Acquiring the skill of trading in the Forex market broadens the horizon for traders as it offers the chance to trade currencies of different nations round the clock. Since the market is decentralized, traders can seize opportunities irrespective of their time zone.

Forex trading centers around speculating on national economies, interest rate variations, and risk tolerance. Becoming proficient in Forex trading empowers traders to engage in macroeconomic trading, bypassing some of the microeconomic concerns associated with trading stocks or options.

Learn how the forex market works

The first thing you will have to do is understand how the currency markets operate. This is much different than most markets that you may be used to, such as futures or stock markets. This is because both futures and stock markets are centrally controlled, via an exchange.

When you are involved in the Forex markets, you are trading them via a network of banks. This is what is known as the over-the-counter, or OTC market. Banks work as market makers, offering a price to buy a particular currency pair, and a quote price to sell that pair. This is why the market is open 24 hours a day because the banks are global in scope.

Most retail traders will have to access the currency markets via a broker, as the size necessary to trade with the major banks is far out of the reach of almost all retail traders.

Choose the Way of Trading Forex

Most Forex trading is done between major institutions and central banks. The entities trade huge positions of currency every day, facilitating cross-border transactions for clients. That being said, individual traders do not have the means to trade in that manner, as to trade on the Interbank market itself requires millions of dollars.

Because of this, there are two main ways that the average trader will access the currency markets, by trading the CFD markets or using a Forex broker.

What is a Forex CFD?

CFD stands for contract for difference. These are instruments that allow traders to benefit from price fluctuation in an instrument without actually owning it outright. For example, you may wish to buy €100,000 against the US dollar. By using a CFD, you and a counterparty agree to settle the difference in value once the trade is closed. Otherwise, if you would have to take delivery of €100,000 to speculate.

CFD stands for contract for difference.

The CFD has allowed traders to not only trade Forex but a multitude of other instruments as well. The advantage of a CFD is that it frees up a lot of the complications of taking delivery of an asset, in this case, a certain amount of currency, and therefore the trader can focus solely on the direction of the market. Once the trade is closed, the trader is either credited or debited the price difference.

Forex trading via a broker

Forex brokers acts very much like CFD brokers, with the exception that they do not offer other instruments. You are still betting on the price movement of a currency pair, and you are still not taking delivery of the underlying currencies involved. However, if you are looking for more opportunities, a CFD broker like Top Coin Miners is the way to go.

Choose a currency pair

When you are trading Forex, you will need to choose a currency pair to focus on. Some traders will trade just one currency pair overall, but there is a whole world of good opportunities in the Forex markets. Because of this, traders will use a methodology or system to place trades and look for currency pairs that offer those setups.

Once they identify a potential trade, they will then typically markup their chart to see where they want to enter, exit, or admit defeat. The currency pair that you choose can have a significant amount of influence on where you place protective and take profit orders.

Forex pair categories

Forex pairs can be categorized into four different types. Each will act a bit differently and will have different volatility characteristics.

- Major pairs: Major pairs constitute about 80 to 85% of all Forex trading. Major pairs all have one thing in common: the US dollar. This category includes the Euro versus the US dollar (EUR/USD), US Dollar versus the Japanese yen (USD/JPY), British pound versus the US dollar (GBP/USD), US Dollar versus the Canadian dollar (USD/CAD), US Dollar versus the Swiss franc (USD/CHF), Australian dollar versus US dollar (AUD/USD), and New Zealand dollar versus US dollar (NZD/USD).

- Minor pairs: Minor pairs include a mix of the major currencies but without the US dollar. Some examples might be the EUR/GBP, EUR/CHF, and GBP/CAD.

- Exotic pairs: Exotic pairs will feature one major currency against a currency from a smaller economy. This could be pairs such as the US dollar versus the Mexican peso (USD/MXN), British pound versus Hungarian Forint (GBP/HUF), and US dollar versus South African Rand (USD/ZAR).

- Regional pairs: Regional pairs are defined by belonging to the same geographical region. These are typically smaller economies that do a lot of commerce with each other. This would include AUD/NZD, Singapore dollar versus the Japanese yen (SGD/JPY), and Korean won versus the Japanese yen (KRW/JPY).

Analyze Forex Market

Before putting any money to work in the Forex market, you should do some analysis. Successful traders know why they are getting into the market, and when it is time to get out. By analyzing the market before getting involved, you can approach the market with a plan in advance, instead of trading based upon the emotions of the moment.

Technical Analysis

Technical analysis is a form of analyzing a market by looking at charts. The most basic forms of technical analysis will try to determine support and resistance, or where markets attract buyers and sellers. At the end of the day, that is the most important thing to know on a chart, and people will typically use technical analysis as an entry or exit signal, perhaps based upon the longer-term movement known as “the trend.”

People who use technical analysis are focused on things like momentum, trend, and of course, support and resistance. There is a multitude of indicators and candlestick patterns that traders will use to determine potential moves as well.

