Volatility is the most critical factor in financial markets fueling all price action and, therefore, profits. Without volatility, price action is flat and lacks the fluctuations that provide the opportunity to trade an asset back and forth to achieve a higher return on investment.

Volatility Definition: What Is Volatility?

Volatility has many definitions as it applies to finance.

When talking about Bitcoin and the cryptocurrency’s notorious volatility, it more closely references the Oxford Dictionary’s standard definition of the term, a noun describing the “liability to change rapidly and unpredictably, especially for the worse.”

The more common way volatility is referred to in finance, is describing the degree of variance in an asset’s traded price within a specific timeframe. This version of volatility in investment is typically measured by the standard deviation of logarithmic returns.

Diving even further into different types of volatility, reveals that there is much more to the definition of the term than meets the eye. There are also varying degrees of volatility: low, medium, and high.

Example of Low Volatility

The forex market is a strong example of a low volatility market. In the below example of the USDJPY trading pair, an entire year of price action was contained within a 7.5% range.

Each six-month period also was trapped within a tighter, under 5% trading range. During Q4 of 2019, USDJPY traded within just a small, 1.77% range.

Despite the low volatility, there is still much money to be made from the most liquid market in the world. Traders can either increase the frequency or trade size to make up for the lack of intense movements or use a tool called leverage to amplify movements.

Example of Medium Volatility

The stock market is a medium volatility market. Some may have considered it a high volatility market until the emergence of cryptocurrencies like Bitcoin.

In the example below, the S&P 500 traded within a sizable 40% range during 2019. The first half of the year remained within a 28% range, while the back half traded within an 18% range. During two distinct periods, the S&P 500 traded within a 6% range before a breakout and expansion.

Example of High Volatility

Bitcoin is a high volatility asset. The entire asset class of cryptocurrencies is a speculative asset class, making it highly susceptible to wild price swings. In the example below, in the same one-year timeframe of 2019, Bitcoin climbed 250%.

Within the same year, it fell by over 62%. It also had another 46% decline, a 42% rise, and another 165% rally all in the same timeframe as the other examples. It’s these large swings that give that asset class its high volatility.

Types of Volatility: The Differences Between Historic, Implied Volatility, and More

There are several types of volatility, each providing traders and analysts a unique view of price action within a specific timeframe and more.

Here are the most common types of volatility traders should be most concerned with and interested in.

Historical Volatility

Historical speaks to the volatility of an asset over a set period of time, looking back across past price action.

Implied Volatility

Implied volatility looks forward in time using the market price of a derivative product.

Intraday Volatility

Intraday volatility refers explicitly to the price swings taking place within a small, single-day timeframe.

How to Calculate Volatility

The standard method to calculate and measure volatility involves using a variance and a standard deviation, with the standard deviation being the square root of the variance. Estimates won’t do in this case; the data must be accurate for the formula to provide the desired results.

The first step in the calculation first requires finding the mean of the data set. This is done by adding all of the values together, then dividing the number by the total number of values in the data set.

The next step involves calculating the difference between each data value and the mean. Once the deviations are listed, squaring the deviations is the next step.

Next, add all of the squared deviations together. Finally, divide the total sum of the squared deviations but the total number of data values from step one.

Factors Affecting Volatility

Volatility is what drives the profits derived from financial markets. Because it is such an integral part of all price action, a variety of external factors can significantly impact price volatility in all types of markets, digital and traditional.

Trends

When an asset’s price is trending strongly, volatility is often high as a result. This is because, during the strongest trends, price moves quickly and powerfully in one direction as a result.

Reversals

Volatility can spike during trend reversals, due to opposing market forces of buying and selling coming into equilibrium.

News

Few factors can cause an increased spike in volatility as news can. Breaking news impacting markets or monetary policy in some way can have a butterfly effect across markets that sends volatility soaring.

Negative news can cause a sudden crash, while positive news may spark a rally. Fake news can also have a similar impact, as the market prices then later reprices false information.

Events

Similar to news, certain political or economic circumstances can cause an increase in volatility. This includes presidential elections, conventions, hearings, court rulings, and much more.

Political Influence

How a politician views an asset can have a dramatic impact on its value. If a politician or political party takes a sudden positive or negative stance on an asset, volatility may ensue.

Environmental Influence

Environmental factors can have a dramatic impact on commodities specifically, but all markets are affected in some way. Environmental disasters can cause economic distress that can lead to a burst in volatility.

Regulatory Influence

Much like politics can create a surge in volatility, comments from or the sudden change in stance from a regulatory entity can have a significant impact on asset prices and volatility.

