Ethereum is the second largest cryptocurrency by market cap and the top ranked overall altcoin. It’s place in the market is now nearly as important as Bitcoin. Without Bitcoin, Ethereum might never have existed, but without Ethereum the crypto market as we know today wouldn’t look the same. Most altcoins are made on the ERC-20 token standard and just about all of DeFi is built on Ethereum.

But as more and more is built on Ethereum, the network has become congested and caused fees to rise. To achieve greater scalability, speed, and throughout, the Ethereum development community is rolling out what they’re calling the Ethereum 2.0 upgrade and it could revolutionize the cryptocurrency market. Here’s everything you need to know about ETH 2.0.

What Is Ethereum 2.0? ETH Goes Proof of Stake

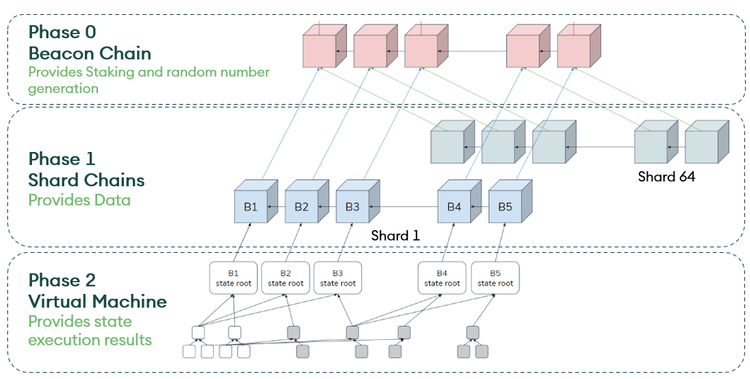

Ethereum 2.0, also called the “Serenity” update or Eth2 is a major upgrade to the Ethereum blockchain that will be released in four distinct phases. Phase 0 of the upgrade began starting in December 2020, and will continue to be rolled out over time.

What Is Ethereum 1.0? The Original Proof of Work Chain

Ethereum 1.0 is the original and current Ethereum network, created by Vitalik Buterin. The crypto Phase 0 first launched this past December 2020 with the introduction of the Beacon Chain. The Beacon Chain contains the registry of all validators on the network. The Ethereum 2.0 rollout however will last through 2022 or potentially longer, so it is not fully released until the end of phase 2. is different from Bitcoin, because it enables smart contracts as part of each transaction. ETH 1.0 is the original Ethereum PoW chain.

What Is The Difference Between Ethereum 1.0 And Ethereum 2.0?

Ethereum 2.0 brings with it a host of new improvements and benefits crucial to the overall blockchain upgrade, which heavily relies on shard chains, and a switch to a Proof of Stake mechanism (PoS).

With the current technology found in Ethereum 1.0, the system relies on the computing power of miners and a similar “Proof-of-Work” consensus mechanism to verify blocks and secure the network. The switch to PoS over PoW Ethereum, increases scalability, security, and overall efficiency. Rather than relying on miners like PoW Ethereum, the new PoS Ethereum uses validators and deposit of Ether – the name of the ETH token powering the Ethereum blockchain.

The added shard chain mechanism boosts throughput on Ethereum which is a much needed improvement due to the advent amd explosion in popularity of decentralized finance (DeFi). Shard chains in theory could increase transaction speeds by effectively splitting the data processing mechanism among many nodes. This allows for many transactions to be processed at the same time. Ethereum Foundation think tank ConSenSys compares each shard chain as adding a new “lane” to the “highway.” The more “lanes” the higher the throughput and the more scalability the Ethereum mainnet is able to achieve. Shard chains are not available as part of Phase 0, but will included in Phase 1 according to the roadmap.

When Was Ethereum 2.0 Released?

Phase 0 first launched this past December 2020 with the introduction of the Beacon Chain. The Beacon Chain contains the registry of all validators on the network. The Ethereum 2.0 rollout however will last through 2022 or potentially longer, so it is not fully released until the end of phase 2.

