With all of the headlines that Dogecoin has received over the last few years, it’s no surprise that short-term and long-term speculators have a lot of interest in this market. That being said, the maximum supply of Dogecoin is something you need to understand, as well as the volatile nature of the coin itself.

How many Dogecoin coins are there?

As of mid-2022, there are approximately 132 billion Dogecoin. This is a considerable number, mainly because there are no restrictions on how many can be minted. This was done by design as Dogecoin initially started as a joke.

Since then, the idea of using Dogecoin for micropayments has made it somewhat attractive for certain people, but this same massive supply will keep the price of Dogecoin low.

Does DOGE Have a Limit?

Dogecoin does not have a limit on how many will be released. Because the amount of Dogecoin is unlimited, it is an inflationary coin. The inventors did not take the design of Dogecoin seriously. Since then, people have looked at it as a potential payment method, since transactions are incredibly cheap.

Facts and Numbers on the Dogecoin Cryptocurrency

To take advantage of the Dogecoin market, you need to understand the facts and figures behind the market. While an extraordinarily volatile market, a few significant points hold over the longer term. Yes, the occasional social media tweet can make Dogecoin move rather rapidly, but fundamentals continue to be paramount at the end of the day.

Is DOGE supply centralized?

The supply of DOGE is technically not centralized, but there are very large holders. The top wallet is currently holding roughly 30% of the total supply. That being said, there is a protocol that mints new blocks and coins, as long as there are mining rigs out there producing.

Is there a limit to how many Dogecoins can be mined in a day?

Every minute, a new block is produced on the blockchain, allowing 10,000 DOGE to be released. This means that every day 1.44 million are created. Furthermore, the total amount of DOGE in circulation will be unlimited.

How is DOGE mined? Is it easy to mine Dogecoin?

Dogecoin is a fork of Bitcoin, with significant differences in its source code. That being said, it is mined very similar to how Bitcoin is. It is a decentralized currency whose digital ledger is maintained by a decentralized network of nodes instead of one single entity.

Dogecoin is issued and released by the protocol in a pre-programmed way. Miners receive rewards via DOGE for solving mathematical problems. You will need to mine Dogecoin with a GPU on your computer, or use a script-specific miner. Most miners are part of a mining pool.

Quite frankly, for the average person, it would not be worth going through the process of mining DOGE anymore as the price of Dogecoin has dropped. Furthermore, the more miners that have joined the network have increased the hash rate, making it a bit more challenging to be rewarded for solving a block as the crowd has gotten bigger.

How is Dogecoin primarily used?

Dogecoin is primarily used for payments and purchases, but the biggest problem is that it’s not an effective store of value. This is because the supply of Dogecoin is unlimited, so it is more likely than not going to be something that could depreciate over the longer term.

Furthermore, Dogecoin is not accepted in many places, so therefore the primary function of Dogecoin is pure speculation. Whether or not it has a future is an entirely different question, but at the end of the day, we have seen a couple of bear markets in crypto, which have been used to wipe out those coins with no longer-term intrinsic value.

Dogecoin was initially a “meme coin,” meaning it was at the whim of speculators and those who follow social media. Some of the most significant moves in the market have been due to Elon Musk tweeting about it. Serious investors understand that any money put into Dogecoin is highly speculative , which is why most would trade it from a short-term perspective. To “buy-and-hold” a significant amount of Dogecoin is more likely than not going to be a losing proposition.

Dogecoin

https://dogecoin.com/

To understand the trading dynamics of Dogecoin, you need to understand some of the underlying fundamental factors. Furthermore, you also have to know that it is primarily used for speculation, so trading the CFD market is the best way forward. This is because it allows you to quickly get in and out of the trade without taking custody. Remember, the supply of DOGE is unlimited. This, by its very nature, means that the coin is inflationary.

