One of the most crucial global commodities is oil, which serves as both a fuel for the planet and a massive and significant market. Despite the growing demand for cleaner energy sources, the oil market remains attractive to investors due to its continued high dependence.

As we entered 2023, the oil market faced an intriguing situation with the reopening trade coming into vogue, leading to a substantial resurgence of the travel and work sectors. However, it is also worth noting that now that the fanfare has died, traders have begun to worry about demand as central banks have tightened. Furthermore, the concern about a lack of Russian crude has made trading a bit more difficult.

Crude Oil Overview

| Current price for today (30 July 2023) | $80.36 |

| Price Change 24h | 0% |

| Price Change 7d | 5.1% |

Oil Prices Historical Overview

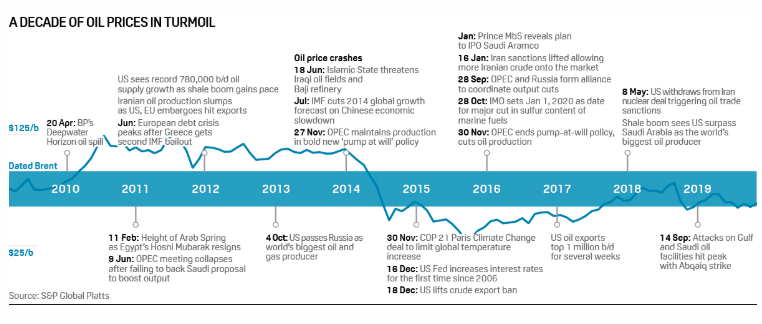

The 20th and 21st century overview of the oil market can be defined heavily by the evolution of the middle eastern crisis, as well as periods of oil drought, and oil glut. Oil price is heavily influenced by political movements and uncertainty, especially related to the volatile area of the middle east. But they are also heavily influenced by market movements and that is what makes the last two centuries interesting times to look back over for a forecast into the future.

Oil production and markets started being taken seriously in the 1960s when the Organization of the Petroleum Exporting Countries (OPEC) was founded in Iraq. The entire goal of this organization was to take control of the oil market as the main contributors to the production of the resource.

However, with oil production and price control so heavily centralized in these OPEC countries, when political upheaval struck Iran in the 1970s, an oil crisis emerged as the global oil supply was constrained and the price of oil more than doubled.

In countering that, through the 1980s, there was an oil glut when non-OPEC countries like the USA and the UK increased their production to try and haul back some control over the market, but this added supply lowered the price of oil significantly.

During the 2008 financial crisis, the price of oil underwent a significant decrease after the record peak of $147.27. One barrel fell as low as $30.28 during the crisis. It was even argued that this collapse, which came at the time of the financial crisis, was due to speculation on prices before which overinflated Oil’s value.

Top Factors That Affect The Oil Prices

Oil is a commodity that is highly affected by geopolitical events and structures, as well as the global market performance. However, there are a few other factors that are worth considering when examining how the price of oil is determined.

The following factors should always be considered when gauging what the price of oil will do:

- OPEC

- Non-OPEC oil producing countries

- Exogenous shocks

- Global economic performance

- Alternative energy sources

- Strength of the US dollar

- Market speculation

OPEC has positioned itself as one of the most important organizations around the oil market. The collection of oil producing nations have aligned themselves to be very much in control of the production, supply, and regulation of price of a barrel of oil. It is a good thing that OPEC is looking to control the market for oil, as it is a finite resource and left unregulated, would be used up in an unsustainable way. This organization also takes into consideration other instances where oil’s price can be changed or manipulated and tries to ride these out. For example, the US has been upping its fracking industry which has led to OPEC warning of an increased supply of oil on the horizon.

While OPEC as an organization contains oil producing countries, there are other countries that also produce vast sums of oil who are not part of the membership. These are called Non-OPEC oil producing countries. Non OPEC countries are also rather big players on the world economic stage, and include countries like the USA, Canada and China. In fact, the US is the world’s biggest oil producer with 13 million barrels being produced each day in 2017.

Because oil is a commodity so closely correlated with markets and economies, it is highly susceptible to what is known as exogenous shocks; these are economic events that affect the price of a commodity in a way that cannot be explained or controlled — such as natural disasters or wars. An example of such an event was when Hurricane Katrina landed on the East Coast of the USA in 2005 and damaged oil supply lines. People panicked and the price of fuel rose as much as half a dollar in this time of fear.

Like any commodity though, oil is highly affected by supply and demand factors. Global economic performance is one such demand factor that is constantly shifting the price of oil. Major non OPEC countries, like the USA and China, as well as Europe, have the biggest demand for oil but as such, when global financial uncertainty strikes in these areas, the demand for oil usually drops rapidly. This again was seen in the 2008 financial crisis that slowed the globe’s industry and sent the price of oil falling by $100 over five months.