Technical analysis can be as simple or complex as the trader chooses and needs to incorporate specifics that the trader is comfortable using. The most important thing that you should pay attention to when using technical analysis is that it is about probabilities, not certainties. Markets can and will do anything they want to.

Fundamental Analysis

Fundamental analysis is a form of analyzing the market based upon economic announcements, interest rate expectations, geopolitical risks, news reports, and central bank behavior. While there are a huge amount of potentially market-moving events that can fall under the umbrella of “fundamental analysis”, there are certain ones that are much more important than others.

Economic reports on a country’s economy will be one of the crucial tools that a fundamental analyst will use. This is to determine whether or not the economy is healthy, and more importantly, growing. If it is, as a general rule traders will want to own that currency. Some of the most important ones include:

- Gross domestic product

- Employment

- Retail sales

- Inflationary announcements such as CPI, PPI, etc.

- Central bank reports

There are also other less tangible so-called “soft announcements”, such as the University of Michigan Consumer Sentiment, which measures how the US population “feels” about the economy. The idea of course is that with these types of announcements, if the consumer feels strong, then they are much more likely to continue spending.

Other such announcements are based upon specific industries, sections of the economy, and even age groups. The biggest trick with fundamental analysis is that although it may lay out a strong case for particular currency strengthening, it is still somewhat vague in its approach. This is why so many people use technical analysis right along with fundamental analysis, using the fundamental analysis as a way to look for the directionality of the trade, and the technical analysis as a gauge for entry, stop, and profit-taking levels.

Build a trading plan

Building a trading plan is crucial so that you are not simply guessing where the market is going to go. This is the difference between being a professional trader, and a gambler. If you choose to simply guess where things are going, you do have the possibility of being profitable occasionally, but the longer-term success is highly questionable.

The trading process can be very emotional if you are simply guessing, so it is important to have a set of rules laid out before you even get involved. The Forex market can move based upon a multitude of unforeseen factors, so testing a methodology is going to be crucial. This is because you know that over the longer term, your rules do make money. This allows the trader to psychologically accept the losses that will inevitably come from time to time.

The Forex market can move based upon a multitude of unforeseen factors, so testing a methodology is going to be crucial.

Whatever you use as a system, be it technical, fundamental, or more likely than not, a combination of both, it is crucial that you do what is known as backtesting. Backtesting means that you are looking through historical data to see how your system would have performed. If you know that you can have three losses in a row and still make an average of 2% a month, it gives you much more in the way of confidence and the ability to stick with what you know works.

Unfortunately, most traders do not spend the time necessary to backtest a system and will simply come up with the latest and greatest thing on a forum to start putting money to work. That being said, the trader will not know how the system typically performs and will not stick with it.

Choose your forex trading platform

Forex traders will need to choose a trading platform, and there are quite a few out there. However, Top Coin Miners offers an excellent online platform that many traders love. The only necessary thing is an Internet connection because it can be run from any browser.

The platform offers a plethora of technical indicators, as well as several different charting styles. The platform also allows you to quickly switch from not only Forex pair to Forex pair, but other CFD markets as well, as Top Coin Miners offers so many other markets such as crypto, energy, and indices.

Open, monitor, and close your first position

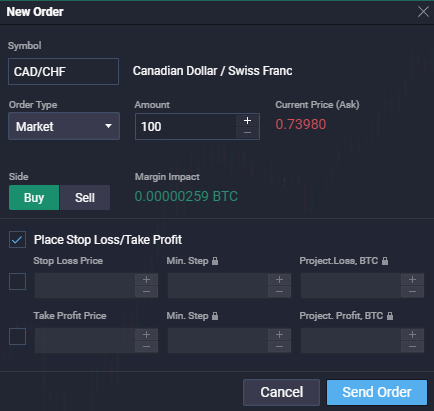

For your first trade, you identify potential setups and then decide whether you are going to buy or sell a currency pair. After that, place stop-loss orders and limit orders. Once you press the “buy” or “sell” button, your position is in the market.

Monitoring is something that will be different for everyone. If you trade intraday, you are more likely to sit and watch the trade unfold. However, if you are more of a longer-term trader, you free up time to walk away from the computer and monitor where the position is heading every few hours, or even every few days.

Closing your position typically happens when a stop-loss order gets hit, and the case that your position goes against you, or when your limit order gets hit as your target is reached. Some traders will adjust the trade along the way, thereby ending up with a different target than when they started the position.

Manage Risks

Managing risk is your top priority when trading Forex, or any other financial market for that matter. The markets can suddenly move in one direction or the other, and it isn’t always favorable. Because of this, taking precautions is the best thing you can do to prolong your trading career.

What is a stop-loss order?

A stop-loss order is an order that tells the broker to get you out of a trade if a specific price is hit. This is to protect your account in the event of a wrong prediction on price movement. You should never place a trade without a stop-loss order, as it will limit losses.

The stop-loss order is placed at a point where you admit your trade idea hasn’t worked out. As the markets are open 24 hours, there are times when you won’t be able to watch your trade, so the stop loss will mitigate risk.

What is a limit order?