Economic Influence

If the economy is in trouble, certain assets may experience an increase in volatility that may not otherwise have been experienced. Abrupt changes to a nation’s economy can have a strong influence on forex currencies, stock markets, and more.

Sentiment Influence

Sentiment strongly leaning to one side or the other can lead to a surge in volatility.

Abundance of Positions

When sentiment is leaning strongly toward one direction, it can cause an abundance in one type of position. For example, an abundance of short positions in the stock market currently could make these traders a target for a short squeeze. If this happens, volatility will increase drastically.

Contract Expiration

When certain types of derivatives, futures, or options contracts expire, it can lead to increased trading volume and volatility as a result of traders taking new positions or trading spot markets to try to influence option expiration results

Black Swan

As the world has recently learned, when a black swan event arrives such as the recent pandemic, it brings with it explosive, record-breaking volatility. This also makes for the most significant financial opportunity possible.

Advantages and Disadvantages of Volatility

Like all aspects of financial markets, and everything else in the world, there are both many advantages and disadvantages to extreme volatility. Here are the essential pros and cons of volatility, as well as how to avoid or take advantage of them.

Pros

Profits

The most generous advantage volatility offers, is the increase in the amount of profits traders can generate from each price swing back and forth. Without volatility, financial markets would be stagnant, and there would be no price action to trade back and forth.

Excitement

Volatility also provides the excitement and rush traders feel when markets are especially wild. Boredom can lead to losing interest in trading, so the more volatility and lively markets are, the more thrilling they can be.

Opportunity

When markets are volatile, they bring about the most opportunity. When there are record-setting rallies and crashes around every corner, there is more opportunity for traders to learn, profit, and take additional positions.

Cons

Risk

Volatility causes wild swings in price action. Volatility increases profit potential, but also the potential for risk of loss increases just as much.

Fear

Volatility can also increase certain emotions, such as fear, uncertainty, and doubt. Traders must have a steady hand and mind to withstand the most powerful volatility and not let it influence their decisions.

Failure

Those that give into fear or suffer from loss due to poor risk management, it can lead to a feeling of failure.

Why Volatility Matters For Investors and Traders

The most important reason for investors and traders to care about and pay close attention to volatility all comes down to profits.

Volatility is what drives the price action carrying an asset to each significant peak and trough, along with all the ebb and flow that takes place in between. The constant push and pull dynamic going on between buyers and sellers, creating a tug of war between supply and demand, wouldn’t happen without volatility.

Volatility is what brings profit and opportunity. Without it, there would be no reason to trade. The more volatility in a market, the more trading interest it attracts. This increases trading volume, and therefore liquidity.

Due to these critical factors, it is easy to see why volatility is among the most important forces fueling financial markets.

Volatility Indicators

Specific technical analysis indicators, for example, Bollinger Bands or the Volatility Index, can be used to gauge volatility.

Here is a list of the best volatility measuring tools available:

Volatility Index (VIX)

The Chicago Board Options Exchange offers its signature VIX Volatility Index to institutional traders. The tool provides a measure of the S&P 500‘s expected volatility based on index options. However, it is utilized globally as a benchmark for overall financial market volatility. When VIX spikes, more than the S&P 500 responds with volatile price action.

In the example below, a spike in VIX is matched with an explosive move in the S&P 500.

Average True Range

- Welles Wilder Jr. developed the Average True Range to measure commodities market volatility based on how much an asset moves within a timeframe on average to define its “true range.” However, the tool works well across any market.

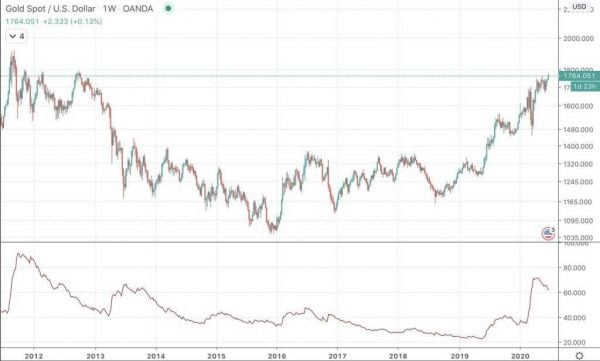

In the below example of the spot gold marker on the XAUUSD pair, the Average True Range indicator shows a spike during periods of increased volatility. As gold prices settled from the highs and consolidated, the Average True Range lowered in value. Later, as gold prices began a new uptrend, ATR indicates the increase in volatility.

