This is the final week before Bitcoin undergoes its third mining reward halving. This event is anticipated to be a big one for the market despite it being one that mostly impacts the miners. The halving will see the reward for unlocking a new Bitcoin block cut in half from 12.5 BTC to 6.25 BTC.

Profitability for miners will instantly go down, but over time, it will also cause the scarcity of Bitcoin to rise as the incoming circulating supply will be cut down as well. In terms of macroeconomic theories this states that as supply drops, demand should grow, and thus the price should follow.

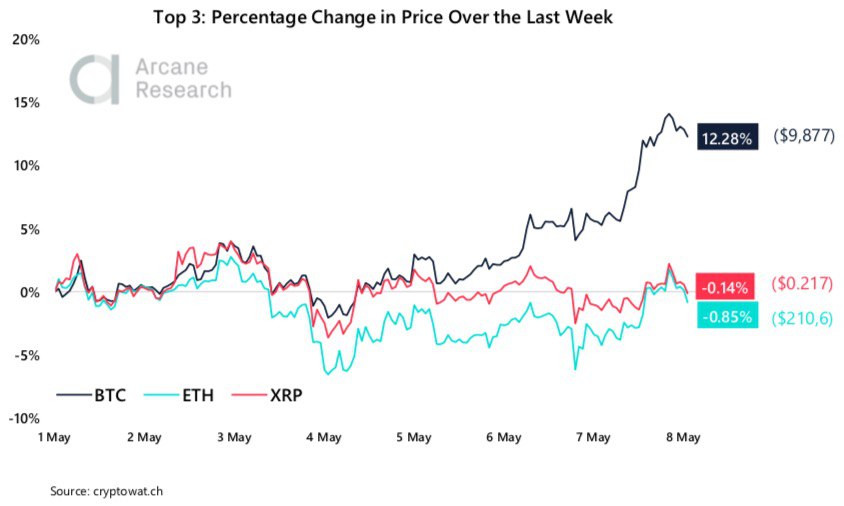

This week preceding this event it has been seen that the expectation is a price rally from Bitcoin, although it cannot be accurately predicted just yet. But, speculative moves from the market have seen the coin grow to touch the all important $10,000 market after growing week on week since the market collapsed in mid march to levels as low as $3,800.

This halving event, coupled with the speculative positivity over the last six or seven weeks, has helped push the broader Bitcoin market into a position of greed for the first time since February this year. Even more positive is the volume of Bitcoin trading is also backing up the greed returning to the market.

It also appears, after fleeing Bitcoin when the entire global market collapses, the institutional investors are back for Bitcoin as they have seen its positive moves in comparison to the stuttering stock markets and other commodities like Oil.

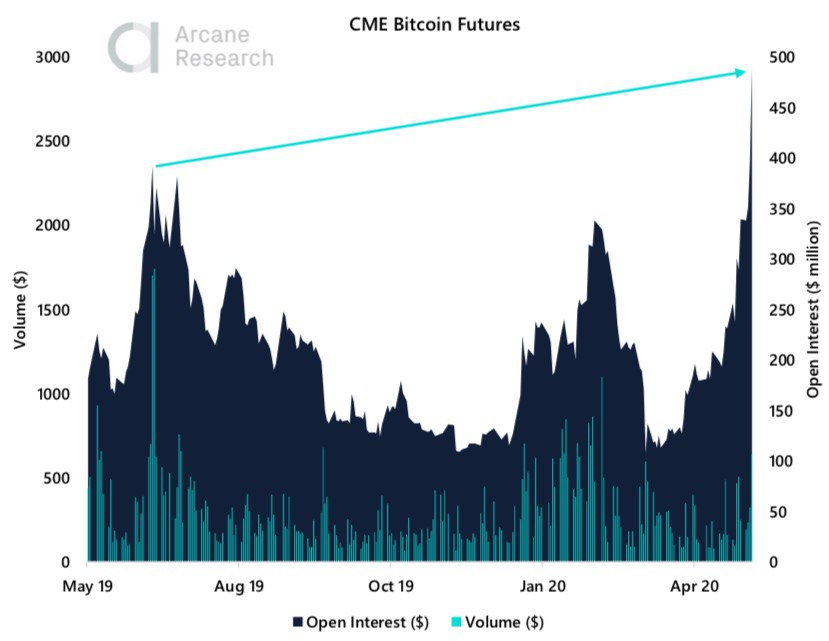

Open Interest on CME tapped a new all-time high this week. Many are actually putting this down to well-known macro investor Paul Tudor Jones who publicly told investors that he sees Bitcoin as a global hedge in this uncertain time.

