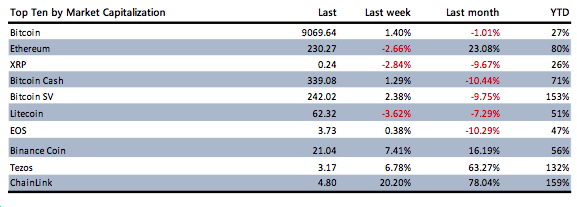

After the worst week on record for 2020 last week, the recovery this week has been markedly better, but Bitcoin’s price has still had a rather mixed bag in terms of its performance. The price has managed to climb back over $9,000 after it fell to the floor of $8,500. This represents a small gain on the week of 1.40 percent, but at the same time, that means Bitcoin’s price is down a percent for the month.

The last few days of February still saw Bitcoin falling in price, but it was on the first day of Spring, 1 March, that the market started turning around. However, it is only in the last two days or so that Bitcoin has managed to make a positive percentile move in regards to its price.

The altcoin market has once again mirrored Bitcoin’s recovery, however, in the top three coins XRP and ETH have not fared as well as the major coin by market cap as they are still in red numbers having lost 2.6 percent for ETH, and 2.8 percent for XRP.

In the top 10 coins, the best faring has been Chainlink which is up an impressive 20 percent hitting a historic high of $4.94 on the news that something big is brewing at the smart, smart contract platform. However, even these gains were outdone by Bitcoin Gold that managed to rise to 38.9 percent.

In terms of the next move for Bitcoin, it has managed to rise back above its 200DMA at the latter end of this week having lost that support for a few days. The next possible resistance looks to be near the 50DMA which is about $9,300.

Bitcoin Back Above $9,000

Even though the growth of Bitcoin’s price compared to last week is a mere percent, the sentimental point of cross back above $9,000 following the horrific fall last week paints a more pleasing picture. Bitcoin is still up 27 percent for the year, and $10,000 is back in sight — even if it is only sentimentally.

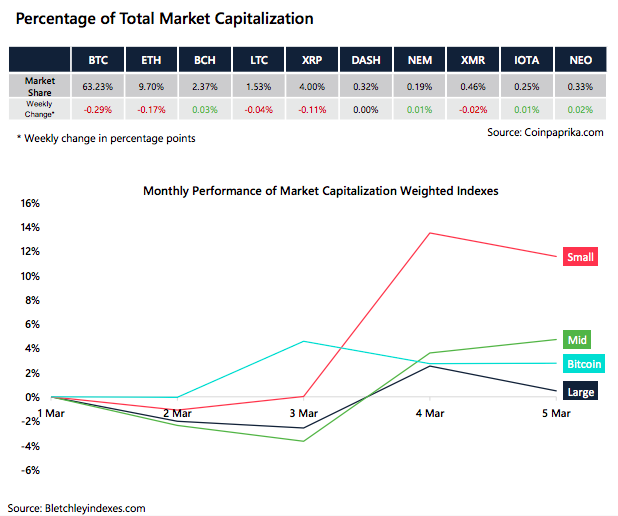

The fact that Bitcoin has bounced back enough to cement its position means that the altcoin market has had time to react too. As mentioned, there are a few coins that have seen phenomenal gains and are helping boost their indexes.

Bitcoin has managed to outperform large market cap coins this week, but has still been beaten by medium cap; yet it is the small cap coins that are performing incredibly well, especially since March 3 when the market started to turn around.

Bitcoin certainly looks to be in recovery mode as the coin is hovering above $9,000, but more importantly, it is back above the 200DMA. When Bitcoin dropped below this level, there were big warning signs that more gains could be shed, but when the coin spiked back up, it managed to move above the 200DMA again and has positioned itself to move up, rather than down, in the short to medium term.

If Bitcoin can go one step further and make it above the 50DMA, which is around $9,300, then it will be even better positioned to make a run towards $10,000. There is still evidence however that Bitcoin could fall and retest the $8,700 mark even with the Bitcoin reward halving set for May of this year getting ever closer.

One still needs to keep an eye on the 200DMA going forward this month though because if that resistance is broken then there is a chance that the coin could go back towards the $8,000 mark.

Institutional Traders Preparing For Liquidity Squeeze

It is not only Bitcoin’s market that has been under pressure for the last two or so weeks. Globally, there has been a huge downtrend in the traditional markets as fears around the effect of the Coronavirus intensify. The economy is taking a massive hit as workplaces shut down to try and stop the spread of the virus, and this panic has forced its way to investors.

In light of this, institutional investors have not been showing much love to any asset, let alone Bitcoin. The coin has been spoken about as a potential hedge in such circumstances, however, this has not been bought by traditional traders who are interested in cryptocurrencies.