Average Directional Index

Yet another tool created by Wilder, who also developed the Relative Strength Index and Parabolic SAR, the Average Directional Index, is a trend strength measuring tool.

The ADX measuring the strength of a trend also can act as an indicator of volatility, as this metric always picks up when assets are trending strongly. During a lack of a trend, volatility is at its lowest.

In the below example of WTI Crude Oil falling against USD, ADX can be seen growing during the dominant trend.

Bollinger Bands

The Bollinger Bands are a technical analysis tool that serves many functions, including measuring volatility. It consists of a simple moving average and two standard deviations of that SMA.

The two standard deviations act as the upper and lower “bands.” Most price action takes place within the bands, so when asset price reaches or closes outside either band, it often acts like a rubber band sending price action back down to the other band.

These bands widen and tighten, depending on volatility. When the bands squeeze for an extended period of time, a break in volatility is likely due. During powerful volatility, the bands expand to extremes and give them a strange appearance.

In the below example of the Dow Jones Industrial Average, the bands tighten and squeeze ahead of an explosive movement. As volatility picks up, the bands widen substantially.

Bollinger Band Width

This is a modified version of the Bollinger Bands, instead providing only a visual measure of the width of the bands.

By eliminating all other aspects of the tool, it provides an even more precise gauge of market volatility. Absolute lows can also act as a trigger for explosive instability.

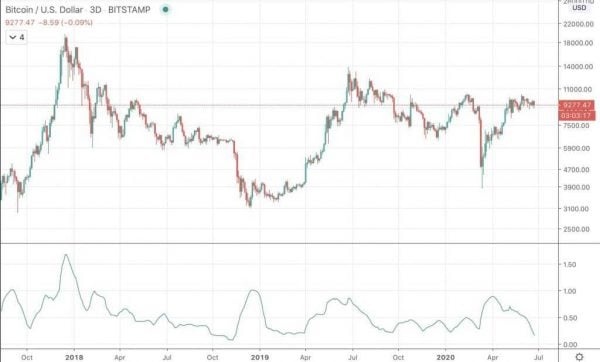

In the below example of Bollinger Band Width in Bitcoin, each time the metric reaches a low, it rises in the opposite direction and more volatility is then triggered.

Volatility In Different Markets

All markets are different and are influenced by various factors that give them more or less volatility overall. For example, the speculative crypto asset class volatility is much higher than that of the highly liquid forex market.

Stock Market Volatility

In terms of overall financial market volatility, the stock market is somewhere in the middle between the wildly speculative asset class of cryptocurrencies, and the relatively stable price action found in the forex currency market.

Like all markets, the stock market can experience periods when volatility sharply increases. This typically occurs during times of economic distress, or political tensions.

The black swan event that is the recent pandemic that swept the world and led to lockdown conditions brought about with it the powerful, record-setting volatility across all markets.

It started with a record-seeing crash now referred to as Black Thursday, followed by a historic rally and V-shaped recovery. In the example below, you can see how this incredible price action developed.

Crypto Market Volatility

The cryptocurrency market is notorious for its wild price volatility, driven by speculation by market participants.

Bitcoin is known for making people rich and just as quickly making people broke. Those who bought into the asset early on enjoyed as much as 1,000,000 percent ROI.

However, those that bought the asset during its rise to $20,000, possibly lost a fortune as it crashed later.

The rise and fall of Bitcoin are among the best examples of powerful price volatility found across any market. The asset rose from $1,000 to $20,000 in just one year, and then a year later was trading at just above $3,000.

The following year, the asset ballooned again to $14,000, before falling back to $4,000.

Forex Market Volatility

Forex volatility is low compared to other markets. These assets trade at relatively stable prices due to the sheer size of these markets and the liquidity they offer.

Due to this, forex traders often rely on leverage to gear their trades and bolster performance.

Commodities Market Volatility

The commodities market heavily relies on the environment, economic, and political factors to drive volatility.

Commodities often go through phases of general stability then experience more substantial volatility when an event or other factors, as mentioned above, impact supply and demand in some way.

The commodities market is a low to medium volatility market, depending on the asset itself.

Volatility in Trading

During volatile times, more opportunity is available at a higher frequency and with more significant profit potential. As price swings wildly back and forth from the push and pull of buyers and sellers, there’s an opportunity to earn a profit from the direction of price movements regardless of which way they turn.

In spot markets, buying low and selling high protects capital from risk and grows profit margins.

Meanwhile, using derivatives or contracts such as CFDs, traders can long or short without having to actually buy or sell the underlying asset by placing bets on if an asset price will rise or fall.

