Cardano is one of the biggest cryptocurrencies by market cap. It’s known for being flexible, sustainable, and efficient. Many cryptocurrency traders tend to think of Cardano as the leader of the new wave of the market. Lowered gas fees, an open-source network, and peer-reviewed research are the main reasons for Cardano’s success.

What is Cardano? – Definition & Meaning

Cardano is a blockchain platform designed to process transactions with its cryptocurrency called ADA. The platform can handle various types of transactions. Still, the long-term aspiration of Cardano is to become an “Internet of Blockchains,” which would have the ability to connect multiple blockchains.

Cardano is supported by the Cardano Foundation and the IOHK Research Institute, which has a peer review with a formal development model. By doing so, it should be widely accepted by mathematicians and cryptographers alike.

Cardano will more likely go through several evolutionary changes in the future, as it is open source. Therefore programmers and developers will be able to use the network in ways that we are not imagining yet. The flexibility of Cardano is one of the most significant benefits of using the ecosystem.

Abbreviated History of Cardano

Crypto legend Charles Hoskinson founded Cardano after being a co-founder of Ethereum. Cardano was launched in 2017 and is considered to be “Crypto 3.0” to improve where Ethereum has left off. Hoskinson had a falling out with the Ethereum team due to arguments as to whether or not the project should be commercial.

Hoskinson has launched Cardano to be more scalable, interoperable, and sustainable than Ethereum. It’s intended to improve on Bitcoin and Ethereum, the two largest cryptocurrencies.

How does Cardano work?

With any blockchain network, there will be a need for a way to verify transactions, ensuring that tokens do not get used more than once. As there is decentralization, this is the primary concern for most blockchains, as there is no “authority” to prevent this.

Cardano uses staking to verify transactions, which is a process where network participants deposit specific amounts of crypto to earn the ability to participate in the operation of the blockchain. The Cardano protocol is designed to keep energy expenditure minimal, in stark contrast to Bitcoin and the original Ethereum. (You should note that Ethereum has gone to staking, drastically reducing energy needs.)

Those who choose to stick their crypto get rewards in this “proof of stake” system, much like other POS networks. This allows those who stake Cardano to earn a passive income. Cardano also has a multilayer architecture, which allows for the rapid approval of transactions.

Examples Using Cardano

The organizations behind Cardano offer three current products. Atala PRISM, Atala SCAN, and Atala Trace. Atala PRISM is an identity management tool that can be used to provide access to services. It’s often used to verify credentials to open up a bank account or qualify for government aid.

Atala SCAN and Atala Trace are both used in supply chain measures, allowing the user to scan an object into the supply chain and its database and then trace where it is and where it is going. It provides a real-time update as to where goods may be.

Cardano is also developing a smart contract platform that will be used to develop enterprise-level decentralized applications. The team plans on using a democratic on-chain governance system called Project Catalyst to manage both the development and the execution of projects. There will also be a treasury management system to fund future costs using Project Catalyst.

Cardano is looking to become more democratic than many other blockchain projects, as the Project Catalyst governance is geared towards. Allowing those on the blockchain to make decisions keeps the IOHK from being a centralized power. In this sense, Cardano should eventually run itself in a relatively hands-off fashion.

What are Cardano Native Tokens?

Cardano can create native tokens. Much like Ethereum tokens, which can include NFTs or stablecoins, Cardano native assets can be created and distributed on the blockchain and interact with smart contracts.

Unlike Ethereum-based tokens, Cardano native tokens aren’t created by a smart contract. They run on the same architecture as the native coin, ADA cryptocurrency, does. This makes Cardano native assets “first-class citizens” on the blockchain. This means that the token should be much more secure and reduce the fees associated with transactions, one of the biggest appeals to using the Cardano blockchain.

The low fees for transactions allow smaller companies to use the ecosystem as well, as the transaction fees are small enough for “micro-transactions.” Using Cardano for smaller economies comes into the picture, as the prohibitive costs for Ethereum have made transactions extraordinarily expensive at times. This is why some people have in the past referred to Cardano as “the Ethereum killer.”

What is ADA?

ADA is the native cryptocurrency of the Cardano platform. ADA is named in honor of Ada Lovelace, the 19th-century mathematician who many consider the world’s first computer programmer. The ADA token fuels the Cardano platform, like the ETH tokens fuel the Ethereum platform.

ADA is used to pay transaction fees and is staked by validators which want to help maintain the security and stability of the Cardano network in exchange for earning rewards. ADA will be a governance token in the future, allowing members of the black chain to vote on changes and upgrades to the Cardano platform.

How to Use Cardano

You can use ADA like most other cryptocurrencies. ADA can be held as an investment or used for purchases and exchanges. ADA is used to cover transaction fees on the Cardano network and for staking purposes to earn more ADA.