One of the new factors also influencing the price of oil is renewable energy. There is a strong drive in industry and consumerism for sustainable energy, of which oil does not fit the bill. As such, renewable energy sources are becoming bigger, and more popular, which again affects the demand for oil — and thus its price. If demand continues falling, and supply is still growing, the price of oil could rapidly drop in this shift to sustainable energy sources.

Through it all though, the oil price is also heavily affected by the world’s strongest currency — the US dollar. Like many commodities, oil is still exchanged in US dollars across the globe and because of this, a strengthening dollar price can actually make the price of oil fall — albeit nominally if all other factors remain the same. Then, vice versa, if the dollar weakens, oil will often rise.

Finally, as with any investment, the speculation that surrounds the market can greatly impact the price of the commodity. Oil is no different, especially with oil prices being set on the futures market which means the market is trading on a price point in the future. Market speculation happens when news events that can possibly affect oil start to emerge. For example, news on the use of more nuclear power in China can see people speculating on a drop in the price of oil due to less demand, and thus the market can react speculatively.

Crude Oil Price Forecast for 2023-2024

In 2023, there are a lot of moving pieces that traders will have to keep in mind. To begin with, there is a ban on Russian oil exports, which has caused less supply. However, there are concerns about the banking sector, and of course a major recession. If the world does in fact head into a major recession, the demand for crude oil will most certainly drop. This makes it a very noisy environment to make a crude oil price forecast for 2023.

Because of these issues, it’s very likely that both Brent Oil and West Texas Intermediate (WTI) will have a very difficult time sustaining trends, and it’s likely that the markets will move on the latest news. Because of this, it’s very important to keep on top of the latest headlines, understand technical analysis, and of course keep a reasonable position size, such as the CFD market allows. As a general rule, its believed that the crude oil price forecast for 2023 is that we are eventually going to rally, it may be much safer to trade oil via CFD markets. Historical data suggests that when markets get volatile, it’s better to trade smaller positions.

When deciding to look into the oil forecast for its suitability to invest in over the coming year, five years, and ten years, it is also important to understand the market that the asset operates on and how it is defined. Firstly, Crude oil is the naturally occurring, unrefined petroleum product that is typically obtained through drilling.

When you come across the term Brent Crude Oil, this refers to the oil contract that investors will be looking at. In Europe, Africa, and the Middle East, the benchmark is North Sea Brent crude, which trades on the Intercontinental Exchange (ICE) and is more sensitive to overseas news while in North America, the benchmark for oil futures forecast is West Texas Intermediate (WTI) crude, which trades on the New York Mercantile Exchange (NYMEX), and is where the West Texas Intermediate crude oil price forecast happens.

In other words, a lot of the price will come down to the part of the world that performs the best this year, and next. The markets may diverge from time to time, but as the global economy is so interconnected, they generally move in the same direction.

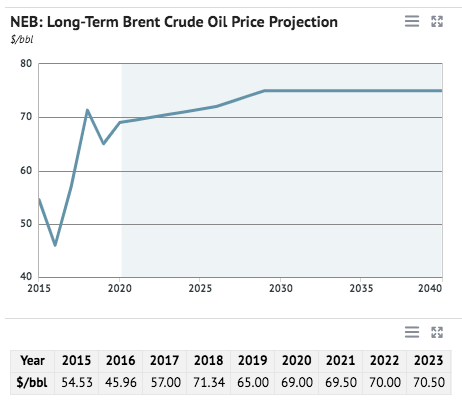

Oil Price Forecast for 2025 and Beyond

A crude oil price forecast for 2025 is going to be difficult, and as a result, it’s even more troublesome to come up with a crude oil price forecast for 2030. This is because there are a lot of geopolitical issues, supply issues, and even global growth concerns.

As traders around the world continue to measure potential global recession, oil has remained depressed. However, if the global markets start to turn around, it’s very likely that we will see oil as one of the better performing assets, as demand will skyrocket.

If Oil prices can get back above the $80 level, it is possible that there might be a huge rally, mainly due to the increase in demand, especially in China.

Oil Price Predictions For The Future

Currently, the situation is very fluid, as traders try to discern whether or not the global economy is going to fall hard. If it does, it will drive down the demand for crude oil, and oil prices will be the first victim. That’s exactly what has been seen in the first couple of months during training in 2023, but now there are questions as to whether or not the central banks are going to slow down the rate hikes, and perhaps even turn things back around.

