Gold is an established and mature market for investable assets. Although it has been a significant commodity in the past, with major uses in electronics and jewelry, it is often considered a safe haven for investment due to several reasons.

The fact that gold works as a safe haven asset, one that often moves in anti-correlation to the traditional markets, means that the commodity is a great hedge against financial troubles, but it is also an asset that has shown steady and solid growth in value for a long time.

Gold is not an asset that is prone to big price swings, or high volatility, but it is known to almost constantly be growing as its uses and market desire keep growing. Also, the fact that Gold is an asset that is scarce, but with an uncertain supply, means the markets are often worth watching and forecasting gold prices for the next 10 years can often lead to positive gains over this long period of time.

GOLD Overview

| Current price for today (30 July 2023) | $1959.17 |

| Price Change 24h | 0% |

| Price Change 7d | -0.1% |

Gold Prices Historical Overview

Historically, gold has been around since thousands of years as an important metal, but it wasn’t used for money until around 550 B.C. At first, people carried around gold or silver coins. If they found gold, they could get the government to make tradable coins out of it.

It played an important role through the Roman Empire where Emperor Augustus, who reigned in ancient Rome from 31 B.C. to 14 A.D., set the price of gold at 45 coins to the pound. In 1257, Great Britain set the price for an ounce of gold at 0.89 pounds.

But then, in the 1800s most countries printed paper currencies that were supported by their values in gold. This was known as the gold standard, but In 1971, US President Richard Nixon told the Fed to stop honoring the dollar’s value in gold and ended its primary use as a currency value and helped drive the asset to be more of a store of value.

This saw the price of gold start to take off as an ounce was with $40 dollars when depegged from the dollar, but in less than 10 years it rose to be worth $2,249 in relative with by 1980.

Gold Price For Today

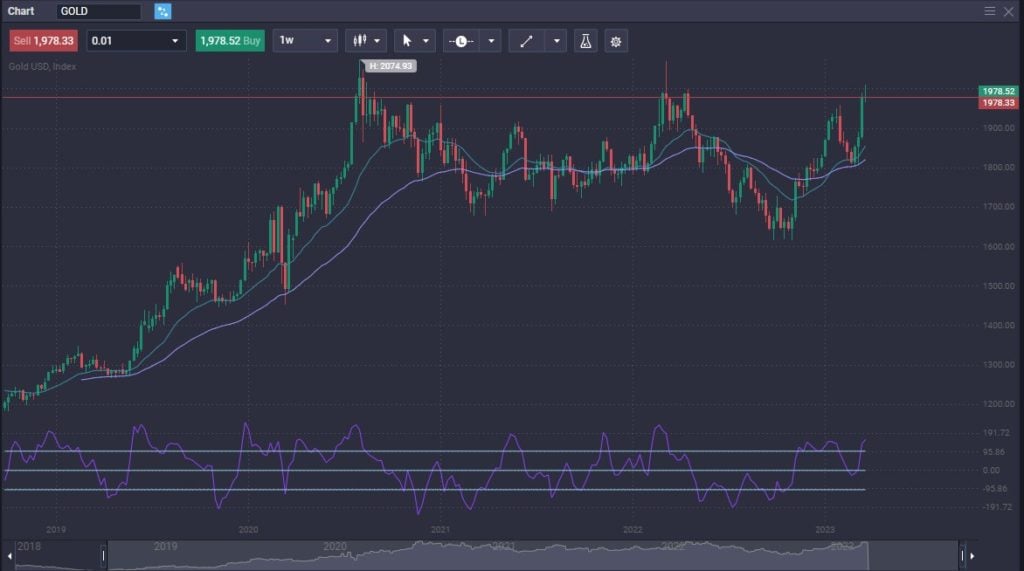

Today, the gold price is below its recent all-time high but holding above support and could be ready for another phase of growth. Part of the reason for the growth spurt in the last few years has been the concern about an impending recession and the need for a safe haven asset, but the latest pandemic around the globe has also played its part and has made the financial markets full of fear and uncertainty.