A limit order is an order that you give to the broker as an instruction to sell a currency pair at the market price once it reaches a specific target. This means that they will get you the best price available, once a level is touched. This is an order that is used to take profit on a trade that has worked out in a trader’s favor.

This is optional because some traders believe and hang onto the longer-term trend. Regardless, it is an option that you have on our platform at Top Coin Miners.

Forex trading example

To understand how a Forex trade works, we will run through an example that is both profitable, followed by a loss. Understanding how to calculate both gains and losses will be crucial.

Trading a GBP/USD CFD

GBP/USD has a sell price of 1.35100 while being offered at 1.35130. You decide that the pound will continue to look weak going forward, as the economic figures coming out of the United Kingdom continue to nosedive. You decide to trade two standard lots.

Remember, each standard lot is worth 100,000 units of the base currency, or the first one that is being quoted in terms of the second one.

The calculation of selling a single standard lot of GBP is the same as trading £100,000 for $135,100 so your total position is worth $270,200 (£200,000).

Remember that Top Coin Miners offers leverage on their CFD products, so it is not necessary to put down the full value that you are trading. A trade on the GBP/USD CFD contract has a margin requirement of 0.10%, so your margin would be 0.10% of the total exposure of your trade, which is £400.00.

If your prediction is correct

Your analysis was correct, and the British pound has fallen significantly. You decide to close the trade once the pair reaches 1.34500.

To calculate the profit you have made, you multiply the difference between the closing price and the opening price of your deal by its total size.

This works out to 1.35100 – 1.34500 = 60 points. You then multiply 60 points by two CFDs to get a profit of $1200.

Calculating profit from your FX CFD

Remember that the price per point of a standard lot in the GBP/USD pair is worth $10, so it is simply a matter of multiplying the distance traveled in points by the worth of each contract. It is also worth noting that not every trade will be a full contract, so therefore the calculation needs to pay special attention to the position size.

If your prediction is wrong

In this scenario, the GBP/USD pair has risen instead. You have your stop-loss order hit at 1.35350, protecting your account but locking in losses.

As your position has moved 25 points against you, you take a loss of $500.

Calculating loss from your FX CFD

As the pair moved from 1.35100 to 1.35350, this means that the trade lost 25 points.

As to contracts are worth $20 a point, multiplying by 25 gives you the total loss of $500.

| Price of GBP/USD | 1.351150 |

| Bid/Ask price | 1.35100 / 1.35130 |

| Trade | Sell @ 1.35100 |

| Trade size | 2 contracts (£ 100,000 per contract) |

| Margin | £ 400.00 |

| Commission | 0.0001% (£0.20) |

| Other | Funding fees if held overnight |

| Example 1 | Sell @ 1.35100 1.35100 – 1.34500 = 60 point gain 20 x 60 = $ 1200 profit |

| Example 2 | Sell @ 1.35100 1.35100 – 1.35350 = 25 point loss 20 x 25 = $ 500 loss |

Why trade Forex with Top Coin Miners

Top Coin Miners offers the world at your fingertips, as the various instruments offered will allow the trader to take advantage of global trends, correlations between markets, and a whole host of opportunities.

- Trade on margin: The ability to trade on margin at Top Coin Miners means that you can make larger profits with smaller deposits.

- Crypto deposits: Top Coin Miners allows you to deposit and use crypto, offering the possibility of growing the value actively or passively.

- Online trading platform: The platform that Top Coin Miners uses is state-of-the-art technology that can be accessed anywhere with an Internet connection and a web browser.

- Copy-trading: Top Coin Miners offers a copy trading service, where novice traders can follow the trades of more experienced and successful ones.

- Earn interest: With your deposited crypto, you can earn interest at Top Coin Miners by staking, offering the opportunity to make money not only by trading but passively.

How much money do I need to start trading forex?

At Top Coin Miners, we accept Bitcoin deposits. To trade Forex CFDs with us, the trader needs to deposit just 0.00005 BTC to get started. If you do not have any Bitcoin, you can buy it on our website.

What do I need to start trading Forex?

The first thing you need is a broker like Top Coin Miners. This allows access to the markets. After the simple sign-up process, you then will deposit to your account to get access to the currency markets.

Can anyone trade Forex?

Basically yes. However, there is a list of countries that aren’t allowed to trade at Top Coin Miners, due to local regulations. These include the United States of America, Japan, St. Vincent and the Grenadines, Canada, Cuba, Algeria, Ecuador, Iran, Syria, North Korea, Sudan, United States Minor Outlying Islands, American Samoa, and the Russian Federation.

What is a good Forex trading strategy?

A good Forex trading strategy is profitable obviously. That being said, not all trading systems will work out for all traders. For example, the most important thing is that it is a trading system is one that you are comfortable with. This can be accomplished by backtesting and knowing that the system is not only profitable but how it behaves over the long term.

What currency pairs move the most?

As a general rule, currency pairs to have the widest spreads tend to be the ones that move the most. Exotic pairs are without a doubt some of the most volatile pairs out there, but when it comes to more common pairs, the pairs that feature the Japanese yen tend to be the biggest movers.