As a cryptocurrency trader, you will eventually encounter the “Crypto Fear and Greed Index.” This article explores this valuable tool, provides insights on how to utilize it, and outlines its significance to your cryptocurrency investments.

What is the Crypto Fear and Greed Index? – Definition & Meaning

The original “Fear and Greed Index” was formed by CNNMoney to gauge investor sentiment in the stock market. The index is measured daily, weekly, monthly, and yearly. The idea is that investors can decide whether or not a stock market is priced correctly. Excessive fear drives down prices, while greed tends to have the opposite effect.

How the Fear and Greed Index Works

To understand how to use the Crypto Fear and Greed Index, you need to know how the original one works, as it is simply an extension of that indicator. It is used as a way for investors to gauge the market. This indicator is based on the idea that stocks tend to trade far below their intrinsic value when there is excessive fear, while they will trade far above their intrinsic value when there’s unbridled greed.

- Stock Price Momentum: This measures the S&P 500 Index versus its 125-day moving average.

- Stock Price Strength: The number of stocks hitting 52-week highs versus those hitting 52-week lows on the New York Stock Exchange.

- Stock Price Breadth: This analyzes the trading volumes in rising stocks against declining ones.

- Put and Call Options: This will measure the difference between put options and call options. The idea is that if there are extreme changes and differentials between one or the other, it can give you an idea of where investor psychology stands.

- Junk Bond Demand: Junk bonds are considered relatively far out on the risk appetite spectrum. Measuring the spread between yields on investment-grade and junk bonds can give you an idea of how far out on the risk spectrum people are willing to step.

- Market Volatility: The CBOE’s Volatility Index is defined by the 50-day moving average.

- Safe Haven Demand: The difference in returns in the stock market versus treasury markets.

How is the Crypto Fear and Greed Index Calculated?

As the crypto markets mature, it makes sense that they started using some more traditional tools. Understanding the psychology of the market goes a long way in determining whether the market is in a sustainable move or if things have been “overdone.” In a market like crypto, this can be especially useful as the momentum can be so strong.

When calculating the Crypto Greed and Fear index, there will be different inputs as it is an entirely different market. The following information is used to come up with the calculation:

Volatility (25% of total calculation)

To come up with the volatility input for the index, the current bitcoin price is compared with the average bitcoin price from the last 30 to 90 days. Volatility in a market can signify uncertainty and extreme fear among those in the marketplace.

Market Momentum/Volume (25% of total calculation)

The current trading volume and momentum of Bitcoin are compared to that of the last 30 and 90-day average values before being put together. High daily buying volumes can be considered a sign of a bullish market, but overbought valuations can be thought of as a greedy market.

Social Media (15% of total calculation)

Social media plays a huge factor in the way crypto trades. The index will combine the number of Twitter feeds and tweets tagged under related hashtags to Bitcoin and the rate at which users tweet that hashtag. A consistent and unusual rise in interaction is usually a sign of an overbought and, therefore, greedy market.

Google Trends Data (10% of total calculation)

Google Trends data related to Bitcoin also comes into the picture. Paying attention to search-related queries suggests whether there is increased or decreased interest in a market. If there are more searches for “Bitcoin” and “crypto”, it can be thought of as a sign of interest..

Surveys (15% of the total calculation)

The Crypto Fear and Greed Index also considers the results of various surveys. It combines data sources from public polling platforms and can give an idea of how traders feel about the crypto market at any given moment.

How Do You Read the Crypto Fear and Greed Index?

