In the Forex trading, the terms “pip” and “pipette” are frequently utilized to characterize price fluctuations and changes. A complete understanding of these fundamental terms is essential for comprehending the worth of a currency and its behavior in terms of price movements.

What are Pips in Forex Trading?

The phrase “pip” in Forex trading refers to the slightest price change, which is the last decimal point of a quoted price. Most major currency pairs, such as the US dollar, Euro, British pound, Canadian dollar, Swiss franc, etc., move in increments of four decimal places, with a few exceptions, such as the Japanese yen, which is quoted in two decimal places.

In other words, a “pip,” which is also called a “price interest point,” can be represented by a movement of 0.0001 in the case of pairs such as EUR/USD and GBP/USD but can also be represented by a movement of 0.01 in other currency pairs such as USD/JPY or CAD/JPY.

You trade Forex markets based upon CFDs (Contract for difference), predicting and betting on one currency rising over another. Every time the market rises or falls by a pip, it will either increase or decrease the value of your position.

If you buy a currency pair at 1.0005 and sell it at 1.0010, you have made a five pips gain. However, if you were to sell a Japanese yen-related pair at 131.21 but close the position at 131.30, you would have realized a nine pips loss.

What Are Pipettes?

Most brokers have now switched to using pipettes or a fifth decimal point to get an even tighter spread. A pipette is equal to 1/10 of a pip. An example would be as follows:

EUR/USD example:

EUR/USD = 1.05181

EUR/USD = 1.05181 = 0.0008 is the pip

EUR/USD = 1.05181 = 0.00001 is the pipette.

In other words, the fourth decimal place is the pip, while the fifth decimal place is the “pipette.”

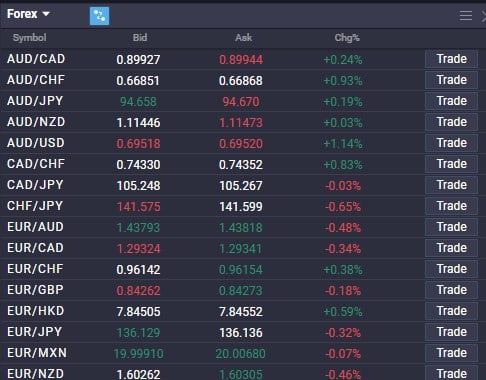

FX quotes in the Top Coin Miners platform.

Why You Should Use Pips in Forex

FX markets are highly liquid and have a huge volume of transactions, so the unit of measurement for transactions is essential. Units are typically relatively small; traders will need a larger number of decimals to capture variations in exchange rates to ensure accuracy.

Traders can normally use pips, but exchange rates become difficult to calculate with pips in an environment of hyperinflation. Hyperinflation is when the prices of goods and services are increasing excessively and in an out-of-control fashion, such as in the Weimar Republic in Germany during the 1930s or Zimbabwe in 2008, where inflation ran above 79 billion percent in November. In that type of situation, a measurement of pips becomes utterly useless as the market moves so quickly.

Major Currencies Pips

The value of a pip varies per currency depending on how the currency is traded. On some platforms, you will have four digits (pips), but others will show 5 (pipettes).

Furthermore, some currencies are divisible by 10, while other currencies, such as the Swiss franc and the Japanese yen, have different denominators.

Major currencies in the Forex markets are the Japanese yen (JPY), Great British Pound (GBP), Euro (EUR), Swiss Franc (CHF), Australian Dollar (AUD), Canadian Dollar (CAD), and the US Dollar (USD). You can trade these currencies against each other and what would be known as a “major pair,” as long as it involves the US dollar. If it does not, it is considered a “cross pair,” as in the case of the AUD/JPY pair. You can also mix these currencies with smaller markets to perform a trade in an “exotic pair,” such as USD/ZAR. (South African Rand.)

Below is a table that shows the average movement in pips per trading session:

| Pair | New York Session | Tokyo Session | London Session |

| EUR/USD | 92 | 76 | 114 |

| USD/JPY | 59 | 51 | 66 |

| GBP/USD | 99 | 92 | 127 |

| AUD/USD | 81 | 77 | 83 |

| USD/CAD | 96 | 57 | 96 |

| USD/CHF | 83 | 67 | 102 |

| EUR/JPY | 107 | 102 | 129 |

| AUD/JPY | 103 | 98 | 107 |

| EUR/CHF | 84 | 79 | 109 |

| EUR/GBP | 47 | 78 | 61 |

| GBP/JPY | 132 | 118 | 151 |

Forex Position Size Calculator

Pips are often used for the calculation of position size. If the combined position sizes are too large and a trader experiences a string of losses, they could wipe out their capital. Because of this, trading with the appropriate position size is one of the most important things to pay attention to.

There are a handful of steps to calculate the appropriate position size for any trade:

- The trader decides how much of their trading capital they are willing to risk on a position. A typical amount is 1% because it allows for a minimum of 100 losses before they compound enough to destroy most of the account. If the account is $10,000 and the trader is willing to risk 1%, that’s $100.

- The trader will determine a stop loss in pips based on market conditions. For example, they may buy the GBP/USD pair at 1.2020 and place a stop-loss order at 1.1970, meaning they are willing to risk 50 pips.

- The position size being traded determines how the last step is calculated. A standard lot refers to 100,000 units of the base currency. This equates to $10 per pip movement in most major currency pairs. A mini lot is 10,000 units of the base currency, equating to $1 per pip movement in the same markets. A micro lot is 1000 units of the quote currency worth $0.10 per pip movement.

In the case of the GBP/USD pair trade mentioned above, if the trader wishes to risk 1% of their $10,000 balance per trade, they would have 50 pips to account for. The trader would trade two mini lots or trade $2 per pip. (50 pip loss @ $2 = $100.)