This is not to say that it won’t rise in value occasionally, but it suggests that the unlimited supply of DOGE could continue to keep a heavy lid on price. To say that Dogecoin is speculative is an understatement, and you should note that Dogecoin typically reacts well to a lot of risk appetite. Because of this, Dogecoin reacts to not only Bitcoin fluctuations but other markets you would not usually think of, such as the stock market, commodities, etc.

How many Dogecoins do the top investors own?

There is no definitive answer, as the decentralized nature of the network makes it difficult to track investors. However, it has been noted that the most prominent “whale” owns 30.16% of the total DOGE in circulation.

The future of Dogecoin (in short)

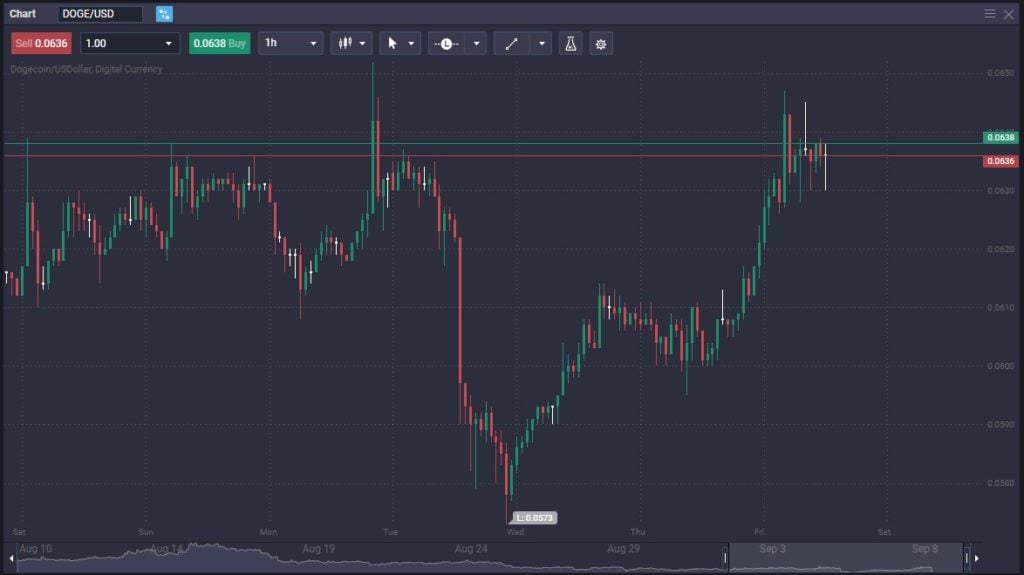

Chart of Dogecoin on Top Coin Miners platform

At best, people will use Dogecoin for tiny transactions. A few companies here and there have offered to take the coin for payment, such as Tesla and the Dallas Mavericks, but those are few and far between. Most of the traction that Dogecoin has gained is due to random tweets by Elon Musk and Mark Cuban.

It is considered a “meme coin,” so it should be treated as a highly speculative investment. It’s difficult to see the road forward for Dogecoin, which is why treating the CFD market is preferable to holding DOGE in your wallet. This allows you to benefit from price fluctuations without owning the coin. Trading the CFD market means you do not have to take ownership of the coin, which, quite frankly, has a sketchy future.

Trading CFDs at Top Coin Miners frees up not only trading capital due to leverage but also mental capital, meaning you do not have to worry about future adaptability or anything else. If you believe that Dogecoin is going to continue to drop due to a lack of adoption, it is easy to short using the CFD.

How many Dogecoin are in circulation?

As of the middle of 2022, there is 132 billion DOGE in circulation.

How many Dogecoin coins are left?

The total amount of Dogecoins that will be minted has no cap, so it is limitless.

Who owns the most Dogecoin?

Even though most people believe it would be Elon Musk, the largest holder of Dogecoin is thought to be Robinhood, the popular broker in the United States.

How many Dogecoins are mined per day?

1.44 million DOGE are minted each day. This is based on 10,000 being released with each block, which is mined every minute or so. Remember, the total amount of Dogecoins is entirely unlimited.