Before the fear of the recession, gold was slightly left behind and made to feel unloved and needed in the last 10 years but this is mostly because it played a big role in 2008 when the last financial crisis struck, but as the economy recovered, the need for a safe haven asset fell away and the price of gold started dropping.

Moving forward, gold should continue to be a solid store of value, however, it has been losing some market share to Bitcoin and other cryptocurrencies that offer similar benefits.

Factors That Are Affecting On Gold Price

Because gold is such a mature and established market, there are a number of factors that come into play when determining its price and how it is affected. Gold is also a rather unique asset compared to things like stocks and bonds, and that also makes it act differently and the fact that it operates as a hedge means one needs to look for factors that impact other assets differently.

A list of the factors to consider include: Consumption demand, Protection against volatility, Gold and inflation, Gold and interest rates, Good monsoon, Correlation with other asset classes, Geo political factors, Weakening dollar, Future gold demand.

Consumption demand has to do with the uses of gold as an asset removed from its market. Demand for gold keeps changing, and in recent times has been boosted as electronics manufacturers have seen the use of gold in their goods for conductivity.

Of course, gold is also consumed as jewelry, and there are big drives in demand even from global governments who seek out gold as a store of value that they keep in central banks.

As mentioned before, Gold is an asset that helps with protection against volatility. There is a demand for gold from people who are looking to protect themselves from volatility and uncertainty. Gold is a physical asset so it is able to be stored and kept by individuals, and its market moves differently from typical volatile markets so it is in demand for people hedging against uncertainty.

Underlining gold’s attraction as an asset for good times and bad, most investors would buy gold whether the domestic economy was growing or in recession.

Gold and inflation also work together as inflation is one way in which money can quickly devalue, and when this happens, people would rather have their money kept in something that would grow in value instead — like gold.

Therefore, in times when inflation remains high over a longer period, gold becomes a tool to hedge against inflationary conditions. This pushes gold prices forecast higher in the inflationary period.

In a similar way Gold and interest rates also play their part in moving the price of gold as lower interest rates — which usually come about when there are times of financial uncertainty and governments want people to spend, means that saving is harder.

However, keeping gold means that the interest rate drops are kept away and the value of saving is maintained through the precious metal. In fact, according to some industry experts, under normal circumstances, there is a negative relationship between gold and interest rates.

Interestingly, there are instances that can impact the gold price from regional areas that are impacted by things like the weather. For example, India annually consumes 800-850 tonnes of gold and rural India accounts for 60 percent of the country’s gold consumption. Therefore, monsoon plays a big part in gold consumption because if the crop is good, then farmers buy gold from their earnings to create assets.

Because gold is also seen as a highly effective portfolio diversifier due to its low to negative correlation with all major asset classes it is often picked up in times of uncertainty and this is why one of the factors to look out for is the relation between gold and the other asset classes feeling the pressure or the pleasure in the current financial circumstances.

Of course, gold is also used as a hedge in times of geopolitical uncertainty too as the asset provides a more stable value when there are looming crises such as war. These geopolitical tensions also add pressure onto financial markets but help in boosting the demand and value of gold.

This also ties interestingly to how a weakening dollar leads to a stronger gold price. The dollar is very much linked to gold as it is primarily exchanged for dollars. But because of its negative correlation, when the dollar loses value — such as through inflation — then the gold price often goes up.

And finally, because gold is an uncertain supply that is mined, it is actually mostly recycled, so when the global demand rises, it is hard to meet supply, so demand heavily rises the price of the asset.

Gold Price Predictions For 2023-2024

The gold price prediction today, and the gold price forecast (for) 2023 Looks to be rather positive, as the beginning of the year has already been extraordinarily bullish, and in the extreme geopolitical concerns continue to be a positive factor. With Russia and Ukraine actively fighting on the European continent, many traders have looked for safety.

Toward the end of 2022, gold had been on its back foot, plunging down below the $1650 level. However, as the calendar flipped, more and more people started running back toward the gold market, and have pushed it toward the $2000 an ounce area.