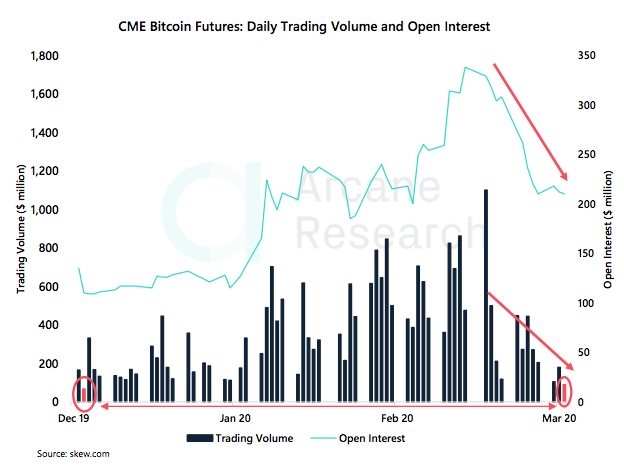

Last week, CME showed its lowest volume of 2020 that recovered sharply. That recovery did not last long though as the downtrend continued through this week and just as the market started recovering, CME posted only $89million on that day — the lowest daily volume for three months.

More so, open interest has also been dropping rapidly and now sits at only $200 million. To put that in perspective, open interest was $350 million only two weeks ago before the market fell.

It does indeed look as if sophisticated investors are taking a break from what they deem riskier assets — such as Bitcoin — but there might be something else at play. The drop in the stock market might have had an effect through margin calls leading to a short term liquidity squeeze. This theory is backed up by the opening co-movement of stocks and the digital asset and then the sudden disconnection as BTC turned into an upward trend.

The market is still being viewed as one tilted towards fear, when looking at the Fear & Greed Index, in fact, there has been little change there although what change there has been back towards greed thanks to the small market recovery. The Index now reads at 41 with investors still trying to work out if the bottom has been reached.

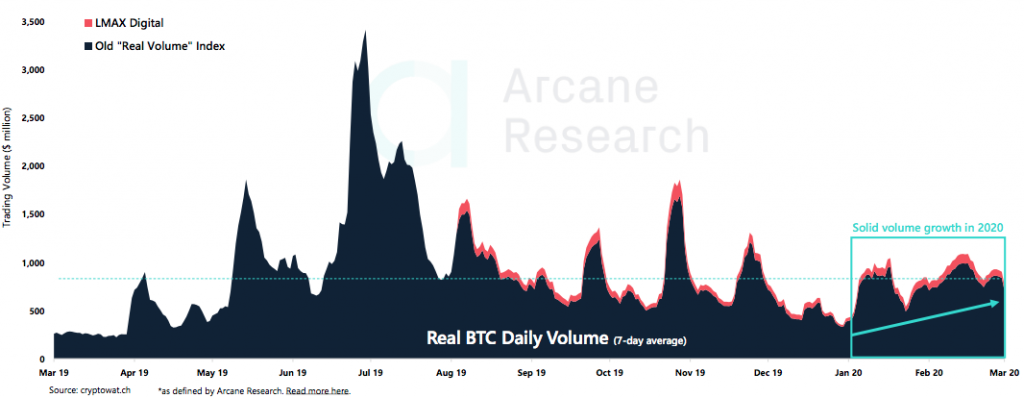

Despite all this, Bitcoin’s volume in 2020 is still extremely bullish. In fact, it is showing better signs than the majority of 2019, barring the summer months where things really looked positive for Bitcoin trading.

The seven-day average real trading volume looks a lot different to last year thanks to the strong surge through January which set Bitcoin off to a strong start in the year. Since that January surge, trading volumes have not fallen to the lows that were seen in 2019, and that includes these last two weeks which have been flashing bearish signs. The average volume in 2020 is outperforming most months in 2019, except for the summer months.

Bitcoin Is Becoming More Normalized

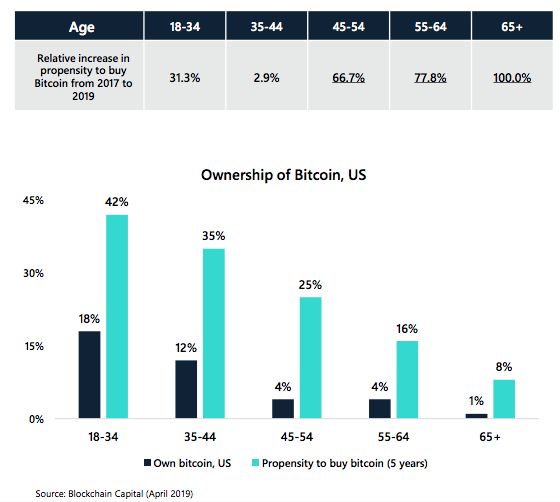

Bitcoin has come a long way in the hearts and minds of people, but it is undeniable that those flying the flag highest for the digital currency; looking for it to become normalized and appreciated, are the younger generations. Millennials have been tied to the Bitcoin revolution as they seem to understand and appreciate it, and this is backed up by Bitcoin ownership data.