There are two official Cardano wallets, the Daedalus wallet, and the Yoroi wallet. The Daedalus wallet is a full-node wallet, while the Yoroi is a light note. Both allow users to stake Cardano and vote in Project Catalyst, the fund that awards Cardano projects. There are plenty of other wallets that can store Cardano, but you should note that the development group only recognizes these two wallets.

The Cardano network can be used for projects, even if they do not use the ADA token directly. The Atala PRISM project issues digital identities to students across Ethiopia, including trustless and verifiable information about academic performance. Furthermore, there are plenty of DeFi and non-fungible token initiatives within the Cardano ecosystem, including a decentralized exchange called Sundaeswap and a decentralized and crustless lending protocol called Meld.

What are the Advantages of Cardano?

Cardano has many advantages over some of its peers, as it is built for a sustainable future. It is also built for widespread adoption, making it a logical choice for those looking for a longer-term investment in the use of cryptocurrency.

- Environmentally friendly – Cardano is much more efficient than most other cryptocurrencies, thanks to its two-layer core architecture. The Cardano Clearing Level is a clearing unit that allows users to trade instantly with extraordinarily low fees.

- Cheaper transactions – The Cardano Clearing Level allows users to trade the native token, ADA, much more efficiently, quicker, and with fewer costs than many of its competitors.

- Low transaction fees – Cardano features some of the cheapest transaction fees available. This makes Cardano a feasible ecosystem for some less wealthy countries globally, offering more significant potential for adoption globally.

- Peer-reviewed network – Unlike most other networks, the Cardano team works closely with academics to generate peer-reviewed research to guide development. It is an open-source and peer-reviewed black chain that helps ensure its evolution and survival beyond its parent organization.

- Transaction speed – Transaction speeds on the Cardano network are much faster than It coin or Ethereum, as it can process more than 250 transactions per second, compared to 4.6 transactions per second for Bitcoin and between 15 and 45 transactions per second for Ethereum. This makes the network very scalable, but one should note that Ethereum 2.0 will address some of the same issues.

- Open source – Being an open-source network allows Cardano to be used in a multitude of different ways. The native tokens make it possible for the Cardano network to be used in many situations. The future may be challenging to see because there are so many possibilities.

What are the Disadvantages of Cardano?

Cardano is an excellent blockchain project and seems extraordinarily scalable. However, nothing is perfect, and of course, Cardano has its issues. Most of the problems involving this ecosystem have to do with things outside the technological realm. While the technology is very stable and promising, the reality is that there are far too many competitors.

- Playing “Catch up” – Unfortunately, Cardano is trying to play “catch up” to some of the more established ecosystems. While it is trying to create a better network than the larger ones, competitors like Ethereum and Bitcoin have the advantage of a long history of use and uptake by developers.

- Can it stand out from the crowd? – Can Cardano stand out from the crowd? It’s challenging to stand out from the crowd when so many different cryptocurrency ecosystems compete for the same space. In a world that seems to be driven by hype as much as anything else, Cardano is a relatively subdued brand.

- Slow development process – One of the downfalls of being peer-reviewed and so heavily tested is that the network is somewhat slow to move forward. However, if you think of more longevity, this is a minor issue that will correct itself over the longer term.

Is Cardano a Good Investment?

