Algorand is a permissionless blockchain platform that runs on a decentralized Byzantine agreement protocol. It utilizes a pure proof-of-stake protocol to validate the network. PPoS allows users to reach a consensus and validate transactions based on a portion of ALGO coins they own. Capable of meeting demanding computational challenges, it can make transactions that were once invalid, valid again.

What Is Algorand?

Algorand is a decentralized network built to solve the blockchain “trilemma” of achieving security, speed, and decent civilization. This is what most blockchain ecosystems attempt to do, so in that sense, it is yet another choice. Launched in June 2019 by computer scientist MIT professor Silvio Micali, Algorand is a permissionless, open-source blockchain network that anybody can build on. It’s designed to be a payments focus network with speed and the ability to achieve near-instant finality.

The network can process over 1000 transactions per second, achieving the finality of transactions in less than five seconds. It uses a proof-of-stake consensus mechanism and distributes rewards to validators via the ALGO cryptocurrency. Strong network thorough put capacity and community incentive visitation make Algorand capable of managing high throughput requirements of global usage and many uses.

As a public smart contract blockchain, it relies on staking and is capable of hosting decentralized applications development and providing scalability. Rising gas fees on other blockchains, specifically Ethereum, have led many dApps developers and DeFi traders to look for alternate solutions.

Algorand allows developers to use the Algorand Standard Asset protocol to create new tokens or to transfer existing tokens to the ecosystem. Stablecoins such as USDT and USDC also exist as ASAs on the Algorand blockchain and enjoy much higher throughput and lower transaction fees than what will be typically found on Ethereum.

Of particular interest is that central-bank digital currencies, also known as CBDCs, are particularly interested in exploring Algorand. The small central bank of the Marshall Islands has a CBDC on Algorand.

History of the ALGO Token

The ALGO token was launched in 2019. Its development was overseen by Massachusetts Institute of Technology professor Silvio Micali, with theoretical work starting two years previous. Prof. Micali is an esteemed cryptographer and computer scientist who has won the Touring Prize.

In the original white paper, Algorand was thought of not just as a cryptocurrency but as something that could track real-world assets such as titles to property and their sale, as well as a platform for smart contracts.

Algorand raised $60 million through a token sale in 2019, making the project “come alive.”

How Does Algorand Work?

One of the most important distinctions of the Algorand network is that it uses “pure-proof-of-stake.” This is distinctive from the usual “proof-of-work” that Bitcoin uses, where the blockchain is maintained through a computer solving mathematical problems to generate new blocks and confirm transactions. While it is a very secure method of operating a blockchain, it is extraordinarily inefficient.

With pure proof-of-stake, transactions and new blocks can happen faster and in a much more efficient manner. ALGO holders are randomly selected, who will then “validate and improve” each subsequent block in the chain. The group of users that validate these blocks is chosen randomly every time there’s a new one.

This process allows the Algorand network to be global, decentralized, and secure. The more ALGO a user holds, the more likely they will be selected to verify and validate the new blocks and transactions. Because of the way this is done, it allows the Algorand network to approve and process transactions in seconds, which is much quicker than Bitcoin.

Why does Algorand have value?

ALGO has value because it allows the ability to be used for decentralized applications on the Algorand blockchain and allows the investor to stake ALGO on the network. The idea is that the investor believes that designers will use the Algorand network to launch new kinds of decentralized applications. Unfortunately, Algorand is one of many blockchains trying to accomplish the same movement of smart contracts.

What is Algorand used for?

https://ecosystem.algorand.com/

Algorand is used to design and enable developers to create new kinds of applications fueled by ALGO, the network’s cryptocurrency. The platform has been used in real estate, copyright, microfinance, and more.

The code for the network is open source and can be cloned, copied, or otherwise used in private, or permission blockchains should developers choose to do so.

How Does Algorand Differ from Ethereum?

The difference between Algorand and Ethereum is somewhat nuanced, but the most significant difference will be the consensus mechanism each blockchain uses. Ethereum uses the proof-of-stake method as of 2022. It has increased the network’s speed, but it is still a gradual transition from the original proof-of-work method, which was very inefficient. Algorand uses what is known as a “pure proof-of-stake” method to validate transactions.

Ethereum can process a new block of transactions every 10 seconds, while the transactions processed on Algorand are typically finalized within about four seconds.

Benefits of ALGO

ALGO has numerous benefits, although it is still very young. While a speculative investment, there are some things to pay attention to that could make it stand out from the crowd:

- Speed – Speed is a significant advantage in the Algorand network, as the average transaction speed is roughly 5 seconds. At the same time, other larger blockchains, such as Litecoin, is closer to 2.5 minutes, and Bitcoin is closer to 8 or 9 minutes.

- Strong foundation – Algorand features a speedy and efficient architecture that makes it superior as a foundation for a blockchain ecosystem, according to developers.

- Crowded space – Unfortunately for ALGO, it is in a very crowded space. It competes with several other giants, not the least of which would be Ethereum.