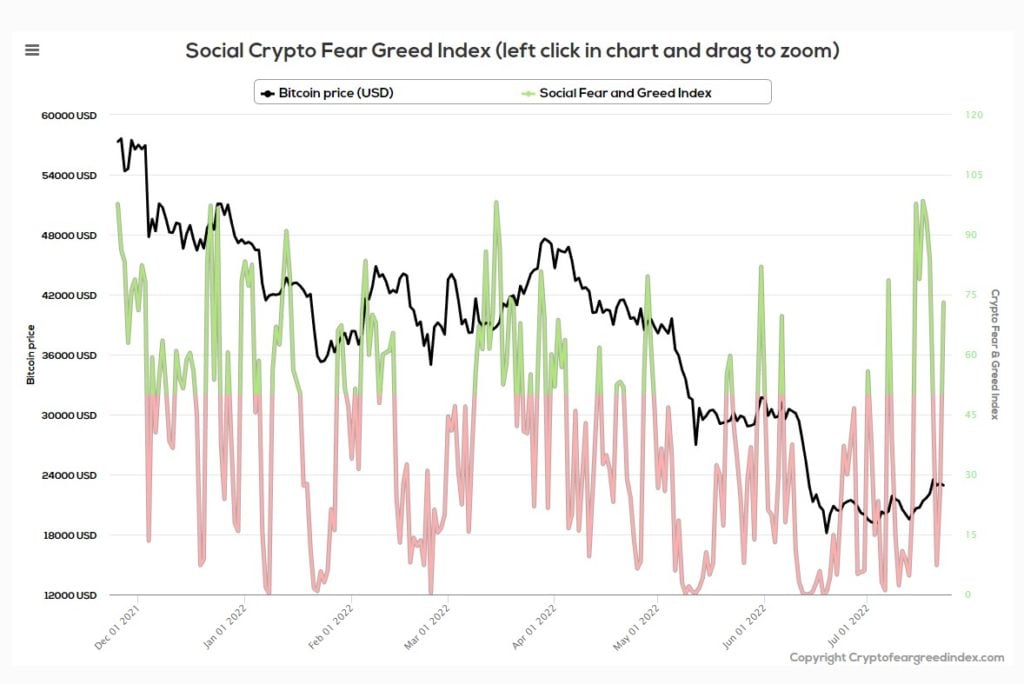

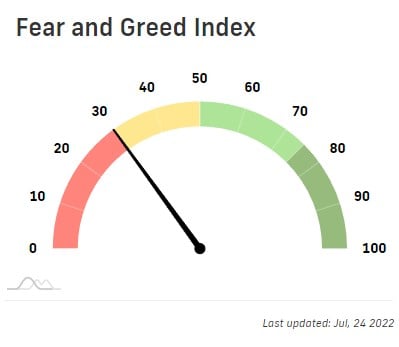

The Crypto Fear and Greed Index is straightforward. It’s a numerical value between 0 and 100, with zero being the most fearful end of the spectrum and 100 being the most greedy

Think of the 50 level as being “balanced.” If the market has a reading below 50, it could mean that the market might be undervalued and ready for an upswing. On the other hand, if the reading is above 50, the market is experiencing greed, and it could be overvalued and ready for a pullback.

That being said, a reading of 52 is not extremely greedy. However, a reading of 93 would be. For fear scores, 48 is not important, but a fear score of 2 should get your attention.

There are many places to find the index online, but one of the most intuitive ones that follow crypto markets can be found at: https://cryptocurrencytracker.info/en/fear-and-greed-index.

What Are the Advantages of The Crypto Fear and Greed Index?

There are a lot of advantages to using the Crypto Fear and Greed index. Some of the major ones include:

- Simplicity: One of the most significant advantages of the indicator is that it is so simple to use. Most traders will divide up the index readings into quadrants, meaning that they can devise specific strategies for each one-quarter of the index.

- Widely followed: Another significant advantage of using the Crypto Fear and Greed Index is that it is relatively common for traders to follow it. In other words, it can have a bit of a “self-fulfilling prophecy” aspect.

- Can confirm reversal signals: The Crypto Fear and Greed Index can confirm a reversal signal when used in conjunction with other forms of technical analysis. Furthermore, it can also give you a bit of a “heads up” as to when you may want to take profits in a trade that has already been profitable.

What Are the Disadvantages of The Crypto Fear and Greed Index?

While the Crypto Fear and Greed Index can be helpful, nothing is perfect. There are a few things to keep in the back of your mind when using this tool, including:

- Ambiguity: You must use common sense when trading via this indicator. After all, it’s not as straightforward as a buy or sell signal. It’s a general gauge as to how traders are “feeling.”

- Not necessarily standardized: While we have talked about the most common calculations for the Crypto Fear and Greed Index, other versions are out there, causing confusion.

- Not a standalone system: While the index can be quite helpful, it’s not a standalone system. Traders do not simply buy or sell based upon this index, but it does tend to do reasonably well as a secondary or tertiary indicator.

How to Use the Fear and Greed Index When Trading

There are multitudes of ways traders can use this index, but one of the most common ways is to allocate your trading capital based on how the market is trending and when perceived “value” may be entering the market. For example, Bitcoin could be in a downtrend, and the Crypto Fear and Greed Index could be in an extremely low reading.

If you are an investor, at this point, you may be looking to buy a bit more, with the understanding that the index itself does not guarantee a bounce, but it suggests that perhaps the selloff is a bit “overdone.” Furthermore, if you are a short-term trader, you may play the bounce more aggressively, assuming you have a technical or fundamental setup.

Beyond that, traders will often use this indicator to tell them when to take profits or perhaps simply go from crypto to cash. If you see that the markets are trending down and the index is starting to drift lower, it may be time to close out positions and go to cash, waiting for a more suitable market to be involved in.

Is the Fear and Greed Index Reliable?

The Fear and Greed Index can be reliable depending on your timeframe. Over the short term, it’s often observed that if the market leans too far in one direction, it will act as a pendulum and go on the other. For example, if we see a very bearish market with extreme fear built into it, a swing in the other direction could be coming soon

If you are a longer-term investor, it may not be as reliable or potentially significant. The index will be much more helpful if you are more short-term focused.

The Fear and Greed Index is a technical indicator, so you should keep in mind that it does not consider any fundamental factors in its final calculation. If you invest in crypto based on a macroeconomic outlook, the index may be irrelevant to you.

Conclusion

Ultimately, the index should be thought of as confirmation of existing technical or fundamental analysis.You cannot trade based upon this index alone, as it is not easy to quantify. The market will likely reverse if things get overextended in either direction.

There’s no reason to ignore the index, as it is easily found on various websites. That being said, if you find that you are in a position that has moved significantly, it does not hurt to check it. There are multiple versions of the Crypto Greed and Fear Index out there, so if you are a swing trader, you can buy and sell your CFDs at Top Coin Miners if the market swings too far in one direction, allowing you to maximize potential profits.

What is the CNNMoney Fear and Greed Index?

The CNNMoney Fear and Greed Index is a measurement of the stock market to determine whether or not traders have become far too pessimistic or perhaps far too greedy.

Who created the Fear and Greed Index?

CNNMoney created the Fear and Greed Index to measure investor sentiment.

What is the Bitcoin Fear and Greed Index?

The Bitcoin Fear and Greed Index is a calculation of several variables that determine whether or not traders have become too fearful or if they have become too greedy as far as Bitcoin is concerned. It can be used to serve as a secondary or even tertiary indicator.

How to check the Fear and Greed Index?

There are multiple places where you can find the Fear and Greed Index on the internet; some are even tied to specific cryptocurrency markets. A simple Google search will lead you to multiple indices.