It is expected the gold will continue to attract attention as there have been several banks causing ripples of anxiety through the markets. This includes Silicon Valley Bank, First Republic, and of course Credit Suisse. Crypto has also seen fraud exposed, with the now defunct FTX being the biggest culprit. Because of this, gold has seen much more interest than it had in several years.

As calls for a global recession continue, most larger funds and wealthy investors are exposing their portfolios to more gold, as it tends to hold value in tough economic times. Further exacerbating the issue has been the fact that the Federal Reserve and other central banks around the world continue to struggle fighting inflation, mainly by raising interest rates.

This has made the concerns about defaults a real issue, and therefore most traders are at least protecting some of their portfolio through gold and the bond market. At this point, gold looks as if it is trying to do everything it can to break out to the upside and hit fresh, new highs, but 2023 is more likely than not going to continue to be extraordinarily volatile, which while that does help gold, it can throw the price around quite drastically at times.

Somewhat ironically, gold was attractive due to all of the money printing that had occurred previously. Dollar debasement was one of the biggest attractions for investors, but now that the US dollar is strengthening, mainly due to central bank tightening, gold now is starting to be used to protect wealth, meaning that both the US dollar and gold are rising.

Inflation will cause a lot of damage to most currencies, and that may end up being the case with the US dollar eventually. Nonetheless, gold is the original currency, and it does make a certain amount of sense that it will continue to do well. The last time that the global economy saw this much inflation was in the 1970s, and into the 1980s. During that time frame, gold did quite well, and therefore it does provide a little bit of the template.

Gold Price Forecast for 2025 and Beyond

In general, it is believed that the gold market will continue to attract inflows. Central bank buying of gold by itself will continue to help pricing power. Most analysts have a gold price forecast for 2025 of well over $3000 an ounce.

Considering that the market has reached the $2000 an ounce price in March of 2023 alone suggests that there is a lot of momentum. Some analysts are much more bullish, but $2000 has been a major psychological barrier, so it could be difficult to get above there. However, a short squeeze may happen once we get above that level, thereby opening up the door to much higher prices by the time we get to 2025, and most certainly by the time we get to 2030.

Gold Predictions For the Future

Because gold is such a mature and well established market, and a rather settled and slow moving one, there are a lot of predictions that are made into the future for the precious metal. Of course, there are factors that need to be considered for long term gold price forecasts that are often unpredictable, such as the mining supply, or geo-political tensions. But, there are also a lot of factors that help drive gold, and these have been mostly driving the price up slowly over the years, such as currency inflation and the need for safe haven assets.

The digital gold narrative has also been eating into gold’s market cap. Still, the trend is up given how bullish the asset is. Gold is starting to make a comeback as Bitcoin cools off and the delta COVID variety begins to shake up markets again.

Gold price forecast For Next 5 years (Until 2028)

As has been explained above, the movement of gold is primarily upwards, but at a slow pace. That being said, the price of gold could rocket at this important juncture and have lasting moves for the gold price predictions for next 5 years

Gold is now pulling back from its highs, but it could be forming a bull flag pattern that could send prices soaring much higher. For example, Rich Dad, Poor Dad Author Richard Kiyosaki has a gold price forecast of $5,000 in the next few years, and most banks are now suggesting that gold has quite some way to go over the next 5 years. A gold price forecast for the next few years is typically going to be bullish, but gold price predictions are difficult due to unforeseen circumstances like the war in Ukraine.

Christopher Lewis, Senior Analyst, FXEmpire, explains why gold looks so healthy as an investment right now.

“The most important thing that traders are looking at recently has been geopolitical concerns, the debasement of multiple currencies around the world, and the potential need of the central banks around the world to loosen monetary policy after cracks in the banking system does suggest that gold is one of the purest plays for safety, and could be attractive to most traders around the world for the next several years if we go into a major recession,” he said.

