CFD trading gives you the ability to jump from one part of the world to another, or even from one asset to another. Markets around the world are interconnected like never before. One of the best ways to take advantage of this is to trade CFD markets. Top Coin Miners allows you to take advantage of this exciting market.

What is CFD Trading?

CFD stands for contract for difference. In CFD trading, buyers and sellers agree that the buyer will either pay the seller the difference between the current value of an asset and its value at the end of the contract. When the contract is closed out, if the underlying asset has appreciated, the seller then pays the difference. If the asset drops in value, the buyer pays the difference.

The contract is simply based on the difference in the value of the asset, not a sale of the asset.

The contract is simply based on the difference in the value of the asset, not a sale of the asset. Traders can benefit from price appreciation or depreciation without holding the trade in traditional markets. This eliminates the need for multiple brokers, markets, or a host of other hassles.

How do CFDs work?

You will be buying or selling the position with a platform that does all the work under the hood for you, not signing contracts. The trader decides on which direction they think the market will go, and the broker facilitates the trade by matching the trade with another trader that is looking to do the opposite.

While Trader A will be matched up with Trader B, they don’t have to both agree to close out the position. If Trader A closes, the order will be matched to anyone willing to take the other side of the trade. At this point, if the Traders have made a profit, it will be added to their account. If not, the losses will be subtracted.

Costs of trading

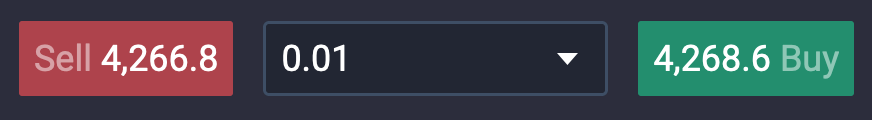

The CFD markets are similar to other markets in the sense that there is a bid and an ask price. This is what is known as “the spread.” The bid price is what the buyers are willing to pay for a particular asset and is where you can short a market. The ask price, sometimes referred to as the offer price, is where you can go long a market.

The spread will be variable in most CFDs, meaning that for a bid price to be valid, there needs to be somebody there willing to buy the contract. Ultimately, for the ask price to be valid, there have to be people willing to sell the contract at that price.

There is also a commission to be paid for the execution of an order. In the world of trading, you typically either pay a commission to your broker or have a wider spread. At Top Coin Miners, a small commission is charged to keep spreads tight. This is a way of offering more value to the customer, instead of simply widening spreads and taking a piece of that difference. Commissions vary depending on the market traded, but commodities, Forex, and index trading have a commission of 0.0001%, while cryptocurrency markets have a 0.05% commission.

Contract size of CFDs

CFD markets are traded in what is known as a “lot.” This is a standardized contract, which will vary depending on the asset being traded, mimicking how it is traded in a futures market or other such standardized marketplace.

That being said, traders also have the ability and the CFD markets to trade other sizes instead of a standardized futures contract. For example, the WTI Crude is traded on US futures exchanges at 1000 barrels per contract. If trading a CFD, the trader could choose to trade much smaller, perhaps with an equivalent size of 100 barrels, effectively bringing their risk down to 10% of a futures contract.

Traders can also choose to trade “odd increments” such as 1100 barrels, instead of having to go from 1000 barrels to 2000 barrels to gain more exposure. Simply put, CFD markets allow for better money management.

Duration of contract

Most CFD contracts have no fixed expiration date, unlike futures markets. Because of this, a trader can hold onto a position for as long as they want without going through the process of “rolling over a contract”, which is the process of closing out the current futures contract and placing the same position in the next one as it opens.

The ability to simply hang onto a CFD contract is one of the huge benefits of CFDs, as it allows for longer-term investment, as well as the ability to simply jump in and out of the markets rather easily without having to worry about which contract month you are trading.

There is a financing charge at the end of the trading day, which means you will be charged for funding your trade, which is typical of financial markets globally. This is typically a very minute amount of your position size, such as 0.0003% for a currency CFD.

Gains and losses with CFDs

To calculate your gain or loss from placing a CFD trade is simple. Multiply the number of contracts by the value of each contract. You then multiply the answer by the difference in points between the price that you opened up the contract, and when you closed it.