How to Calculate Pips

To calculate the value of a pip, you need first to multiply one pip or 0.0001 by the contract size. Standard lots are 100,000 units of the base currency, while mini lots are 10,000 units.

Using GBP/USD as an example, one pip movement using a standard lot would equal $10 (0.0001 x 100,000).

Pip value: 100,000 x 0.0001 (one pip)

Pip value = $10.00

With each incremental pip movement in the trade, the movement translates to a $10 profit or loss.

Depending on the quote currency, the pip value will change. Let’s look at the US dollar’s base currency versus when it is different.

Example w/ USD as the quote currency:

The trader places a $100,000 trade in the EUR/USD pair, buying it at 1.0500.

The value of the EUR/USD pair rises to the 1.0530 level, resulting in a 30 pip profit. (1.0530-1.0500 = 0.0030, or 30 pips).

The profit in this situation is calculated as (100,000 x 0.0001 = $10) x 30 = $300.

Example w/ other currency as the quote currency:

The trader places a $100,000 trade in the USD/CAD pair, buying it at 1.0500.

The value of the USD/CAD pair then rises to the 1.0600 level, resulting in a 100 pip profit. (1.0600-1.0500 = 0.0100, or 100 pips).

The pip value in USD is (0.0001 x 100,000) / 1.0600 = $9.43

The trader made a gain of 100 x $9.43 = $943.00.

An Exception – The USD/JPY Currency Forex Pip

An exception to the calculation is the Japanese yen. The Japanese yen is calculated using two decimals to represent a pip. Let’s look at a couple of examples:

Example of a JPY trade:

You decide to sell one full lot of the USD/JPY pair at 112.50. One full lot of the USD/JPY pair is worth 100,000 USD. You are therefore selling 100,000 USD to purchase 11,250,000 JPY. (1 x 100,000 x 112.50 = 11,250,000 JPY.)

The trade moves against you, and you decide to exit. You close the position at 112.00, representing a drop of 50 pips.

You close your position by purchasing 1 lot of USD/JPY at 112.00 to buy back $100,000 of USD. This is calculated: 1 x 100,000 x 112.00 = 11,200,000 JPY. This is 50,000 JPY less than your original purchase of US dollars gave you.

This works out as a $446.42 loss. The calculation is as follows: (50,000 / 112 = 446.42)

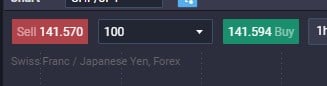

Below is an example of a JPY quoted pair, the CHF/JPY pair. (Swiss franc / Japanese yen.)

Order entry on the Top Coin Miners platform of CHF/JPY.

How to Use Pips in Forex Trading

If a trader enters a long position on EUR/USD at 1.1500 and it moves to 1.1525, the price has moved 25 pips in the trader’s favor, leading to a profit if the position is closed. Alternatively, if the trader went long at that same price of 1.1500, and EUR/USD moves down to the 1.1480 level, the trader will have lost 20 pips, leading to a loss if the trade is closed at that point.

If a trader were to go long on CAD/JPY at 105.00, and it moves to 105.33, the price has moved 33 pips in the trader’s favor. However, if the exchange rate fell to the 104.87 level, the trader would have had the market move 13 pips against them.

Not only are pips good for measuring price movements, but they’re also helpful in managing risk in Forex trading and determining the amount of leverage to use on a trade. A trader can use a stop-loss order to set the maximum amount they are willing to lose in terms of pips on a trade. Placing a stop-loss will help limit losses if the currency pair moves in the wrong direction. Traders can use pips to measure a potential take-profit target on trades as well.

What Influences Pip Values?

The currency the trader’s account is based on will determine the pip value of many currency pairs. For USD denominated accounts, which is typical for most traded currency pairs, if the currency pair has “USD” as the 2nd or quote currency, the pip value will always be $10 on a standard line, $1 on a mini lot, and $0.10 on a micro lot.

Pip values change only if the USD is the base currency or the first currency in the currency pair. Other examples are when no USD is involved in the currency pair, such as the EUR/CHF pair.

Conclusion

In conclusion, you need to understand what drives pip value before putting any money into the market. After all, you need to understand the risks you are taking, which can significantly influence the position size and the quote currency.

One of the most important things you can do as a trader is to figure out the risk of each trade and use proper money management. Good money management is impossible if you do not understand the value of each pip or pipette of the currency pair and position you are trading.

Understanding pips also allows you to communicate with other traders and brokers. For example, if you are referring to a “move of 50 pips”, everybody involved in the conversation understands the distance traveled. Like any other endeavor, you must know at least the most basic jargon to join the conversation and enter the market.

How much are 50 pips worth?

It depends on the quote currency in the pair and, of course, the position size. It is a move of 0.0050 in most pairs.

What does a movement of 100 pips mean?

The currency pair moved 0.01 in most pairs or 1.0 in yen-related pairs.

How much are 20 pips worth?

It depends on the quote currency in the pair and, of course, the position size. It is a move of 0.0020 in most currency pairs.

How do I read pips?

If the currency pair is quoted in 4 decimal points, it is the last digit. If quoted in 5 decimal points, it is the 4th decimal. The Japanese yen is quoted in 2 decimal points, meaning that the 2nd decimal is a pip. On a platform that quotes the yen-related pairs in 3 decimal points, a pip is a 2nd decimal.

How much profit is a pip?

It is the smallest increment of profit that you can make in the currency markets.

How do you count pips in forex?

You can calculate pips by adding or subtracting the 4th digit of major currency pairs. For example, if you enter a trade at 1.0111 and exit that trade at 1.0119, that pair has moved eight pips.