The demographic traits of Bitcoin show that most Bitcoin holders are young adults, and unsurprisingly, the older people get, the less likely they are to hold BTC. Data from Blockchain Capital indicates that 18 percent of young adults — that is 18 to 34 year olds — in the US, own Bitcoin.

But even more interestingly, those in the same age bracket indicated that they were interested in buying Bitcoin in the next five years — perhaps proving that there is a lot of potential being seen in the coin over the next few years. These figures dropped significantly as people got older with only 1 percent of over 65 year olds saying they held Bitcoin and less than 10 percent saying they would buy the digital coin.

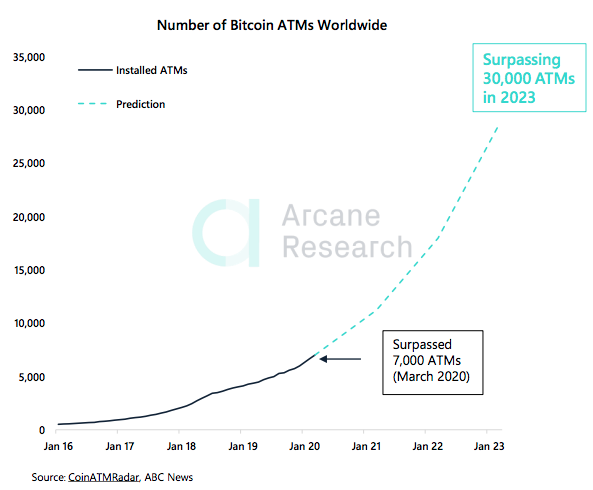

As part of this drive to make Bitcoin the next evolution of money and investing, there has been a significant spike in the number of Bitcoin ATMs across the globe. The propensity of having these ATMs around the globe likens Bitcoin to cash and makes the coin easy and accessible for all.

The number of Bitcoin ATMs is now over $7,000 across 75 countries which indicates a massive growth of 60 percent in a year. In March of 2019, there were only 4,300 registered ATMs. The rapid growth in these ATMs has seen predictions that as many as 30,000 will be seen around the world in 2023.

The first ever Bitcoin ATM was in Vancouver, set up in 2013. On the say it opened shop, it transacted a staggering $10,000.

Risk Reward Is High In A Risk-Averse Time

Bitcoin, despite its potential to be a hedge against falling stocks and traditional markets, is still very much seen as a risky investment, especially for investors from a traditional sense. They will view gold as the only viable safe haven in such market panicked times.

However, the current price level of Bitcoin actually suggests that there is quite an attractive risk / reward ratio for investors brave enough to take it on.

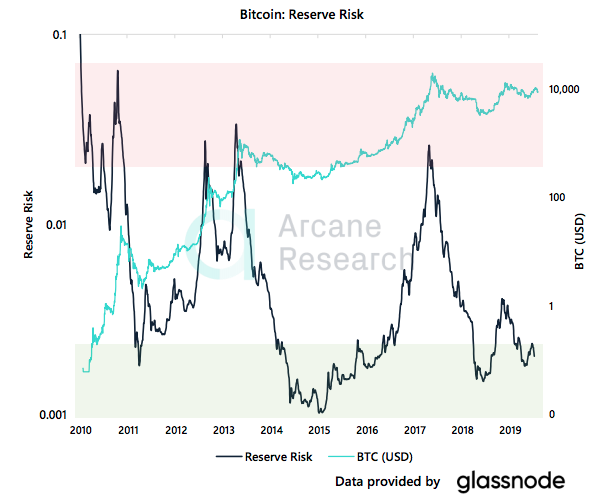

The Reserve Risk Metric — or as it is known in crypto circles, the ‘Hodl Bank’ metric, considers how long people have been holding Bitcoin in order for its price to increase in value. This Reserve Risk is currently low, and sits in a green zone which indicates an attractive risk / reward scenario for investors.

Essentially, it is being noted that confidence in Bitcoin is high, and the price is still relatively low, so the general impression is that this is a good buying opportunity.

In the News

South Korea Makes Big Strides In Legitimizing Bitcoin

South Korean legislators have decided this week to implement stringent requirements on the cryptocurrency industry in the country. While this makes things harder for businesses using crypto, it also legitimizes the space and brings it under the legal umbrella of the country. The biggest threat to crypto innovation is regulatory ambiguity, and South Korea is fighting against that.

India Also Warms Up to Cryptocurrency

India has been against cryptocurrency for some time now and even saw its Reserve Bank lead the call for a law banning businesses banking with the country that used crypto — effectively outlawing its growth. However, the Supreme Court if India has now repealed that ban and essentially reopened the doors for businesses in India to operate and work with cryptocurrency.

Blockchain Company INX Edging Closer To $130 Million IPO — Seeks NY BitLicense

INX. LTD is edging closer to its $130 million IPO launch scheduled for next month. In doing so, it has applied for a notoriously difficult to acquire New York BitLicnese, but should it succeed this could be the largest registered securities sale by a company in the blockchain sector.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Top Coin Miners. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Top Coin Miners recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.