An example would be that you buy 1000 barrels of US oil for $112. With 1000 barrels, each point is equal to $10. If you were to close out the trade at $113, you will have had a gain of $1000, excluding commissions. On the other hand, if you were to close out the position at $111, you would have a loss of $1000, excluding commissions.

What assets can you trade with CFDs?

In theory, CFDs can be used in almost any market. If they have a standardized measurement of accounting, it can be done. However, most CFD markets are going to be based upon popular and liquid assets.

Forex pairs are CFD markets. After all, you are not looking to take delivery of the currency, so you are simply trying to take advantage of the price fluctuation between two currencies in relation to each other. For example, the EUR/USD is a commonly traded pair.

The commodities markets are also very popular. Gold, silver, natural gas, and other assets make up this area of CFD markets. The easiest way to think about commodity CFD markets is that they are a representation of futures markets.

CFD markets also cover a wide range of equity indices. These are wide and varying, but the most common ones will include the Dow Jones 30, NASDAQ 100, DAX 30, and Nikkei 225. This is a great way to diversify stock exposure by using a large group of stocks from various parts of the world.

The most recent area of CFD markets has focused on cryptocurrencies. These can include any digital asset, with the most common being Bitcoin, Ethereum, Litecoin, and other top markets. Crypto markets aren’t necessarily the easiest to trade at times, but traders have found the CFD markets as a great way to benefit from price fluctuations without extra issues such as custody, storage, and conversion from fiat to crypto.

Why You Should Trade CFDs

CFD markets offer a world of opportunities. The range of markets allows the trader to diversify their financial exposure and take advantage of opportunities wherever they appear. The global markets are fast-moving and using a CFD broker like Top Coin Miners is a great way to get ahead, instead of the traditional route of switching between brokers.

The ability to take advantage of price movement without having to take possession of an asset is the main feature. You also can trade less or more than the standard-sized contract, and this means that the trader can position size in a much more effective manner than usual.

The trading of CFD markets can also save the trader quite a bit of money. The charges and fees with most brokerages will be more expensive but CFD traders simply pay the small spread and commissions with a CFD contract, which is savings that can add up over time.

How to trade CFDs

Getting involved in the CFD market is simplified here at Top Coin Miners, as you can trade so many different markets at the same time. By being able to trade so many assets here, you eliminate the need to go from broker to broker. However, there are a few steps that you need to take to get started.

Step 1. Understand how CFDs function

You must understand how the CFD market works. There are some differences between the CFD market and other forms of financial assets, so knowing them is important. The CFD market offers quite a few benefits that other markets do not, and you should take full advantage of them.