Bitcoin In $10,000 Territory

$10,000 is known as an important level for Bitcoin as it represents the halfway mark to it’s all time high of $20,000, but it is also seen as a bullish mark when the coin crosses this, and this week alone Bitcoin has put on around $1,000.

The last time Bitcoin touched the $10,000 mark was in February after more than a month of good growth, and before the market started getting fearful. But, Bitcoin is the strong leader in comparison to other coins because of the halving, up 10 percent over last week.

Altocin have also been, in the last few weeks, growing alongside Bitcoin and have been producing good results, but this week has been all about Bitcoin, and understandably it is known why. Both Ethereum and XRP, the next biggest coins have been mostly flat.

In fact, the entire global markets have been flat as well and this positive week could well be a chance for the major cryptocurrency to decouple and break away from the high correlation that has been seen since the markets crashed in March.

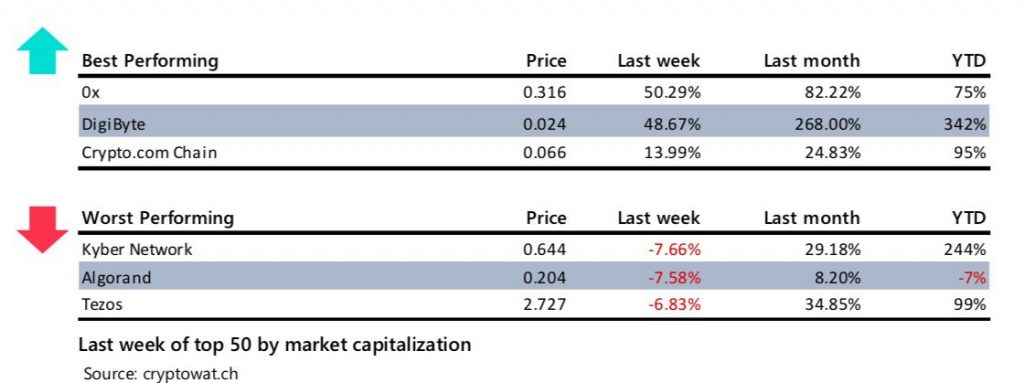

In saying that Bitcoin has had a good week, as is often the case, some of the smaller altcoins have managed to have weeks that have been very successful, and on the other hand, there are a few coins that have lost over seven percent this week that has been mostly green for the altcoins.

Breaking Out From The Stock Market

It was quickly identified that the correlation between Bitcoin and the stock market was probably much bigger than anyone expected. This was shown when, on the day that the stock market had a major collapse, so Bitcoin also fell at the same time. This was put down to the institutional investors leaving what they thought was a risky investment.

During the Covid-19 induced market panic, it has been continually seen that the movement of the stock market and the Bitocin market have almost been mirroring each other, but this looks to be changing.

The past week or so has been more similar to the altcoin market and has been trading mostly flat, but this is different to what Bitcoin has been doing and perhaps the excitement about the halving may be big enough to decouple this type of correlation.

Bitcoin and the stock markets are not designed to be similar, and for the most part, these two markets are seen as anti-correlated, so it was more a case of when, rather than if, this decoupling would come.

Markets Get Greedy Before $10,000 Topped

Unsurprisingly when the markets collapsed so dramatically in March, the Fear & Greed Index dropped like a stone. And even though the drop was substantial, it was hardly the biggest or most rapid seen by Bitcoin, but because of the global sentiment around the globe, fear was bounding. This was even seen by the evacuation of the much more cautious institutional investors.

But, this week, the index continued climbing this with the momentum looking promising. Bitcoin is pushing higher, and the market is now in the “Greed” area, with the index being at 55. The last time the market showed any sort of greed was back in February and this shows that the market has now fully entered a stage of recovery.