Gold price forecast For Next 10 Years (Until 2032)

Looking even further ahead in the gold forecast, even the gold price prediction chart for the 10 years seems promising for the asset as the general gold prediction remains that its value will only go up especially considering there is a financial crisis looming and we can see what happened in the 10 years following 2008.

Dohmen Capital Research sees a good recent example is the 2008 global crisis. Gold plunged 31 percent as credit tightened, the crisis accelerated and a rush to cash from all assets commenced. That was painful for bulls who didn’t know that a credit crisis causes all assets to plunge. But it also created a great buying opportunity at the bottom.

Gold price trends generally have been bullish longer term, but the last couple of years had been more or less consolidation. That being said, with so many different negative factors at the same time, it’s very difficult to imagine that gold won’t continue to strengthen over the next 10 years.

A gold commodity forecast has to take into account that there are plenty of banks around the world that will be looking for some type of protection, and some of the major central banks from the BRICS+ (Brazil, Russia, India, and China – as well as new countries) buying gold hand over fist, there a lot of reasons to expect gold to continue rising.

Summary: What Is The Future Of Gold

In the world of investing, there is of course always going to be risk and potential for loss. Gold is no different, but it is also one of the least risky investments that there is. It is an asset that will always be in demand, either for its uses in Jewelry, or electronics, and it is also in demand from central banks as well as investors.

Gold is also a resource that has an uncertain, but scarce, supply. This supply is also always dwindling which means the demand will keep rising along with the price. With the recent concerns around the world for global stability and the possibility of contagion when it comes to debt markets, that also can push a lot of money into safety assets such as gold, and of course bonds. With that being the case, people are looking for plenty of liquidity, and safety at the same time, making gold likely to be one of the first places they run.

| Year | Gold Price Prediction |

| 2023 | $2,500 |

| 2024 | $3,000 |

| 2025 | $3,449 |

| 2026 | $4,721 |

| 2027 | $4,988 |

| 2028 | $5,012 |

| 2029 | $8,732 |

| 2030 | $9,126 |

| 2031 | $10,178 |

| 2032 | $10,895 |

Investing in gold has never had a better time to start than right now, the price is primed to explode, but getting involved in trading such a commodity can be difficult due to its physical nature and the exclusivity of many gold brokers who are not so open to new traders.

One alternative option, which makes investing in gold a lot easier, and even possibly more profitable, is to sign up with Top Coin Miners. The platform has won awards for its app, as well as been praised for its incredibly low fees. Top Coin Miners also allows you to start trading in under 10 minutes, and with a small amount of money. Sign up here.

Will gold go up or down?

While there is no way to know for sure, the reality is that gold has already seen quite a bit of interest in 2023. The gold market has seen a lot of inflows, and as such has shown itself to be very bullish. With so much uncertainty around the world, gold serves as a safe haven.

Will gold go up in 2023?

It already has. Whether or not I can continue to rally will be influenced by multiple things, not the least of which will be Federal Reserve monetary policy, and of course whether or not there is demand to protect wealth. With several banks having issues during the year, and central banks around the world purchasing gold, it does tend to suggest further interest.

What will gold be worth in 2025?

There is no way to know, but it should be noted that a lot of pundits do believe that we are on the precipice of a major bullish run, and most precious metals investors seem to be fairly confident. If there is a crisis of confidence, it does make a lot of sense that gold will be thought of as a desirable place to park your money.

Is gold a good investment?

Gold is typically thought of as a safety investment, and most wealthy investors have at least a portion of their portfolio allocated toward gold. This can be through the CFD market, physical gold, or gold related stocks. Experts suggest various amounts of gold exposure, depending on your investment thesis and needs.

Should I buy gold now or wait?

To ask the question “should you invest in gold now? “ is far too open. Nobody can tell you whether or not you should buy gold now, but it never hurts to have a bit of exposure. Whether or not it goes higher or lower is somewhat irrelevant, because it keeps its purchasing power. In other words, if your local currency goes down in value, gold should retain its value as far as purchasing power is concerned.