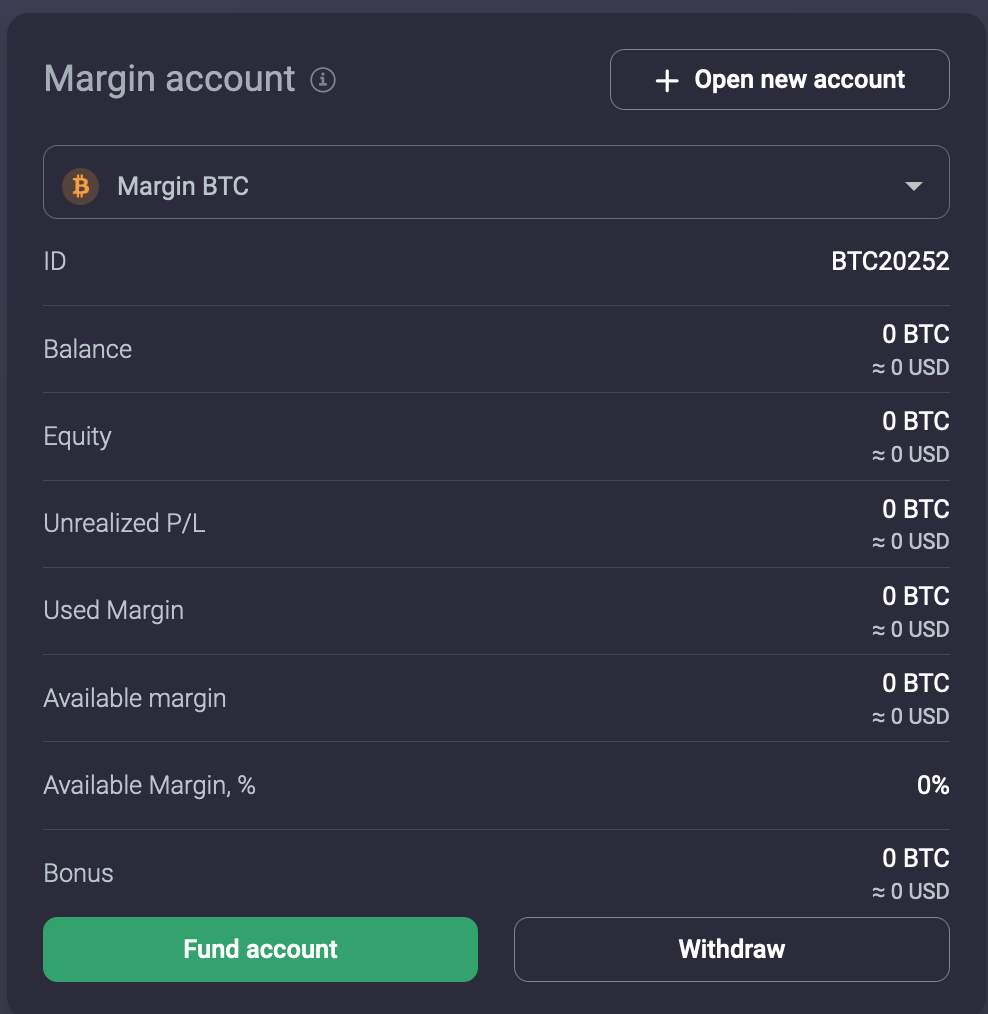

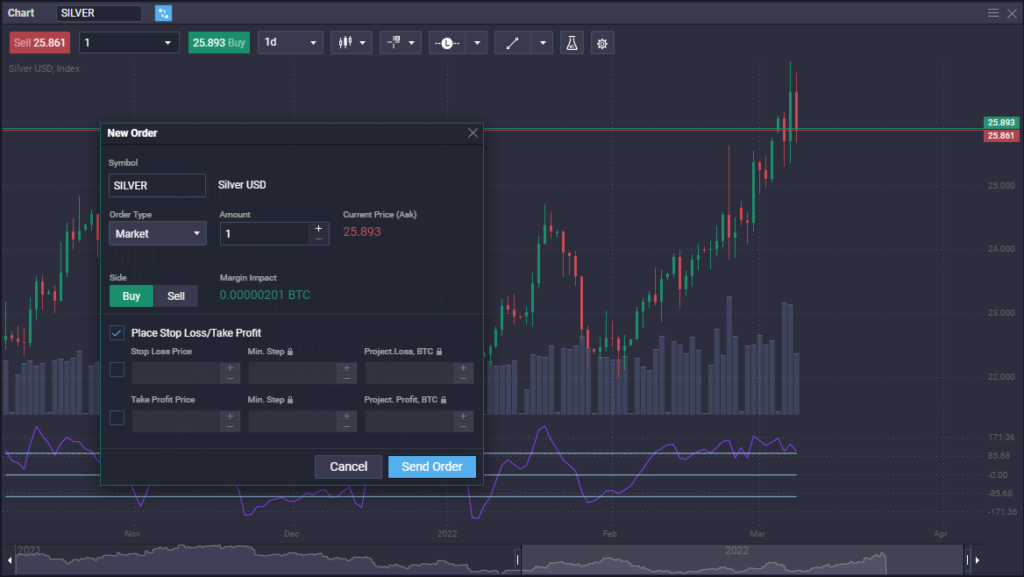

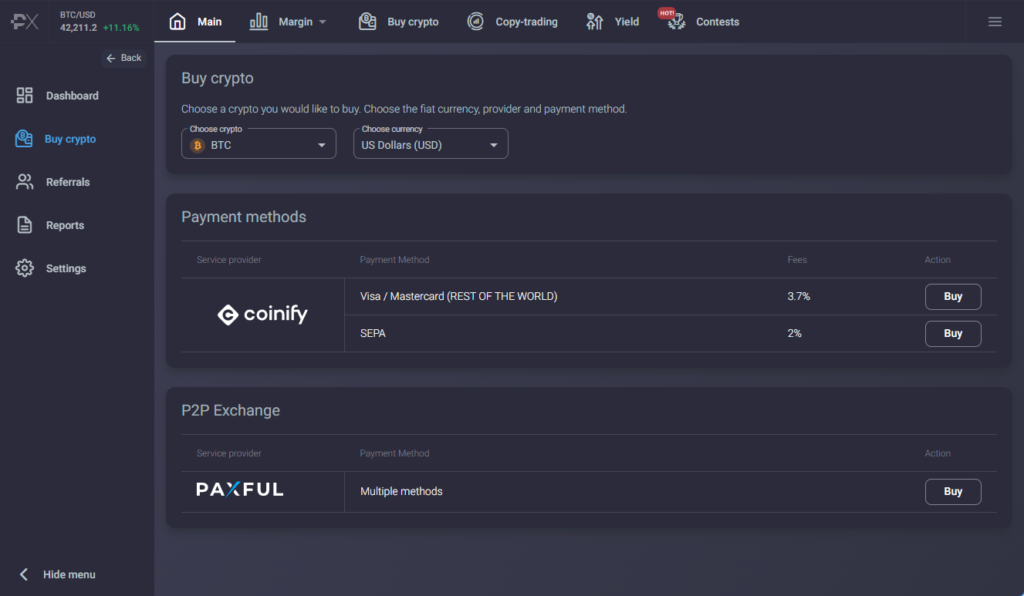

Step 2. Open and fund your account

Applying for a CFD account at Top Coin Miners is a rather straightforward process and is your first step to entering the market. You will have to supply an email address and confirm that to get involved. Next, you either buy crypto or deposit it through the website.

Step 3. Build your trading plan

Depending on how you choose to trade, your trading plan can be either done through technical analysis or fundamental analysis. Most traders use a mix of the two, meaning that they are paying attention to geopolitics, economic indicators, and inflation, all while watching the charts and looking for things like support and resistance.

The most important thing you can do with any trading plan is figure out whether or not it is profitable. This is why you should do what is known as “backtesting”, which is when you look at historical data and test how the system would have performed. Once you understand that a system is profitable over the longer term, you can put it to work in the real markets.