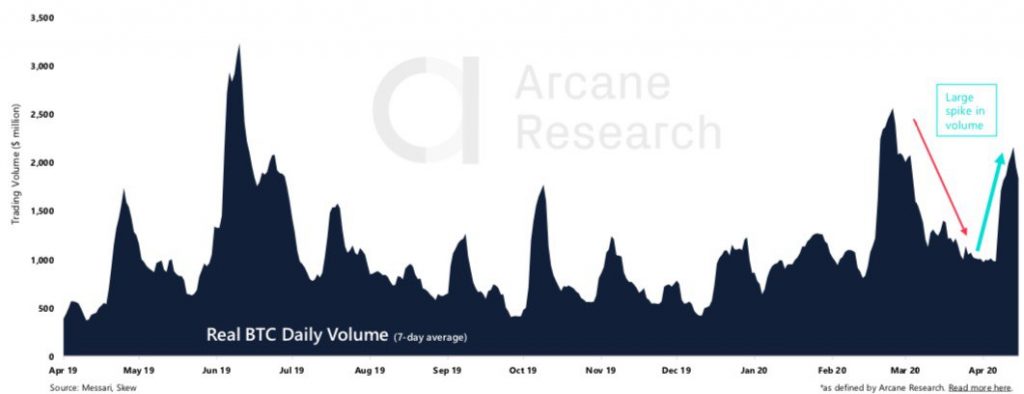

But, it is not only the greed that is growing with the price, it is also the trading volume that is on the rise. Trading volume is vitally important to the real health of a Bitcoin rally as it is often seen that if the price is rising but the volume is not, it is not a viable rally and can easily collapse.

But, on Thursday, the daily volume crossed $3 billion for the fifth time in 2020. However, if we look at the The 7-day average real trading volume, this has made an impressive spike up to above $2 billion this week.

The volume push has held strong along with Bitcoin pushing to a new high since the market collapse. This is very important for Bitcoin to maintain its price rise because the halving event is expected to have a positive impact, but in the short run there could be a fall, but the volume of trading suggests otherwise currently.

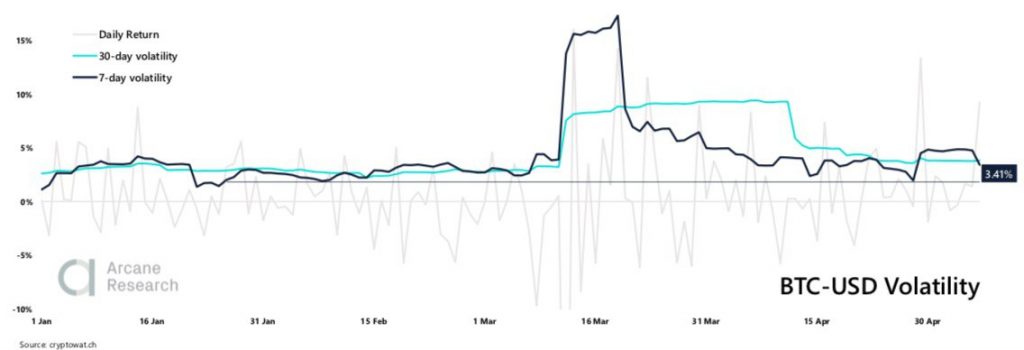

When looking at the other metrics that have a say in how the price of the coin is doing, volume is important and another one to look at is the volatility of Bitocin — which is slowing, another good sign for continued upward price action.

During the price collapse in March, it was unsurprising that a big spike was seen in volatility as the coin quickly dropped, and then bounced a few times, and even fell further — moving through $1,000s of dollars in a matter of hours. But, since then, the volatility has been falling.

That being said, there was a volatility spike yesterday, but that was directly down to the move to $10,000. The 7-day volatility just dropped down below the 30- day volatility, but an uptick in volatility could be seen again after Bitcoin pushed to this new mark and with the halving approaching.