What Is Proof of Stake?

Proof of Stake (PoS) is a consensus algorithm that relies on validators that are rewarded with additional ETH for validating transactions on the Ethereum blockchain. Validators are essentially “virtual miners” serving a similar, yet less wasteful function.

What Is The Difference Between Proof of Stake And Proof of Work?

Proof of Work (PoW) relies on a energy-hungry process and consumes hash power created by miners. No BTC is required to mine for BTC, while Ethereum validators must stake ETH to activate additional rewards. Proof of Stake coins allow for sharding, able to potentially improve scalability and throughput.

What Are The Four Phases Of The Ethereum 2.0 Release?

The Ethereum 2.0 roadmap consists of four distinct phases, which include:

Phase 0

Phase 0 has been available since the implementation of the Beacon Chain. The Beacon Chain, as mentioned, contains the registry of validators and is essential to the Proof of Stake consensus mechanism. During this time, the original POW chain will continue to be operable alongside ETH 2.0. This is being done to ensure data consistency between the two chains throughout the process.

Phase 1

Phase 1 is technically the second phase of Ethereum 2.0 and is scheduled currently for 2021. Phase 1 will see the introduction of the scalability mechanism called “sharding” or “shard chains.” In total, the Ethereum blockchain will be split into 64 shard chains, enabling at minimum 64 more times the throughput as the original Ethereum blockchain. Much more is planned and expected.

Phase 1.5

Phase 1.5 is not an official phase during the Ethereum update but is the name given for the period while Ethereum 1.0 and Ethereum 2.0 blockchains are being merged. After the completion of Phase 1.5, the Ethereum 1.0 PoW blockchain will operate as a shard of the Ethereum 2.0 PoS blockchain.

Phase 2

Phase 2 is the third and final phase of Ethereum 2.0 and is projected to launch some time in 2021 or 2022. This phase contains some unclear details, but addresses scalability of the public mainnet overall, and finally concludes the Ethereum 1.0 blockchain. The final phase also offers improvements over transfers and withdrawals.

Advantages of Ethereum 2.0

- Ethereum 2.0 boosts the scalability and security of the Ethereum public mainnet. To the benefit of ETH holders, the buzz surrounding the update has caused prices to skyrocket, which is an advantage in and of itself.

- Ethereum 2.0 preserves the integrity of all assets, data, and blockchain history, while adding the beacon chain and shard chains. Combined Ethereum will operate more like a highway system versus a single lane road.

Disadvantages of Ethereum 2.0

- The biggest disadvantage to Ethereum 2.0 is the confusion that still surrounds it. Many won’t know anything at all is happening but the discussion around it has investors curious.

- There is also some risk of losing funds due to “slashing” of the ETH being staked on the network. For example, a validator might lose funds as part of a penalty for being offline. The p. This incurs a relatively mild penalty: roughly the same as the reward you could have made. Staking requires at minimum 50% participation to avoid losing stake.

- Validators can also have from 1 ETH to the entire stake slashed if the validator is ejected from the system. This can occur when chain data isn’t consistent.

- Slashing can be avoided and is included to prevent malicious actors from abusing the system.

The Future of Ethereum 2.0

The scalability and improvements that Ethereum 2.0 brings to the table will enable much faster transactions and Dapps. Fees should lower and allow for more innovation at less cost for users and developers alike. DeFi apps will be able to scale to meet and exceed the throughputs of traditional centralized financial systems.

How Could Ethereum 2.0 Affect Ethereum’s Price?

The launch of Ethereum 2.0 has already proven profitable for ETH holders. Since it was launched in December 2020, the price per ETH has grown by 150% and set a new all-time high over its 2018 peak.

The breakout from bear market resistance has sent the asset into a new uptrend. Past uptrends have resulted in incredible ROI. The below image demonstrates what could happen if a similar rise happens post-breakout.