Whatever the method, it’s the volatility that drives a trader’s PnL and all the price action that takes place. Without it, there would be no profits to be made.

Volatility during its most extremes can be shocking and more powerful than you expect. But it’s during this time when the most money is made and lost. Preparing yourself for the event of extreme market volatility by setting stop loss or take profit orders can lead to more success and less overall loss.

Strategies & Tips for Trading in Volatile Markets

There are two primary ways to trade intense volatility: swing trading and day trading.

Swing trading takes advantage of trading more significant price swings across a short-to-medium term trend created by volatility.

When markets are volatile enough for swing trading, they are typically also more volatile intraday as well, making even more opportunities available intraday for day traders.

Each type of trading technique requires a unique strategy, different position sizing, and more. For example, because of the long duration in between each trade, swing traders may choose to risk more for a higher reward, while day traders who take frequent trades per day will get in and out quickly even at a small percentage win per trade.

The same tools and indicators can be used across both trading techniques but should be adjusted for shorter or longer timeframes for day trading and swing trading, respectively.

The most important thing to pay attention to during extreme volatility is setting stop-loss orders properly and sticking to a plan.

It may require tailoring stop losses to be more loose than usual, so adjust accordingly. Sticking to a plan at all times will prevent a trader from making a poor decision due to panic or shock.

Conclusion: Take Advantage of Market Volatility With Top Coin Miners

Volatility, capital, and trading strategies are the most crucial pieces of the profitability puzzle. How these fit together determines how much money can be made.

Throughout this helpful guide, you’ve learned all there is to know about volatility, its meaning in economic markets, and why it matters to traders.

The remaining pieces to the puzzle can be found on Top Coin Miners – an award-winning Bitcoin-based margin trading platform offering exposure to over 50+ trading instruments across forex, stock indices, commodities, and cryptocurrency.

The platform also provides traders with built-in charting tools, both natively and through TradingView analysis. Long and short positions allow traders to profit from market volatility, whichever direction price heads next.

To protect capital from volatility and to maximize the profit generated, stop loss, and take profit orders can be added to each and every position.

Further protecting capital, accounts are secured by password encryption, compulsory address whitelisting, and two-factor authentication. The platform runs on bank-grade infrastructure for an ultra-reliable and stable trading experience.

Orders are executed with rapid speed at the price you want, thanks to a high level of liquidity from multiple sources. The platform also boasts as much as 99.9% uptime.

Should any issues arise, a friendly and helpful 24/7 live customer support team is available through chat or email. A help center is also available to assist in setting up an account and making a first-time deposit.

Initial minimum deposits are just 0.001 BTC, making it a low barrier for entry for even those with small starting capital. The platform caters to traders of any account size or experience level, from beginner to professional.

A mobile application keeps users connected at all times, while the desktop version of the trading terminal offers many customizations, widgets, and multi monitor support.

Registration takes just 60 seconds or less, and in no time, you can register for a free Top Coin Miners trading account and get started taking advantage of the powerful volatility that’s currently spreading across all global markets.

What is volatility?

Volatility is the degree of variance in an asset's traded price within a specific timeframe and is typically measured by the standard deviation of logarithmic returns. Volatility is what makes markets move, and prices fluctuate back and forth from the underlying forces of supply and demand between buyers and sellers.

Is volatility a good or bad thing?

Volatility is both a good and bad thing for traders. Volatility is how profits are made, which is obviously the point of trading and where the opportunity lies. However, volatility during its most extremes can be outright scary and uncomfortable for even the most experienced and stoic traders.

What does volatility mean to traders?

Volatility means the difference between a stagnant, sideways trading market and a lively market with large prices swings across many different timeframes.

What happens during a lull in volatility?

When volatility wanes, it is either a sign an asset is losing interest in the public eye, or could simply be a period of harmony or equilibrium taking place before a breakout. When the breakout arrives, the lull typically ends, and volatility returns in a significant way.

How do you trade volatility?

Typically, traders rely either on frequent and highly active day trading strategies, or longer, focused, more sizable swing trading positions. Either way, traders can make more money the more volatility there is.

How does volatility compare across different markets?

It varies greatly. For example, the highly liquid forex market, with its massive daily trading volume keeps assets more stable in price compared to the highly volatile cryptocurrency market where speculation drives price action. The stock and commodities markets rank somewhere in between.

How can you measure volatility?

There are many tools designed to measure volatility including the Bollinger Bands, Bollinger Band Width, the Average Directional Index, Average True Range, and the Chicago Board Options Exchange VIX Volatility Index.