The potential issues with the banking sector also have a lot of people concerned, and if we end up finding some type of financial crisis like we did in 2008, that will certainly have a negative influence on not only oil, but anything risk related. With that, it’s also worth noting that the war in Ukraine continues to have a lot of sanctions thrown against the Russians, and that can perhaps put a bit of the floor in the market.

For all of these reasons, crude oil will more likely than not continue to see a lot of volatility, which of course could make it a great trading opportunity for those who are diligent with the research, and of course nimble with their trading positions. However, if you are more risk-averse, keeping your position size small will be paramount.

Expert Oil Price Predictions

A recent Bloomberg article has quoted several oil desks as to what their predictions were in the WTI Crude Oil and Brent Crude Oil markets.

JP Morgan Chase has recently come out with a price prediction of $90 a barrel, but only after a significant pullback. The projected price is meant for late in 2023. Meanwhile, Goldman Sachs believes that the oil markets may reach $88 in the same time.

Bank of America has analysts that believe oil can reach as high as $95 by the end of the year. However, it should be noted that the predictions all run on the premise that the Federal Reserve starts to loosen monetary policy some time this year.

Oil Price Forecast Next 5 Years (Until 2028)

Oil’s price, especially over a period of five years, can be very volatile and change drastically. For example Brent Crude prices fluctuated from as high as US$125 a barrel in 2012 to as low as US$30 per barrel in January 2016.

Inflation could push prices higher, even despite less reliance on fossil fuels.

Overall, it’s believe that oil prices in the next 5 years will be influenced by a handful of issues. The first one of course will be supply disruptions that could lead to a surge in the price of oil. This was seen after the Ukrainian war started as traders were worried about whether or not the supply of Russian oil was going to disappear.

Inflation also has a part to play, but it also has a negative effect on global growth, which could work in both directions. Initially, it was bullish for crude oil, but since then traders have started to focus on the idea that inflation could bring down spending, and therefore bring down movement.

One of the major influences will also be central banks around the world, as they continue to raise interest rates. That will slow down economic growth in and of itself, so it’s possible that we could see oil get a little bit of a boost after the war in Ukraine stops, as it could bring in a lot of risk appetite in general.

One thing that most analysts believe is that we are going to see a lot of volatility and choppy behavior, but as things stand currently, the crude oil market does look as if it is trying to form some type of basing pattern.

Oil Price Prediction For Next 10 Years (Until 2033)

The next decade in the oil price forecast 2030 may well be more positive than the next five years as the additional time allows for a recovery from a global recession, as well as a period of reinvigoration and growth. In fact, there are many forecasts that are putting the next demand peak for the oil price in 2030.

The International Energy Agency (IEA) said in its latest annual World Energy Outlook.

“Oil demand for long-distance freight, shipping and aviation, and petrochemicals continues to grow. But its use in passenger cars peaked in the late 2020s due to fuel efficiency improvements and fuel switching, mainly to electricity. Lower battery costs are an important part of the story: electric cars in some major markets soon become cost-competitive, on a total-cost-of-ownership basis, with conventional cars,” the IEA said in its outlook to 2040.

Another important factor for the next 10 years is how OPEC will deal with the growing market share that the US is taking in the energy stakes. The US and its Shale Energy production is a big threat to OPEC, but the shale energy is slowing.

Summary: What is the future of the oil?

Oil remains a commodity that is vital to how the world and the economy works. It is a commodity that is looking to be phased out, but this phasing out is still more than 50 years away and thus has an important role to play going forward.

But, more than this, the market of oil is also an important one and it is a market that attracts a lot of investors as it has many different facets that influence it, providing investors big opportunities with both the dips and the rises in price.

Even with today’s price of oil being so low, and in a real state of panic, for some investors this represents a buying opportunity that not many will probably see again in their lifetime. For this reason, it is worth looking into investing, and starting up is not as difficult as many would believe. Top Coin Miners, a multi-commodity trading platform has quick and easy sign up that allows investors to begin trading in oil in a matter of minutes — sign up here.

Why is the oil price dropping?

Oil’s price was dropping due to significantly less global demand, and a transition into greener energies. But oil prices have been rising due to inflation and front running of demand.

Will oil prices go up?

Oil remains an important commodity globally and will have a demand for many years to come. With travel reopening, and the sanctions on Russian crude, one would have thought that the price of oil should rally. However, there are a lot of concerns about global growth, and therefore global demand.

Who controls oil prices in the world?

Oil prices are mostly determined by an open market of speculative traders and buyers and sellers. However, the market is also regulated and controlled by organizations like OPEC who do their bit to control this finante resource.

Who is the largest producer of oil?

As a stand alone nation, the US produces the most amount of barrels of oil per day. However, when groups collaborate, such as OPEC, these groups produce far more than anyone nation and they work together as one entity.