How To Make Money With Ethereum 2.0 and Top Coin Miners

Ethereum 2.0, Bitcoin FOMO, and general bullish crypto market sentiment has sent ETH into an uptrend against the dollar. This makes “buying the dip” with long positions potentially extra lucrative. But even the strongest uptrends have pullbacks and eventually come to an end, so it is important to prepare with trading strategies that approach both directions of the market.

That’s why relying on an award winning crypto trading platform is key to successfully making money with the opportunity ETH 2.0 provides. Top Coin Miners offers long and short positions on Ethereum, Bitcoin, and other crypto, as well as forex, stock indices, gold, oil, silver, and more.

Top Coin Miners is also home to Covesting, a copy trading platform that connects followers with strategy managers. Those who are new to markets or don’t have the time for technical analysis can follow successful strategy managers and copy their trades. At the center of it all is the Ethereum based utility token COV, which unlocks a wealth of extra benefits.

To get started on Top Coin Miners it takes just a few clicks, and a small 0.001 BTC deposit. After making a deposit to a secure BTC wallet users can find their trading account to trade more than 50 CFDs all under one roof. Learn how to trade Ethereum

ETH Trading Strategies

Here are some common ETH trading strategies, along with a tip on how to potentially spot a trend reversal before it happens.

In the below chart, the Bollinger Bands are enabled on the week ETHUSD chart. The Bollinger Bands consist of a moving average and two standard deviations that widen and contract, measuring volatility. The middle moving average, however, can also be used as a reliable short or long signal, when price action passes through it and closes.

An intraday strategy can also be employed using the MACD. The MACD is called the moving average convergence divergence indicator. When the two moving averages diverge, it signals overbought or oversold conditions. When they converge and crossover, it can act as a powerful signal.

The MACD is a lagging signal, however, and as the example below shows, it is extremely effective but stops need to be adjusted to allow for some fluctuations in price. So long as risk is properly managed, the signal is ultimately profitable.

The example below shows the conclusion of the last bull market compared to the current. Both times Ethereum entered the “bull zone” on the weekly RSI. This high of a reading on the Relative Strength Index suggests the altcoin is highly overbought, but during strong trends assets can remain overbought or oversold for extended periods of time.

One way to spot when a top is potentially in, is to watch for large bearish divergences. A bearish divergence happens when price action rises to a higher high, but an indicator fails to make a corresponding high.

The last major bearish divergence started the bear market and could help provide clues to when the uptrend has ended and when it’s time to go heavily short.

Conclusion

Ethereum 2.0 is one of the primary catalysts driving the Ethereum bull market. The rush to buy enough ETH to earn staking rewards has driven up prices, along with general interest surrounding.the upgrade. Coinciding with all of this is a greater crypto market uptrend and an explosion of DeFi applications that use ETH as fuel for transactions.

All this has caused Ethereum to set a new all time high and it could only be the start of what’s to come.

Did Ethereum 2.0 Launch?

Yes, technically Ethereum 2.0 did launch with a release date in December 2020 with Phase 0. But because it is a rollout across multiple phases, the full vision for the upgrade isn’t yet available. ETH 2.0 will roll out across four distinct phases: phase 0, phase 1, phase 1.5, and phase 2.

Is Ethereum 2.0 A New Coin?

No, Ethereum 2.0 is an upgrade to the Ethereum 1.0 blockchain and coin. Existing ETH will automatically work with the ETH 2.0 contract address once deposited.

Will Ethereum 2.0 Replace Ethereum?

Yes, the older Ethereum blockchain will be phased out and essentially become the first shard of Ethereum 2.0 in phase 1. Currently, Ethereum 1.0 blockchain will continue to be improved until phase 1.

Does Ethereum 2.0 Increase Price?

Ethereum 2.0 has nothing to do with price action whatsoever, but is has caused more investors to become interested in the project, and because earning rewards requires a certain amount of ETH to be staked, there has been an increased demand for the token as a result of Ethereum 2.0, which in turn is driving up prices.