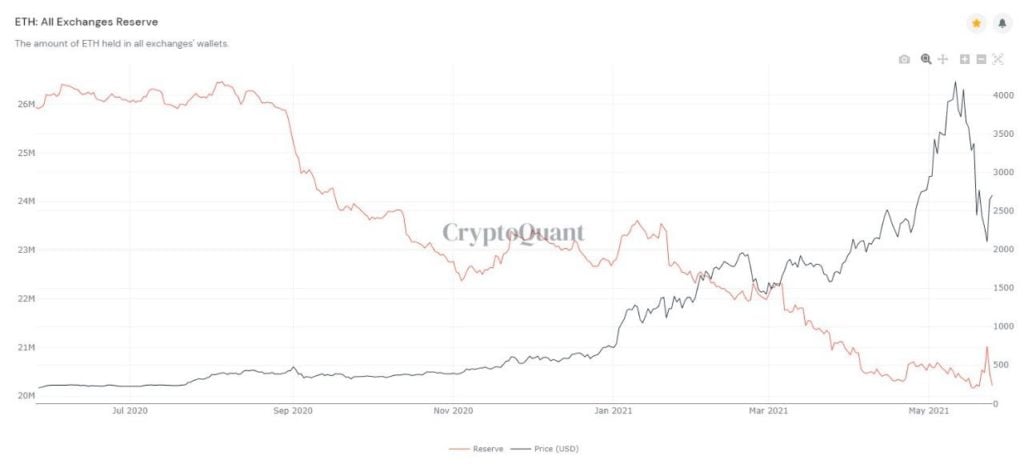

ETH Price Dips, But Buyers Are Mopping Up Supply

Meanwhile, ETH price also took a beating, not able to hold on to its early week bounce to $2,800, and thereby opening up the possibility of retesting its $1,730 low. However, exchange reserves of ETH saw a sharp fall, implying that many took the dip as an opportunity to load up on more ETH and remove them from exchanges.

In fact, more investors had been buying up ETH compared with BTC since the start of May, with trading volume for ETH starting to surpass that of BTC, a sign that investors are much more interested in ETH than in BTC. This could set the stage for ETH to outperform BTC, especially when most institutions have indicated a preference in ETH over BTC. Many experts are expecting ETH to flippen BTC to become the most highly valued blockchain within the next one to two years.

Altcoins Continue to Drift Lower On a Lack of Catalyst

With the leading top 2 coins in limbo, the rest of the market could barely recover, with altcoins continuing to look weak through-out the week, not being able to recoup their losses incurred the week before. The exception was MATIC, which rallied 100% back up above $2 mid-week after Mark Cuban said he was an active user of the Polygon blockchain and that he had bought an undisclosed amount of its MATIC token. MATIC however, has given back 50% of the gains made as the broad market continued languishing.

Other noteworthy news includes Paypal’s allowing of crypto withdrawals for its customers, and Ark Investment’s circa $20 million investment into BTC. Ark Investment is bullish on BTC, saying it is not possible for governments to shut it down and that the firm has a price target of $500,000 for BTC.

However, with the technical picture looking weaker, and a Memorial Day holiday on Monday, crypto prices are not expected to trade with much conviction either way until institutional investors are back at work Tuesday onwards.

BTC may continue to slide towards $30,000 and range trade between $30,000 and $40,000 until another major catalyst comes to send prices breaking out of the range. Meanwhile, altcoins are likely to continue in their zombie state on light trading volume until BTC finds a clear direction.

About Kim Chua, Top Coin Miners Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Top Coin Miners. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Top Coin Miners recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.