Step 4. Find a trading opportunity

Trading the CFD markets allows for many markets to be traded. This “go anywhere” type of attitude will quite often offer multiple trading opportunities once you have scanned the markets.

The testing that you have done of your system should give you the confidence to get involved. You should know that the system should produce profits over the longer term, so once you have found your potential trade, it is simply going to be a matter of executing at this point.

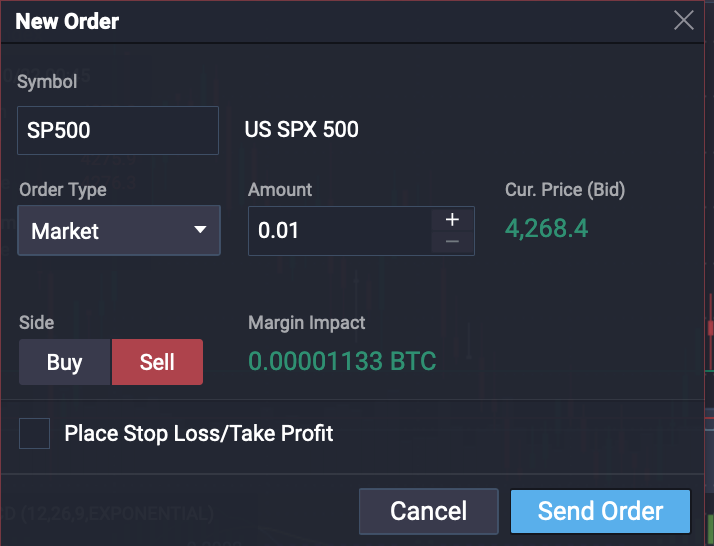

Step 5. Understanding your CFD trading platform

Understanding the platform is crucial for a trader to access various markets. At Top Coin Miners, we offer a low latency world-class online trading platform that can be accessed through any browser. Before you start to trade in any real funds, you must take time to explore some of its features.

