Stellar Lumens are tokens on the Stellar Network that quickly and efficiently allow for payment exchanges. This network thrives on cross-border payments and foreign exchange, which sometimes might be not only costly but difficult to achieve. Because of this, several central banks worldwide are experimenting with the Stellar Network.

What Is Stellar?

Stellar is a decentralized network where users can create, send, and trade several types of cryptocurrency. It was designed in 2014 and launched the following year with the goal of bringing global financial systems together in one network.

The Stellar network uses a token called a “Lumen” and has blockchain technology spread out among multiple servers. This means that a singular source does not monitor activity, nor is it controlled by one.

About Stellar

In 2014, Jeb McCaleb left Ripple, the financial transaction platform he co-founded, to create a new system. He teamed up with former lawyer Joyce Kim to launch Stellar as a platform for everyday use. The Stellar Development Foundation was founded soon after, with the help of several others, including the CEO of Stripe.

Stellar had experienced significant growth, such as when Mercado Bitcoin announced its platform use. In less than a year, Stellar housed 3 million user accounts. Moneygram and Flutterwave have also jumped on board.

What Are Stellar Lumens?

Stellar allows the representation of money and crypto assets from all over the world. It does provide its native digital currency called Lumens, or XLM, which powers the network.

Lumens are most often used to pay transaction fees on Stellar. They also act as the intermediate currency that allows the Stellar Network to execute trades quickly. A built-in protocol will automatically convert money sent through Stellar to Lumens and then to the desired currency.

An example would be if you were to send Euros to a recipient in Mexico. While the EUR/MXN transaction is a bit difficult, the Stellar Network would convert the Euros into Lumens, find someone looking to sell Lumens for Pesos, and then send the Pesos to the recipient.

It’s worth noting that the native currency was initially called “Stellars.” However, the network changed the name to Lumens, so sometimes, you will hear the two terms used interchangeably.

How Does Stellar Lumens Work and What is the Technology Behind It?

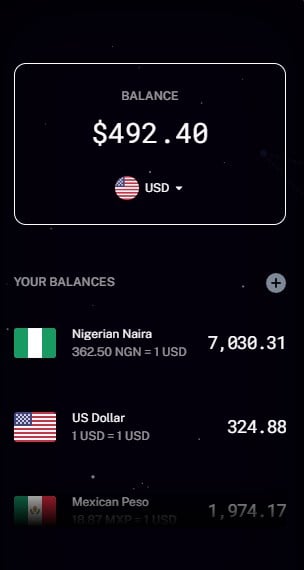

In the Stellar Network, tokens called “Lumens” are used to send sums of money and convert currency. The network is decentralized, peer-to-peer in structure. The network allows one type of currency to be sent from one peer and arrive as a different currency to the receiver.

The currency being sent can transition through several currencies during the transaction. The Stellar Network does this by seeing if a direct currency swap is available. If it is not, it can determine the demand for the initial currency, swapping the scent currency for the tokens. (XLM)

At that point, it can search for a pair of Lumens and the desired exit currency. Anchors within the network make this all possible, as they facilitate the exchange of currency within the network by holding a deposit and issuing credit in a different currency. The process is extraordinarily fast, as all anchors are on the same network.

Are Stellar Lumens Real Money?

Even though Stellar Lumens have intrinsic value on the network, the primary use of the tokens is to act as a bridge between other currencies, typically fiat. Lumens are more than just money; they give users the ability to convert currencies for others in a very short amount of time.

Fees & Expenses

There are some costs involved in using the Stellar network. The fee for a Lumens transaction is 0.00001 XLM, meaning that it is very cheap. When you purchase tokens on an online crypto exchange, the site will charge a fee for your purchase.

Regardless, the minuscule charge used to make these transactions makes the Stellar Lumens transaction very attractive to institutions, significantly reducing the cost of sending money worldwide.

What Are the Benefits of Stellar Lumens?

Stellar Lumens has several significant benefits that make the network and the crypto itself very attractive for large institutions.

Cost – The cost to transfer Lumens is almost negligible, making it a very competitive and attractive method of transferring money compared to traditional and other blockchain methods.

Currency exchange – When using the network, Lumens can be swapped seamlessly, even though some currency pairs in the Fiat world are not very common. This is because Lumens allow holders of various currencies to trade back and forth within the network, making a conversion from a relatively uncommon pair in the real world possible.

Simplicity of access – It’s relatively easy to use the network, as all someone needs is an Internet connection and a lumens-ready wallet. After that, access to an online exchange is all that is necessary.

Decentralized – The stellar network is decentralized, meaning that no particular authority controls the movement of Lumens. The community authorizes transactions and then records them on the blockchain, which everyone can access.

Can Stellar Lumens Be Used Anonymously?

There is a certain amount of anonymity when using the network. Still, while the wallet address does not carry your identity, the very nature of the blockchain technology used on the Stellar Network allows for every transaction to be stored on blocks. This means that anybody can access these transactions, so they are not entirely anonymous, although pseudo-anonymous.

Most exchanges will require some form of identification to set up an account in the interests of safety and to combat illegal activity. This is known as “Know your customer” or KYC rules in the financial industry.

How Safe Are Stellar Lumens?