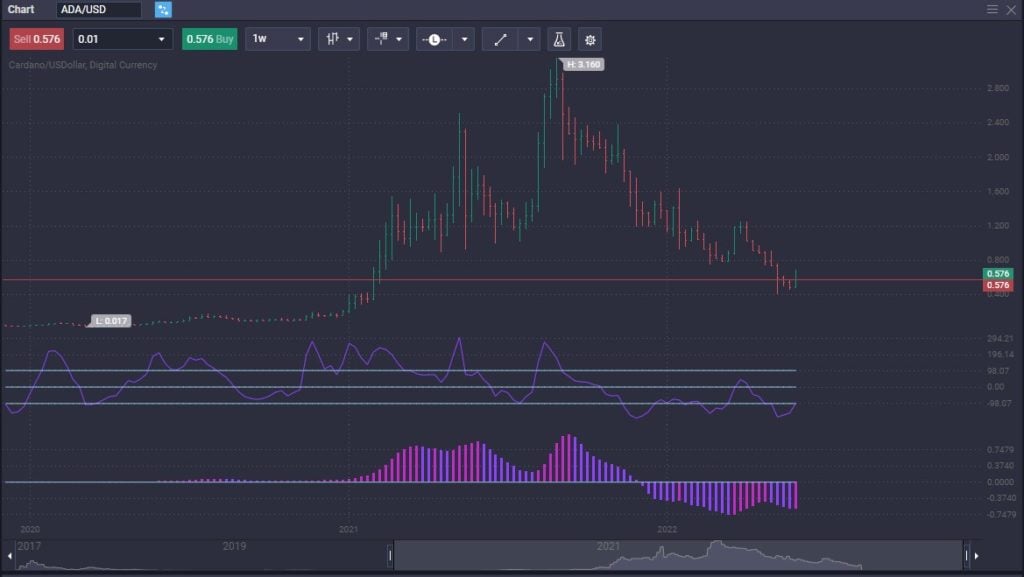

The answer to this question will be, “if you can handle the volatility of Cardano.” While there are a lot of practical use cases for Cardano, the reality is that price is all over the place. Cardano suffers at the hands of the overall attitude of cryptocurrency in general, so if there is a general selling of crypto, Cardano will not be immune to that.

The keyword will be “investment,” as you will more likely than not be forced to hang on to the trade for an extended time to realize significant gains. That being said, there are times when all crypto moves very quickly, thereby offering short-term opportunities.

It is worth noting that Cardano is currently working with several governments around the world and large institutions to facilitate banking for a vast population that does not have access to it. Because of this, the future for Cardano is bright, but it doesn’t necessarily mean that it is immediate.

Most of the Cardano community seems to be of the “buy and hold” variety, which helps keep a floor in the market price. This alone is one of the most significant benefits, and of course, the fact that it was developed and run by one of the core developers at Ethereum gives it a certain amount of “street cred” to begin with.

However, suppose you are looking to take advantage of price movement in Cardano without the added custody issues. In that case, you will find trading CFDs at Top Coin Miners a great way to enter and exit the market efficiently.

Conclusion

Cardano has an exciting future because it seems to be taking a different approach to crypto than many others are. For example, there’s not much “hype” around Cardano because it focuses more on functionality and scalability. This is the long-term approach that a successful project needs to have.

The government of Ethiopia is looking to expand its use of Cardano, presently used for securing academic information. However, in smaller countries like Ethiopia, measures are being taken to use Cardano as a payment method. Furthermore, Cardano is also being used in the supply chain, an area of intense interest post-pandemic. The supply chain issues that Cardano is trying to tackle might have the most short-term benefit.

Longer-term, Cardano can host native tokens, making it extraordinarily flexible. Being peer-reviewed and open-source means that the ecosystem should have a long lifespan; thereby, Cardano will likely take on several different iterations. It’s difficult to predict the future when there are so many possibilities. Because of this, Cardano stands out above many other ecosystems, even though it may not be as “flashy.”

Most cryptocurrency holders with a diversified portfolio can find a reason to own some Cardano. It is not necessarily something you would go “all in,” but it certainly could be a stabilizing factor for your portfolio. It has remained one of the top 10 cryptocurrencies for quite some time and has shown no propensity to lose that achievement. Resiliency is one of the most compelling arguments for having an allocation to your portfolio.

What is Cardano used for?

Cardano is used for decentralized finance, allowing users to entirely skip the middleman, such as an intermediary bank or custodial facility. Cardano has an extraordinarily flexible ecosystem that can enable it to make transactions in multiple scenarios.

How is Cardano different from Bitcoin?

Bitcoin is a “proof-of-work” cryptocurrency, which means that there are giant miners that use enormous amounts of energy to solve complex problems to validate transactions on the blockchain. Cardano is a “proof-of-stake” cryptocurrency that uses much less energy and is much cheaper than Bitcoin. It is also much faster.

Is Cardano better than Ethereum?

It used to be that Ethereum ran on a “proof-of-work” consensus algorithm, but as it is switching to “proof-of-stake,” some of the significant advantages of Cardano has disappeared. However, Cardano is still much cheaper to make transactions with than Ethereum.

Going forward, Cardano will be one of the significant competitors to Ethereum, but the future looks likely to present a case-by-case basis for uses. Cardano will continue to shine where Ethereum cannot, and vice versa

Can Cardano make you rich?

Like any other speculative investment, this is a possibility. It is also possible that you could lose money in your investment, so use caution. The reality is that Cardano makes up a key ingredient to a well-balanced portfolio in the crypto markets, as do many other coins.

Understand the benefits of diversification, as some markets will outperform each other. While Cardano has a lot of benefits, so do so many different ecosystems. We are at the beginning of the crypto revolution, so betting all of your money on one asset is foolish and can be dangerous.

Does Cardano have a future?

While there is no guarantee, Cardano has a lot of potential in the future. It has worked closely with several African governments as a payment system. You should note that Cardano is built for sustainability, and the founders are working with several large “Third World” countries to facilitate adoption. The future of Cardano is wide open, as the open-source nature of the network allows for it to be used in ways that we cannot imagine yet.