Understand how to enter an order, including stop-loss orders, limit orders, and changing any variables necessary. You should also understand how to pull up a new chart, review the account totals, including your wallet. You should also familiarize yourself with copy trading if you choose to go in that direction.

Make sure to take advantage of a demo account to familiarize yourself with all of the necessary processes that you will have to do in the course of any given trading day.

Step 6. Opening, monitoring, and closing your first trade

The first step in your trading career is to open up your first trade. Once you have identified a potential trading opportunity, this is where you execute. You set up your trade by either buying or selling a CFD. You also will place stop-loss orders and limit orders. Once you press the button, you are now in the market.

Monitoring your trade is something that will vary widely depending on the timeframe that you are involved in. If you are an intraday trader, you are more likely than not to sit at your computer and watch the trade as it unfolds. However, if you are more of a longer-term trader, you are going to be more likely to simply walk away from the computer and check price action every few hours. Any adjustments that may be necessary can be made along the way.

Closing your position can be done in multiple ways, such as your target price being hit at your limit order, your stop loss being hit because the trade has gone against you, or you may choose to close out the position manually.

What to Consider When Trading CFDs

When you are trading CFDs, there are a handful of things to pay attention to. By understanding the most important aspects of the markets, you can succeed over the long term. Like any other area of interest, there is a certain amount of jargon that needs to be understood.

Bid, Ask and Spread

When you trade the CFD markets, there are always two separate prices shown. The first price will be the “bid”, which is the price that buyers are willing to get involved, and the second price will be the “ask”, which is where sellers are willing to transact.

The difference between the two prices is known as the “spread.” This spread can vary, depending on market conditions and the markets that you are trading.

Position Size

You will need to decide how many contracts of the CFD you wish to trade. The position size should be reflective of your money management and account size. Basic money management will go a long way, and the ability to trade variable sizes in the CFD market is something that you should take advantage of.

CFD markets are leveraged, meaning that you only need to put up a little bit of the position value to control a much bigger position. It can be very beneficial, but it can also be very detrimental if you are not careful. Take advantage of leverage in a responsible manner, and size accordingly.

Stop and limit orders

Placing a stop-loss order will help you restrict losses and is something that should always be part of any trade. When you enter a market, you should understand where it is that you will admit that your trading idea did not work out. The stop loss order will tell Top Coin Miners when to get you out of the market.

When you enter the market, you should have an idea of where you believe the market is going. By placing a limit order, your trade will be closed to lock in profit.

There is also what is known as an “OCO order”, which is an acronym meaning “one cancels other order.” In other words, if one of the two levels that you put into the platform gets hit, the other order gets close. A lot of range-bound traders will use this to their advantage to get into the market on a break of a trading range.

CFD trading examples

CFD trades offer an entire world at your fingertips and help you bypass a lot of extra legwork as you can trade so many different markets in one spot. As a result, understanding how these markets work can lead to a wealth of trading opportunities. The following examples can give you an idea of what is possible while trading CFD markets.

Example: buying a share CFD

Share trading is taking a position in an underlying stock position. You may see that Apple has a sell price, or bid price, of $158.13 while having a buying price or ask price, of $158.23 currently.

You decide that the price of AAPL should continue to rise over the next several days and wish to buy to CFD to take advantage of this move. You decide to buy 1000 share CFDs at the ask price of $158.23. This is the same as buying 1000 shares of Apple.

Remember, CFD markets are leveraged. This means that you do not have to put up the full value of the trade, as you only need to cover the margin requirements. If AAPL has a margin requirement of 5%, your margin will be 5% of the total value of the position.

(1000 share CFDs x $158.23 = $158,120 x 5% = $7906)

You can see how much you save but using this instrument.

If your prediction is correct

After a few days, Apple has risen from the initial price of $158.23 to a bid price of $160.90. This is a gain of $2.67 per CFD share. You decide to close the position by selling all 1000 shares.

Calculating gains from the trade

The calculation of profit is simple: You take the number of shares and multiply it by the gains per share.

In this case, the gain of $2.67 on 1000 shares means that you have just made $2,670 on the trade.

This calculation does not include the commissions or any overnight funding charges, which should be minimal.