As Stellar Lumens charges a fee per transaction and requires a minimum of 1 XLM in a Lumens wallet at any one time, it offers a degree of protection from “flood attacks.” These are attacks where hackers try to flood the system with a vast number of micro transactions.

Stellar Lumens has protected itself against these attacks by making them too expensive for the hacker to yield any gain. The Stellar Network has never suffered a severe attack as a sign of its safety.

Can I Make Passive Income with Stellar?

You can generate passive income with Stellar through the Ultra Stellar project. Stellar is built on the Stellar network and issues yield generating tokens. XLM backs each yield-generating token.

The following coins are available with Ultra Stellar:

yXLM (Stellar Lumens)

yUSDC (USD Coin)

yBTC (Bitcoin)

yETH (Ethereum)

Ultra Stellar allows you to swap your regular tokens for yield-generating tokens and earn interest on them. If you have Lumens, you can exchange them for yXLM and start earning daily interest payments. You can switch back to your XLM at any time.

Stellar Lumens Mining

Unlike some of the most common crypto, Lumens cannot be mined. Instead, the supply of Lumens is controlled by Stellar. There were originally 100 billion Lumens created, and the supply was inflated by 1% each year for five years until the Stellar community voted against it.

Stellar has since listened to the community and halved the number of Lumens to 50 billion, vowing never to make more. This means that the coin is no longer able to be inflationary. Only about 20 billion are in circulation, with the remainder being held by the Stellar Development Foundation for development and promotional purposes.

There is no mining “proof-of-work,” nor is there staking. Instead, all transactions are validated through the Stellar Consensus.

Stellar Lumens Wallet

Like most crypto, you will need a wallet to store your new stellar. Stellar Lumens wallets need a minimum of 1 XLM in them to function. There are many wallets that you can use, and with different functions.

The Ledger wallet series handles Stellar, as does Trezor. These are hardware wallets and are considered some of the most secure ways to carry your crypto. That being said, there are other wallets that you can use.

Keybase is a desktop and mobile wallet, as is a Solar wallet. Alternatively, you can go with an exchange, thereby using an online “hot wallet.”

Is XLM a Good Investment?

Stellar Lumens is a potential investment that most crypto portfolios can benefit from. Nothing is guaranteed, and there are a couple of things that you need to keep in mind before putting money into it. However, instead of holding the asset for the long-term, if you are looking to speculate, one of the best ways is through the CFD market at Top Coin Miners.

Overall, the performance history of XLM has been promising. This is a cryptocurrency subject to wild swings. When Stellar Lumens were released, they were worth just fractions of a cent. However, they have risen as high as $0.27 in the first few years and $0.73 in May 2021.

It comes down to your risk tolerance, but this is something that can be said about any cryptocurrency. You should always hold several to even out your equity curve.

Stellar has destroyed half of its Lumens and does not plan on creating more. It’s essential to note that the coin could be somewhat scarce in the future, and rarity increases the value of just about any item.

How to Buy Stellar

You can buy Stellar Lumens at most large crypto exchanges. As it is well-traveled and has an actual use case daily, finding an exchange that sells Lumens will not be difficult. Some of the biggest exchanges, such as Coinbase, Binance, Huobi, Upbit, and Kraken, offer it.

Another example is simply speculating in the CFD market instead of taking sole custody. Doing this simplifies the process and allows you to benefit from price fluctuations. This is what we offer at Top Coin Miners.

Conclusion

Stellar Lumens could find a place in your portfolio. Stellar has quite a bit of excitement because it solves multiple problems in a very cost-effective and timely manner. Stellar allows financial services to cross borders without any hesitation and does it much cheaper than the existing alternatives, including most blockchains.

What also makes Stellar interesting is that central banks are also using it to explore the idea of central bank-created digital currencies. In that sense, stellar might be a bit of a hedge against the idea of governments cracking down on blockchain. It may have the ability to win the argument by default in that scenario.

You should also keep in mind that all cryptocurrency is speculative at this point, so just like any other cryptocurrency, you should not throw all of your money into it. However, it does show promise for remittances and cross-border payments and certainly can handle the job of domestic payments. Because of this, Stellar Lumens should continue to be an attractive ecosystem for financial services and retail use alike.

What is Stellar used for?

Stellar is used to transfer payments between financial institutions, drastically reducing the cost of transactions, especially cross-border ones.

What is Stellar, and how does it work?

Stellar has a basic operation that is similar to most decentralized payment technologies. It runs a network of decentralized servers with a letter that is distributed and updated every 2 to 5 seconds amongst nodes. Its consensus protocol takes a slice of the network, using the Federated Byzantine Agreement algorithm to process transactions.

Is Stellar a good investment?

It may be too early to tell. There are a handful of central banks experimenting with Stellar. You should diversify your crypto holdings.

How is Stellar different from Bitcoin?

Bitcoin is a proof-of-work network, while the Stellar Lumens network uses the Federated Byzantine Agreement algorithm, which makes it much faster than bitcoin as it uses quorum slices or a portion of the network to approve and validate a transaction.

How many banks use Stellar?

It is a relatively small number, with most users being in the form of Central Bank Digital Currencies, or CBDCs. However, some commercial banks have stepped up, such as the Philippines-based RCBC, Brazil’s Banco Bradesco, and Bank Busan of South Korea. There are several other banks, but most of the momentum is with central banks.