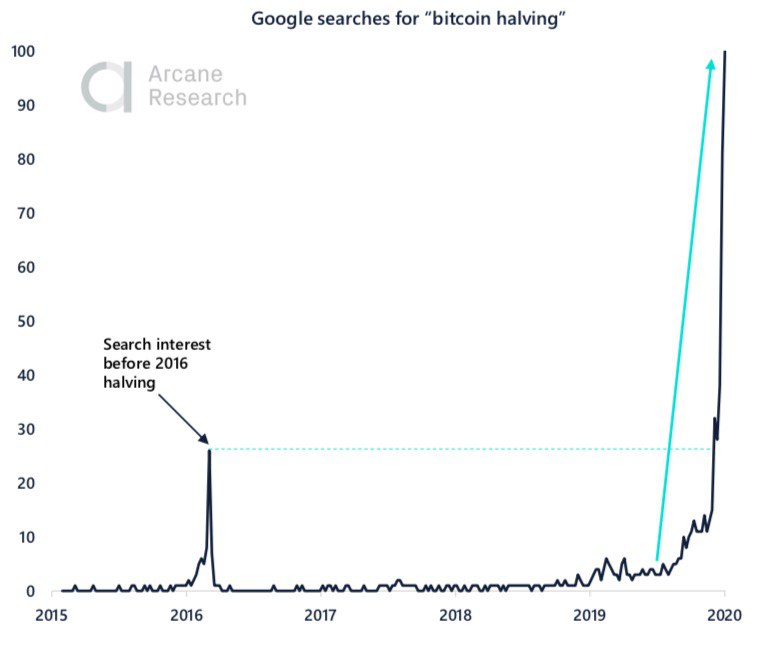

Finally, if there was any uncertainty about the excitement entering the Bitcoin market at this time with the halving only a few days away, it is worth looking at the Google searches.

The relative search interest for “bitcoin halving” has been climbing for some time now, and 2020 has been a year for interest in this event. It is now showing now 4-times the interest from the 2016 halving.

But closer to the time, the last month has been a very different showing to the entire year as a month ago the chart looked similar to the one seen in 2006. That means the fever and excitement has peaked 3x in the last 30 days. But, interestingly, the searches for “bitcoin halving” is insignificant compared to searches for the term “bitcoin”.

Institutional Investors Come Crawling Back

Last week it was already seen that the open interest fromCME has been rising but on Thursday the Open Interest surpassed its previous highs from the price peak in 2019 and moved up to $489. This is the highest ever registered and shows that these institutional investors are indeed back.

A lot of this may be down to the fact that the traditional markets are struggling in the fear of the Covid-19 market collapse, but this week it was also seen that macro investor Paul Tudor Jones said buying bitcoin futures was a good idea.

Even still, It is worth noting that the daily trading volume is not coming up at the same level. Levels above $1 billion in daily trading volume were not uncommon last time the Open Interest hit these levels, but as it stands there it is under $500 million, without any notable growing trend.

$10,000 And Above?

Looking at the technical analysis involved in the past few weeks, it can be seen that bitcoin is nearing its year-high — and it has reached this place after eight straight weeks of green weekly candles. But, following this week, the future is quite uncertain because of the halving as well as the charts.

The next big resistance level for the bitcoin price is up at its yearly high around $10,500. One can expect some sort of rejection here, but all of the past resistances in the eight weeks have all been bested. It is simple for Bitocin as it stand because the coin needs to hold the level around $9,500 and make this support, for the price to stay up

But, if the halving sees Bitcoin drop and the level doesn’t hold, the fall will go down to about the mid $8,000 level – which is still above the 200-day moving average and could be a healthy pullback.

In The News

Hedge Fund Big Shot Paul Tudor Jones Backs Bitcoin

Paul Tudor Jones is betting on Bitcoin’s potential to be an inflation hedge in this current uncertain financial time. Jones’ Tudor BVI Global Fund, managed by Tudor Investment Corp., has been authorized to hold as much as “a low single-digit percentage exposure percentage” of its assets in Bitcoin futures.

Bitcoin ATMs From Coinstar Set For 40 Percent Expansion

Coinstar is looking to almost double its bitcoin supermarket locations for ATMs within a year. Currently, the company boasts about 3,500 machines and could push that to 7,000

Another Crypto Firm, ErisX, Manages To Secure New York BitLicense

Eris Clearing, the clearing and settlement arm of ErisX, has secured the infamous and hard to achieve virtual Currency License from New York’s Department of Financial Services (NYDFS).

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Top Coin Miners. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Top Coin Miners recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.