If your prediction is wrong

Unfortunately, there will be times when your trade doesn’t work out. Let’s take that Apple trade example from above. In this case, the stock fell from the initial purchase price of $158.23, to hit your stop loss of $157.73, and the platform automatically liquidates your position.

Calculating loss from your share CFD

Calculating a losing trade works the same way that a winning trade does. You take the initial price and find the difference between that and the closing price. In this scenario, you have lost $0.50 per share.

The loss can be figured out by simply multiplying the $0.50 loss by 1000. In this case, you will have lost $500.

Again, remember that this calculation does not include commissions of overnight funding costs.

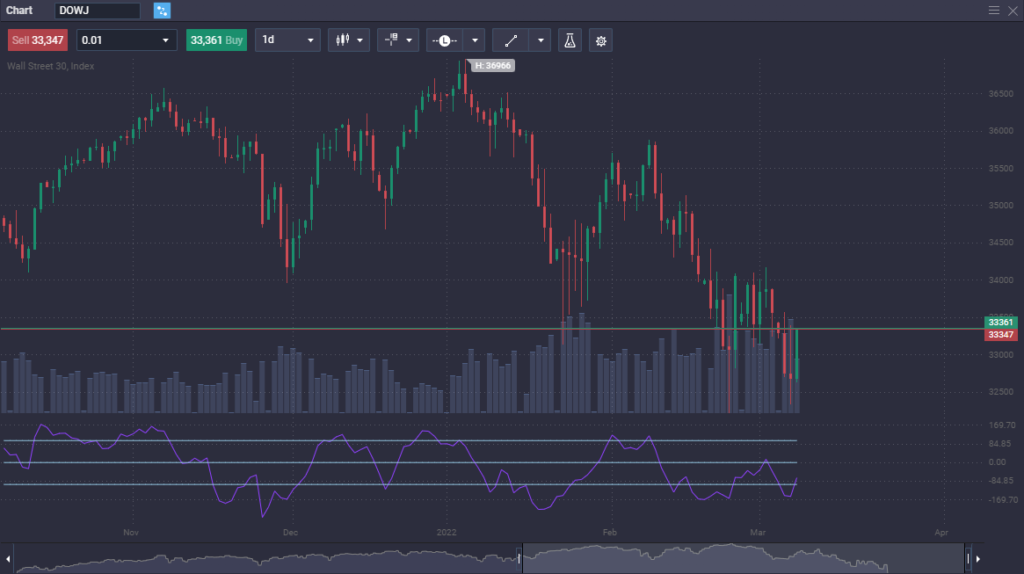

Example: selling the US 30

You decide that the US economy is heading into a slowdown and wish to take advantage of a slumping stock market. After careful consideration, you believe that industrials will suffer. As a result, you choose to short, or sell, the US 30.

The US 30 currently has a sell price, or bid price, of 31,650 while having a buying price or ask price of 31.655. You decide to short the market and get filled for 100 CFDs at the best bid price of 31,650. At this point, you are betting on a price decline.

If your prediction is correct

The price of the US 30 drops over the next several weeks, thereby leading to a decline of the market overall. You decide that it is time to collect your profits, as price hits your take profit limit order at 31,250. The platform automatically triggers this take-profit scenario, where it buys back the 10 CFD positions that you had sold previously.

Calculating profit

Calculating your profit from the trade works very much in the same way it did when you traded Apple. You will be looking at the difference between the open and close price, which in this case would be 400 points. You then multiply the size of the position by the difference and then multiply by $1. (The point value of the contract.)

The calculation is 400 x 10 = 4000. 4000 x $1 = a total profit of $4000.

This does not include any commissions or overnight costs.

If your prediction is wrong

In an alternate scenario, you may have projected the market movement incorrectly. Take the same trade, but this time it hits your stop loss at 31,750. This is a 100 point loss, but the platform has liquidated your position as the market was moving against you.

Calculating your loss

In this 100 point loss scenario, the calculation is the same as a profit. You are taking the difference between the open and close price and multiplying that by the position size. After that, multiply that by $1.

The calculation is 100 x 10 = 1000. 1000 x $1 = a total loss of $1000.

This does not include commissions or overnight funding costs.

What is the contract length of CFDs?