Disadvantages of ALGO

Regardless of how exciting a network or cryptocurrency is, there are always disadvantages. When it comes to ALGO, some of the following issues are the most pertinent:

- Low level of adoption – ALGO has had a relatively low level of adoption, which is an absolute killer for longer-term value. That doesn’t mean it won’t pick up momentum, but this reason alone should keep you from going “all in” into this market.

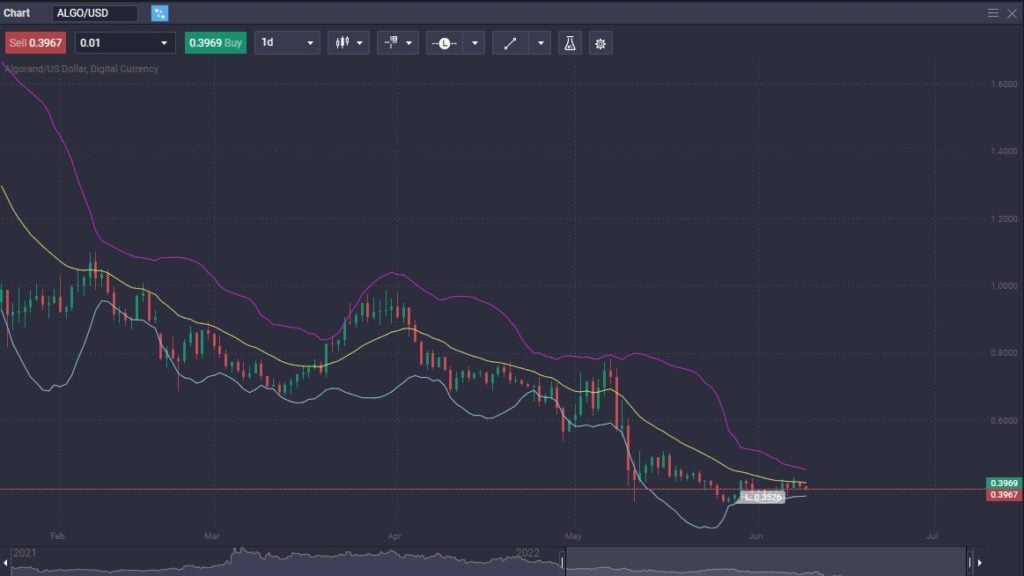

- ICO price not reached – ALGO had fallen below its ICO price and has struggled to get back above it. That doesn’t mean that it can’t, just that you need to understand the extraordinarily speculative nature of this investment.

Can you mine ALGO?

As ALGO is a pure proof-of-stake network, it uses validators rather than minors to operate the blockchain platform. Because of this, you can earn rewards staking, but mining isn’t possible.

How to Buy ALGO Cryptocurrency

Buying ALGO is simple. You need to set up an account at a cryptocurrency exchange or trading platform that supports ALGO trading. Most major exchanges now carry ALGO, so more likely than not, you should find several suitable options.

Although it is not the preferred method, you can store ALGO on a hot or cold wallet or sometimes on an exchange. It is simply a matter of buying the ALGO and keeping it how you choose. The simplest way to benefit from price appreciation is to buy it at Top Coin Miners, via a CFD contract. This eliminates the need to worry about custody and is pure price play.

Conclusion

Algorand is a highly speculative asset at this point, so you need to be very cautious about how much money you put into it. However, the fact that it is so quick and secure does make it attractive for developers. Furthermore, it’s interesting that several central banks have been looking at it as a network for CBDCs, with the Marshall Islands using it.

It’s just one of many blockchain projects trying to solve the same issues. With that in mind, it could be part of your portfolio, but it should be thought of as a very speculative asset and what is already a speculative industry. In other words, it should be a tiny portion of your portfolio.

Like many other blockchain projects, it needs a “homerun application” to bring a lot of users into the ecosystem. So far, there are quite a few interesting applications on the network, but nothing that has indeed caught the public’s imagination.

Is Algorand a good investment?

It is still far too early to determine whether Algorand will be a good investment. It has its uses but is one of many crypto platforms in a vast sea of competitors.

What is Algorand being used for?

Most of the applications on the Algorand network focus on decentralized finance, especially decentralized lending and trading. The blockchain also supports other cryptocurrencies, such as stablecoins.

What is so special about Algorand?

Algorand makes it easier to tokenize, transfer, and program conditions on any instrument of value. You can create fungible tokens, NFTs, and security tokens with a single transaction.

How is Algorand different from Bitcoin?

By far, Bitcoin is much bigger than ALGO. The Algorand network is less than 1% of the market cap of Bitcoin. Bitcoin uses the old proof-of-work consensus mechanism, making it much slower and energy-intensive than the Algorand network.

Will Algorand be successful?

At this point, there’s no real way to know. Crypto is very new, so many of these projects will have the possibility of disappearing. Whether or not this one does is still up for debate.

Is Algorand the future?

At best, ALGO is probably going to be part of the future. It does not look likely to take out Ethereum or even Bitcoin, as brand recognition alone will keep it from doing that. However, depending on who decides to use the platform will determine its future.