CFD contracts typically have no expiration date, meaning that it is unlimited. The fact that CFD trades do not get shut down by a specific end of the contract is one of the major benefits of trading in this market. The only way that a CFD contract gets closed out is if the trader reverses the trade by closing it.

The one exception is if you are trading a CFD that has an underlying futures contract. Typically, most CFDs follow the spot market so this is not an issue. However, you should keep in mind that if you keep your CFD position open overnight, you will be charged a small overnight funding fee.

Risk managing CFD trades

Because CFD markets allow leverage, each trade should be approached with a reasonable amount of caution. This can be accomplished quite easily if you take a few steps to protect your balance. Remember that the value of the trade can rise and fall, so if the market moves against your expectations, losses can be expected. With leverage, losses can be bigger than anticipated if you do not take the proper steps.

Money management, or the amount that you are willing to risk per trade is a crucial part of any trading plan. Keep in mind that not all assets have the same degree of volatility, so the more volatile assets should be the smallest part of your portfolio.

Stop loss and take profit orders

It is imperative that you set up stop loss orders when getting involved in a trade so that your platform will automatically close out a position if it goes against you. If you are wrong in a trade, you are better off letting your stop loss order protect you.

You can also set a limit order to take profit to keep profits. After all, if a position moves too quickly, it may turn right back around and move back against you. If you have a target in mind, you can place a limit order to keep those profits once the trade hits that level.

While a stop loss order is an absolute must, some traders choose to not set a limit order for profits, to take advantage of a longer-term move. Regardless of which way you trade, protecting your trading capital is paramount, and a trade should never be entered without at least a stop loss order attached to it.

Protection from negative balance, and liquidation

One of the major advantages of trading CFD markets with Top Coin Miners is that you are protected from losing more than your initial investment. To keep a leveraged position open, there is a maintenance margin requirement, which is the minimum amount of capital that needs to be kept in the account to cover any risks.

The amount of capital kept in a margin account acts as collateral for the credit extended to you to lever your position up. Top Coin Miners will issue what is known as a “margin call” if the amount of trading capital does not cover credit risks. You will need to either add more funds to your balance or close some of your positions. If you do not, once the amount of margin necessary is gone, you will be liquidated from positions until you are in good standing.

Hedging

Using the CFD market is a great way to hedge potential exposure. Hedging is when you are putting on a position to protect another existing position. For example, you may have a portfolio of technology stocks that you hold for a longer-term investment. If those stocks are represented fairly well in the NASDAQ 100, you may choose to short that index to protect yourself from losses, thereby making gains on the falling index CFD, and mitigating some volatility in your total profit and loss statement.

Why trade CFDs with Top Coin Miners

Top Coin Miners offers world-class technology in a robust online trading platform. Furthermore, Top Coin Miners also offers a wide range of markets that you can trade to take advantage of opportunities where they show up.

- Trade on margin: By offering significant margin, traders can benefit from larger positions than what would be offered in a traditional broker.

- Crypto deposits: Top Coin Miners allows you to deposit and use crypto, offering the possibility of growing the value actively or passively.

- Robust online trading platform: Top Coin Miners offers a robust and intuitive online trading platform that can be accessed anywhere that you have access to a browser and an Internet connection.

- Copy trading: Top Coin Miners allows traders to follow successful traders to benefit from price movement without having to put in all of the typical research.

- Earn interest: With your deposited crypto, you can earn interest at Top Coin Miners by staking in a DeFi liquidity pool.

Is CFD Trading Legal in the USA?

Unfortunately, no. The United States has very stringent rules on trading CFD markets, and therefore they cannot be offered to US residents.

Is Trading CFDs Safe?

Yes. CFD markets are backed by massive pools of liquidity. CFD trading cannot be done without both a buyer and a seller of an asset, much like any other market.

Can You Make Money with CFDs?

Yes, assuming that you do the necessary work to become a profitable trader. This includes building a trading system that is profitable over the longer term, working on trader psychology, and understanding the geopolitical, financial, and economic forces that move markets.

Is CFD trading good for beginners?

Yes. CFD trading is excellent for beginners because it allows them to get exposure to various markets that they would not necessarily be able to do easily in one particular trading account. Furthermore, it gives traders the possibility of trading in very small amounts, which is ideal for beginners learning to trade.